Understanding Taxes on Cars in CT: A Complete Guide

Imagine navigating a city’s intricate network of streets—each turn, signal, and lane change mirroring the complexities of a state’s car tax system. Just as a city planner must understand every alley and avenue to ensure smooth traffic flow, so too must drivers and prospective buyers grasp the nuances of Connecticut’s auto taxation landscape. Taxes on cars in Connecticut (CT) are not just straightforward levies; they form a vital part of the state’s revenue system, intertwined with economic, legal, and policy frameworks that influence vehicle ownership, affordability, and sustainability. This comprehensive guide aims to demystify these mechanisms, compare them to familiar concepts, and offer clear insights into making informed decisions about vehicle ownership in Connecticut.

Fundamentals of Car Taxes in Connecticut: The Road Map

At its core, the Connecticut car tax system operates as a layered construct—much like an urban transit network that includes tolls, fare zones, and parking fees—organized to generate revenue and regulate vehicle use. Two primary aspects define this landscape: the motor vehicle property tax, which is assessed annually, and the sales tax applied at the point of vehicle purchase. Both elements function as financial tolls that contribute to funding state infrastructure, road maintenance, and transportation initiatives.

Unlike some states where vehicle taxes are predominantly centered on sales or registration fees, Connecticut blends these approaches. The annual property tax resembles a toll paid periodically—reflecting a vehicle’s value and ownership period—whereas the sales tax acts as an upfront toll, collected during purchase. This duality ensures both ongoing contributions and initial revenue streams, akin to a city’s combination of toll booths and parking meters, capturing revenue at different transit points.

The Connecticut Vehicle Property Tax: Annual Toll on Ownership

Connecticut’s vehicle property tax is levied annually based on a vehicle’s assessed value, which is determined by the state’s depreciation schedules and market trends. Think of this as paying a regular toll—every year you owe a fee proportional to your vehicle’s worth, adjusted for wear and tear. The assessment often leans on the National Board of Revenue estimates, applying a mill rate—expressed as a dollar amount per $1,000 of assessed value—that varies by municipality.

The tax rate in Connecticut can fluctuate based on local budgets and policy priorities, much like toll rates might vary between bridges or tunnels. For example, Fairfield County may have a different mill rate than Hartford, reflecting differing municipal needs. The assessed value itself diminishes as the vehicle ages, mirroring the depreciation curve of an asset—like a used bicycle losing its shine over time—but the rate remains a crucial factor in computing total liability.

| Relevant Category | Substantive Data |

|---|---|

| Average Vehicle Property Tax Rate | Approximately 15-20 mills (i.e., $15-$20 per $1,000 assessed value), depending on municipality |

| Average Assessments | For a 3-year-old car, assessed value typically ~60-70% of market value |

Sales Tax on Vehicles: Upfront Fee at Purchase

The sales tax on cars purchased in Connecticut is calculated at a rate of 6.35%, applied to the full purchase price or fair market value. This tax acts akin to the toll paid upon entering a toll road—the initial fee to get onto your journey. It’s enforced at the dealership or private sale, with the city or town infrastructure benefits being immediate and apparent.

For used car purchases, the valuation might be based on the bill of sale, an appraisal, or the National Automobile Dealers Association (NADA) valuation service, ensuring fairness and transparency. The tax is due at the time of registration, which acts as the gateway to legal vehicle operation.

Additional Fees and Considerations

Beyond the primary taxes, Connecticut imposes other charges, such as registration fees, title fees, and specialized taxes for certain vehicle types or environmental programs. For example, electric vehicles might encounter additional fees to offset reduced fuel tax revenues, functioning like congestion tolls designed to fund sustainable transit initiatives.

Some municipalities also offer exemptions or discounts—for instance, for veterans or low-income residents—akin to toll discounts for public transportation users, highlighting targeted policy interventions aimed at equity and affordability.

| Relevant Category | Substantive Data |

|---|---|

| Registration Fee | $120 for passenger vehicles; varies for commercial or specialty vehicles |

| Environmental Surcharge | $100-$500 for electric vehicles, depending on model and year |

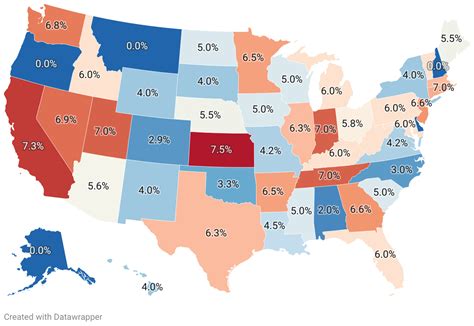

Regional Variations and Local Impact on Car Taxes

Much like districts might have different toll rates based on congestion or infrastructure costs, Connecticut municipalities wield authority over certain aspects of vehicle taxation. Meriden might levy a different property tax rate than New Haven, and these local policies directly impact what car owners pay annually.

Additionally, urban centers may introduce incentivization strategies—like reduced taxes for electric vehicles—paralleling congestion fee discounts to promote cleaner transportation options. These regional policies reflect broader economic strategies, balancing revenue needs with environmental and social goals.

Influence of Vehicle Age and Value

Since depreciation diminishes assessed value over time, owners of older vehicles tend to face lower property taxes, yet they might pay higher relative registration fees or specialty taxes. This dynamic mirrors the depreciation curve of a classic car: as it ages, its tax burden shifts from annual property assessments toward potential environmental or usage fees.

| Relevant Category | Substantive Data |

|---|---|

| Impact of Age on Property Tax | Decreases by approximately 20% every 3 years of ownership |

| Regional Rate Differences | Average deviation of ±2 mills between urban and suburban municipalities |

Historical Evolution and Policy Trends

The landscape of Connecticut’s auto taxation has evolved from a simple registration fee structure to a multifaceted system addressing environmental concerns, urban congestion, and revenue diversification. Historically, vehicle taxes were instituted primarily as revenue streams; today, they also serve as policy levers to encourage greener transportation modalities. For example, recent legislation introduced electric vehicle surcharges, akin to tolls on dedicated electric corridors, to offset lost fuel tax revenue—a clear reflection of adaptive policy responding to technological change.

From the 1970s onward, CT shifted toward a more comprehensive approach, including environmental and usage considerations, aligning with broader national trends emphasizing sustainability and urban planning.

Key Points

- Connecticut’s vehicle tax system combines annual property assessments and upfront sales taxes, shaping the total ownership cost.

- Regional variations significantly influence individual tax liabilities, urging owners to consider local policies before purchase.

- Policy trends now integrate environmental incentives, reflecting shifts toward sustainable transportation models.

- Understanding depreciation and local tax rates can enable strategic financial planning for vehicle ownership.

- Future developments may include dynamically adjusted taxes aligned with vehicle emissions or usage metrics.

Making Informed Decisions: Strategic Tips for Car Buyers and Owners in CT

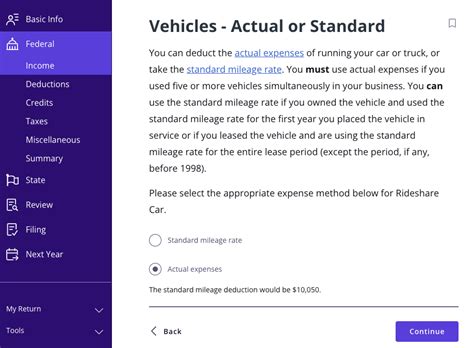

Just as an urban planner analyzes traffic patterns and infrastructure needs before designing a new transit system, prospective vehicle buyers should scrutinize local tax policies and valuations. Consider the long-term implications: a cheaper vehicle upfront might incur higher annual taxes, or vice versa. For instance, choosing a hybrid or electric vehicle might mean paying an additional environmental surcharge but benefit from lower property taxes or qualifying for regional incentives, akin to picking alternate routes that balance tolls and travel time.

Engaging early with local DMV offices and municipal tax offices can uncover specific exemptions, discounts, or upcoming policy shifts—comparable to consulting a city’s transportation department for the most current toll updates. Leveraging tools like online valuation calculators, tax estimate tools, and regional policy reviews empowers consumers to optimize total cost of ownership, much like a commuter planning the fastest, most cost-effective route through city streets.

Future Outlook: Trends and Potential Changes

The trajectory suggests increasing sophistication—integrating digital tracking of vehicle emissions, dynamic tolling based on congestion, and data-driven policies that reward low-impact vehicles. For example, some towns are exploring ‘pay-as-you-drive’ models, akin to congestion pricing in urban centers worldwide, which may reshape traditional tax frameworks and incentivize sustainable choices. Staying abreast of legislative proposals and technological advancements will be critical for owners aiming to minimize costs and maximize benefits.

How does the assessed value of my vehicle affect my property tax in Connecticut?

+The assessed value, which diminishes over time due to depreciation, directly impacts your annual property tax. A higher assessed value results in a higher tax bill, so understanding how depreciation is calculated assists in estimating your ongoing costs.

Are there any exemptions or discounts available for certain types of vehicle owners?

+Yes, Connecticut offers exemptions or reductions for veterans, low-income residents, and electric vehicle owners, among others. Checking local policies and applying for eligibility can lead to substantial savings similar to toll discounts for public transit users.

What is the impact of regional policies on my total vehicle ownership costs in CT?

+Regional policies influence both the assessed valuation and additional fees, such as environmental surcharges, which vary across municipalities. Being aware of these differences can help you optimize cost by strategic planning or choosing a location with favorable policies.