Denmark Income Tax

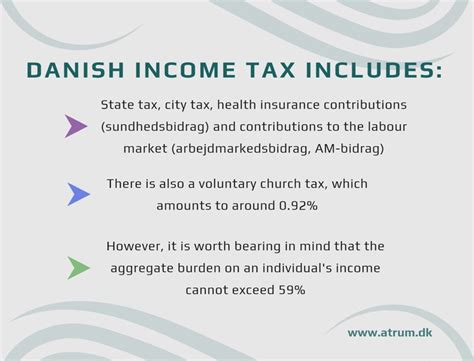

Denmark, known for its progressive income tax system, is often recognized as a welfare state with a strong focus on social equality. The country's tax system plays a crucial role in funding its extensive social safety net, which includes universal healthcare, education, and social security benefits. Understanding the intricacies of Denmark's income tax system is essential for both residents and expatriates living in the country.

An Overview of Denmark’s Income Tax Structure

Denmark’s income tax system is characterized by its progressive nature, meaning that higher incomes are taxed at progressively higher rates. This system aims to ensure that individuals with higher earnings contribute a larger proportion of their income to the country’s welfare system. The tax year in Denmark runs from January 1st to December 31st, and individuals are required to file their tax returns annually.

The income tax in Denmark is levied on various sources of income, including employment income, business profits, rental income, and capital gains. The tax rates are determined by the taxable income bracket an individual falls into, with rates varying across different income levels. The tax system also includes deductions and allowances that can reduce the taxable income, providing relief to taxpayers.

Taxable Income Categories and Rates

The Danish tax system divides taxable income into different categories, each with its own tax rate. These categories are defined by the Danish tax authorities and are subject to regular updates. As of the current tax year, the income tax rates in Denmark are as follows:

| Taxable Income Category | Tax Rate |

|---|---|

| Income up to DKK 51,500 | 0% |

| Income between DKK 51,501 and DKK 293,000 | 15% |

| Income between DKK 293,001 and DKK 586,000 | 33% |

| Income over DKK 586,000 | 51% |

These tax rates are applicable to personal income, including wages, salaries, and self-employment profits. It's important to note that the Danish tax system also includes municipal and state taxes, which can further impact the overall tax liability.

Deductions and Allowances

Denmark offers a range of deductions and allowances that can reduce the taxable income, thereby lowering an individual’s tax burden. These deductions include expenses related to employment, such as commuting costs, professional training, and certain work-related equipment. Additionally, individuals can deduct expenses for pension contributions, interest on mortgages, and certain healthcare costs.

One notable deduction is the "income tax ceiling," which limits the amount of tax an individual has to pay. This ceiling ensures that even high-income earners do not pay more than a certain percentage of their income in taxes. The income tax ceiling is calculated based on a formula that considers factors like the taxpayer's income and family situation.

The Role of the Danish Tax Agency (SKAT)

The Danish Tax Agency, or Skatteforvaltningen (SKAT), is the government agency responsible for collecting taxes, managing tax returns, and ensuring compliance with the country’s tax laws. SKAT plays a vital role in the tax system, providing support and guidance to taxpayers, as well as enforcing tax regulations.

SKAT offers an online platform where taxpayers can register, file their tax returns, and access their tax-related information. The platform provides a user-friendly interface, allowing individuals to navigate the tax system efficiently. SKAT also provides resources and tools to help taxpayers understand their obligations and rights, ensuring a fair and transparent tax system.

Tax Compliance and Penalties

Denmark takes tax compliance seriously, and individuals are expected to meet their tax obligations accurately and on time. Failure to do so can result in penalties and interest charges. The Danish tax authorities have robust systems in place to identify and address tax evasion and non-compliance.

To promote tax compliance, SKAT offers a range of support services, including tax counseling, guidance on tax obligations, and assistance with tax returns. Additionally, SKAT actively engages in outreach programs to educate taxpayers about their rights and responsibilities, ensuring a better understanding of the tax system.

Tax Benefits and Incentives

Denmark’s tax system offers various benefits and incentives to promote specific behaviors and support certain sectors. These incentives are designed to encourage investment, innovation, and economic growth.

Investment and Business Incentives

The Danish government provides tax incentives to promote investment and business growth. These incentives include tax breaks for research and development activities, investment in new technologies, and support for small and medium-sized enterprises (SMEs). The government also offers tax advantages for certain industries, such as renewable energy and green technologies, to drive sustainable development.

For example, the "Green Tax Incentive" scheme provides tax reductions for companies investing in environmentally friendly technologies and practices. This initiative aims to encourage businesses to adopt sustainable practices and contribute to Denmark's environmental goals.

Education and Training Incentives

Denmark places a strong emphasis on education and lifelong learning. As such, the tax system provides incentives for individuals to invest in their education and professional development. Deductions are available for tuition fees, books, and other education-related expenses. Additionally, individuals can claim tax relief for professional training courses and seminars, promoting continuous skill development.

The Impact of Denmark’s Income Tax on the Economy

Denmark’s income tax system has a significant impact on the country’s economy and social landscape. The high tax rates, particularly for higher-income earners, contribute to a robust social safety net, ensuring that all citizens have access to essential services and support.

Funding Social Programs

The revenue generated from income taxes plays a crucial role in funding Denmark’s extensive social programs. These programs include universal healthcare, which provides free or low-cost medical services to all residents, and a comprehensive education system, offering free education from primary to tertiary levels.

Additionally, the tax system supports Denmark's social security system, which provides benefits such as unemployment insurance, retirement pensions, and disability support. These social programs contribute to a high quality of life and a sense of social security for all Danes.

Economic Growth and Innovation

Despite the high tax rates, Denmark’s economy has thrived, with a strong focus on innovation and entrepreneurship. The tax incentives and support for research and development have encouraged businesses to invest in new technologies and ideas, driving economic growth. Denmark’s competitive tax environment for SMEs has also fostered a dynamic business landscape, attracting both domestic and foreign investors.

Furthermore, Denmark's tax system has facilitated the development of a strong welfare state, promoting social equality and reducing income inequality. The progressive tax structure ensures that wealth is distributed more evenly, leading to a more balanced and harmonious society.

Conclusion: Navigating Denmark’s Income Tax System

Denmark’s income tax system is a complex yet essential component of the country’s social and economic fabric. It plays a vital role in funding the extensive social safety net, promoting equality, and driving economic growth. Understanding the tax system is crucial for individuals living and working in Denmark, as it impacts their financial planning and overall quality of life.

By navigating the tax system effectively, individuals can take advantage of the various deductions and incentives available, minimizing their tax liability while contributing to the country's social and economic development. The Danish tax authorities, through SKAT, provide valuable resources and support to ensure a transparent and fair tax system for all.

What is the average income tax rate in Denmark for 2023?

+The average income tax rate in Denmark for 2023 is approximately 36.5%. This rate takes into account the progressive nature of the tax system, where higher incomes are taxed at higher rates. It’s important to note that the average rate can vary based on individual circumstances and deductions.

How often do I need to file my tax return in Denmark?

+In Denmark, you are required to file your tax return annually. The tax year runs from January 1st to December 31st, and the deadline for filing your tax return is typically in April of the following year. It’s important to meet this deadline to avoid penalties and interest charges.

Are there any tax-free thresholds in Denmark?

+Yes, Denmark has a tax-free threshold, which means that a certain amount of income is exempt from taxation. As of 2023, the tax-free threshold is DKK 51,500. Any income above this amount is subject to taxation based on the applicable tax rates.

What are some common deductions available in Denmark’s tax system?

+Denmark offers a range of deductions, including expenses for employment, such as commuting costs and professional training. Individuals can also deduct expenses related to pensions, mortgages, and certain healthcare costs. It’s important to review the specific deductions available and ensure you meet the eligibility criteria.

How does Denmark’s tax system support social equality?

+Denmark’s progressive tax system, with its higher rates for higher incomes, contributes to social equality by ensuring that wealth is distributed more evenly. The tax revenue funds the country’s extensive social programs, providing universal access to healthcare, education, and social security benefits, thus reducing income inequality and promoting a more balanced society.