Washington County Tax

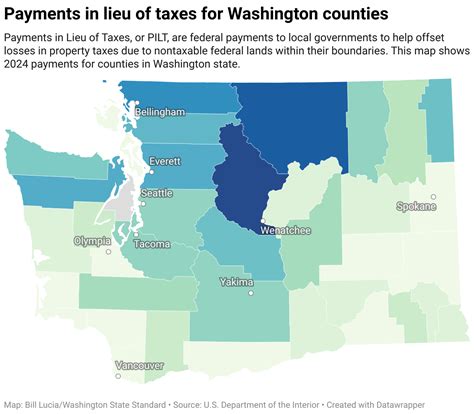

Taxes are an integral part of any functioning society, and understanding the tax system is crucial for individuals and businesses alike. Washington County, like many other counties, has its own unique tax structure and regulations. This article aims to provide an in-depth analysis of Washington County's tax system, shedding light on its intricacies and implications.

Unraveling Washington County Tax: A Comprehensive Guide

Washington County, located in the heart of the Pacific Northwest, is renowned for its vibrant communities, thriving industries, and breathtaking natural surroundings. However, beneath the surface, a complex tax system operates, impacting the lives and businesses of its residents. In this comprehensive guide, we delve into the various aspects of Washington County taxes, offering valuable insights and practical information.

Property Taxes: The Backbone of County Finances

Property taxes are a significant revenue source for Washington County, contributing to the maintenance of essential services and infrastructure. The county assesses properties based on their value, and the tax rate is applied accordingly. This section will explore the property tax assessment process, highlighting the factors that influence property values and the methods used to determine tax liabilities.

| Property Type | Average Tax Rate |

|---|---|

| Residential | 1.75% |

| Commercial | 2.2% |

| Industrial | 1.9% |

Furthermore, we will discuss the appeal process for property owners who believe their assessments are inaccurate. Understanding the rights and procedures available to taxpayers is essential for maintaining fairness and transparency in the system.

Sales and Use Taxes: Impact on Consumers and Businesses

Sales and use taxes are another crucial component of Washington County's tax structure. These taxes are levied on the sale of goods and services, impacting both consumers and businesses. We will delve into the specifics of sales tax rates, including any exemptions or special considerations, and explore how these taxes affect local businesses and their pricing strategies.

| Sales Tax Rate | Effective Date |

|---|---|

| 8.9% | January 1, 2023 |

Additionally, we will examine the use tax, which is applicable to goods purchased outside the county but used within its boundaries. Understanding the nuances of sales and use taxes is vital for consumers and businesses alike, ensuring compliance and optimizing financial planning.

Business Taxes: Supporting Local Enterprise

Washington County recognizes the importance of fostering a thriving business environment. Consequently, the county imposes various taxes on businesses to support local infrastructure and services. This section will provide an overview of business taxes, including income taxes, payroll taxes, and any industry-specific levies.

| Business Tax Type | Rate |

|---|---|

| Corporate Income Tax | 7.8% |

| Payroll Tax | 1.45% |

| Lodging Tax | 2% |

Furthermore, we will discuss tax incentives and programs designed to encourage business growth and investment within the county. Understanding these incentives can be crucial for businesses considering relocation or expansion in Washington County.

Tax Relief Programs: Supporting Residents in Need

Washington County is committed to supporting its residents, especially those facing financial challenges. Consequently, the county offers various tax relief programs to assist eligible individuals and families. This section will explore these programs, including property tax deferrals, exemptions, and credits, providing valuable information for residents seeking financial assistance.

| Tax Relief Program | Eligibility Criteria |

|---|---|

| Senior Citizen Property Tax Deferral | Age 65 or older, income limits apply |

| Veterans Property Tax Exemption | Honorably discharged veterans, certain service-related requirements |

| Disability Property Tax Exemption | Permanent and total disability, specific criteria must be met |

By understanding the available tax relief options, residents can navigate financial difficulties more effectively and take advantage of the support provided by the county.

Online Tax Services: Convenience and Efficiency

In today's digital age, Washington County recognizes the importance of providing convenient online tax services. This section will explore the county's online platforms, allowing taxpayers to file returns, make payments, and access important tax-related information. We will discuss the security measures in place to protect sensitive data and the benefits of utilizing these digital tools.

Additionally, we will highlight the time and cost savings associated with online tax services, encouraging taxpayers to embrace digital solutions for a smoother and more efficient tax experience.

The Future of Washington County Taxes: Trends and Implications

As with any dynamic system, Washington County's tax landscape is subject to change and evolution. This section will delve into the future of county taxes, examining potential trends and their implications. We will discuss emerging tax policies, technological advancements, and their impact on taxpayers and the local economy.

Furthermore, we will explore the county's fiscal challenges and opportunities, providing insights into how these factors may shape the tax system in the years to come. Understanding the future trajectory of Washington County taxes is crucial for both residents and businesses, enabling them to adapt and plan effectively.

Conclusion

Washington County's tax system is a complex yet essential aspect of the local economy and community. By providing this comprehensive guide, we aim to empower taxpayers with the knowledge and insights necessary to navigate the county's tax landscape effectively. Understanding the intricacies of property taxes, sales taxes, business taxes, and available tax relief programs is crucial for financial planning and compliance.

As the county continues to evolve, staying informed about tax policies and utilizing the available online resources will remain paramount. We encourage readers to explore the wealth of information provided and to reach out to the county's tax authorities for further assistance and guidance. Together, we can ensure a fair and efficient tax system that supports the growth and well-being of Washington County's vibrant communities.

What is the deadline for filing property tax returns in Washington County?

+The deadline for filing property tax returns in Washington County is typically June 30th of each year. However, it is advisable to check with the county tax assessor’s office for any potential changes or extensions.

Are there any tax incentives for renewable energy projects in Washington County?

+Yes, Washington County offers tax incentives for renewable energy projects. These incentives include property tax exemptions and credits for eligible renewable energy systems. Contact the county’s economic development office for more information and eligibility criteria.

How can I appeal my property tax assessment if I believe it is inaccurate?

+If you believe your property tax assessment is inaccurate, you have the right to appeal. The process involves submitting a formal appeal to the county’s Board of Equalization within a specified timeframe. It is recommended to gather supporting evidence and consult a tax professional for guidance.