Ny 529 Plan Tax Deduction

For residents of New York State, the 529 Plan has become a popular savings tool for those looking to invest in their children's future education. The tax benefits associated with this plan have made it an attractive option for many families. In this comprehensive guide, we will delve into the specifics of the NY 529 Plan Tax Deduction, exploring its benefits, eligibility criteria, and the steps required to maximize this tax advantage.

Understanding the NY 529 Plan Tax Deduction

The New York 529 College Savings Program, commonly known as the NY 529 Plan, offers a unique opportunity for taxpayers to save for qualified higher education expenses while enjoying significant tax benefits. This program, administered by the New York State Higher Education Services Corporation (HESC), provides a tax-advantaged way to save for college, making it an essential tool for families planning for their children’s future educational expenses.

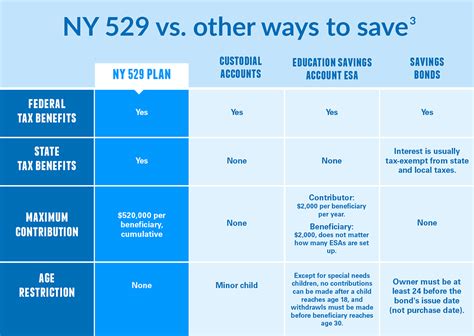

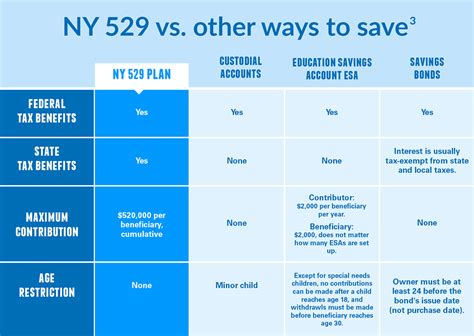

The 529 Plan allows individuals to invest in a variety of portfolio options, ranging from conservative to aggressive, catering to different risk appetites and investment horizons. Contributions to the plan are not federally tax-deductible, but they do grow tax-free at the federal level, and withdrawals used for qualified higher education expenses are also tax-free at the federal level. However, it is the state-level tax benefits that make the NY 529 Plan particularly attractive to New York residents.

Tax Deduction Eligibility

One of the key advantages of the NY 529 Plan is the state income tax deduction it offers on contributions. This deduction is available to New York taxpayers who contribute to either of the state’s 529 plans: the Direct Plan or the Advisor Sold Plan. The deduction is taken against the contributor’s New York State taxable income, providing a substantial incentive to save for education.

| Plan | Description |

|---|---|

| Direct Plan | A cost-effective, direct-sold plan with a variety of investment options. Managed by New York's HESC, it offers flexibility and control over investments. |

| Advisor Sold Plan | Designed for those who prefer professional guidance, this plan is sold through financial advisors and offers personalized investment strategies. |

To be eligible for the tax deduction, the contributor must be a New York State resident, and the beneficiary of the 529 plan must be a resident, a dependent, or a family member of the contributor. The deduction is limited to contributions made for the benefit of a single beneficiary per year, up to a maximum amount.

Maximum Deduction and Contribution Limits

The maximum deduction for New York State income tax purposes is 10,000 for single filers and 20,000 for married couples filing jointly. This deduction applies to contributions made to either of New York’s 529 plans, with the same limit applying to both the Direct Plan and the Advisor Sold Plan. It’s important to note that the 10,000/20,000 limit is not a contribution limit but rather the maximum deduction allowed on New York State tax returns.

As for contribution limits, the NY 529 Plan has a lifetime contribution limit of $529,000 per beneficiary. However, this limit is not an annual cap but a cumulative total. Contributions can be made in any amount, as long as they don't exceed the lifetime limit, and can be made by anyone, including grandparents, relatives, and friends.

Tax Benefits for Non-Residents

While the primary tax benefit of the NY 529 Plan is the state income tax deduction, which is only available to New York residents, there are other advantages that extend to non-residents as well. Contributions to the plan grow tax-free at the federal level, and withdrawals used for qualified higher education expenses are also tax-free at the federal level, regardless of the contributor’s state of residence.

Maximizing Your NY 529 Plan Tax Deduction

To make the most of the tax benefits offered by the NY 529 Plan, there are several strategies that taxpayers can employ. Understanding the eligibility criteria, contribution limits, and the mechanics of the tax deduction is the first step.

Timing Your Contributions

One strategy to maximize the tax deduction is to time your contributions. Since the deduction is based on the calendar year, it’s advantageous to make contributions before the end of the year to take advantage of the current tax year’s deduction. This allows taxpayers to lower their taxable income for the year and potentially reduce their state income tax liability.

Using Multiple Beneficiaries

Another strategy is to utilize multiple beneficiaries. The 10,000/20,000 deduction limit applies per beneficiary, so if you have multiple children, you can establish separate 529 plans for each child and maximize your deductions. This strategy can significantly increase the tax savings over time.

Gift Tax Exemption

The NY 529 Plan also offers an opportunity to utilize the annual gift tax exclusion. You can contribute up to $15,000 per year per beneficiary without triggering gift taxes. This means that you can make contributions for multiple beneficiaries and effectively double or even triple your tax-free contributions, depending on your family’s circumstances.

Rollover Options

If you have an existing 529 plan in another state, you can rollover those funds into a NY 529 Plan without any tax consequences. This can be a strategic move if you’re looking to take advantage of New York’s tax benefits or if you’re planning a move to New York. The rollover doesn’t count towards the annual contribution limit and can be a way to maximize your savings and tax advantages.

Performance and Investment Options

The NY 529 Plan offers a range of investment options to suit different financial goals and risk tolerances. These include age-based portfolios that automatically adjust the asset allocation as the beneficiary gets older, static portfolios with a fixed allocation, and individual fund selections for those who prefer a hands-on approach.

The plan's performance has been strong, with most portfolios outperforming their benchmarks over the past several years. The age-based portfolios, in particular, have shown impressive results, providing a balanced approach to investing for education. The plan's expense ratios are also competitive, ensuring that more of your investment goes towards your child's education.

Asset Allocation and Risk Management

The NY 529 Plan’s asset allocation strategy is designed to balance growth potential with risk management. Age-based portfolios start with a higher allocation to stocks and gradually shift towards more conservative investments as the beneficiary approaches college age. This strategy aims to maximize growth potential while mitigating risk as the need for funds draws nearer.

| Age-Based Portfolio | Stock Allocation | Bond Allocation |

|---|---|---|

| Birth to Age 11 | 80% | 20% |

| Age 12 to 15 | 60% | 40% |

| Age 16 to 19 | 40% | 60% |

Fee Structure

The NY 529 Plan has a straightforward fee structure. There are no sales loads or surrender fees, and the annual administrative fee is only 0.25% of the account value. This low-cost structure ensures that more of your investment goes towards the beneficiary’s education, rather than being eaten up by fees.

Qualified Expenses and Withdrawal Rules

Understanding what constitutes a qualified expense is crucial when it comes to withdrawing funds from your NY 529 Plan. Qualified expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Room and board are also eligible expenses, provided the beneficiary is enrolled at least half-time.

Withdrawals for non-qualified expenses are subject to income tax and a 10% penalty on the earnings portion of the withdrawal. However, there are certain exceptions where the 10% penalty may be waived, such as in cases of the beneficiary's death, disability, or receipt of a scholarship.

Changing Beneficiaries

One of the flexible features of the NY 529 Plan is the ability to change beneficiaries. If the original beneficiary doesn’t end up using the funds, you can change the beneficiary to another qualified family member without incurring taxes or penalties. This flexibility allows you to adapt to changing family circumstances and ensure the funds are used for their intended purpose.

Future of the NY 529 Plan

The NY 529 Plan has been a successful program, helping thousands of New York families save for their children’s education. With its tax benefits, strong performance, and flexible features, it continues to be an attractive option for those planning for higher education expenses.

Looking ahead, the plan is expected to maintain its focus on providing a tax-advantaged way to save for education. The state's commitment to education and its residents' financial well-being is likely to continue supporting and improving the NY 529 Plan. As the cost of education continues to rise, the plan's benefits will only become more valuable.

Additionally, with the federal government's recent changes to 529 plans, allowing them to be used for K-12 education expenses, the NY 529 Plan is well-positioned to adapt and offer even more flexibility to its participants. This expansion of qualified expenses opens up new opportunities for families to save and plan for their children's educational journey.

Frequently Asked Questions

Can I deduct contributions to the NY 529 Plan on my federal taxes?

+

No, contributions to the NY 529 Plan are not federally tax-deductible. However, they do grow tax-free at the federal level, and withdrawals used for qualified higher education expenses are also tax-free at the federal level.

What is the maximum deduction allowed for the NY 529 Plan contributions?

+

The maximum deduction for New York State income tax purposes is 10,000 for single filers and 20,000 for married couples filing jointly. This deduction applies to contributions made to either of New York’s 529 plans.

Can I change the beneficiary of my NY 529 Plan account?

+

Yes, you can change the beneficiary of your NY 529 Plan account to another qualified family member without incurring taxes or penalties. This flexibility allows you to adapt to changing family circumstances.

What happens if I withdraw funds from my NY 529 Plan for non-qualified expenses?

+

Withdrawals for non-qualified expenses are subject to income tax and a 10% penalty on the earnings portion of the withdrawal. However, there are certain exceptions where the 10% penalty may be waived.

Can I use my NY 529 Plan funds for K-12 education expenses?

+

Yes, due to recent federal changes, 529 plans can now be used for K-12 education expenses. This includes tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible K-12 private school.