Sales Tax Charlotte Nc

When it comes to understanding sales tax in Charlotte, North Carolina, it's important to delve into the intricacies of the tax system and its impact on businesses and consumers. The sales tax rate in Charlotte is subject to both state and local regulations, which can influence the overall tax burden for residents and businesses alike. This comprehensive guide will provide an in-depth analysis of the sales tax structure in Charlotte, NC, offering valuable insights into how it functions and affects the local economy.

Understanding the Sales Tax Landscape in Charlotte, NC

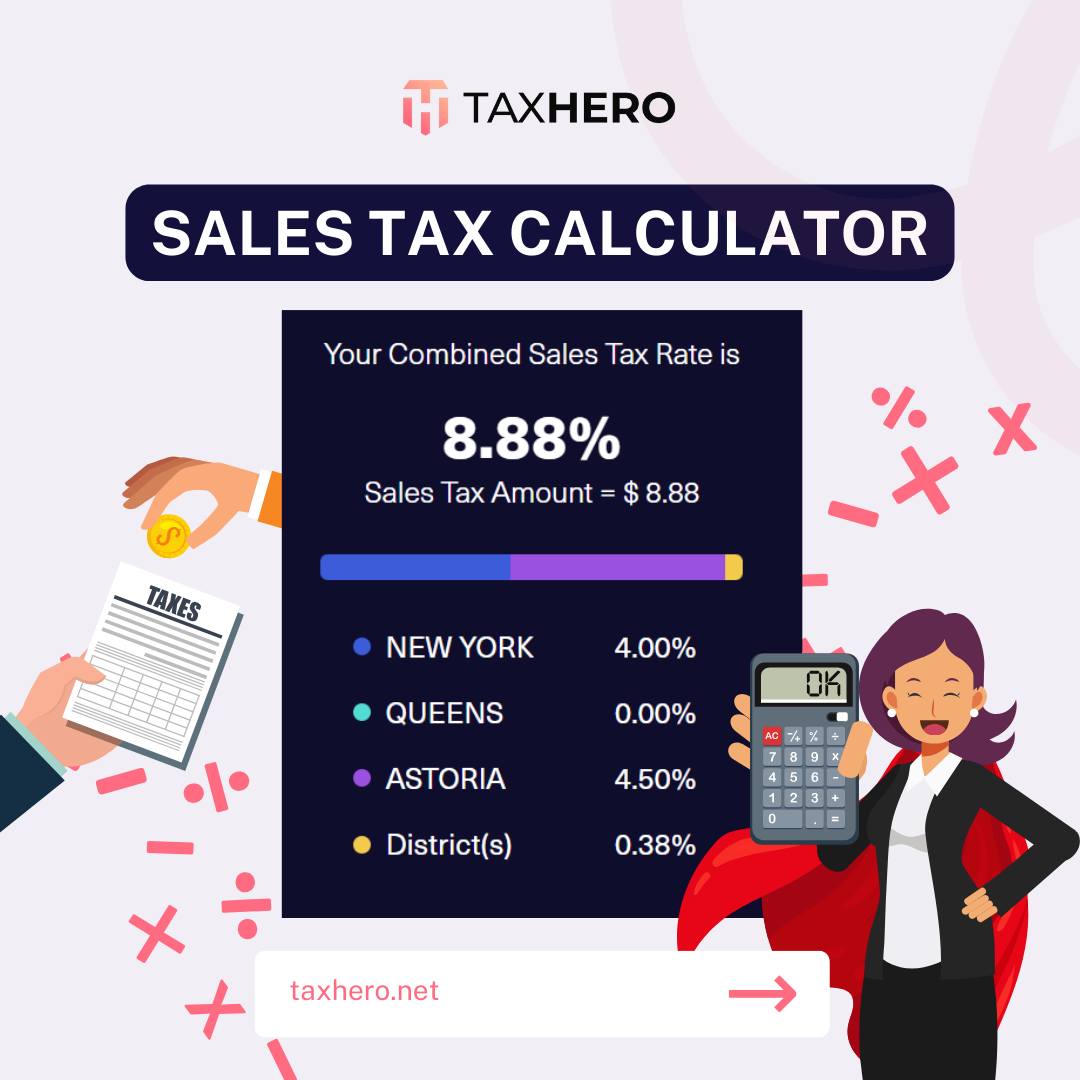

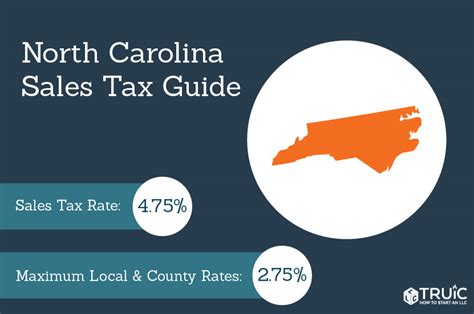

Charlotte, the largest city in North Carolina, operates within a complex sales tax system that includes state, county, and municipal taxes. The state sales tax rate is set at 4.75%, which is applied uniformly across the state. However, Charlotte, like many other cities, has an additional local sales tax rate that varies depending on the jurisdiction.

In the city of Charlotte itself, the local sales tax rate is 2.25%, bringing the total combined sales tax rate to 7% for most purchases. This local tax rate is utilized to fund essential city services and infrastructure projects. However, it's important to note that certain counties and municipalities surrounding Charlotte may have different local sales tax rates, which can impact the overall tax burden for businesses operating in these areas.

The Impact of Sales Tax on Local Businesses

Sales tax in Charlotte can significantly influence the profitability and competitiveness of local businesses. For retailers, the sales tax rate directly affects the price of goods and services, and therefore, their ability to attract customers. A higher sales tax rate can potentially discourage customers from making purchases, especially if they have the option to shop in nearby counties or online where the tax rate might be lower.

From a business perspective, managing sales tax compliance can be complex. Businesses must accurately calculate and collect the appropriate sales tax based on the location of the sale and the type of goods or services provided. Failure to comply with sales tax regulations can result in significant penalties and legal consequences.

Additionally, businesses often have to navigate the challenge of competing with online retailers, which may not be subject to the same sales tax regulations. This disparity can create an uneven playing field and impact the success of local brick-and-mortar stores.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| North Carolina (State) | 4.75% |

| Charlotte (City) | 2.25% |

| Mecklenburg County (County) | 1% |

In the case of Charlotte, the additional 1% sales tax in Mecklenburg County further complicates the tax landscape. This county-wide tax is allocated to fund specific projects and services, such as public transportation and community development initiatives.

Sales Tax Exemptions and Special Considerations

While the sales tax rate in Charlotte is relatively straightforward for most goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of.

For instance, many states, including North Carolina, offer sales tax exemptions for specific types of goods, such as groceries, prescription medications, and certain manufacturing inputs. These exemptions can significantly reduce the tax burden for consumers and businesses operating in these sectors.

Additionally, there are special provisions for certain types of businesses, such as online retailers and out-of-state sellers, which may have different sales tax collection and remittance requirements. Understanding these exemptions and provisions is crucial for businesses to avoid over-collection or under-collection of sales tax, which can lead to compliance issues.

The Future of Sales Tax in Charlotte: Trends and Implications

The sales tax landscape in Charlotte, like many other cities, is subject to change and evolution. As the city continues to grow and develop, there may be shifts in tax rates and regulations to accommodate changing economic conditions and infrastructure needs.

Potential Tax Rate Adjustments

In recent years, there has been a trend towards increasing sales tax rates in many cities and counties across the United States, including in North Carolina. This is often driven by the need to fund specific projects, such as infrastructure improvements, education initiatives, or public safety enhancements.

While a higher sales tax rate can provide much-needed revenue for these projects, it can also impact consumer spending and business profitability. As such, any potential tax rate adjustments in Charlotte would likely be a topic of significant debate and consideration among stakeholders.

The Rise of E-Commerce and Remote Sales Tax Collection

The rapid growth of e-commerce has presented unique challenges for sales tax collection. Traditionally, sales tax was only collected on transactions that occurred within the physical boundaries of a state or municipality. However, with the rise of online shopping, the distinction between in-state and out-of-state sales has become increasingly blurred.

As a result, many states, including North Carolina, have implemented remote seller laws, which require online retailers to collect and remit sales tax on transactions made with customers in the state, even if the retailer does not have a physical presence there. This shift towards remote sales tax collection is expected to continue, impacting both online retailers and consumers.

Impact on Tourism and Hospitality

Charlotte, known for its vibrant hospitality and tourism industries, may be particularly affected by changes in sales tax rates. Higher sales tax rates can influence the attractiveness of the city for tourists and impact the profitability of businesses in these sectors. On the other hand, a well-managed sales tax system can provide a stable revenue stream to support the development and maintenance of tourist attractions and infrastructure.

Conclusion: Navigating the Sales Tax Landscape in Charlotte

Understanding and navigating the sales tax landscape in Charlotte, NC, is crucial for both businesses and consumers. The city’s sales tax rate, which includes state, county, and municipal taxes, can significantly impact the cost of goods and services and influence business competitiveness.

As the sales tax system continues to evolve, staying informed about changes and regulations is essential. Whether it's adjusting to potential rate increases, adapting to remote sales tax collection laws, or understanding the impact on specific industries like tourism, being proactive in tax compliance and strategic in business planning can help navigate the complex world of sales tax in Charlotte.

What is the current sales tax rate in Charlotte, NC?

+The current sales tax rate in Charlotte is 7%, which includes a 4.75% state tax and a 2.25% local tax.

Are there any sales tax exemptions in Charlotte?

+Yes, there are certain sales tax exemptions in Charlotte, including for groceries, prescription medications, and some manufacturing inputs. It’s important to consult the North Carolina Department of Revenue for a comprehensive list of exemptions.

How do online retailers handle sales tax in Charlotte?

+Online retailers are required to collect and remit sales tax on transactions made with customers in North Carolina, even if the retailer does not have a physical presence in the state. This is known as remote seller laws.