Pa Property Tax Rebate

The Pennsylvania Property Tax (or School Property Tax) Rebate Program is a crucial initiative aimed at providing relief to eligible homeowners and renters across the state. This program, administered by the Pennsylvania Department of Revenue, offers financial assistance by rebating a portion of the property taxes paid. The aim is to ease the burden of property taxes, particularly for those on fixed or lower incomes, and to promote homeownership. With the cost of living rising and property values fluctuating, this rebate program plays a significant role in supporting Pennsylvanians.

Understanding the Pennsylvania Property Tax Rebate Program

The School Property Tax Relief Act, enacted in 2006, established the Property Tax Rebate Program. This program offers a rebate of up to 650 for homeowners and up to 500 for renters, based on their income and the property taxes they’ve paid. The rebate amount is determined by a complex formula that takes into account factors like the individual’s income, the total property tax paid, and the number of months they’ve owned or rented the property during the tax year.

For instance, consider a homeowner, Jane, who earned $35,000 in 2022 and paid $2,000 in property taxes. Given her income and tax payment, she would be eligible for a rebate of approximately $350. This example demonstrates how the program provides tailored relief, ensuring those who need it most receive adequate support.

The program's significance lies not only in its financial relief but also in its contribution to Pennsylvania's economy. By reducing the tax burden on homeowners and renters, the program encourages property ownership and stabilizes the real estate market. This, in turn, has a positive impact on the state's overall economic growth and development.

Eligibility Criteria

To be eligible for the property tax rebate, homeowners and renters must meet certain criteria. Firstly, their income for the tax year must not exceed the maximum income limit set by the program, which is 35,000 for single filers and 70,000 for married couples filing jointly. This income limit is crucial as it ensures that the program targets those who need financial assistance the most.

Additionally, homeowners must have owned and lived in their home for the entire year, or at least for the majority of it. Renters, on the other hand, must have lived in their rental property for at least six months of the tax year. These residency requirements are designed to prevent abuse of the system and ensure that the rebate goes to those who have a consistent presence in the state.

Another key criterion is that homeowners must have paid their property taxes in full by the deadline. Renters, meanwhile, must have paid at least half of their rent during the tax year. These payment requirements are in place to ensure that individuals are actively contributing to their community and not relying solely on government assistance.

| Eligibility Factor | Criteria |

|---|---|

| Income | Single: $35,000; Married Filing Jointly: $70,000 |

| Homeownership | Owned and lived in the home for the entire year |

| Rentership | Lived in the rental for at least 6 months of the tax year |

| Property Tax Payment | Paid in full for homeowners; at least half for renters |

Application Process and Rebate Calculation

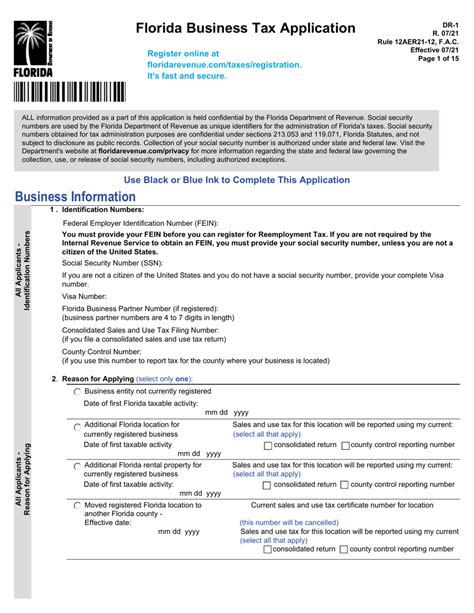

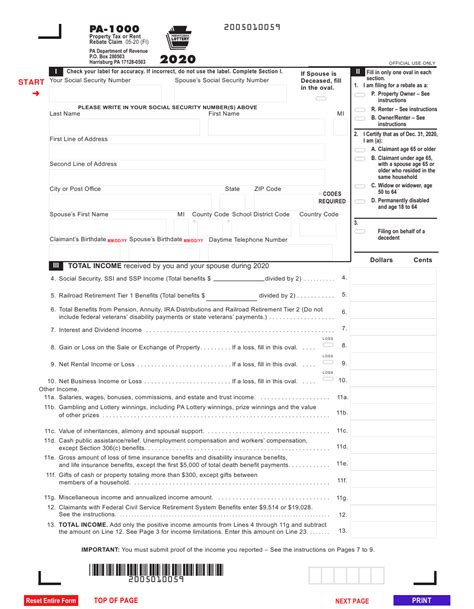

The application process for the Pennsylvania Property Tax Rebate is straightforward but requires attention to detail. Applicants can choose between a paper application or an online application, depending on their preference and comfort with technology. The paper application can be obtained from the Department of Revenue’s website or by calling their toll-free number. Once completed, it should be mailed to the address provided.

For those who prefer the online route, the Department of Revenue's website offers a user-friendly application form. Applicants need to create an account and provide detailed information about their income, property taxes paid, and residency status. The online system also allows for the direct upload of supporting documents, such as tax returns and proof of residency, making the process more efficient.

Once the application is submitted, the Department of Revenue reviews it for accuracy and completeness. If any additional information is required, applicants will be contacted via email or phone. The review process can take several weeks, especially during peak periods, so it's important to apply well in advance of the deadline.

Maximizing Your Rebate

To ensure you receive the maximum rebate possible, it’s crucial to provide accurate and complete information on your application. This includes declaring all sources of income, such as wages, pensions, investments, and any other taxable income. Additionally, you should carefully calculate your total property taxes paid, including any local taxes and school district taxes.

For homeowners, it's beneficial to keep detailed records of all property-related expenses, such as mortgage interest, property insurance, and real estate taxes. These expenses can be used to increase your potential rebate amount. Renters, on the other hand, should keep receipts or other records of their rent payments to ensure they meet the eligibility criteria.

The rebate calculation formula takes into account these various factors to determine the final rebate amount. While the formula can be complex, the Department of Revenue provides detailed instructions and examples to help applicants understand the process. It's recommended to review these resources thoroughly to ensure you're maximizing your potential rebate.

Impact and Future Outlook

The Pennsylvania Property Tax Rebate Program has had a significant impact on the lives of many Pennsylvanians. Since its inception, it has provided financial relief to hundreds of thousands of homeowners and renters, helping them manage their property tax obligations. The program’s success is evident in the number of applicants and the positive feedback it has received.

For instance, a recent survey conducted by the Department of Revenue found that over 90% of applicants were satisfied with the rebate program. Many participants highlighted how the rebate helped them pay for essential expenses, such as groceries, utilities, and medical bills. This feedback underscores the program's effectiveness in providing much-needed financial support to Pennsylvanians.

Looking ahead, the future of the property tax rebate program appears promising. With the ongoing commitment of the Pennsylvania government and the positive impact it has on the state's residents, the program is expected to continue and potentially expand. There are discussions underway to increase the income limits and the maximum rebate amount to further support homeowners and renters.

Additionally, the program's administrators are exploring ways to streamline the application process and make it more accessible. This includes potential improvements to the online application system and the introduction of new payment methods for rebate disbursements. These enhancements aim to make the program more user-friendly and efficient, ensuring that more Pennsylvanians can benefit from it.

What is the Pennsylvania Property Tax Rebate Program?

+

The Pennsylvania Property Tax Rebate Program is a state-funded initiative that provides rebates to eligible homeowners and renters to help offset the cost of their property taxes. It was established to provide financial relief to Pennsylvanians and encourage homeownership.

Who is eligible for the property tax rebate?

+

Homeowners and renters who meet certain income and residency criteria are eligible. Income limits vary depending on filing status, and applicants must have owned or rented their property for a minimum period during the tax year.

How is the rebate amount calculated?

+

The rebate amount is calculated based on the applicant’s income, the total property tax paid, and the number of months the property was owned or rented during the tax year. The formula takes into account various factors to determine the final rebate.

When is the deadline for applying for the rebate?

+

The deadline for applying for the Pennsylvania Property Tax Rebate typically falls in June or July each year. However, it’s important to check the official website or contact the Department of Revenue for the exact deadline as it can vary slightly from year to year.

How can I apply for the property tax rebate?

+

You can apply for the property tax rebate through a paper application or an online application. The Department of Revenue’s website provides detailed instructions and the necessary forms for both methods. Ensure you have all the required information and supporting documents ready before starting the application process.