San Mateo County Real Estate Taxes

Welcome to a comprehensive guide on the intricacies of San Mateo County's real estate taxes. In this article, we will delve into the specifics of the tax system, explore its impact on property owners, and provide valuable insights to help you navigate this crucial aspect of owning real estate in this vibrant county.

Understanding San Mateo County’s Real Estate Tax System

San Mateo County, located in the heart of California’s Bay Area, boasts a diverse landscape ranging from coastal communities to bustling urban centers. With its thriving economy and desirable residential areas, it’s no surprise that property ownership is a significant consideration for many residents and investors.

The real estate tax system in San Mateo County is a vital component of the local economy and plays a crucial role in funding various public services and infrastructure. Property taxes are an essential revenue source for the county, contributing to the maintenance of schools, law enforcement, transportation, and other essential community services.

The tax system in San Mateo County operates under the principles outlined by Proposition 13, a landmark legislation passed in 1978. This proposition introduced significant changes to the way property taxes are assessed and collected in California. One of its key provisions is the limitation of annual property tax increases to a maximum of 2% or the inflation rate, whichever is lower.

Property Tax Assessment

Property tax assessment is a critical process that determines the taxable value of a property. In San Mateo County, the Assessor’s Office is responsible for this task. They evaluate each property based on its characteristics, such as size, location, and improvements, to determine its fair market value.

The assessed value of a property serves as the basis for calculating the annual property tax bill. However, Proposition 13 introduces an additional layer by setting a property's taxable value at its purchase price or its assessed value, whichever is lower. This "base year value" is then used to calculate the tax liability.

| Assessment Process | Details |

|---|---|

| Fair Market Value Assessment | The Assessor's Office determines the fair market value of a property based on recent sales data and property characteristics. |

| Base Year Value | The lower of the property's purchase price or assessed value is used as the base year value, providing a stable foundation for tax calculations. |

Tax Rate Structure

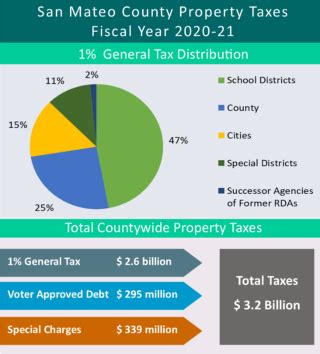

The tax rate in San Mateo County is comprised of several components, including the general tax rate, voter-approved bonds and overrides, and special assessments. These components are added together to determine the total tax rate for a specific property.

The general tax rate, set by the State of California, is currently 1% of the property's taxable value. Voter-approved bonds and overrides are additional taxes approved by the local community to fund specific projects or services. These rates vary depending on the specific bond or override and the property's location within the county.

Special assessments are levied to fund specific improvements or services that directly benefit a particular property or neighborhood. These assessments can include fees for street lighting, park maintenance, or other local improvements. The rates for special assessments are determined by the agency responsible for the improvement and are usually based on the property's proximity to the project.

Tax Bill Components

A typical property tax bill in San Mateo County includes various components, each contributing to the overall tax liability. These components include:

- General Tax: The 1% general tax rate applied to the property's taxable value.

- Voter-Approved Bonds/Overrides: Additional taxes approved by the local community for specific projects or services.

- Special Assessments: Fees for local improvements or services that directly benefit the property.

- Penalty and Interest: Late payment penalties and interest charges may apply if the tax bill is not paid by the due date.

- Collection Costs: Administrative fees incurred by the county for collecting the taxes.

It's important to note that the tax bill may also include charges for other services, such as water and garbage collection, if these services are provided by the county or a local agency.

The Impact of Real Estate Taxes on Property Owners

Real estate taxes in San Mateo County have a significant impact on property owners, both financially and in terms of their overall property ownership experience.

Financial Considerations

The annual property tax bill can be a substantial expense for property owners. While the tax system aims to provide stability and predictability, the cumulative effect of various components can result in a significant financial obligation.

For example, consider a residential property in San Mateo County with a taxable value of $1,000,000. The general tax rate of 1% would result in an annual tax liability of $10,000. Additionally, if the property is located in an area with voter-approved bonds and overrides, the tax bill could increase by several thousand dollars. Special assessments for local improvements could further add to the overall tax burden.

Property owners should carefully consider their financial plans and budget for their annual tax obligations. It's advisable to set aside funds specifically for property taxes to ensure timely payments and avoid penalties.

Property Ownership Experience

The real estate tax system in San Mateo County influences various aspects of the property ownership experience.

Firstly, the stability and predictability provided by Proposition 13 can give property owners peace of mind. Knowing that their tax liability will not increase significantly from year to year allows for better financial planning and budgeting. This stability is particularly beneficial for long-term property owners.

However, the tax system also presents challenges. The cumulative effect of various tax components and special assessments can result in higher tax bills, especially for properties located in areas with multiple bonds or assessments. This can impact the affordability of property ownership and influence decisions regarding home purchases or renovations.

Additionally, the tax system can affect property maintenance and improvements. Property owners may need to carefully consider the impact of proposed improvements on their tax liability. For instance, adding a significant addition to a home could increase its assessed value, leading to higher property taxes in subsequent years.

Strategies for Managing Real Estate Taxes

Understanding the intricacies of San Mateo County’s real estate tax system is the first step in effectively managing your tax obligations. Here are some strategies to consider:

1. Property Tax Appeals

If you believe that your property’s assessed value is incorrect or has been unfairly assessed, you have the right to appeal. The assessment appeal process allows property owners to challenge the assessed value and potentially reduce their tax liability. It’s important to gather supporting evidence and present a strong case to increase your chances of a successful appeal.

2. Tax Relief Programs

San Mateo County offers various tax relief programs to assist eligible property owners. These programs aim to provide financial relief to senior citizens, disabled individuals, and low-income homeowners. Examples include the Senior Citizen’s Property Tax Postponement Program and the Homeowner and Renter’s Assistance Program. Researching and applying for these programs can help reduce the financial burden of property taxes.

3. Tax Deductions and Credits

Explore tax deductions and credits that may be available to you. For instance, mortgage interest and property taxes are often deductible for federal income tax purposes. Additionally, California offers various tax credits and deductions for homeowners, such as the Homeowner’s Property Tax Exclusion, which provides a partial exclusion from property taxes for eligible homeowners.

4. Strategic Property Management

Consider the impact of property improvements and maintenance on your tax liability. While improvements can increase the value and appeal of your property, they may also result in higher assessed values and subsequent tax increases. Plan and budget for these improvements carefully, and explore options such as phased improvements or energy-efficient upgrades that may qualify for tax incentives.

5. Stay Informed

Stay up to date with changes in the tax system and local legislation. San Mateo County periodically reviews and adjusts tax rates, and new bonds or overrides may be proposed. By staying informed, you can anticipate potential changes and plan accordingly. Attend local government meetings, follow relevant news sources, and engage with your community to stay informed about tax-related developments.

Conclusion

San Mateo County’s real estate tax system is a complex yet crucial aspect of property ownership in the region. Understanding the assessment process, tax rate structure, and the various components of the tax bill is essential for effective financial planning and property management.

By exploring strategies such as tax appeals, relief programs, deductions, and staying informed about tax-related developments, property owners can navigate the tax landscape more effectively and ensure a more positive property ownership experience.

How often are property taxes assessed in San Mateo County?

+Property taxes in San Mateo County are assessed annually. The assessed value is typically based on the property’s value as of January 1st of the assessment year.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfairly assessed. The appeal process is managed by the San Mateo County Assessor’s Office, and property owners should follow the guidelines and timelines set by the office.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes can result in penalties and interest charges. If the taxes remain unpaid, the county may initiate tax default proceedings, which could lead to the property being sold at a tax default sale to recover the outstanding taxes.

Are there any tax relief programs available for property owners in San Mateo County?

+Yes, San Mateo County offers several tax relief programs to assist eligible property owners. These programs include the Senior Citizen’s Property Tax Postponement Program, the Homeowner and Renter’s Assistance Program, and others. Each program has specific eligibility criteria and application processes.

Can I deduct my property taxes from my federal income taxes?

+Yes, property taxes paid on your primary residence are generally deductible from your federal income taxes. However, there are limitations and restrictions, such as the SALT (State and Local Taxes) deduction cap. It’s advisable to consult with a tax professional to understand your specific situation.