Is 401K Pre Or Post Tax

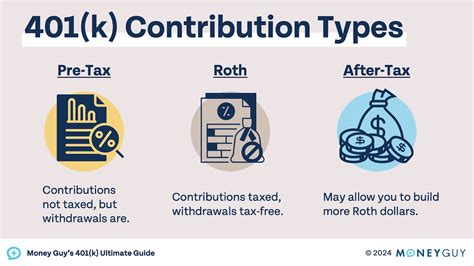

The 401(k) plan, a popular retirement savings vehicle in the United States, is a powerful tool for individuals to secure their financial future. Understanding its tax implications is crucial for maximizing the benefits of this plan. The 401(k) offers a unique advantage: the ability to contribute pre-tax dollars, providing an immediate reduction in taxable income. This pre-tax nature of contributions makes the 401(k) a highly attractive option for tax-conscious individuals.

The Pre-Tax Advantage

When you contribute to a traditional 401(k), the money you invest is deducted from your pre-tax income. This means that the amount you contribute is not subject to federal income tax at the time of deposit. For instance, if you earn 60,000 annually and contribute 6,000 to your 401(k), your taxable income for the year is reduced to $54,000. This immediate tax reduction can result in substantial savings, especially for those in higher tax brackets.

Tax Benefits of Pre-Tax Contributions

By contributing pre-tax dollars, you effectively defer the tax liability until you withdraw the funds during retirement. This deferral can be especially advantageous if you expect your tax rate to be lower in retirement. The lower tax burden during your working years can lead to significant savings and provide more financial flexibility.

Additionally, pre-tax contributions allow for the compound growth of your investments over time. As your investments grow within the 401(k) account, the gains are not taxed until withdrawal. This tax-deferred growth can result in a substantial nest egg by the time you reach retirement age.

| Key Benefits of Pre-Tax 401(k) Contributions |

|---|

| Immediate Tax Reduction |

| Deferral of Tax Liability |

| Compound Growth without Taxation |

| Potential for Higher Retirement Income |

Post-Tax Contributions: An Alternative

While the pre-tax nature of traditional 401(k) contributions is widely known, some plans also offer post-tax contributions, also known as Roth 401(k) contributions. With post-tax contributions, the money you invest is taken after taxes have been deducted from your income. While this means you won’t receive an immediate tax reduction, the funds grow tax-free within the account, and more importantly, withdrawals in retirement are tax-free.

The choice between pre-tax and post-tax contributions depends on various factors, including your current tax bracket, expected tax rates in retirement, and your personal financial goals. Many plans offer the flexibility to contribute to both pre-tax and post-tax options, allowing for a customized retirement savings strategy.

Tax Implications and Withdrawal Strategies

When you reach retirement and start withdrawing funds from your 401(k), the tax implications come into play. For traditional 401(k)s, withdrawals are subject to income tax at your current tax rate. However, if you’ve made post-tax contributions to a Roth 401(k), withdrawals are typically tax-free, as long as certain conditions are met, such as a minimum holding period and age requirements.

Rolling Over Your 401(k)

If you leave your job, you have the option to roll over your 401(k) into a new employer’s plan or an IRA (Individual Retirement Account). Rolling over pre-tax 401(k) funds maintains their pre-tax status, while post-tax funds retain their tax-free status when rolled into a Roth IRA. This rollover process ensures you maintain the tax advantages you’ve built over the years.

Frequently Asked Questions

Are there any income limits for contributing to a traditional 401(k)?

+Yes, there are annual income limits set by the IRS. For 2023, the income limit for full deductibility of traditional 401(k) contributions is 76,500 for single filers and heads of household, and 129,000 for married filing jointly. Beyond these limits, contributions are still allowed but may not be fully tax-deductible.

Can I contribute to both a traditional and Roth 401(k) simultaneously?

+Yes, many plans allow for “dual contribution,” where you can contribute to both a traditional and Roth 401(k) within the same plan. This provides the flexibility to customize your retirement savings strategy based on your tax preferences.

What happens if I withdraw funds from my 401(k) before the age of 59 1⁄2?

+Early withdrawals from a traditional 401(k) may be subject to a 10% penalty tax, in addition to regular income tax. However, there are exceptions, such as for certain hardships or if you’ve reached the age of 55 when separating from service. Withdrawals from a Roth 401(k) after a five-year holding period are generally penalty-free.