Income Tax Missouri Calculator

Missouri Income Tax Calculator: Unlocking Precision for Your Tax Planning

Welcome to a comprehensive guide on navigating the intricate world of Missouri’s income tax system. In this article, we’ll delve into the specifics of calculating your Missouri income tax obligations, offering a step-by-step breakdown that empowers you to make informed financial decisions. As a resident of Missouri, understanding the ins and outs of your tax liabilities is essential for effective financial planning. Let’s explore the key aspects and equip you with the knowledge to confidently tackle your tax calculations.

The Missouri Tax Landscape

Missouri, nestled in the heart of the United States, boasts a diverse economy and a vibrant tax system. With a progressive income tax structure, Missouri’s tax landscape offers a nuanced approach to taxation, catering to individuals and businesses alike. The state’s tax code encompasses a range of income sources, from wages and salaries to investments and business profits, each subject to specific tax rates and regulations.

Understanding Missouri’s Tax Rates

At the core of Missouri’s income tax system lies a progressive rate structure, designed to allocate tax responsibilities fairly across different income levels. The state currently employs six tax brackets, each corresponding to a specific income range and a unique tax rate. These brackets ensure that as your income increases, your tax rate gradually rises, maintaining a balanced approach to taxation.

Here’s a breakdown of Missouri’s current tax brackets:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | $0 - $2,000 | 1.50% |

| 2 | $2,001 - $3,000 | 2.00% |

| 3 | $3,001 - $4,000 | 2.50% |

| 4 | $4,001 - $6,000 | 3.00% |

| 5 | $6,001 - $9,000 | 4.00% |

| 6 | $9,001 and above | 5.30% |

These tax brackets are subject to periodic adjustments, reflecting the state’s economic conditions and legislative decisions. It’s crucial to stay updated with the latest tax rates to ensure accurate calculations.

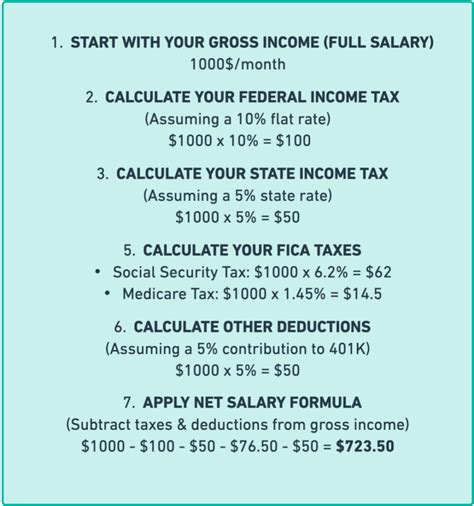

Step-by-Step Guide to Calculating Your Missouri Income Tax

Calculating your Missouri income tax involves a systematic process, taking into account various factors that influence your tax liability. Let’s break down the steps:

1. Determine Your Taxable Income: - Start by calculating your total income for the tax year, including wages, salaries, interest, dividends, and any other taxable sources. - Subtract any applicable deductions, such as contributions to retirement accounts, medical expenses, or charitable donations, to arrive at your taxable income.

2. Identify Your Tax Bracket: - Refer to the latest tax bracket guidelines provided by the Missouri Department of Revenue to determine which bracket your taxable income falls into. This step is crucial for accurate tax rate application.

3. Calculate Your Tax Liability: - Apply the corresponding tax rate from your identified bracket to your taxable income. - For example, if your taxable income falls within the 6,001 - 9,000 bracket, you’ll apply a tax rate of 4.00%. - Multiply your taxable income by the applicable tax rate to calculate your preliminary tax liability.

4. Consider Tax Credits and Adjustments: - Missouri offers various tax credits and adjustments that can reduce your tax liability. These may include credits for low-income individuals, dependent care expenses, or certain business-related activities. - Research and claim any applicable credits or adjustments to further refine your tax calculation.

5. Calculate Your Final Tax Due: - After accounting for all tax credits and adjustments, subtract any withholdings or estimated tax payments you’ve made throughout the year. - The resulting figure represents your final tax due for the tax year.

Real-Life Example: Calculating Tax for a Missouri Resident

Let’s illustrate the calculation process with a practical example:

Scenario: Sarah, a resident of Missouri, has a taxable income of $12,500 for the year.

Step 1: Determine Taxable Income: - Sarah’s total income for the year is 12,500. - She has no applicable deductions, so her taxable income remains at 12,500.

Step 2: Identify Tax Bracket: - Consulting the tax bracket guidelines, we find that Sarah’s taxable income falls within the $9,001 and above bracket, subject to a tax rate of 5.30%.

Step 3: Calculate Tax Liability: - Applying the 5.30% tax rate to Sarah’s taxable income: 12,500 * 0.0530 = 661.25

Step 4: Consider Tax Credits: - Sarah qualifies for a $200 tax credit for her dependent child.

Step 5: Calculate Final Tax Due: - Subtracting the tax credit from the preliminary tax liability: 661.25 - 200 = $461.25

Final Tax Due: Sarah’s final tax liability for the year is $461.25.

Tax Planning Strategies for Missouri Residents

Understanding how to calculate your income tax is just the beginning. Effective tax planning involves exploring strategies to optimize your financial situation and potentially reduce your tax burden. Here are some key considerations:

- Maximizing Deductions: Explore opportunities to increase your deductions, such as contributing to retirement accounts or itemizing deductions for eligible expenses.

- Tax Credits: Research and claim applicable tax credits, including those for education, energy-efficient improvements, or business investments.

- Tax-Efficient Investment Strategies: Consult with financial advisors to develop tax-efficient investment plans that align with your financial goals.

- Tax-Advantaged Accounts: Utilize tax-advantaged accounts like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to reduce your taxable income and save on healthcare expenses.

- Business Tax Planning: If you own a business, consider strategies to optimize your tax liability, such as tax-efficient business structures or deductions for business expenses.

The Role of Technology in Tax Calculation

In today’s digital age, technology plays a pivotal role in simplifying tax calculations and ensuring accuracy. Missouri offers online tools and resources to assist residents in calculating their income tax obligations. The Missouri Department of Revenue provides user-friendly calculators and tax estimation tools, making it convenient to estimate your tax liability with just a few clicks.

Stay Informed, Stay Prepared

Missouri’s tax landscape is dynamic, with frequent updates and legislative changes. Staying informed about tax regulations, brackets, and credits is essential for accurate tax planning. Regularly consult official sources, such as the Missouri Department of Revenue’s website, for the latest information and guidance.

FAQ Section

How often are Missouri's tax brackets updated?

+Missouri's tax brackets are typically updated annually to account for inflation and economic adjustments. It's essential to refer to the most recent tax tables released by the Missouri Department of Revenue for accurate calculations.

Are there any special tax rates for specific industries or professions in Missouri?

+While Missouri has a progressive tax system, it does not offer special tax rates based on industries or professions. The tax rates apply uniformly across different sectors.

Can I calculate my Missouri income tax manually, or is software necessary?

+You can calculate your Missouri income tax manually using the provided tax brackets and rates. However, for convenience and accuracy, many taxpayers opt for tax software or online calculators provided by the state.

As you embark on your tax planning journey, remember that precision and accuracy are paramount. By understanding Missouri’s income tax system and utilizing the tools at your disposal, you can navigate the tax landscape with confidence and make informed financial decisions. Stay tuned for further insights and updates as we explore the ever-evolving world of Missouri’s tax regulations.