Sales Tax In Pennsylvania

In the United States, sales tax is a significant component of the tax system, and each state has its own set of rules and regulations governing this tax. Pennsylvania, a state rich in history and culture, has a unique sales tax structure that impacts both residents and businesses. Understanding the ins and outs of Pennsylvania's sales tax is crucial for anyone conducting business or making purchases within the state.

Unraveling the Complexities of Pennsylvania Sales Tax

The sales tax in Pennsylvania is a transaction-based tax levied on the sale of tangible personal property and certain services. It is a key revenue generator for the state, funding various public services and infrastructure projects. The state’s sales tax rate is set at 6%, but it is important to note that local jurisdictions can also impose additional sales taxes, resulting in a higher overall tax rate.

For instance, in the city of Philadelphia, the combined sales tax rate is 8%, with an additional 2% surcharge applied to the state's base rate. This surcharge is dedicated to funding the city's mass transit system, SEPTA. Similarly, Allegheny County, which includes Pittsburgh, applies an additional 1% tax, bringing the total sales tax rate to 7% in that area.

Pennsylvania's sales tax is applicable to a wide range of goods and services, including clothing, electronics, furniture, and even admission fees to certain recreational activities. However, there are certain exemptions and special considerations that can impact the tax liability.

Exemptions and Special Considerations

Pennsylvania offers a variety of sales tax exemptions, which can significantly reduce the tax burden for certain purchases. For example, the state does not charge sales tax on:

- Food products for home consumption

- Prescription medications

- Nonprescription drugs

- Most clothing items

- Some agricultural and manufacturing equipment

Additionally, Pennsylvania has implemented a "Food Tax Holiday" during specific periods, typically in August. During this time, sales tax is not charged on food items, providing a significant relief to families and individuals during back-to-school shopping.

For businesses, Pennsylvania offers a Sales Tax Holiday for qualified retailers. This holiday period allows retailers to temporarily suspend the collection of sales tax, providing a boost to sales and an incentive for customers to make purchases during that time.

Taxable Services and Sourcing Rules

In addition to tangible goods, Pennsylvania’s sales tax applies to certain services as well. These services include, but are not limited to:

- Installation services

- Repair and maintenance services

- Admission fees to entertainment events

- Telecommunications services

When it comes to sourcing rules, Pennsylvania generally follows the destination-based sourcing principle. This means that the sales tax rate applied to a transaction is based on the location where the goods or services are delivered or used, not where the seller is located.

For example, if a customer in Philadelphia purchases goods from an online retailer based in another state, the sales tax would be calculated based on Philadelphia's 8% rate, not the rate of the seller's state.

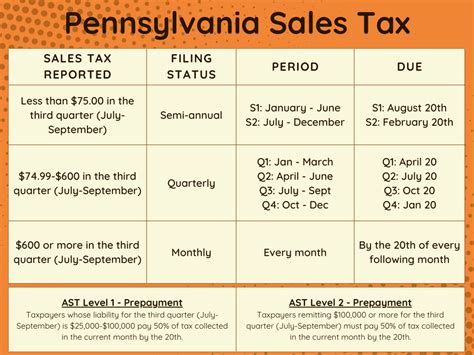

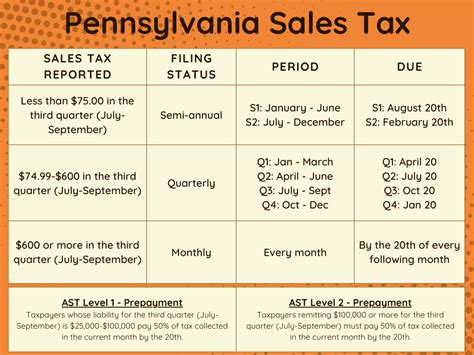

Registration and Compliance

Businesses operating in Pennsylvania or making sales into the state are required to register with the Pennsylvania Department of Revenue and obtain a Sales and Use Tax License. This license allows businesses to collect and remit sales tax to the state on a regular basis.

Compliance with sales tax regulations is crucial to avoid penalties and legal issues. Businesses must accurately calculate and collect the appropriate sales tax rates, maintain proper records, and file timely tax returns. The Department of Revenue provides resources and guidance to help businesses navigate the sales tax landscape.

Impact on E-Commerce and Online Sales

With the rise of e-commerce, Pennsylvania has had to adapt its sales tax regulations to address online sales. The state has implemented laws and regulations to ensure that out-of-state sellers with significant connections to Pennsylvania are required to collect and remit sales tax on their Pennsylvania sales.

This includes remote sellers who meet certain economic thresholds, such as having a substantial number of transactions or exceeding a certain revenue limit from Pennsylvania customers. These sellers are required to register with the state and collect the appropriate sales tax, ensuring a level playing field for in-state and out-of-state businesses.

Pennsylvania’s Sales Tax and Economic Development

Pennsylvania’s sales tax plays a critical role in the state’s economic development and infrastructure. The revenue generated from sales tax supports a wide range of public services and initiatives, including education, healthcare, transportation, and public safety.

For instance, the sales tax revenue funds the state's transportation improvement projects, ensuring safe and efficient roads and bridges for residents and businesses. It also contributes to the maintenance and expansion of the state's world-class universities and healthcare facilities.

Moreover, the sales tax acts as a tool for economic stimulation. The state often utilizes tax incentives and holidays to encourage spending and support local businesses. These initiatives can have a positive impact on employment rates and economic growth.

Sales Tax and Tourism

Pennsylvania’s sales tax structure also impacts the state’s tourism industry. The tax on admission fees to attractions and entertainment events can influence visitor spending and the overall tourism experience.

For example, the state's amusement tax, which applies to certain entertainment venues, can be a significant cost for visitors. However, the state also offers tax incentives and discounts for specific tourism-related purchases, such as hotel stays or rental car bookings, to encourage longer stays and increased spending.

Future Implications and Potential Reforms

As with any tax system, Pennsylvania’s sales tax structure is subject to ongoing evaluation and potential reforms. The state’s legislature and tax authorities regularly review the tax code to ensure fairness, efficiency, and compliance with changing economic conditions.

One area of focus is the potential expansion of sales tax to additional services and digital products. As the economy evolves and more transactions shift to the digital realm, there is a growing discussion around the taxation of streaming services, online software, and other digital goods.

Additionally, there is a movement towards simplifying the sales tax system by harmonizing tax rates and regulations across different jurisdictions within the state. This could reduce compliance burdens for businesses and provide a more consistent tax environment for consumers.

Frequently Asked Questions

What is the current sales tax rate in Pennsylvania?

+The base sales tax rate in Pennsylvania is 6%. However, local jurisdictions can impose additional taxes, resulting in higher rates. For example, Philadelphia has a combined sales tax rate of 8%, while Allegheny County has a rate of 7%.

Are there any sales tax holidays in Pennsylvania?

+Yes, Pennsylvania has implemented sales tax holidays for specific periods. These holidays often include exemptions for certain items, such as clothing or school supplies. The state also offers a Food Tax Holiday, typically in August, where food items are exempt from sales tax.

How does Pennsylvania’s sales tax apply to online purchases?

+Pennsylvania has laws in place to ensure that out-of-state sellers with significant connections to the state collect and remit sales tax on their Pennsylvania sales. This includes remote sellers who meet certain economic thresholds. The state follows destination-based sourcing, so the sales tax rate is based on the location of the buyer, not the seller.

What are the registration requirements for businesses in Pennsylvania?

+Businesses operating in Pennsylvania or making sales into the state must register with the Pennsylvania Department of Revenue and obtain a Sales and Use Tax License. This license allows businesses to collect and remit sales tax. The registration process involves providing business details and tax information to the Department of Revenue.

Are there any sales tax exemptions for specific industries or products in Pennsylvania?

+Yes, Pennsylvania offers a range of sales tax exemptions. These include exemptions for food products for home consumption, prescription medications, nonprescription drugs, most clothing items, and certain agricultural and manufacturing equipment. The state also has a Sales Tax Holiday for qualified retailers.