Tax Refund Status New York

Welcome to our comprehensive guide on the tax refund status in New York. In this article, we will delve into the ins and outs of tracking and understanding the progress of your tax refund in the Empire State. Whether you're a resident or a business owner, staying informed about your tax refund status is crucial for effective financial planning. So, let's dive in and explore the process, the tools available, and some helpful tips to ensure a smooth and efficient journey.

Navigating the Tax Refund Process in New York

The tax refund process in New York can vary depending on several factors, including your filing status, income sources, and the complexity of your tax return. However, the New York State Department of Taxation and Finance has implemented a streamlined system to ensure a transparent and efficient refund journey for taxpayers.

The Filing Process

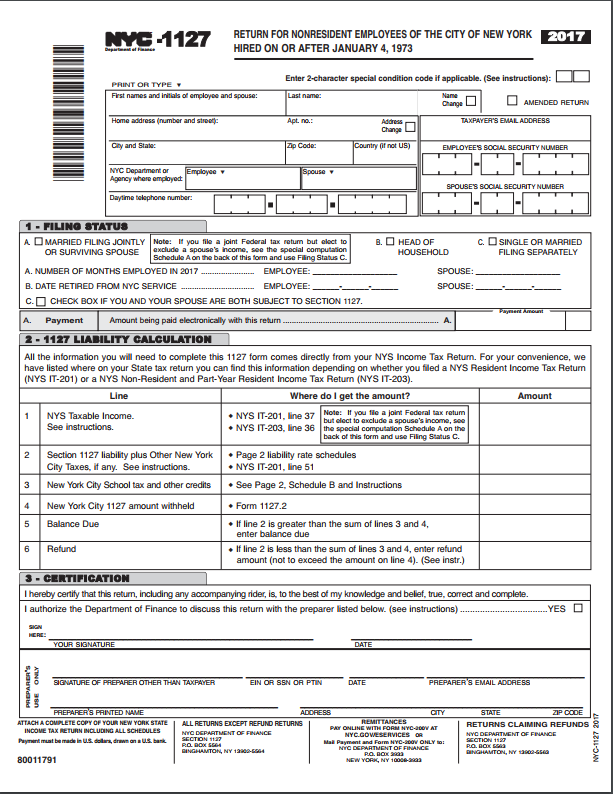

To initiate the tax refund process, New York residents and businesses must first file their tax returns accurately and timely. The state offers both electronic filing and traditional paper filing options. Electronic filing is highly encouraged, as it reduces processing time and minimizes the risk of errors.

When filing electronically, taxpayers can take advantage of user-friendly software or online platforms that guide them through the process step by step. These tools often provide real-time updates and notifications, keeping taxpayers informed about the status of their return.

For those opting for paper filing, it's essential to ensure that all required forms and supporting documents are included. Incomplete or inaccurate submissions may result in delays or additional processing time.

Processing Times and Factors

The time it takes for a tax refund to be processed and issued can vary. Several factors influence the processing timeline, including the volume of tax returns received by the state, the complexity of individual returns, and any necessary reviews or audits.

New York State aims to process electronic returns within 21 business days, while paper returns may take up to 8 weeks or more. However, these estimates can fluctuate, especially during peak tax seasons or in the event of unforeseen circumstances.

| Filing Method | Estimated Processing Time |

|---|---|

| Electronic Filing | 21 business days |

| Paper Filing | Up to 8 weeks |

It's important to note that these processing times are approximate and may not reflect the exact timeframe for your specific tax refund. Various factors unique to your return can impact the duration, so staying informed and patient is key.

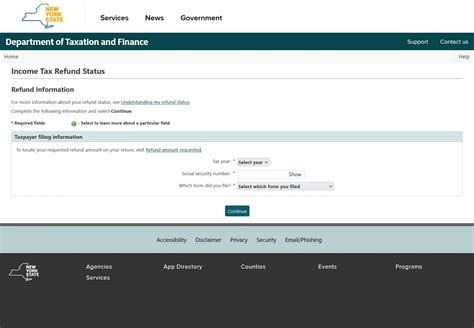

Tracking Your Tax Refund

To stay updated on the status of your tax refund, New York State provides taxpayers with a range of tracking tools and resources. These tools offer real-time information, ensuring you can plan your finances effectively.

- Online Tracking Portals: The Department of Taxation and Finance offers secure online portals where taxpayers can log in and view the status of their refund. These portals provide detailed information, including the date the refund was approved, the estimated issuance date, and the method of payment.

- Mobile Apps: For added convenience, the state has developed mobile applications compatible with iOS and Android devices. These apps allow taxpayers to check their refund status on the go, receive push notifications, and access helpful tax resources.

- Telephone Inquiries: If you prefer a more traditional approach, you can reach out to the Department's customer service representatives via telephone. They are available to provide updates and answer any questions you may have about your refund.

Common Issues and Solutions

While the tax refund process in New York is generally efficient, there may be instances where delays or issues arise. Understanding these potential hurdles and knowing how to address them can help expedite the process and provide peace of mind.

- Missing or Incomplete Information: If your tax return is missing crucial information or supporting documents, the processing of your refund may be delayed. Ensure that you carefully review your return before submission to avoid any errors or omissions.

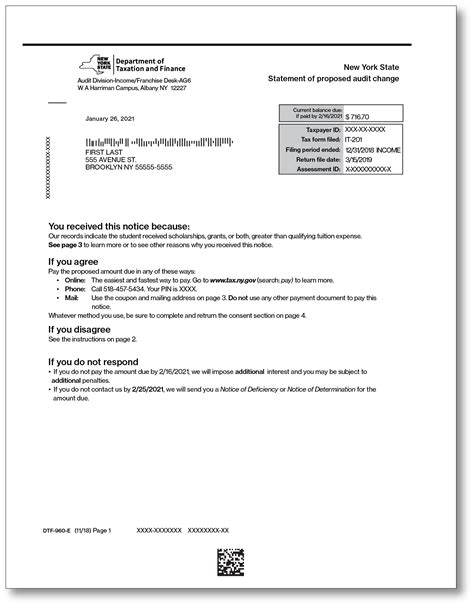

- Audit or Review: In some cases, the Department of Taxation and Finance may select certain tax returns for audit or further review. This process is standard and helps ensure the accuracy of tax returns. If your return is chosen for review, be prepared for additional processing time.

- Identity Verification: To prevent fraud and protect taxpayers, the state may implement identity verification measures. If you are required to verify your identity, follow the provided instructions carefully to avoid any unnecessary delays.

Maximizing Your Tax Refund

Beyond tracking and understanding the progress of your tax refund, there are strategies you can employ to potentially increase your refund amount or optimize your financial situation.

Tax Credits and Deductions

When preparing your tax return, it’s crucial to explore all eligible tax credits and deductions. These financial incentives can significantly reduce your taxable income, resulting in a larger refund or a reduced tax liability.

- Child Tax Credit: If you have qualifying children, you may be eligible for the Child Tax Credit. This credit provides a substantial benefit for families, helping to offset the costs of raising children.

- Education Credits: For those pursuing higher education or supporting family members in their educational endeavors, education credits such as the American Opportunity Credit and the Lifetime Learning Credit can offer substantial savings.

- Energy-Efficient Home Improvements: New York State offers tax credits for energy-efficient home improvements. By investing in energy-saving technologies, you can not only reduce your environmental impact but also potentially qualify for tax benefits.

Tax Planning and Financial Strategies

Tax planning is an essential aspect of financial management. By working with a tax professional or utilizing tax preparation software, you can develop strategies to optimize your tax liability and maximize your refund.

- Retirement Contributions: Maximizing contributions to tax-advantaged retirement accounts, such as 401(k)s or IRAs, can provide significant tax savings. These contributions reduce your taxable income, potentially resulting in a larger refund or a lower tax bill.

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, contributing to an HSA can offer triple tax benefits. HSAs allow you to save pre-tax dollars for qualified medical expenses, providing a tax-efficient way to manage healthcare costs.

- Investment Strategies: Carefully planning your investment strategy can have tax implications. Understanding capital gains taxes, tax-efficient investment vehicles, and tax-loss harvesting techniques can help you optimize your investment portfolio and potentially reduce your tax liability.

Staying Informed and Prepared

Tax laws and regulations can change annually, so staying informed about updates and amendments is crucial. By keeping up with the latest tax news and consulting with tax professionals, you can ensure that you’re taking advantage of all available opportunities to maximize your tax refund.

Additionally, maintaining organized financial records and supporting documentation is essential for an efficient tax refund process. Being prepared with accurate and complete information can streamline the filing and tracking process, reducing the likelihood of delays or errors.

Conclusion: Empowering Your Financial Journey

Navigating the tax refund process in New York can be a seamless and rewarding experience with the right tools and knowledge. By understanding the filing process, tracking your refund status, and employing strategic tax planning, you can take control of your financial situation and maximize your tax refund.

Remember, staying informed, organized, and proactive is key to a successful tax refund journey. Whether you're a New York resident or a business owner, the insights and strategies outlined in this guide can empower you to make the most of your tax refund and plan for a brighter financial future.

How can I check the status of my tax refund in New York if I don’t have access to online portals or mobile apps?

+If you prefer not to use online portals or mobile apps, you can call the New York State Department of Taxation and Finance’s customer service line at 1-800-322-4239. Their representatives can provide you with updates on your tax refund status and answer any questions you may have.

What should I do if I think there’s an error in my tax refund amount or status?

+If you suspect an error with your tax refund, it’s important to act promptly. Contact the Department of Taxation and Finance and explain the issue. They will guide you through the necessary steps to resolve the error and ensure you receive the correct refund amount.

Can I receive my tax refund via direct deposit instead of a check?

+Absolutely! When filing your tax return, you can opt for direct deposit. This method is faster and more secure than receiving a physical check. Simply provide your bank account details accurately to ensure a smooth refund process.