Wayne County Property Taxes

Wayne County, Michigan, is a bustling metropolitan area that encompasses a diverse range of communities and properties. From the vibrant city of Detroit to the charming suburbs, the county's real estate landscape is vast and varied. Property taxes play a significant role in the financial well-being of this region, impacting both residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of Wayne County property taxes, exploring the factors that influence tax assessments, the process of tax calculation, and the various avenues for taxpayers to understand and manage their obligations effectively.

Understanding the Wayne County Property Tax Landscape

Wayne County, with its rich history and cultural diversity, presents a unique property tax environment. The county’s tax system is designed to support local governments, schools, and essential services, ensuring the continued development and maintenance of the region. Property taxes in Wayne County are primarily based on the assessed value of a property and are subject to various factors, including location, property type, and local tax rates.

Property Assessment Process

The assessment process in Wayne County is a meticulous endeavor, aiming to accurately determine the taxable value of each property. The County Equalization Department plays a pivotal role in this process, ensuring fairness and accuracy across the county. Here's a breakdown of the key steps involved in property assessment:

- Data Collection: Assessors gather information about properties, including physical characteristics, recent sales data, and any improvements made.

- Market Analysis: The department analyzes the real estate market to determine the current value of similar properties.

- Assessment Notice: Property owners receive an assessment notice detailing the proposed taxable value. This notice serves as a crucial tool for taxpayers to understand their potential tax liability.

- Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal. The appeal process provides an opportunity for taxpayers to present evidence and argue for a fairer assessment.

The assessment process is vital as it forms the basis for property tax calculations, influencing the financial obligations of property owners throughout the county.

Factors Influencing Property Tax Rates

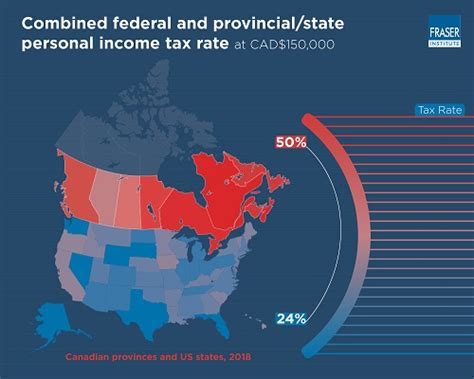

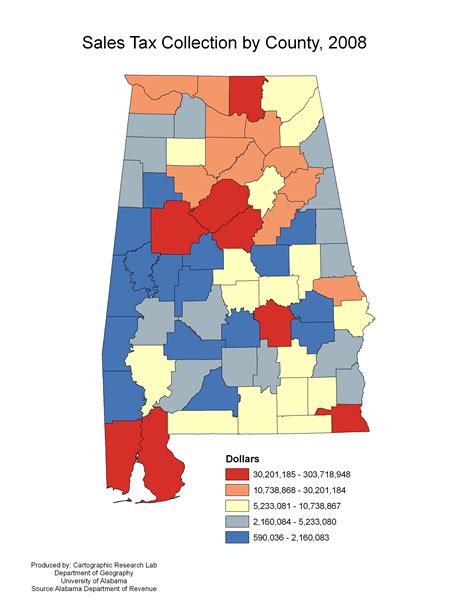

Property tax rates in Wayne County are not uniform and can vary significantly depending on several factors. Understanding these influences is essential for taxpayers to comprehend their specific tax situation.

| Factor | Impact |

|---|---|

| Location | Tax rates can differ between cities and townships within the county. For instance, Detroit may have different tax rates compared to neighboring suburbs. |

| Property Type | The type of property, such as residential, commercial, or industrial, can affect tax rates. Different tax classifications often carry distinct tax responsibilities. |

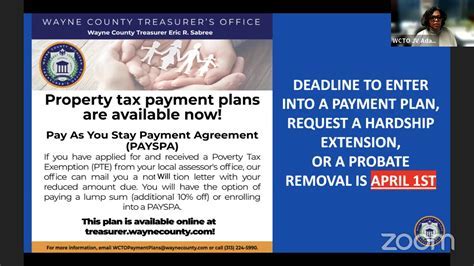

| Millage Rates | Millage rates, set by local governments and school districts, determine the tax rate per thousand dollars of taxable value. Higher millage rates result in increased property taxes. |

| Special Assessments | Special assessments are additional charges levied for specific improvements or services. These can include sewer connections, street lighting, or infrastructure projects. |

Calculating Wayne County Property Taxes

Property tax calculations in Wayne County involve a series of steps that ultimately determine the annual tax liability for each property owner. While the process may seem complex, understanding the methodology can empower taxpayers to make informed decisions.

Step-by-Step Guide to Tax Calculation

- Assessed Value Determination: The first step is to establish the assessed value of the property. This value is typically a percentage of the property's true cash value, as determined by the assessment process.

- Apply Tax Rates: Once the assessed value is known, the applicable tax rates for the property's location and type are applied. These rates, expressed in mills (0.001), are multiplied by the assessed value to calculate the tax amount.

- Consider Special Assessments: Any special assessments applicable to the property are added to the base tax amount. These assessments are often levied for specific improvements or services.

- Review and Payment: Property owners receive a tax bill detailing the calculated amount. They are responsible for paying this amount by the due date to avoid penalties and interest.

Example Calculation

Let’s illustrate the tax calculation process with an example. Suppose a residential property in Wayne County has an assessed value of $150,000, and the applicable tax rate is 35 mills. Here’s how the tax amount is calculated:

Assessed Value: $150,000

Tax Rate: 35 mills (0.035)

Tax Amount = Assessed Value x Tax Rate

Tax Amount = $150,000 x 0.035

Tax Amount = $5,250

In this example, the property owner would owe $5,250 in property taxes for the year.

Managing Property Taxes: Strategies and Resources

Understanding and managing property taxes is essential for maintaining financial stability. Wayne County provides various resources and strategies to assist taxpayers in navigating the tax landscape effectively.

Tax Deductions and Exemptions

Wayne County offers several tax deductions and exemptions to eligible property owners. These can significantly reduce tax liabilities and provide financial relief. Some common deductions and exemptions include:

- Homestead Exemption: This exemption provides a reduction in taxable value for owner-occupied residential properties.

- Veteran's Exemption: Eligible veterans may qualify for a property tax exemption based on their service.

- Senior Citizen Exemption: Senior citizens who meet certain criteria may be eligible for a tax exemption or a reduced tax rate.

- Agricultural Property Tax Relief: Properties used for agricultural purposes may be eligible for tax relief programs.

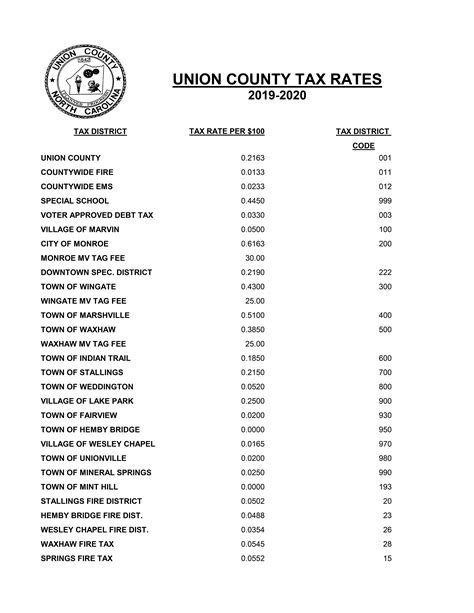

Payment Options and Assistance

Wayne County recognizes that property taxes can be a significant financial burden for some residents. To alleviate this, the county offers a range of payment options and assistance programs:

- Installment Plans: Property owners can opt for installment plans, allowing them to spread their tax payments over multiple months.

- Property Tax Relief Programs: These programs provide financial assistance to eligible low-income homeowners, helping them manage their tax obligations.

- Online Payment Portal: The county's website offers a user-friendly portal for taxpayers to make payments conveniently and securely.

Appealing Tax Assessments

If a property owner believes their assessment is inaccurate or unfair, they have the right to appeal. The appeal process in Wayne County is designed to ensure fairness and transparency. Here’s a simplified guide to the appeal process:

- Gather Evidence: Collect documentation supporting your claim, such as recent sales data or appraisals.

- File an Appeal: Submit an appeal form to the County Equalization Department within the specified timeframe.

- Hearing: If necessary, attend a hearing to present your case. This is an opportunity to provide evidence and argue for a revised assessment.

- Decision: The County Equalization Department will issue a decision, which can be further appealed if the taxpayer disagrees.

The Future of Wayne County Property Taxes

The property tax landscape in Wayne County is dynamic, influenced by economic trends, legislative changes, and community needs. As the region continues to evolve, several factors will shape the future of property taxes:

- Economic Growth: A thriving economy can lead to increased property values, potentially impacting tax assessments and rates.

- Legislative Reforms: Changes in state or local tax laws can have a significant impact on property tax structures and obligations.

- Community Development: Investments in infrastructure and community projects may result in special assessments or changes in tax rates.

- Technology Integration: Advancements in technology can improve the accuracy and efficiency of the assessment process, ensuring fairer tax calculations.

Conclusion

Wayne County property taxes are a critical component of the region’s financial framework, supporting essential services and community development. By understanding the assessment process, tax calculation methodology, and available resources, property owners can navigate the tax landscape with confidence. Whether it’s exploring tax deductions, appealing assessments, or accessing payment assistance, Wayne County offers a range of options to ensure a fair and transparent tax system.

Frequently Asked Questions

How often are property assessments conducted in Wayne County?

+Property assessments in Wayne County are typically conducted every year. Assessors work to ensure that property values are accurately reflected in the tax system.

Can I appeal my property assessment if I disagree with the value assigned to my property?

+Absolutely! If you believe your property’s assessed value is inaccurate, you have the right to appeal. The appeal process provides an opportunity to present evidence and argue for a fair assessment.

What are the payment options for property taxes in Wayne County?

+Wayne County offers a range of payment options, including online payments, installment plans, and traditional methods like checks or money orders. You can choose the option that best suits your financial situation.

Are there any tax relief programs available for low-income homeowners in Wayne County?

+Yes, Wayne County provides property tax relief programs for eligible low-income homeowners. These programs offer financial assistance to help manage tax obligations.