Union County Tax

Welcome to this comprehensive guide on understanding and managing your Union County Tax obligations. As a resident or business owner in Union County, it's essential to navigate the complex world of taxation effectively. In this article, we'll delve into the intricacies of Union County's tax system, providing you with valuable insights and practical advice to ensure compliance and optimize your financial strategies.

Unraveling the Complexity of Union County Tax

Union County, with its vibrant communities and diverse economy, presents a unique tax landscape. From property taxes to income taxes and business-specific levies, the county’s tax structure is designed to support essential services while promoting economic growth. Let’s explore the key aspects of Union County’s taxation system and offer expert guidance to help you make informed decisions.

Property Taxes: A Key Component

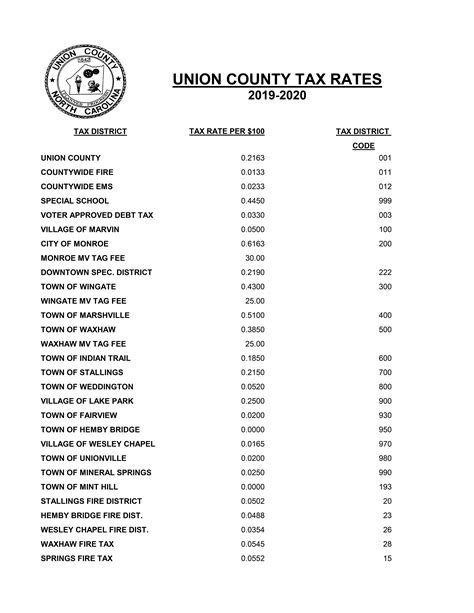

Property taxes form a significant portion of Union County’s revenue stream. As a homeowner or commercial property owner, understanding the assessment process and tax rates is crucial. Here’s a breakdown of the property tax system in Union County:

- Assessment Process: The county conducts regular property assessments to determine the taxable value of real estate. This value is based on factors like property improvements, location, and market conditions.

- Tax Rates: Union County utilizes a millage rate system, where taxes are calculated as a percentage of the assessed value. The millage rate is determined annually by the county government and may vary across different areas within the county.

- Payment Options: Property owners have the flexibility to pay their taxes in installments or opt for automatic payments to streamline the process. Late payments may incur penalties and interest.

| Assessment Year | Millage Rate | Average Tax per $100,000 of Assessed Value |

|---|---|---|

| 2023 | 18.5 mills | $1,850 |

| 2022 | 18.2 mills | $1,820 |

| 2021 | 17.8 mills | $1,780 |

Income Taxes: Navigating Personal and Business Levies

Union County, like many other jurisdictions, imposes income taxes on individuals and businesses. Understanding the tax brackets and filing requirements is essential for accurate reporting and compliance.

- Individual Income Tax: Residents of Union County are subject to a progressive income tax system. The tax rates vary based on taxable income and filing status. It’s crucial to stay updated with any changes in tax laws and brackets to ensure accurate filings.

- Business Income Tax: Businesses operating within Union County are responsible for paying business income taxes. The tax rate may vary depending on the business structure (sole proprietorship, partnership, corporation, etc.) and the specific industry. Consulting with a tax professional can help businesses navigate the complexities of business taxation.

Sales and Use Taxes: Impact on Consumers and Businesses

Sales and use taxes are an integral part of Union County’s tax structure, impacting both consumers and businesses. These taxes are applied to various goods and services and play a significant role in funding public services.

- Sales Tax: When you purchase goods or certain services in Union County, a sales tax is typically added to the purchase price. The rate may vary depending on the type of item and the location of the sale. Businesses are responsible for collecting and remitting sales taxes to the county.

- Use Tax: Use tax is applicable when goods or services are purchased outside of Union County but used or consumed within the county. This tax ensures fairness and prevents tax evasion. Businesses and individuals are required to self-report and pay use taxes to comply with the law.

Tax Incentives and Credits: Boosting Economic Growth

Union County recognizes the importance of encouraging economic development and business growth. To achieve this, the county offers various tax incentives and credits to eligible businesses and industries.

- Job Creation Tax Credits: Businesses that create a significant number of new jobs within the county may be eligible for tax credits. These credits can offset a portion of the employer’s tax liability, providing a financial incentive for job creation.

- Research and Development Tax Credits: Companies engaged in research and development activities may qualify for tax credits. These credits aim to promote innovation and technological advancements, making Union County an attractive hub for R&D-focused businesses.

- Green Energy Tax Incentives: Union County supports the adoption of renewable energy sources. Businesses investing in solar, wind, or other green energy projects may be eligible for tax incentives, encouraging sustainable practices and reducing the county’s carbon footprint.

Staying Informed and Compliant: A Proactive Approach

Navigating the complexities of Union County’s tax system requires a proactive and informed approach. Here are some essential steps to ensure compliance and optimize your tax strategies:

- Stay Updated: Tax laws and regulations can change frequently. Subscribe to official notifications from the Union County Tax Office to stay informed about any updates or changes that may impact your tax obligations.

- Consult Professionals: Engage the services of qualified tax professionals, such as certified public accountants or tax attorneys, who specialize in Union County’s tax system. They can provide personalized advice, ensure accurate filings, and help you maximize available tax benefits.

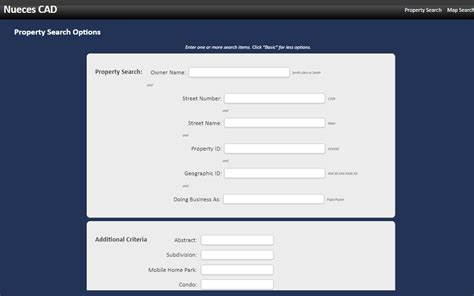

- Explore Online Resources: The Union County Tax Office website offers a wealth of information, including tax forms, payment options, and guides for specific tax scenarios. Utilize these resources to understand your rights and responsibilities as a taxpayer.

- Timely Filing and Payment: Ensure that you file your tax returns and make payments by the designated deadlines. Late filings and payments can result in penalties and interest, impacting your financial well-being.

Conclusion: A Prosperous Union County Through Responsible Taxation

Union County’s tax system, while complex, plays a vital role in supporting the community’s growth and development. By understanding your tax obligations and leveraging the available resources, you can contribute to the county’s prosperity while optimizing your financial strategies. Remember, responsible taxation is a collective effort that benefits all residents and businesses in Union County.

How often are property assessments conducted in Union County?

+Property assessments in Union County are typically conducted every two years. However, certain circumstances, such as significant property improvements or market fluctuations, may trigger reassessments.

Are there any tax exemptions for senior citizens in Union County?

+Yes, Union County offers tax exemptions for eligible senior citizens. To qualify, homeowners must be at least 65 years old and meet certain income and residency requirements. These exemptions can provide significant relief from property taxes.

How can businesses stay updated on tax incentives and credits offered by Union County?

+Businesses can stay informed about tax incentives and credits by regularly visiting the Union County Economic Development website or subscribing to their newsletters. These resources provide detailed information on eligibility criteria and application processes.