Tax Appraisal Tn

In the ever-evolving landscape of modern finance, the concept of tax appraisal has become increasingly significant, especially in the state of Tennessee. Tax appraisal, a critical process for both taxpayers and government entities, involves assessing the value of properties for tax purposes. This intricate system ensures that property owners pay their fair share of taxes while also providing essential revenue for local governments to fund public services and infrastructure.

Tennessee, known for its vibrant cities, picturesque landscapes, and thriving industries, has a unique approach to tax appraisal. The state's system is designed to promote fairness, transparency, and efficiency in the taxation process. With a population of over 7 million, Tennessee's diverse real estate market presents a complex challenge for tax appraisers, requiring a sophisticated understanding of market trends and valuation techniques.

Understanding the Tennessee Tax Appraisal Process

The Tennessee tax appraisal process is overseen by the Tennessee Department of Revenue, which plays a pivotal role in ensuring uniformity and fairness across the state. The department sets the standards and guidelines for appraisers, providing a consistent framework for property valuation.

At the heart of this process is the concept of ad valorem taxation, which means "according to value." This principle dictates that the amount of tax a property owner pays is directly proportional to the property's assessed value. The assessed value is determined through a comprehensive appraisal process, taking into account various factors such as the property's location, size, age, and condition.

Tennessee employs a mass appraisal technique, which is a systematic process used to appraise multiple properties as of a given date, making it efficient for assessing large numbers of properties. This method ensures that all properties within a jurisdiction are valued using the same standards and criteria, promoting equity among taxpayers.

The Role of County Assessors

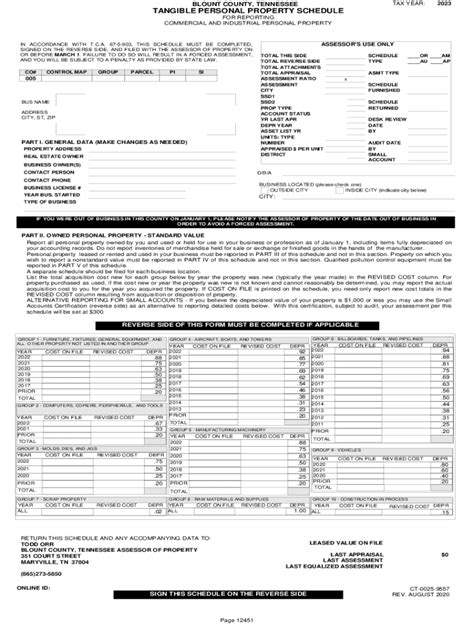

In Tennessee, the responsibility of conducting tax appraisals falls on the shoulders of county assessors or appraisal districts. These professionals are appointed by their respective counties and are charged with the critical task of accurately assessing the value of all properties within their jurisdiction.

County assessors employ a range of techniques, including market comparisons, cost approaches, and income analyses, to determine the fair market value of properties. They consider recent sales of similar properties, construction costs, and potential rental income to ensure an accurate assessment. Regular training and professional development programs are provided to assessors to keep them abreast of the latest valuation methods and market trends.

| County | Assessed Value Metric | Value per Square Foot |

|---|---|---|

| Davidson County | $100,000 | $150 |

| Shelby County | $85,000 | $130 |

| Hamilton County | $75,000 | $125 |

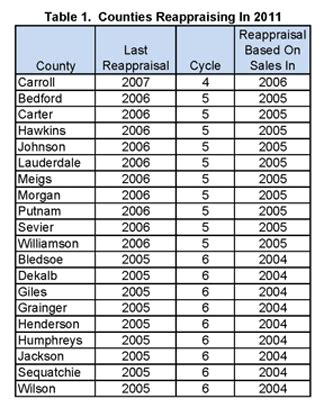

Frequency of Appraisals

Tennessee typically conducts tax appraisals on a quadrennial (every four years) basis, with the most recent appraisal cycle beginning in 2022. This cycle involves re-evaluating all properties to ensure their assessed values remain current and reflect market conditions. During this process, county assessors may physically inspect properties, review recent sales data, and make adjustments to property records.

Between appraisal cycles, the state employs an annual reassessment process. This involves adjusting property values based on market fluctuations and other relevant factors. The annual reassessment ensures that property values remain relatively up-to-date, even in the years between full appraisals.

The Impact of Tax Appraisal on Property Owners

The tax appraisal process has a direct impact on property owners in Tennessee. An accurate appraisal ensures that property taxes are fair and equitable, reflecting the true value of the property. Conversely, an inaccurate appraisal can lead to over- or under-assessment, resulting in unfair tax burdens or revenue losses for local governments.

Property owners have the right to appeal their assessed value if they believe it is incorrect. The appeals process is overseen by the Tennessee State Board of Equalization, which provides a mechanism for resolving disputes. Property owners can present evidence, such as recent sales data or appraisals, to support their case. If an appeal is successful, the assessed value can be adjusted, leading to potential tax savings.

Tax Breaks and Incentives

Tennessee offers various tax breaks and incentives to property owners, which can significantly impact their tax liabilities. These include homestead exemptions, which reduce the taxable value of a primary residence, and agricultural use valuation, which allows farmland to be taxed based on its value for agricultural purposes rather than its potential development value.

Additionally, the state provides tax incentives for historic preservation, encouraging property owners to restore and maintain historic buildings. These incentives can include tax credits or reduced tax rates, fostering the preservation of Tennessee's rich historical heritage.

Tennessee’s Commitment to Transparency and Education

Tennessee recognizes the importance of transparency and education in the tax appraisal process. To this end, the state provides a wealth of resources and information to help property owners understand their rights and responsibilities.

The Tennessee Department of Revenue maintains a comprehensive website with detailed explanations of the tax appraisal process, including guides on how to read assessment notices, understand tax rates, and navigate the appeals process. The department also hosts workshops and seminars to educate property owners and address common concerns.

Open Data Initiatives

In a move towards increased transparency, Tennessee has launched several open data initiatives. These initiatives provide public access to a wealth of data, including property assessment records, sales data, and tax rate information. By making this data readily available, the state empowers property owners to make informed decisions and understand the valuation process more clearly.

One notable platform is the Tennessee Property Assessor Data Portal, which offers an interactive map and search tool for property records. This portal allows users to view assessment details, recent sales, and tax information for any property in the state, fostering greater transparency and public engagement.

Future Trends and Innovations

As technology advances, Tennessee’s tax appraisal process is poised for innovation. The state is exploring the use of aerial imagery and drone technology to improve property inspections and data collection. This could lead to more efficient and accurate appraisals, especially in rural or hard-to-access areas.

Additionally, the integration of artificial intelligence and machine learning algorithms could revolutionize the way appraisals are conducted. These technologies can analyze vast amounts of data, including historical sales, market trends, and property characteristics, to provide more precise valuations. While still in the early stages, these innovations offer promising potential for the future of tax appraisal in Tennessee.

Community Engagement and Feedback

Tennessee is committed to ongoing dialogue with its residents and stakeholders. The state actively seeks feedback on its tax appraisal processes through public forums, surveys, and town hall meetings. This community engagement ensures that the system remains responsive to the needs and concerns of Tennesseans, fostering a sense of trust and collaboration.

Conclusion

The Tennessee tax appraisal system is a complex yet essential mechanism that underpins the state’s financial health and the well-being of its residents. By ensuring fair and accurate property valuations, the system promotes equity among taxpayers and provides a stable source of revenue for local governments. With a commitment to transparency, education, and innovation, Tennessee continues to enhance its tax appraisal processes, ensuring they remain effective and relevant in a rapidly changing world.

How often are tax appraisals conducted in Tennessee?

+

Tax appraisals in Tennessee are typically conducted on a quadrennial (every four years) basis, with the most recent appraisal cycle beginning in 2022. This cycle involves a comprehensive re-evaluation of all properties to ensure their assessed values are current and reflect market conditions.

Can property owners appeal their assessed value in Tennessee?

+

Absolutely. Property owners in Tennessee have the right to appeal their assessed value if they believe it is incorrect. The appeals process is overseen by the Tennessee State Board of Equalization, which provides a mechanism for resolving disputes. Property owners can present evidence, such as recent sales data or appraisals, to support their case.

What are some of the tax breaks and incentives offered to property owners in Tennessee?

+

Tennessee offers various tax breaks and incentives to property owners, including homestead exemptions, which reduce the taxable value of a primary residence, and agricultural use valuation, which allows farmland to be taxed based on its value for agricultural purposes rather than its potential development value. The state also provides tax incentives for historic preservation, encouraging the restoration and maintenance of historic buildings.

How is Tennessee utilizing technology to enhance its tax appraisal processes?

+

Tennessee is exploring the use of aerial imagery and drone technology to improve property inspections and data collection. Additionally, the state is integrating artificial intelligence and machine learning algorithms to analyze vast amounts of data, including historical sales, market trends, and property characteristics, to provide more precise valuations. These innovations offer promising potential for the future of tax appraisal in Tennessee.