Pay Car Tax

Paying car tax, also known as vehicle excise duty (VED) in the UK, is an essential aspect of vehicle ownership. It is a mandatory tax levied on most types of vehicles, and it contributes to the maintenance of roads and the funding of various transport-related initiatives. This article aims to provide a comprehensive guide to understanding and navigating the process of paying car tax, ensuring you stay compliant with the law and avoid any unnecessary penalties.

Understanding Car Tax: A Comprehensive Overview

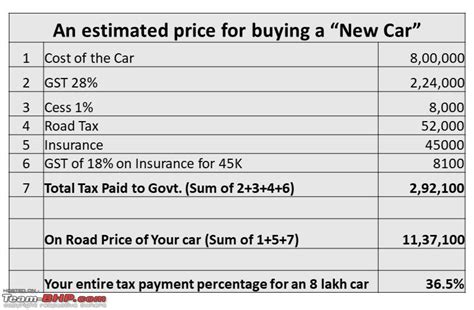

Car tax, or VED, is a legal requirement for any vehicle that is registered and used on public roads in the UK. It is calculated based on various factors, including the vehicle’s fuel type, engine size, and carbon dioxide (CO2) emissions. The purpose of this tax is to generate revenue for the government to invest in transportation infrastructure and promote environmentally friendly practices.

The current car tax system in the UK is divided into two main categories: the first-year rate and the standard rate. The first-year rate applies to newly registered vehicles and is typically higher, reflecting the environmental impact of new cars. The standard rate, on the other hand, is applicable for subsequent years of ownership and is calculated based on the vehicle's emissions.

First-Year Rate

When you purchase a new vehicle, the first-year rate of car tax is applied. This rate is determined by the vehicle’s CO2 emissions and fuel type. For example, a petrol or diesel car with CO2 emissions of 1-50g/km will incur a first-year rate of £0, while a vehicle with emissions of 226-255g/km will face a significantly higher first-year rate of £2,135.

| CO2 Emissions (g/km) | First-Year Rate |

|---|---|

| 1-50 | £0 |

| 51-75 | £10 |

| 76-90 | £25 |

| 91-100 | £125 |

| 101-110 | £140 |

| 111-130 | £160 |

| 131-150 | £200 |

| 151-170 | £515 |

| 171-190 | £830 |

| 191-225 | £1,240 |

| 226-255 | £2,135 |

Standard Rate

After the first year of ownership, the standard rate of car tax applies. This rate is dependent on the vehicle’s fuel type and CO2 emissions. For petrol and diesel cars, the standard rate ranges from £150 to £145 per year, depending on the emissions category. However, for vehicles with lower emissions, the standard rate can be as low as £10 or even £0.

| CO2 Emissions (g/km) | Standard Rate |

|---|---|

| 0-50 | £0 |

| 51-75 | £10 |

| 76-90 | £25 |

| 91-100 | £125 |

| 101-110 | £140 |

| 111-130 | £145 |

| 131-150 | £150 |

The Process of Paying Car Tax

Paying car tax in the UK is a straightforward process, and there are several convenient methods to choose from. The most common ways to pay car tax include:

- Online Payment: The fastest and most efficient way to pay car tax is through the Government's official website. You'll need your vehicle's registration number and make, as well as a valid payment method. This method allows you to pay the exact amount of tax due, and you'll receive a confirmation email as proof of payment.

- Telephone Payment: If you prefer not to use online services, you can pay car tax over the phone. Call the Vehicle Licensing Contact Centre on 0300 790 6802 (England, Scotland, and Wales) or 0300 200 7866 (Northern Ireland), and have your payment details and vehicle information ready.

- Post Office: You can also pay car tax at your local Post Office. Simply take your payment and vehicle details to the counter, and the staff will assist you in completing the transaction. This method is particularly useful if you prefer a face-to-face interaction or have limited access to online services.

Payment Frequency

Car tax is typically paid annually, and the renewal date is based on the month you first registered your vehicle. For example, if you registered your car in March, you will need to renew your car tax every March. It’s important to keep track of this date to avoid any late payment penalties.

Exemptions and Discounts

Certain vehicles and individuals may be eligible for exemptions or discounts when paying car tax. For instance, disabled individuals may qualify for a Disabled Persons’ Vehicle Relief, which allows them to pay a reduced rate or be exempt from car tax altogether. Additionally, some classic cars over 40 years old may also be exempt from car tax.

Staying Compliant and Avoiding Penalties

Failure to pay car tax can result in significant penalties and legal consequences. The penalties for not paying car tax on time include:

- Initial Penalty: If you miss the renewal deadline, you will receive a reminder notice from the DVLA (Driver and Vehicle Licensing Agency) within a few weeks. This notice will inform you of the outstanding tax and the penalty, which is typically 5% of the tax due.

- Further Penalties: If you do not pay the tax and penalty within a specified period, the DVLA may send a final reminder, followed by a court fine of up to £1,000. In extreme cases, your vehicle may be clamped or even taken away by the authorities.

How to Avoid Penalties

To avoid penalties, it’s crucial to stay organized and keep track of your car tax renewal dates. Set reminders on your calendar or use the DVLA’s tax reminder service to receive notifications before your tax expires. Additionally, ensure that your payment method is valid and up-to-date to avoid any issues during the payment process.

Future Implications and Environmental Impact

The UK’s car tax system is constantly evolving to reflect the government’s environmental goals and technological advancements in the automotive industry. In recent years, there has been a shift towards incentivizing the use of electric and hybrid vehicles through tax exemptions and discounts. This trend is expected to continue, with the government aiming to phase out the sale of new petrol and diesel cars by 2030.

The future of car tax is likely to focus on encouraging the adoption of low-emission vehicles and promoting sustainable transportation. As technology advances, we may see the implementation of dynamic car tax rates based on real-time emissions data and usage patterns. This could lead to a more equitable and environmentally conscious taxation system.

Can I pay car tax for multiple years in advance?

+Yes, you can pay car tax for multiple years in advance. This is especially useful if you want to avoid the hassle of annual renewals. However, it's important to note that if you sell your vehicle or it is written off, you may not receive a refund for the remaining tax.

What happens if I change my vehicle's registration details?

+If you change your vehicle's registration details, such as the owner's name or address, you will need to update the DVLA. This is a separate process from paying car tax, but it is essential to keep your records accurate and up-to-date.

Are there any discounts for low-income earners?

+Unfortunately, there are no specific discounts for low-income earners when it comes to car tax. However, individuals on certain benefits may be eligible for the Disabled Persons' Vehicle Relief, which can reduce the tax amount or exempt them from paying altogether.

Staying informed about the latest regulations and tax rates is crucial for vehicle owners in the UK. By understanding the car tax system and staying compliant, you can ensure a smooth and stress-free ownership experience while contributing to the development of a greener and more sustainable transportation network.