Ohio School District Tax

The Ohio School District Tax, a crucial component of the state's education funding system, plays a significant role in shaping the academic landscape of Ohio. This tax, often a topic of discussion and analysis among educators, policymakers, and the public, influences the financial stability and academic resources available to schools across the state. In this comprehensive article, we will delve into the intricacies of the Ohio School District Tax, exploring its history, mechanics, impact on local communities, and its future implications.

Understanding the Ohio School District Tax

The Ohio School District Tax is a property tax levied by local school districts to generate revenue for educational purposes. It is an essential source of funding for public schools, accounting for a significant portion of their operational budgets. This tax is unique in its structure and administration, allowing for local control and flexibility while ensuring a consistent level of funding for educational services.

The tax operates within a complex framework, taking into consideration various factors such as property values, district boundaries, and state regulations. It is designed to provide equitable funding across districts, considering the diverse needs and resources of different communities. The revenue generated through this tax is vital for maintaining school facilities, hiring and retaining qualified staff, purchasing educational materials, and offering a wide range of academic programs and extracurricular activities.

Over the years, the Ohio School District Tax has undergone several reforms and adjustments to address changing economic conditions, demographic shifts, and evolving educational priorities. These reforms aim to ensure that the tax remains fair, efficient, and responsive to the needs of students and educators.

Historical Context and Reforms

The history of the Ohio School District Tax dates back to the early 20th century when the state began to recognize the importance of local control and funding for public education. The tax has evolved significantly since its inception, with major reforms occurring in the 1970s, 1990s, and more recently in the 2010s.

One of the most notable reforms was the implementation of the Ohio School Foundation Program in the 1990s. This program aimed to provide a more equitable distribution of funds by establishing a minimum funding level for each school district, ensuring that no district received significantly less funding than others. The program also introduced a more progressive tax structure, considering the ability of districts to generate revenue based on their property values.

More recently, the Ohio Legislature passed the House Bill 920 in 2015, which brought about significant changes to the school funding formula. This reform aimed to simplify the funding mechanism, reduce reliance on property taxes, and increase state funding for schools. The bill introduced a new formula, known as the Evidence-Based Model, which allocates funds based on the specific needs and challenges of each district, taking into account factors such as student poverty levels, English language learner populations, and special education requirements.

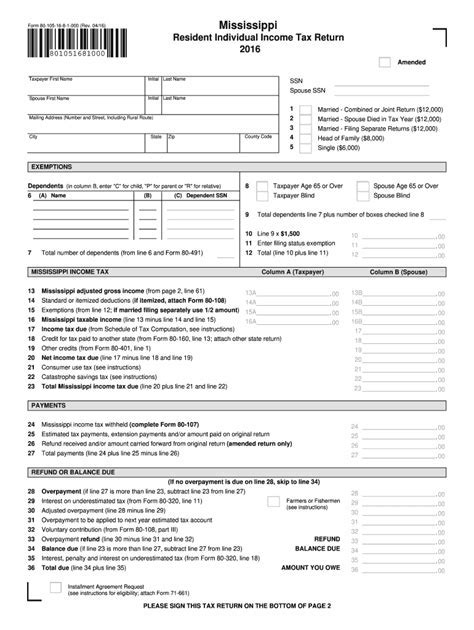

Tax Structure and Administration

The Ohio School District Tax is administered at the local level, with each school district having the authority to set its tax rate within certain state-mandated limits. This local control allows districts to tailor their funding to the specific needs of their communities and student populations.

The tax is levied on both real estate and personal property, with the majority of revenue coming from real estate taxes. The tax rate is typically expressed as a millage rate, where one mill represents one-tenth of a cent per dollar of assessed property value. For example, a tax rate of 20 mills would result in a tax of $2 for every $1,000 of assessed property value.

The assessed property value is determined through a complex process involving property appraisals, exemptions, and adjustments. This process ensures that the tax burden is distributed fairly among property owners within a district. The revenue generated from the tax is then allocated to the district's general fund, which is used to cover a wide range of educational expenses.

Impact on Local Communities

The Ohio School District Tax has a profound impact on local communities, shaping the educational opportunities and resources available to students. Districts with higher property values and stronger tax bases generally have access to more funding, which can translate into better facilities, more advanced technology, and a broader range of academic and extracurricular programs.

On the other hand, districts with lower property values and limited tax bases may face challenges in providing the same level of resources. These districts often rely heavily on state funding and additional grants to supplement their budgets. As a result, there can be significant variations in the quality of education and opportunities offered across different communities within Ohio.

To address these disparities, the state has implemented various programs and initiatives aimed at providing additional support to districts in need. These efforts include targeted funding allocations, grant programs, and partnerships with local businesses and organizations to enhance educational resources and opportunities.

Performance Analysis and Future Implications

The performance of the Ohio School District Tax is a subject of ongoing analysis and debate among policymakers, researchers, and stakeholders. While the tax has successfully provided a significant portion of the funding needed for public education, there are ongoing discussions about its effectiveness, fairness, and potential areas for improvement.

Performance Metrics and Evaluation

Evaluating the performance of the Ohio School District Tax involves examining various metrics and indicators. These include the tax’s ability to generate sufficient revenue, its impact on property values and economic development, and its effectiveness in providing equitable funding to all districts.

One key metric is the revenue yield, which measures the amount of revenue generated per mill of tax. A higher revenue yield indicates that the tax is more efficient in generating funds. Another important metric is the tax burden, which considers the impact of the tax on property owners and the overall economy. A well-performing tax should strike a balance between generating sufficient revenue and minimizing the tax burden on taxpayers.

Furthermore, the tax's impact on educational outcomes is a critical aspect of its evaluation. This includes analyzing how the tax affects student achievement, graduation rates, college readiness, and the overall quality of education provided. By examining these outcomes, policymakers can assess the effectiveness of the tax in meeting its intended goals and identify areas where improvements can be made.

| Performance Metric | Evaluation |

|---|---|

| Revenue Yield | Varies by district, with some districts generating higher revenue per mill. |

| Tax Burden | Generally considered moderate, but can be higher in districts with lower property values. |

| Educational Outcomes | Varies, with some districts showing higher achievement levels and improved outcomes. |

Future Trends and Potential Reforms

Looking ahead, there are several trends and developments that may shape the future of the Ohio School District Tax. One key trend is the increasing focus on equity and fairness in school funding. As the state continues to prioritize equitable education, there may be further reforms to ensure that all districts, regardless of their tax base, have access to the resources needed to provide a high-quality education.

Additionally, the ongoing digital transformation of education and the increasing demand for technology-based learning may impact the tax's structure and revenue allocation. Districts may require additional funding to invest in technology infrastructure, digital resources, and professional development to support remote and hybrid learning models.

Another potential area of reform is the consideration of alternative funding sources. While the Ohio School District Tax remains a critical component of school funding, exploring additional revenue streams, such as corporate partnerships, philanthropy, or state-level initiatives, could provide a more diverse and sustainable funding model for public education.

Furthermore, the state's demographic changes and evolving student needs may necessitate adjustments to the tax structure. As the student population becomes more diverse and includes a higher proportion of students with unique needs, such as those from low-income families or with special education requirements, the tax system may need to adapt to ensure that these students receive the support they need.

Frequently Asked Questions

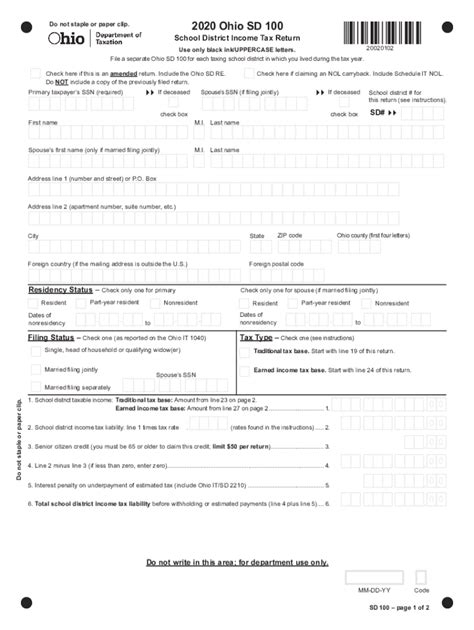

How is the Ohio School District Tax calculated?

+The Ohio School District Tax is calculated based on the assessed value of properties within a school district. The tax rate, expressed in mills, is applied to the assessed value to determine the tax amount. The assessed value takes into account various factors such as property type, location, and improvements.

What are the benefits of the Ohio School District Tax for local communities?

+The tax provides local communities with a dedicated funding source for public education. This funding supports the maintenance of school facilities, the hiring of qualified staff, and the provision of educational resources. It ensures that local schools have the necessary resources to deliver quality education to students.

How does the Ohio School District Tax impact property values?

+The impact of the tax on property values can vary. In some cases, a well-funded school district with high-performing schools can attract homebuyers, potentially increasing property values. However, in districts with lower property values and limited tax bases, the tax burden may impact property values negatively.

Are there any relief programs for taxpayers with the Ohio School District Tax?

+Yes, Ohio offers several relief programs to assist taxpayers with the school district tax. These programs include the Homestead Exemption, which provides a reduction in taxable value for homeowners who meet certain criteria, and the Senior Citizen Tax Reduction, which offers a tax reduction for eligible senior citizens.

How does the Ohio School District Tax contribute to overall state education funding?

+The tax is a significant component of Ohio’s education funding. It provides a stable and reliable source of revenue for school districts, accounting for a substantial portion of their operational budgets. The tax revenue is used to supplement state funding and ensure that schools have the resources needed to deliver a high-quality education.