Mississippi Income Tax Return Status

Are you eager to know the status of your Mississippi Income Tax Return? Understanding the process and tracking your return can provide peace of mind and valuable insights into your financial standing. In this comprehensive guide, we will delve into the specifics of the Mississippi Income Tax Return process, offering detailed information and practical tips to help you navigate the system efficiently.

Understanding the Mississippi Income Tax Return Process

The Mississippi Income Tax Return is an essential part of the state’s fiscal system, contributing to the development and maintenance of various public services. This section will provide an in-depth look at the process, shedding light on the key stages and requirements involved.

Filing Requirements and Deadlines

Mississippi residents and businesses must adhere to specific filing requirements and deadlines to ensure compliance with state tax laws. For individuals, the standard filing deadline is typically April 15th, aligning with the federal tax deadline. However, it’s crucial to note that this date may vary for specific circumstances, such as extensions or unique tax situations.

Businesses, on the other hand, have more varied filing deadlines depending on their legal structure and tax year. For instance, sole proprietorships and partnerships often follow the standard April 15th deadline, while corporations may have a different filing schedule.

| Entity Type | Filing Deadline |

|---|---|

| Individuals (Standard) | April 15th |

| Sole Proprietorships | April 15th |

| Partnerships | April 15th |

| Corporations | Varies based on tax year |

It's important to stay informed about any changes or updates to these deadlines, as they can impact the timely submission of your tax return.

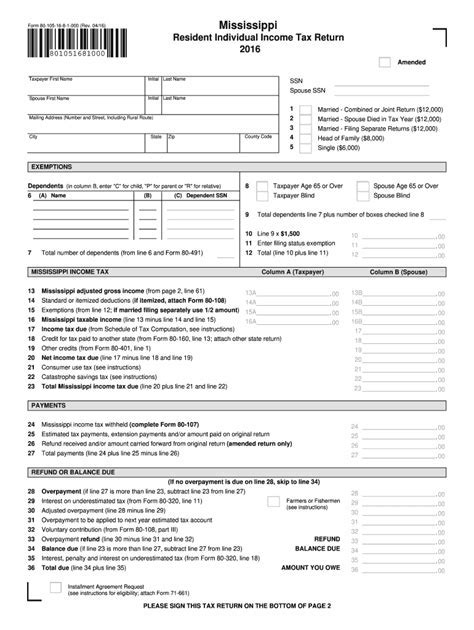

Preparing Your Tax Return

The process of preparing your Mississippi Income Tax Return involves gathering the necessary documents and information to ensure an accurate and complete filing. This includes collecting W-2 forms from employers, 1099 forms for any self-employment income, and other relevant financial records.

For individuals with straightforward tax situations, the Mississippi Department of Revenue provides user-friendly tax forms and instructions. However, for more complex returns, seeking professional tax preparation services or using tax preparation software can be beneficial.

Submitting Your Return

Once your tax return is prepared, you have the option to submit it electronically or through traditional mail. Electronic filing is generally faster and more secure, with the added benefit of receiving your refund more promptly.

If you choose to file electronically, you'll need to select a reputable tax software provider or utilize the Mississippi Department of Revenue's online filing system. Ensure that you have all the necessary information, such as your Social Security number and bank account details for direct deposit.

For those who prefer traditional mail, complete the required tax forms and include any supporting documents. Mail your return to the address specified by the Mississippi Department of Revenue, ensuring timely postage to meet the filing deadline.

Tracking Your Mississippi Income Tax Return Status

After submitting your Mississippi Income Tax Return, it’s natural to want to track its progress and receive updates on its status. Fortunately, the Mississippi Department of Revenue provides several convenient methods to check the status of your return.

Online Status Check

The Mississippi Department of Revenue offers an online status check tool, accessible through their official website. This tool allows taxpayers to input their Social Security number, tax year, and other identifying information to retrieve the current status of their return.

To use this service, visit the Mississippi Department of Revenue website and navigate to the "Where's My Refund?" or "Return Status" section. Follow the prompts to enter your details and retrieve your return status. The tool will provide real-time information, indicating whether your return has been received, is being processed, or if there are any issues that require your attention.

Phone Inquiries

If you prefer a more personal approach, you can contact the Mississippi Department of Revenue’s taxpayer assistance line. Trained representatives are available to answer your questions and provide updates on your return status.

When calling, have your Social Security number and other relevant details ready to expedite the process. The representative will be able to access your account and provide specific information regarding the progress of your return.

| Mississippi Department of Revenue Taxpayer Assistance Line | Hours of Operation |

|---|---|

| (800) 829-1040 | Monday to Friday, 8:00 AM to 5:00 PM (CST) |

Mail Correspondence

In certain cases, the Mississippi Department of Revenue may communicate with taxpayers through traditional mail. This method is typically used for formal notifications, such as acceptance of your return, requests for additional information, or notices of any discrepancies.

It's essential to keep an eye on your mailbox and respond promptly to any correspondence from the Mississippi Department of Revenue. Failure to address these communications in a timely manner may result in delays or complications with your tax return.

Common Issues and How to Resolve Them

While the Mississippi Income Tax Return process is designed to be straightforward, certain issues may arise. Understanding these potential challenges and knowing how to address them can help streamline the process and ensure a positive experience.

Missing or Inaccurate Information

One of the most common issues taxpayers encounter is missing or inaccurate information on their tax return. This can occur due to various reasons, such as errors in data entry or incomplete documentation.

If you receive a notice from the Mississippi Department of Revenue regarding missing or inaccurate information, respond promptly. Provide the requested information or clarify any discrepancies to ensure the timely processing of your return.

Errors or Discrepancies

Errors or discrepancies in your tax return can lead to delays or additional inquiries from the Mississippi Department of Revenue. These issues may arise from mathematical errors, incorrect calculations, or mismatched data.

If you discover an error in your return, it's crucial to take immediate action. File an amended return using the appropriate forms and provide any necessary supporting documentation. The Mississippi Department of Revenue's website offers guidance and resources to assist with the amendment process.

Identity Verification and Fraud Prevention

With the increasing prevalence of tax-related fraud, the Mississippi Department of Revenue has implemented robust identity verification measures. These steps are designed to protect taxpayers and ensure the integrity of the tax system.

If you encounter identity verification issues, such as being flagged for potential fraud, it's essential to cooperate with the Mississippi Department of Revenue's procedures. Provide the requested information and documentation to verify your identity and facilitate the processing of your return.

Frequently Asked Questions

How long does it take to receive my Mississippi Income Tax Refund after filing electronically?

+Typically, electronic returns are processed within 2-4 weeks after submission. However, factors like the complexity of your return or additional reviews by the Mississippi Department of Revenue may impact the processing time.

What should I do if I haven’t received my refund within the expected timeframe?

+If your refund is delayed beyond the expected timeframe, contact the Mississippi Department of Revenue’s taxpayer assistance line. They will investigate the status of your refund and provide you with an update.

Can I check the status of my refund using the Mississippi Department of Revenue’s app or mobile website?

+Yes, the Mississippi Department of Revenue offers a mobile app and a mobile-optimized website. These platforms provide convenient access to various tax services, including the ability to check your refund status.

How can I stay updated on changes to Mississippi tax laws and deadlines?

+Stay informed by regularly visiting the Mississippi Department of Revenue’s website or signing up for their email updates. They provide timely notifications regarding any changes to tax laws, deadlines, and other important tax-related information.

By understanding the Mississippi Income Tax Return process and staying informed about its status, you can navigate the system with confidence and ensure a smooth experience. Remember to utilize the resources provided by the Mississippi Department of Revenue and seek professional assistance when needed.