Iowa State Tax Refund

The topic of Iowa State Tax Refunds can be of great interest to residents of Iowa and those with investments or business interests in the state. Iowa, known for its vibrant agriculture, diverse industries, and strong community spirit, has a unique tax system that affects both individuals and businesses. Understanding the nuances of Iowa's tax refund process is crucial for effective financial planning and ensuring compliance with state regulations.

Navigating Iowa’s Tax Refund Landscape

Iowa’s tax refund process, while designed to be straightforward, can present complexities due to the state’s varied tax structures and regulations. This comprehensive guide aims to demystify the process, offering a detailed analysis of Iowa’s tax refund system, including eligibility criteria, calculation methods, and the steps involved in claiming refunds.

Eligibility and Qualifying Criteria

To be eligible for an Iowa state tax refund, taxpayers must meet specific criteria. These include having overpaid their estimated taxes during the fiscal year, overwithholding on wages, or being entitled to certain tax credits and deductions. For instance, taxpayers who have paid taxes on lottery winnings or certain investments may be eligible for refunds. Additionally, individuals who have moved out of Iowa during the tax year may be due a refund for taxes paid on income earned while residing in the state.

Here is a breakdown of the key eligibility factors:

- Overpayment of Estimated Taxes: Taxpayers who have made quarterly estimated tax payments throughout the year may be eligible for a refund if their actual tax liability is lower than the total estimated payments.

- Overwithholding on Wages: Employees who have had more tax deducted from their paychecks than is necessary can claim a refund for the overwithheld amount.

- Tax Credits and Deductions: Iowa offers various tax credits, such as the Low-Income Credit and the Property Tax Credit, which can reduce the amount of tax owed. If the credits exceed the tax liability, a refund may be issued.

It's important to note that eligibility does not guarantee a refund. The refund amount is determined by the specific circumstances of each taxpayer and can vary significantly.

Calculating Iowa State Tax Refunds

The calculation of Iowa state tax refunds is a crucial aspect of the process, and it involves several steps to ensure accuracy and compliance with state regulations. The first step is to determine the taxpayer’s total tax liability for the year, which is the amount of tax owed based on their income, deductions, and credits.

Once the total tax liability is calculated, the next step is to compare it with the total tax payments and withholdings. If the total payments exceed the liability, the taxpayer is entitled to a refund for the difference. This can include overpayments from estimated tax payments, as well as overwithholding from wages or other income sources.

Iowa's tax system uses a combination of brackets and rates to calculate tax liability. Here is a simplified example to illustrate the process:

| Income Bracket | Tax Rate | Tax Calculation |

|---|---|---|

| $0 - $1,000 | 5% | $50 |

| $1,001 - $5,000 | 7% | $245 |

| $5,001 - $10,000 | 9% | $645 |

| Total Income | $940 |

In this example, the taxpayer's total tax liability is $940. If they have paid more than this amount in taxes, they would be eligible for a refund. The actual refund amount would depend on the specific tax payments and withholdings made during the year.

It's important to note that this is a simplified example, and in reality, the calculation process can be more complex, especially when considering various deductions, credits, and other factors that can affect tax liability.

💡 Expert Tip: Understanding your tax bracket and the associated rates is crucial for estimating potential refunds. However, it's essential to consult with a tax professional or use reliable tax software to ensure accuracy, especially when dealing with complex tax situations.

Claiming Your Iowa State Tax Refund

Claiming an Iowa state tax refund involves a clear and organized process. The first step is to gather all necessary documents, including Form IA 1040, the Iowa Individual Income Tax Return, and any supporting documentation for deductions, credits, or other adjustments. Taxpayers should ensure that all information is accurate and complete to avoid delays or additional scrutiny from the Iowa Department of Revenue.

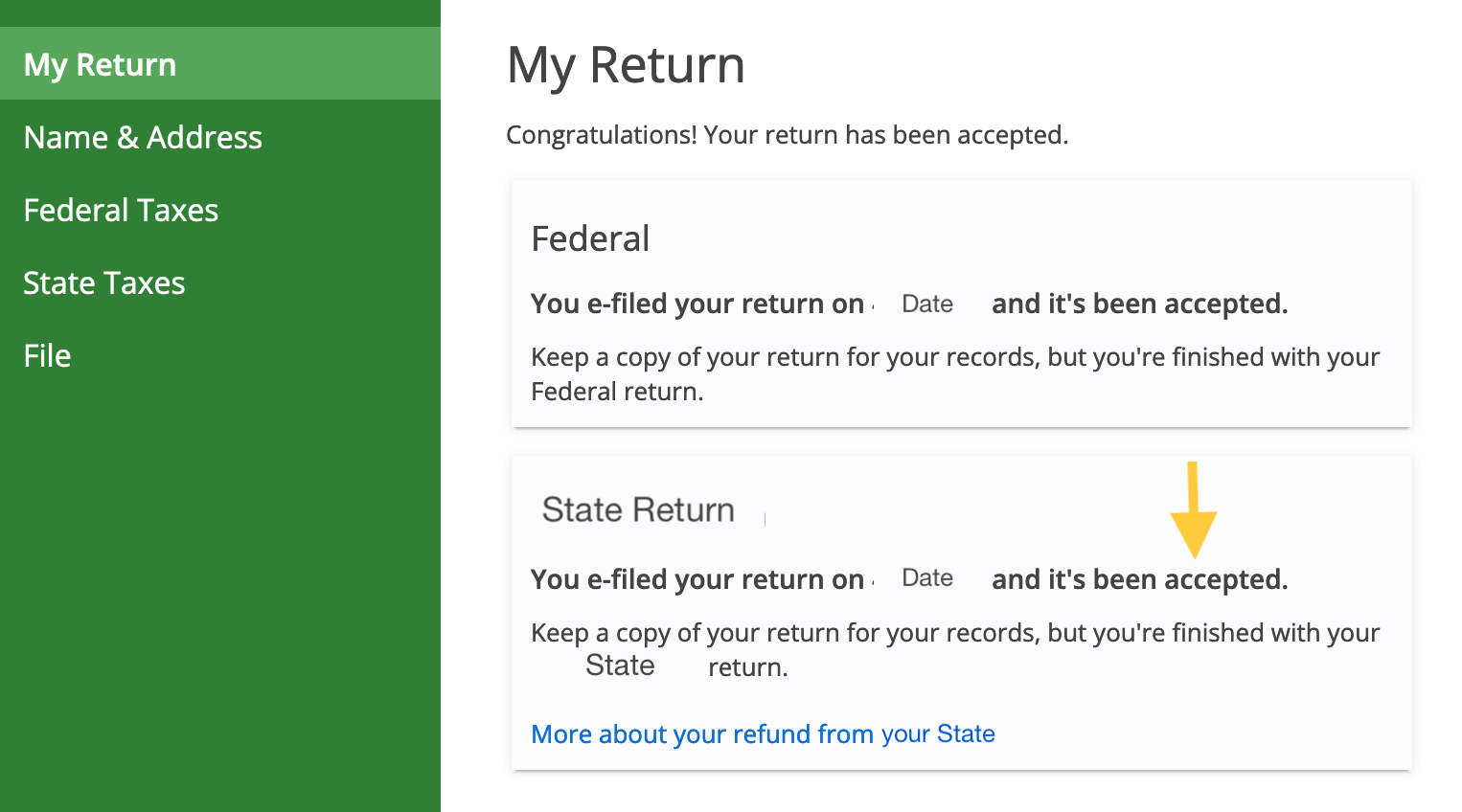

Once the documents are prepared, the next step is to submit the tax return. Iowa offers both online and paper filing options. The online filing system, Iowa Tax & Government Services, provides a secure and convenient way to file returns and claim refunds. It offers real-time status updates and allows taxpayers to track the progress of their refund.

For those who prefer traditional methods, paper forms can be downloaded from the Iowa Department of Revenue's website and mailed to the designated address. However, it's important to note that online filing is generally faster and more efficient, with refunds typically processed within 2-3 weeks.

After submitting the tax return, taxpayers can check the status of their refund online or by calling the Iowa Department of Revenue's refund hotline. The department provides regular updates and a dedicated team to assist with any refund-related inquiries.

Iowa’s Tax Refund Timeline and Processing

Understanding the timeline for Iowa state tax refunds is crucial for effective financial planning. The Iowa Department of Revenue processes tax returns and issues refunds in a timely manner, but the exact timeframe can vary depending on several factors, including the filing method, the complexity of the return, and the volume of returns being processed.

Estimated Processing Times

On average, Iowa state tax refunds are processed within 2-3 weeks after the tax return is received. This timeframe is applicable for both online and paper filings. However, it’s important to note that during peak tax seasons, such as the spring filing period, processing times may be slightly longer due to the high volume of returns being handled.

For taxpayers who choose to file their returns electronically, the processing time can be even faster. Electronic filing, especially when combined with direct deposit for refunds, can result in refunds being issued within 10-14 days.

| Filing Method | Estimated Processing Time |

|---|---|

| Online Filing | 2-3 weeks |

| Paper Filing | 2-3 weeks |

| Electronic Filing with Direct Deposit | 10-14 days |

It's worth noting that these estimated processing times are based on typical scenarios and may vary in exceptional cases. For instance, if a tax return is selected for audit or requires additional documentation, the refund processing time can be significantly longer.

Tracking Your Iowa State Tax Refund

To ensure transparency and provide taxpayers with real-time information, the Iowa Department of Revenue offers several methods to track the status of state tax refunds. The primary method is through the Iowa Tax & Government Services online portal, which allows taxpayers to log in and view the progress of their refund.

By accessing their account, taxpayers can see if their return has been received, is being processed, or if the refund has been issued. The portal provides regular updates and notifications, ensuring that taxpayers are kept informed throughout the process.

In addition to the online portal, the Iowa Department of Revenue also offers a dedicated refund hotline. Taxpayers can call this hotline to receive personalized updates on the status of their refund. The hotline staff is trained to provide accurate and timely information, ensuring that taxpayers have the support they need during the refund process.

For those who prefer traditional methods, the Iowa Department of Revenue also provides a refund status lookup tool on their website. This tool allows taxpayers to enter their social security number and other identifying information to check the status of their refund. While not as detailed as the online portal, it still provides valuable information about the progress of the refund.

Maximizing Your Iowa State Tax Refund

Maximizing your Iowa state tax refund involves a strategic approach to tax planning and an understanding of the various deductions, credits, and exemptions available. While the exact strategies can vary based on individual circumstances, there are several key considerations that can help taxpayers optimize their refund potential.

Deductions and Credits to Consider

Iowa offers a range of deductions and credits that can significantly reduce tax liability and increase the potential for refunds. Some of the key deductions and credits to consider include:

- Standard Deduction: Iowa allows taxpayers to claim a standard deduction, which reduces taxable income. The amount of the standard deduction depends on the taxpayer's filing status and can provide a substantial tax benefit.

- Itemized Deductions: Taxpayers who have significant expenses, such as medical costs, charitable donations, or state and local taxes, may benefit from itemizing their deductions. Itemized deductions can lower taxable income and increase the likelihood of a refund.

- Low-Income Credit: Iowa provides a Low-Income Credit for eligible taxpayers with low to moderate incomes. This credit can offset a portion of their tax liability, potentially resulting in a larger refund.

- Property Tax Credit: Homeowners in Iowa may be eligible for a Property Tax Credit, which can reduce the tax burden associated with owning a home. This credit can be a significant benefit for taxpayers and contribute to a larger refund.

It's important to note that the availability and applicability of these deductions and credits depend on individual circumstances. Taxpayers should consult with a tax professional or use reliable tax software to ensure they are maximizing their refund potential.

Strategic Tax Planning

Effective tax planning is crucial for maximizing Iowa state tax refunds. This involves a proactive approach to managing finances throughout the year, rather than just during the tax season. Here are some strategic tax planning tips to consider:

- Review Tax Withholdings: Taxpayers should periodically review their tax withholdings to ensure they are not overpaying throughout the year. Adjusting withholdings can help prevent overpayment and increase the potential for a refund.

- Maximize Retirement Contributions: Contributions to retirement accounts, such as 401(k)s or IRAs, can reduce taxable income. By maximizing these contributions, taxpayers can lower their tax liability and potentially increase their refund.

- Plan for Deductions: Certain expenses, such as medical costs or charitable donations, can be deducted from taxable income. By strategically planning and documenting these expenses, taxpayers can ensure they are maximizing their deductions and, consequently, their refund.

- Explore Tax-Advantaged Investments: Certain types of investments, such as municipal bonds or education savings plans, offer tax benefits. By incorporating these investments into their financial strategy, taxpayers can reduce their tax liability and potentially increase their refund.

It's important to consult with a financial advisor or tax professional to develop a personalized tax planning strategy that aligns with individual goals and circumstances.

Common Issues and Troubleshooting for Iowa State Tax Refunds

While the Iowa state tax refund process is generally straightforward, there can be instances where taxpayers encounter issues or face challenges. Understanding these common issues and knowing how to troubleshoot them can help streamline the refund process and ensure a smoother experience.

Addressing Common Refund Delays

Refund delays can occur for various reasons, and understanding these reasons can help taxpayers take proactive measures to minimize delays. Some common causes of refund delays include:

- Incomplete or Inaccurate Information: Submitting a tax return with incomplete or incorrect information can lead to delays in processing. Taxpayers should ensure that all information, including personal details, income, deductions, and credits, is accurate and complete.

- Complex Tax Returns: Tax returns that involve complex situations, such as multiple sources of income, business income, or significant deductions and credits, may require additional review and processing time.

- Missing or Incorrect Documentation: Taxpayers must provide all necessary documentation to support their deductions, credits, or other adjustments. Missing or incorrect documentation can lead to delays or even the rejection of the tax return.

- Audit Selection: In some cases, the Iowa Department of Revenue may select a tax return for audit. This is a detailed review of the return and can result in a significant delay in processing the refund.

To minimize the risk of refund delays, taxpayers should carefully review their tax returns before submission, ensure all documentation is complete and accurate, and consider consulting with a tax professional for complex tax situations.

Resolving Refund Errors and Issues

Despite best efforts, refund errors can occur. These errors can range from simple calculation mistakes to more complex issues, such as identity theft or fraudulent activity. Understanding how to identify and resolve these issues is crucial for a successful refund process.

If a taxpayer suspects an error with their refund, they should first check the status of their refund through the Iowa Department of Revenue's online portal or refund hotline. If the refund status indicates an issue, taxpayers should gather all relevant documentation and contact the department's customer service team. The customer service representatives can provide guidance on resolving the issue and may require additional information to process the refund.

In cases of identity theft or fraudulent activity, taxpayers should take immediate action. This may involve filing a police report, contacting the Iowa Department of Revenue's fraud hotline, and working closely with the department to resolve the issue. It's important to act promptly to protect one's financial interests and ensure the security of personal information.

Future Implications and Updates for Iowa State Tax Refunds

Staying informed about future changes and updates to Iowa’s tax refund system is crucial for effective financial planning and compliance. The Iowa Department of Revenue regularly reviews and updates its tax regulations to ensure fairness, simplicity, and efficiency. Understanding these changes can help taxpayers anticipate potential impacts on their refunds and adjust their financial strategies accordingly.

Expected Changes and Updates

The Iowa Department of Revenue has a history of implementing changes to its tax system to keep pace with economic trends and taxpayer needs. While specific future changes cannot be predicted with certainty, there are several areas that are often the focus of updates and improvements:

- Tax Rates and Brackets: The department may adjust tax rates or income brackets to align with economic conditions and ensure fairness. These changes can impact tax liability and, consequently, the amount of potential refunds.

- Deductions and Credits: Iowa's deductions and credits are periodically reviewed to ensure they remain effective and accessible. Changes to these deductions and credits can significantly affect taxpayers' ability to reduce their tax liability and increase their refunds.

- Filing Processes: The department continuously works to improve the efficiency and security of its filing processes. This can include updates to online filing systems, changes to required documentation, or the introduction of new refund options.

- Tax Compliance Initiatives: The department may launch initiatives to improve tax compliance and address potential issues. These initiatives can impact taxpayers' obligations and the processing of refunds.

It's important for taxpayers to stay informed about these potential changes by regularly checking the Iowa Department of Revenue's website, subscribing to their newsletters, or consulting with tax professionals who can provide insights into emerging trends and updates.

Potential Long-Term Trends

Looking ahead, several long-term trends could impact Iowa’s tax refund system. These trends are shaped by economic, demographic, and technological factors, and understanding them can provide valuable insights into the future of Iowa’s tax landscape.

- Economic Growth and Income Levels: As Iowa's economy continues to grow and income levels rise, tax liability and the potential for refunds may be impacted. Higher incomes can result in increased tax payments, while economic downturns can lead to reduced tax liability and potentially larger refunds.

- Demographic Shifts: Changes in Iowa's population, such as shifts in age distribution or migration patterns, can affect the state's tax base and the demand for certain deductions and credits. These shifts can influence the design and availability of tax incentives and, consequently, the potential for refunds.

- Technological Advancements: The continued advancement of technology, particularly in the realm of tax software and online filing systems, can streamline the tax refund process. These advancements can lead to faster processing times, improved accuracy, and enhanced security, benefiting taxpayers and the Iowa Department of Revenue alike.

By staying attuned to these long-term trends and understanding their potential impacts, taxpayers can