Will China Invade Taiwan: A Clear Risk Outlook For Markets

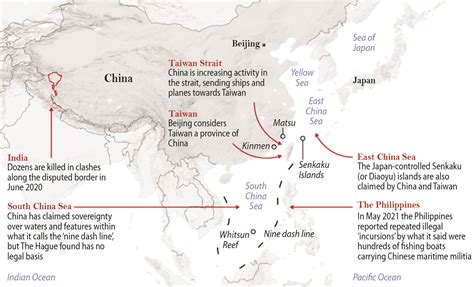

Will China Invade Taiwan is not just a regional question—it is a geopolitical event that could reshape global markets. This article presents a clear risk outlook for markets, examining the drivers, plausible scenarios, and the channels through which prices, volatility, and policy might respond.

Key Points

- In a scenario with intensified cross-strait tension, Taiwan's semiconductor supply would influence tech equities, chip prices, and capex plans worldwide.

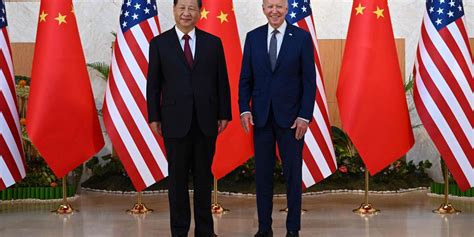

- Deterrence dynamics depend on credible signaling from the United States and its allies, as well as Taiwan's resilience investments and regional security guarantees.

- Market volatility would likely spike across equities, foreign exchange, and credit while safe-haven assets and liquidity measures react to evolving risk premia.

- Policy responses—sanctions, export controls, and diplomatic pressure—would shape the duration and severity of market disruptions.

- Supply-chain diversification and resilience measures could shift long-term capital expenditure toward different regions and suppliers.

Context and Stakes

The cross-strait relationship sits at the intersection of national security, regional stability, and global supply chains. Taiwan remains a key node in the semiconductor ecosystem, and shifts in stance from Beijing or Washington can alter risk pricing across asset classes. The coming years may feature more frequent signaling and misinterpretation, which can cause abrupt spikes in volatility even without a broad military confrontation.

Risk Scenarios and Market Impacts

There are multiple plausible paths short of full-scale war and several that could escalate quickly. Each path carries distinct market consequences, from swift spikes in volatility to gradual shifts in investment flows. A gradation of scenarios helps markets assign probabilities and prepare resilience plans.

What This Means for Markets and Policy

For markets, the key takeaway is to monitor not only the probability of military action but also the credibility of responses from major powers. Confidence in crisis-management and supply-chain resilience can moderate risk premia, while signs of rapid escalation or miscommunication tend to accelerate volatility. Policy makers will influence market outcomes through sanctions, export controls, and diplomatic engagement, which can either dampen or amplify market uncertainty depending on timing and coordination.

Signals to Watch

Investors and officials should pay attention to official statements from Beijing and Washington, allied military exercises, shipment and trade dynamics, and any changes in export controls or sanctions regimes. Sudden shifts in these signals can precede wider market movements and help explain shifts in volatility and risk appetite.

How likely is a full invasion in the near term?

+

The probability is uncertain and policy-dependent. Analysts often frame it as a non-zero risk with high stakes and significant regional and global consequences. Market actors focus on deterrence signaling, alliance commitments, and the tempo of political communications as key indicators.

What market signals would warn of escalating risk?

+

Watch for sudden volatility spikes in equities and credit, widening risk premia, rapid moves in currency markets, and shifts in safe-haven assets such as government bonds and gold. Geopolitical commentary and sanctions announcements can also precede notable price adjustments.

How should policymakers respond to reduce risk for markets?

+

Effective responses include clear and credible crisis-management messaging, coordinated sanctions and export controls when appropriate, and ongoing diplomatic engagement aimed at reducing miscalculation. Supporting resilience in critical supply chains and maintaining financial-system liquidity are also central considerations.

What longer-term shifts could result from ongoing tensions?

+Expect potential geopolitical fragmentation in technology and trade networks, a reorientation of semiconductor supply chains, and new regional security architectures. These shifts could influence investment pacing, risk premia, and policy priorities for years to come.

How can investors think about hedging this risk?

+Adopt scenario-based planning, diversify exposure across asset classes and geographies, maintain sufficient liquidity, and monitor policy signals closely. A structured approach to risk budgeting can help weather sudden shifts in risk sentiment without overreacting to every flare-up.