Monroe County Ny Property Tax

Property taxes are an essential component of local government funding, and understanding how they work is crucial for property owners. In Monroe County, New York, the property tax system plays a significant role in supporting various public services and infrastructure. This article will delve into the intricacies of Monroe County's property tax, exploring its calculation, distribution, and impact on the community.

The Mechanics of Monroe County Property Tax

Property tax in Monroe County, like many other jurisdictions, is calculated based on the assessed value of real estate properties. This value is determined through a comprehensive assessment process, which takes into account factors such as the property's location, size, improvements, and market conditions.

The assessment process aims to ensure fairness and accuracy in the distribution of tax burden among property owners. Assessors employ various methods, including physical inspections, sales data analysis, and market value estimation techniques, to arrive at an estimated market value for each property.

Once the assessed value is determined, it is multiplied by the tax rate, which is set annually by the county's legislative body, the Monroe County Legislature. This rate, expressed as a percentage, represents the portion of the property's value that the owner must pay as tax.

For example, if a property is assessed at $200,000 and the tax rate is 2%, the property owner would owe $4,000 in annual property taxes. This rate can vary from year to year, depending on the county's budgetary needs and the cost of providing essential services.

Assessed Value Calculation

The assessed value of a property is not always the same as its market value. In Monroe County, assessors use a fraction of value or assessment ratio to determine the assessed value. This ratio, typically set by state law, ensures that the assessed value remains consistent across properties and reflects a percentage of the market value.

For instance, if the assessment ratio is 0.80 (80%), a property with a market value of $250,000 would have an assessed value of $200,000. This assessed value is then used for tax calculation purposes.

Monroe County's assessment ratio is periodically reviewed and adjusted to maintain fairness and ensure that property owners are taxed based on a consistent and equitable standard.

Tax Rate Determination

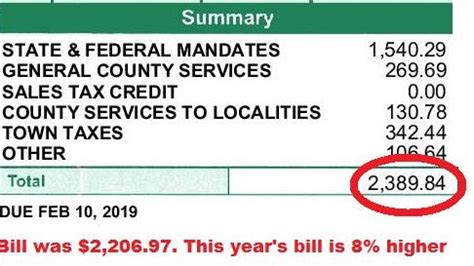

The tax rate in Monroe County is established through a complex budgeting process. The county's various departments and agencies submit their proposed budgets, outlining the financial resources required to deliver services and maintain infrastructure.

The Monroe County Legislature then reviews these proposals, considers the overall financial health of the county, and sets the tax rate accordingly. This rate aims to balance the need for revenue with the county's commitment to fiscal responsibility and taxpayer affordability.

| Year | Tax Rate (per $1,000 of Assessed Value) |

|---|---|

| 2023 | $17.50 |

| 2022 | $17.20 |

| 2021 | $16.90 |

As shown in the table above, the tax rate has remained relatively stable over the past few years, with a slight increase to $17.50 per $1,000 of assessed value in 2023. This rate translates to a property tax bill of $1,750 for every $100,000 of assessed value.

Distribution of Property Tax Revenue

The property tax revenue collected in Monroe County is distributed among various local government entities, each playing a critical role in the community's well-being.

Monroe County Government

A significant portion of the property tax revenue goes directly to the Monroe County government. This funding supports a wide range of services and initiatives, including:

- Public safety: Funding for law enforcement, emergency services, and fire departments.

- Health and social services: Support for public health programs, mental health services, and assistance for vulnerable populations.

- Infrastructure maintenance: Road repairs, bridge maintenance, and improvements to public transportation systems.

- Economic development: Initiatives to attract businesses, create jobs, and promote local economic growth.

- Cultural and recreational amenities: Funding for libraries, parks, and cultural centers, enhancing the quality of life for residents.

Municipalities and School Districts

Property tax revenue is also allocated to the county's municipalities and school districts. These entities use the funds to provide essential services and education to their respective communities.

Municipalities, such as the City of Rochester, use property tax revenue for:

- Municipal services: Street maintenance, snow removal, waste management, and other local infrastructure needs.

- Community development: Funding for neighborhood improvement projects, housing initiatives, and community centers.

- Public safety: Local police and fire departments, ensuring the safety and security of residents.

School districts, on the other hand, rely heavily on property tax revenue to:

- Fund education: Pay for teacher salaries, classroom supplies, and educational programs.

- Maintain school facilities: Cover the costs of building maintenance, repairs, and improvements.

- Provide student support services: Fund counseling, special education, and extracurricular activities.

Tax Equalization and Special Districts

To ensure fairness in the distribution of property tax revenue, Monroe County employs a tax equalization process. This process aims to distribute the tax burden equitably among properties, regardless of their location within the county.

Additionally, special districts within the county, such as fire districts or water districts, may receive a portion of the property tax revenue to fund their specific services and infrastructure.

Impact on the Community

Property taxes in Monroe County have a significant impact on the community's overall well-being and development.

Economic Growth and Development

Property tax revenue provides the necessary funding for infrastructure improvements and economic development initiatives. These investments attract businesses, create jobs, and stimulate economic growth, ultimately enhancing the county's competitiveness and prosperity.

Education and Social Equity

The property tax system plays a crucial role in supporting the county's educational system. Adequate funding ensures that schools have the resources to provide quality education, regardless of the socioeconomic status of the surrounding community. This commitment to education helps bridge the gap in educational opportunities and promotes social equity.

Public Services and Infrastructure

Property taxes directly fund essential public services, such as public safety, health services, and infrastructure maintenance. These services are vital for the health, safety, and overall quality of life of Monroe County residents.

Well-maintained roads, reliable emergency services, and efficient waste management systems contribute to a thriving community where residents can live, work, and thrive.

Frequently Asked Questions

How often are property assessments conducted in Monroe County?

+Property assessments in Monroe County are typically conducted every three years. However, if there are significant changes to a property, such as new construction or major renovations, an assessment may be triggered sooner.

Can property owners appeal their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The process involves submitting an application and providing evidence to support their case. The Monroe County Real Property Tax Services Department handles these appeals.

How does Monroe County determine the tax rate each year?

+The tax rate is determined by the Monroe County Legislature based on the county’s budget needs and the cost of providing essential services. The Legislature considers various factors, including the assessed value of properties, the county’s financial health, and the impact on taxpayers.

Are there any exemptions or reductions available for property taxes in Monroe County?

+Yes, Monroe County offers several exemptions and reductions to eligible property owners. These include the basic STAR exemption for primary residences, senior citizen exemptions, and exemptions for certain types of properties, such as agricultural lands or veterans’ residences. It’s important to check with the Monroe County Real Property Tax Services Department for specific eligibility criteria and application processes.

How can property owners stay informed about changes in their tax bills or assessment values?

+Property owners can stay informed by regularly checking their assessment notices, which are typically mailed out before the tax bill is due. Additionally, they can visit the Monroe County Real Property Tax Services website or contact the department directly for updates and information on assessment values and tax rates.