Hudson County Tax Records

Welcome to a comprehensive guide exploring the intricate world of Hudson County Tax Records, an essential aspect of property ownership and management in this vibrant New Jersey county. In this expert-driven analysis, we'll delve deep into the various facets of tax records, from their historical context to their practical implications for homeowners and investors. By the end of this article, you'll have a thorough understanding of Hudson County's tax landscape, empowering you to navigate this critical administrative process with confidence.

Understanding Hudson County’s Tax History and Context

To grasp the significance of tax records in Hudson County, we must first explore its historical and contextual framework. Hudson County, with its rich tapestry of urban centers like Jersey City and Hoboken, has a long-standing tradition of robust property ownership and a complex tax structure. Understanding this history provides crucial insights into the current tax landscape and the unique challenges and opportunities it presents.

The tax system in Hudson County has evolved significantly over the years, reflecting the county's dynamic real estate market and its diverse population. Historical records reveal a nuanced approach to taxation, with various factors influencing tax rates and assessments, including property values, location, and local infrastructure development.

One notable aspect of Hudson County's tax history is its periodic revaluations, which aim to ensure fair and accurate assessments. These revaluations have often sparked debates and discussions, highlighting the importance of transparent and equitable tax practices. As we navigate the modern tax landscape, it's essential to appreciate the historical context that has shaped these practices.

Unraveling the Complexity of Hudson County Tax Records

Diving into the intricacies of Hudson County Tax Records, we encounter a wealth of information that can be both enlightening and challenging to decipher. These records encompass a vast array of data, including property assessments, tax rates, and payment histories, all of which are vital for property owners and investors.

Property Assessments: The Backbone of Tax Records

Property assessments form the foundation of Hudson County’s tax system. These assessments determine the taxable value of properties, impacting the amount of tax owed. The assessment process involves a meticulous evaluation of factors such as property size, location, improvements, and market trends. Here’s a glimpse into the assessment process and its key components:

| Assessment Category | Description |

|---|---|

| Market Value | Reflects the property's current market worth based on recent sales data. |

| Improvements | Accounts for any upgrades or additions to the property, impacting its overall value. |

| Location | Considers the property's neighborhood, proximity to amenities, and local infrastructure. |

| Assessment Date | Establishes the reference point for determining the taxable value. |

Understanding these assessment components is crucial for property owners, as it allows them to review and potentially appeal their assessments if necessary. Hudson County provides resources and guidelines for property owners to navigate this process effectively.

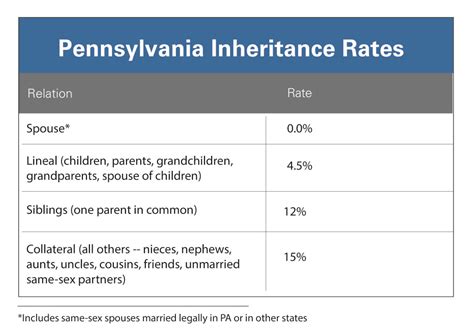

Tax Rates and Calculations: Unlocking the Formula

Beyond assessments, Hudson County’s tax records also reveal the intricate calculations that determine the final tax amount. Tax rates, expressed as a percentage, are applied to the assessed value of the property to calculate the tax liability. These rates can vary based on the property’s classification (residential, commercial, or industrial) and its location within the county.

The tax rate formula takes into account various factors, including the county's budget, local services, and debt obligations. Here's a simplified breakdown of the tax rate calculation:

Tax Liability = Assessed Value x Tax Rate

For instance, if a residential property has an assessed value of $500,000 and the tax rate is 3%, the annual tax liability would be:

Tax Liability = $500,000 x 0.03 = $15,000

Understanding this calculation empowers property owners to estimate their tax obligations accurately and plan their finances accordingly.

Payment Histories: Tracking Tax Obligations

Hudson County Tax Records also provide a detailed record of tax payments, offering a comprehensive overview of a property’s tax history. Payment histories include information such as payment dates, amounts, and methods, ensuring transparency and accountability. These records are particularly valuable for investors and potential buyers, providing insights into a property’s financial track record.

In addition to tracking payments, tax records also highlight any outstanding balances or penalties, allowing property owners to address these promptly. Hudson County offers online portals and resources to access and manage payment histories, ensuring convenience and efficiency for taxpayers.

Navigating Hudson County’s Tax Records Online: A Digital Revolution

In today’s digital age, Hudson County has embraced technology to enhance the accessibility and efficiency of tax records. The county’s official website features a dedicated section for tax records, offering a user-friendly interface for property owners and the public.

The online platform allows users to search for tax records by property address, owner name, or block and lot number. This search functionality provides instant access to critical information, including assessments, tax rates, and payment histories. Additionally, the platform offers interactive tools and resources to help users understand and navigate the tax landscape effectively.

For instance, the Hudson County Tax Map Viewer provides a visual representation of property boundaries and assessments, allowing users to explore the county's tax parcels and their respective values. This tool is particularly beneficial for investors and real estate professionals, offering a bird's-eye view of the county's tax landscape.

Furthermore, Hudson County's online platform integrates with other county services, providing a seamless experience for taxpayers. Users can access tax bill payments, property tax exemptions, and appeal processes, all from a single digital gateway. This digital revolution not only enhances convenience but also promotes transparency and efficiency in tax management.

The Impact of Hudson County Tax Records on Property Ownership

Hudson County Tax Records play a pivotal role in shaping the property ownership experience within the county. These records influence various aspects, from property values and investment decisions to tax planning and community development.

Influencing Property Values and Market Trends

Property assessments, as reflected in tax records, directly impact a property’s market value. Accurate assessments ensure fair pricing and facilitate informed buying and selling decisions. Buyers and investors rely on tax records to evaluate properties, assess their potential, and make strategic investments.

Additionally, tax records provide insights into market trends and property value fluctuations. By analyzing historical assessments and tax data, investors can identify emerging neighborhoods, understand appreciation patterns, and make data-driven decisions. This level of transparency fosters a healthy and dynamic real estate market in Hudson County.

Shaping Tax Planning and Financial Strategies

Tax records are invaluable tools for property owners and investors to plan their finances strategically. By understanding their tax obligations and payment histories, individuals can budget effectively and explore tax-saving opportunities. Hudson County’s tax records provide the necessary data to make informed decisions, whether it’s optimizing tax deductions, utilizing tax credits, or planning for future investments.

Furthermore, tax records facilitate long-term financial planning. Property owners can analyze their tax trajectories, assess the impact of potential property improvements, and make informed choices regarding upgrades and renovations. This proactive approach ensures that tax obligations are considered in the overall financial strategy, fostering financial stability and security.

Community Development and Local Initiatives

Hudson County Tax Records also play a vital role in community development and local initiatives. Tax data provides insights into neighborhood demographics, property values, and tax revenue generation, informing policy decisions and resource allocation. Local governments and community organizations rely on tax records to develop targeted initiatives, allocate funds effectively, and address community needs.

For instance, tax records can highlight areas with high concentrations of low-income households, prompting the development of affordable housing initiatives. Similarly, tax data can inform infrastructure development plans, ensuring equitable access to essential services across the county.

Future Implications and Trends in Hudson County Tax Records

As we look to the future, Hudson County’s tax records are poised for continued evolution and innovation. Technological advancements and changing demographics will shape the tax landscape, offering new opportunities and challenges.

Embracing Technology and Data Analytics

Hudson County is likely to further integrate technology and data analytics into its tax management processes. Advanced data analytics can enhance the accuracy and efficiency of assessments, ensuring fair and equitable taxation. Additionally, predictive analytics can anticipate tax trends, identify potential issues, and inform proactive policy decisions.

The integration of technologies like blockchain and artificial intelligence can revolutionize tax record management, offering enhanced security, transparency, and accessibility. These advancements will not only benefit taxpayers but also streamline administrative processes, reducing costs and improving overall efficiency.

Addressing Social and Economic Inequities

Hudson County’s tax records also have a role to play in addressing social and economic inequities. By analyzing tax data, the county can identify disparities in property values, tax burdens, and access to services. This data-driven approach can inform policies aimed at promoting social justice and economic equality.

For instance, tax records can reveal areas with disproportionately high tax burdens, prompting initiatives to provide tax relief or support for low-income residents. Similarly, tax data can highlight neighborhoods lacking essential services, prompting targeted investments and infrastructure development.

Adaptability in a Changing Real Estate Market

The Hudson County real estate market is dynamic and ever-evolving, and tax records must adapt to these changes. As property values fluctuate and market trends shift, tax assessments and rates must remain responsive to ensure fairness and accuracy. Hudson County’s tax system will need to be agile, leveraging data and analytics to adjust assessments and tax rates accordingly.

Additionally, the county may explore innovative tax policies and incentives to encourage sustainable development, affordable housing, and economic growth. By staying attuned to market dynamics, Hudson County can foster a resilient and vibrant real estate ecosystem, benefiting both property owners and the community at large.

Conclusion: Empowering Property Owners and Investors

In conclusion, Hudson County Tax Records are an indispensable resource for property owners, investors, and the community. These records provide a wealth of information, from property assessments and tax rates to payment histories and market trends. By understanding and leveraging these records, individuals can make informed decisions, plan strategically, and contribute to the county’s vibrant real estate landscape.

Hudson County's commitment to transparency and accessibility, coupled with technological advancements, ensures that tax records remain a powerful tool for empowerment and progress. As we move forward, the county's tax system will continue to evolve, adapting to the changing needs of its residents and the dynamic real estate market.

How often are property assessments conducted in Hudson County?

+Property assessments in Hudson County are conducted periodically, typically every 3 to 5 years. These revaluations ensure that assessments remain accurate and reflect changes in property values.

Can property owners appeal their assessments?

+Yes, property owners have the right to appeal their assessments if they believe they are inaccurate or unfair. Hudson County provides guidelines and resources for the appeal process, ensuring transparency and due process.

How can I access Hudson County Tax Records online?

+Hudson County offers an online platform accessible through its official website. Users can search for tax records by property address, owner name, or block and lot number. The platform provides instant access to assessments, tax rates, and payment histories.

What resources are available to help me understand my tax obligations in Hudson County?

+Hudson County provides a wealth of resources, including tax guides, FAQs, and contact information for tax professionals. These resources offer detailed explanations of tax processes, rates, and exemptions, ensuring taxpayers have the information they need to navigate their obligations effectively.