Nj Sales Tax Payment

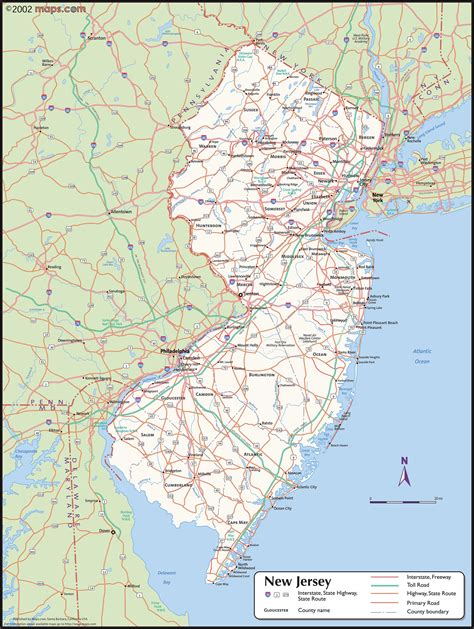

Navigating the complex world of sales tax compliance is an essential aspect of managing a business, especially in the state of New Jersey. The New Jersey Division of Taxation oversees the collection and administration of sales and use taxes, ensuring that businesses operate within the state's legal framework. This comprehensive guide aims to provide an in-depth understanding of the NJ Sales Tax Payment process, covering everything from registration to payment methods and deadlines.

Understanding the NJ Sales Tax

The NJ Sales Tax is a consumption tax imposed on the sale of tangible personal property and certain services. It is an important revenue source for the state, contributing to various public services and infrastructure development. As a business owner, understanding and adhering to sales tax regulations is crucial to avoid penalties and maintain a positive relationship with the state’s tax authorities.

Registration Process

The first step in managing your NJ Sales Tax obligations is registering with the New Jersey Division of Taxation. This process involves providing detailed information about your business, including its legal structure, location, and the nature of its operations. Upon successful registration, you will receive a Sales and Use Tax Permit, which serves as your authorization to collect and remit sales tax in the state.

During the registration process, you will need to choose a tax identification number. The state provides two options: the Business Registration Certificate (BRC) number or the Federal Employer Identification Number (FEIN). The BRC number is unique to New Jersey and is required for certain transactions, while the FEIN is a federal identifier that many businesses already possess. It's important to note that choosing the FEIN does not replace the need for a BRC, as both serve different purposes in New Jersey's tax system.

Sales Tax Rates and Exemptions

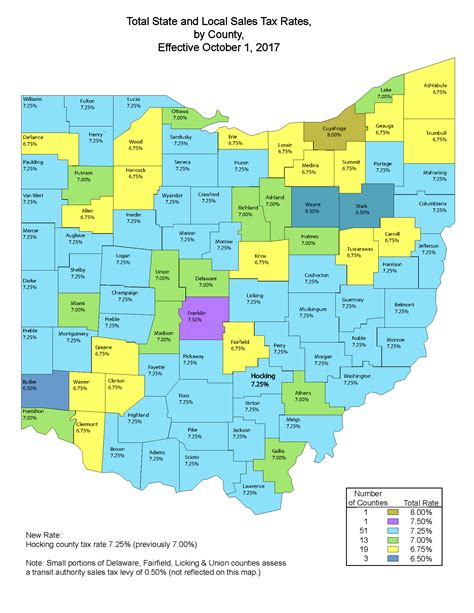

The NJ Sales Tax is applied at a standard rate of 6.625% on most taxable goods and services. However, certain items are exempt from sales tax, such as most groceries, prescription drugs, and residential utility services. Additionally, there are specific localities within New Jersey that have additional local sales tax rates, bringing the total tax rate to 7.625% in those areas. It’s crucial for businesses to stay updated on these variations to accurately calculate and remit sales tax.

| Standard NJ Sales Tax Rate | 6.625% |

|---|---|

| Local Sales Tax Rate (Specific Localities) | 1% |

| Combined Total Sales Tax Rate (Specific Localities) | 7.625% |

Calculating and Remitting Sales Tax

Calculating sales tax accurately is a critical aspect of your business’s financial management. The process involves applying the appropriate tax rate to the taxable portion of each sale. In New Jersey, the taxable portion excludes certain items like shipping and handling charges, and tax-exempt items. It’s important to maintain detailed records of these calculations to ensure compliance and facilitate audits if needed.

Payment Methods and Deadlines

The New Jersey Division of Taxation offers a range of payment methods to accommodate different business needs. These include electronic payments, credit card payments, and traditional methods like checks or money orders. The state encourages electronic payments for their convenience and security, with options such as EFT (Electronic Funds Transfer) and ACH (Automated Clearing House) transactions.

Payment deadlines are crucial to avoid penalties. Generally, sales tax returns and payments are due on the 20th day of the month following the reporting period. For example, sales tax collected in January would be due on February 20th. However, it's important to note that if the 20th falls on a weekend or holiday, the due date is adjusted to the next business day. It's always best to consult the official guidelines or reach out to the New Jersey Division of Taxation for clarification on specific deadlines.

| Standard Payment Deadline | 20th of the month following the reporting period |

|---|---|

| Example: January Sales Tax Due Date | February 20th |

| Adjustment for Weekends/Holidays | Payment due on the next business day |

Late Payment Penalties and Interest

Failure to remit sales tax by the deadline can result in penalties and interest charges. The New Jersey Division of Taxation imposes a 5% penalty on the amount due for late payments. Additionally, interest accrues on the outstanding balance at a rate of 0.5% per month, or 6% annually. It’s important to note that these penalties and interest charges compound, so addressing late payments promptly is crucial to minimize financial burdens.

Managing Sales Tax Records

Maintaining accurate and organized sales tax records is essential for several reasons. Firstly, it ensures that your business can easily calculate and remit sales tax accurately. Secondly, it provides a defense in case of an audit, as the New Jersey Division of Taxation may request documentation to verify sales tax payments. Lastly, proper record-keeping simplifies the process of preparing sales tax returns and filing them on time.

Required Sales Tax Records

The New Jersey Division of Taxation requires businesses to maintain specific sales tax records. These include sales receipts, invoices, and other documentation that support the calculation and payment of sales tax. Additionally, businesses should retain records of any exemptions claimed, as these may be subject to verification during an audit.

It's important to note that the state does not specify a retention period for sales tax records. However, it is generally recommended to keep these records for at least three years, which is the statute of limitations for tax assessments in New Jersey. This ensures that businesses can provide documentation if needed during an audit or for any other tax-related matters.

Future Implications and Considerations

As the tax landscape continues to evolve, businesses must stay informed about potential changes to sales tax regulations. The New Jersey Division of Taxation periodically updates its guidelines and procedures, so regular checks for updates are advisable. Additionally, with the increasing adoption of online sales, businesses should be aware of the New Jersey Sales and Use Tax Streamlined Sales and Use Tax Agreement (SSUTA), which simplifies sales tax collection for remote sellers.

Online Sales and the SSUTA

The New Jersey Sales and Use Tax Streamlined Sales and Use Tax Agreement (SSUTA) is a voluntary program that simplifies sales tax compliance for remote sellers. By participating in SSUTA, businesses can benefit from a standardized sales tax administration system, reducing the complexity of managing sales tax across multiple jurisdictions. This is particularly beneficial for businesses with online sales, as it streamlines the process of collecting and remitting sales tax.

Conclusion

Navigating the complexities of NJ Sales Tax Payment requires a thorough understanding of the state’s regulations and a commitment to timely compliance. From registration to accurate calculations and timely remittances, every step is crucial to maintaining a positive tax standing. By staying informed and leveraging the resources provided by the New Jersey Division of Taxation, businesses can effectively manage their sales tax obligations, ensuring a smooth and compliant financial management process.

What happens if I miss the sales tax payment deadline in New Jersey?

+Missing the sales tax payment deadline can result in penalties and interest charges. The state imposes a 5% penalty on the amount due, and interest accrues at a rate of 0.5% per month or 6% annually. It’s crucial to address late payments promptly to minimize financial burdens.

Are there any options for payment plans if I’m unable to pay the full sales tax amount?

+Yes, the New Jersey Division of Taxation offers payment plans for businesses facing financial difficulties. These plans allow for the payment of sales tax liabilities over a specified period, helping businesses manage their tax obligations while maintaining financial stability.

How can I stay updated on changes to New Jersey’s sales tax regulations and procedures?

+Staying informed about changes to sales tax regulations is crucial. The New Jersey Division of Taxation provides regular updates and resources on its website. Additionally, subscribing to their email notifications or following their social media channels can ensure you receive timely information about any updates or changes.