Sales And Use Tax Nj

Sales and Use Tax in New Jersey is a critical aspect of the state's revenue system, impacting both businesses and consumers. With a complex tax structure, understanding the intricacies of these taxes is essential for compliance and effective financial planning. This comprehensive guide aims to provide an in-depth analysis of New Jersey's Sales and Use Tax, offering insights into its functioning, implications, and recent developments.

Understanding Sales and Use Tax in New Jersey

New Jersey imposes a Sales and Use Tax on the retail sale, lease, or rental of most goods, as well as certain services. The tax is collected by the seller and remitted to the New Jersey Division of Taxation. The current Sales and Use Tax rate in the state is 6.625%, which includes the state tax rate of 6.625% and an additional 0% local tax rate that may vary by municipality.

What is Sales Tax and When is it Applicable?

Sales Tax is a consumption tax levied on the sale of tangible personal property and certain services. In New Jersey, it is applicable to most retail sales, including:

- Clothing and footwear

- Electronics and appliances

- Furniture and home goods

- Automotive sales

- Groceries (except for certain staple foods)

- Restaurant meals

The tax is typically included in the displayed price, and businesses are responsible for collecting and remitting it to the state.

Use Tax: An Important Consideration

Use Tax, often overlooked, is an essential component of New Jersey’s tax system. It is a self-assessed tax applied to tangible personal property or services purchased from out-of-state vendors for use, storage, or consumption in New Jersey. This tax ensures that regardless of where a purchase is made, New Jersey residents and businesses contribute to the state’s revenue.

| Tax Type | Description |

|---|---|

| Sales Tax | Tax on retail sales within New Jersey, collected by sellers. |

| Use Tax | Tax on purchases from out-of-state vendors, self-assessed by buyers. |

Registration and Compliance

Businesses operating in New Jersey or selling goods or services into the state are required to register with the New Jersey Division of Taxation for a Sales and Use Tax permit. This process ensures that businesses understand their tax obligations and can comply with the state’s tax laws.

Registration Process

The registration process involves completing the Business Registration Application, providing details such as business activities, tax liabilities, and contact information. Upon approval, businesses receive a Business Registration Certificate and a Sales and Use Tax permit number.

Compliance Requirements

Registered businesses must collect and remit Sales and Use Tax on all applicable transactions. Compliance includes:

- Displaying tax-inclusive prices

- Issuing tax invoices

- Filing periodic tax returns (typically quarterly or annually)

- Remitting tax payments by the due date

- Maintaining accurate records for audit purposes

Tax Rates and Exemptions

New Jersey’s Sales and Use Tax rates can vary depending on the location and nature of the transaction. While the state tax rate is a uniform 6.625%, local tax rates can differ, impacting the total tax liability.

Local Tax Variations

In addition to the state tax, some municipalities in New Jersey impose a local tax, known as the Municipal Sales Tax. This tax can range from 0% to 3.5%, depending on the location of the sale. For instance, in cities like Jersey City and Newark, the local tax rate is 3.5%, resulting in a combined tax rate of 10.125%.

Exemptions and Special Cases

Certain goods and services are exempt from Sales and Use Tax in New Jersey. These exemptions include:

- Prescription medications

- Certain medical devices

- Food items for human consumption (excluding prepared foods)

- Educational materials

- Nonprofit organization sales

Additionally, some businesses, such as charitable organizations and religious institutions, may qualify for tax-exempt status.

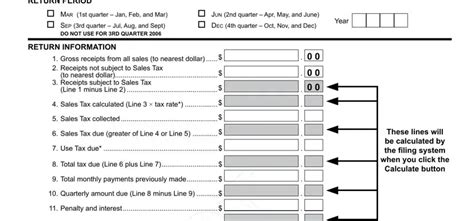

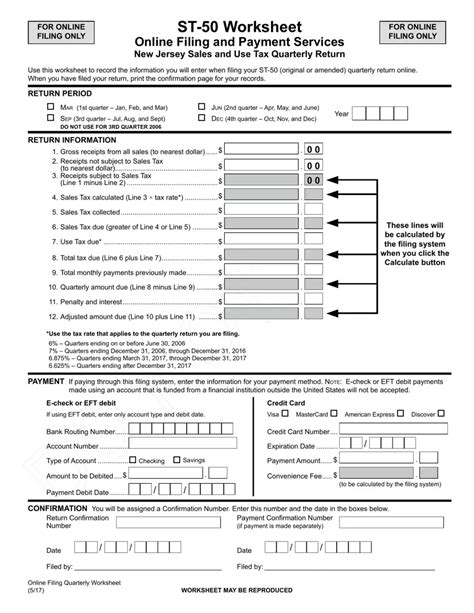

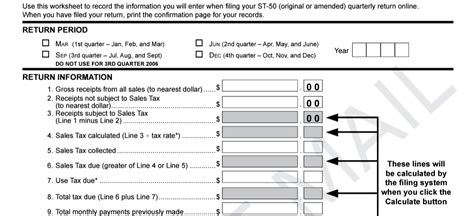

Tax Remittance and Filing

Registered businesses are required to file Sales and Use Tax returns and remit tax payments to the New Jersey Division of Taxation on a regular basis. The frequency of filing and remittance depends on the business’s tax liability and can range from monthly to annually.

Electronic Filing and Payment

New Jersey encourages electronic filing and payment of Sales and Use Tax through its online system, NJTAXES.gov. This platform offers a secure and efficient way to manage tax obligations, providing real-time transaction history and payment tracking.

Due Dates and Penalties

Timely filing and remittance of Sales and Use Tax is crucial to avoid penalties and interest. Late filings and payments can result in substantial penalties, which can quickly accumulate. It’s essential for businesses to maintain a compliant schedule to avoid these additional costs.

Recent Developments and Future Outlook

New Jersey’s Sales and Use Tax landscape is dynamic, with regular updates and changes. Recent developments include:

COVID-19 Impact

The COVID-19 pandemic has significantly impacted New Jersey’s economy and tax revenue. To support businesses and stimulate the economy, the state has implemented various tax relief measures, including:

- Waiving late payment penalties for certain taxes, including Sales and Use Tax

- Extending filing deadlines

- Offering payment plans for businesses with tax liabilities

E-Commerce and Remote Sellers

The rise of e-commerce has led to a focus on remote sellers and their tax obligations. New Jersey has implemented laws to ensure that out-of-state sellers with substantial nexus in the state collect and remit Sales and Use Tax. This includes the Marketplace Facilitator Law, which holds online marketplaces and facilitators responsible for collecting and remitting tax on behalf of their sellers.

Tax Simplification Initiatives

New Jersey is committed to simplifying its tax system, making it more efficient and user-friendly. Recent initiatives include:

- Standardizing tax rates and regulations across the state

- Improving tax administration through technology and online services

- Enhancing taxpayer education and outreach

Conclusion

New Jersey’s Sales and Use Tax system is a vital component of the state’s revenue generation, offering a complex yet crucial framework for businesses and consumers. Understanding the intricacies of this tax is essential for compliance and effective financial management. As the state continues to evolve and adapt, staying informed about tax laws and regulations is key to successful business operations in New Jersey.

What is the current Sales and Use Tax rate in New Jersey?

+The current Sales and Use Tax rate in New Jersey is 6.625%, which includes the state tax rate of 6.625% and a 0% local tax rate (which may vary by municipality).

How often do businesses need to file Sales and Use Tax returns in New Jersey?

+The frequency of filing Sales and Use Tax returns depends on the business’s tax liability. Businesses with higher tax liabilities typically file quarterly, while those with lower liabilities may file annually. However, it’s important to note that late filings can result in penalties.

Are there any tax exemptions for Sales and Use Tax in New Jersey?

+Yes, New Jersey offers exemptions for certain goods and services. These include prescription medications, certain medical devices, food items for human consumption (excluding prepared foods), educational materials, and sales by nonprofit organizations. It’s important to review the specific exemption guidelines to ensure compliance.

How has the COVID-19 pandemic impacted Sales and Use Tax in New Jersey?

+The COVID-19 pandemic has led to various tax relief measures in New Jersey, including the waiver of late payment penalties for certain taxes (including Sales and Use Tax), extended filing deadlines, and payment plans for businesses with tax liabilities. These measures aim to support businesses and stimulate the economy during challenging times.

What is the Marketplace Facilitator Law in New Jersey, and how does it impact Sales and Use Tax?

+The Marketplace Facilitator Law in New Jersey holds online marketplaces and facilitators responsible for collecting and remitting Sales and Use Tax on behalf of their sellers. This law ensures that out-of-state sellers with substantial nexus in New Jersey comply with tax obligations, helping to level the playing field for local businesses.