Sales Tax On A Car In Mo

Sales tax on a car purchase is an important consideration for any buyer, as it can significantly impact the overall cost of the vehicle. In the state of Missouri, the sales tax system for vehicles has specific rules and rates that buyers should be aware of. This article will delve into the details of sales tax on cars in Missouri, covering the tax rates, exemptions, and how to calculate and pay the tax effectively.

Understanding Missouri’s Sales Tax Structure

Missouri has a state sales tax rate of 4.225%, which is applied to most retail sales, including vehicles. However, it’s important to note that local jurisdictions can impose additional sales taxes, resulting in varying total sales tax rates across the state.

For instance, St. Louis City has a local sales tax rate of 3.225%, while Kansas City has a rate of 2.725%. These local rates are added to the state sales tax, leading to a combined sales tax rate that can differ from one city to another.

To illustrate, let's consider an example. If you purchase a car in St. Louis City, the total sales tax rate would be 7.45% (state rate + local rate). On the other hand, in Kansas City, the total sales tax rate would be 6.95%.

Calculating Sales Tax on a Car Purchase

When buying a car in Missouri, the sales tax is calculated based on the purchase price of the vehicle. Here’s a step-by-step guide to calculating the sales tax:

- Determine the Purchase Price: This is the price you negotiate with the dealer, excluding any trade-in value.

- Apply the State Sales Tax Rate: Multiply the purchase price by the state sales tax rate of 4.225%.

- Add the Local Sales Tax Rate: Depending on your location, add the appropriate local sales tax rate to the state tax.

- Calculate the Total Sales Tax: Add the state and local sales taxes together to get the total sales tax amount.

Let's take an example. If you buy a car in St. Louis City for $30,000, the sales tax calculation would be as follows:

- State Sales Tax: $30,000 x 4.225% = $1,267.50

- Local Sales Tax (St. Louis City): $30,000 x 3.225% = $967.50

- Total Sales Tax: $1,267.50 + $967.50 = $2,235

So, the total sales tax on a $30,000 car purchase in St. Louis City would be $2,235.

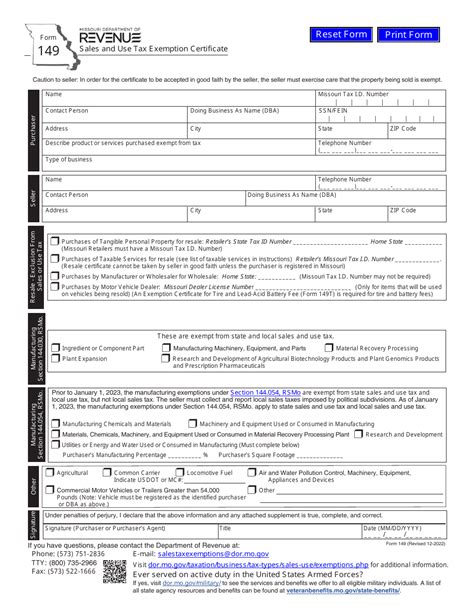

Exemptions and Special Cases

Missouri offers certain exemptions and special provisions regarding sales tax on vehicles. Here are some notable ones:

- Trade-In Vehicles: If you trade in a vehicle as part of your purchase, the sales tax is calculated based on the difference between the purchase price and the trade-in value. This can help reduce the overall sales tax liability.

- Military Personnel: Active-duty military personnel who are Missouri residents may be eligible for a sales tax exemption when purchasing a vehicle. This exemption is subject to specific criteria and documentation.

- Vehicle Type Exemptions: Certain types of vehicles, such as recreational vehicles (RVs) and motorcycles, may have different tax rates or exemptions. It's essential to check the specific regulations for these vehicles.

How to Pay Sales Tax on a Car Purchase in Missouri

When you purchase a car from a dealer in Missouri, the sales tax is typically included in the overall cost. The dealer will handle the tax calculation and payment process on your behalf.

However, if you're buying a car from a private seller or out of state, you'll need to pay the sales tax separately. Here's a guide on how to do it:

- Obtain a Temporary Operating Permit: If your new vehicle doesn't have license plates, you'll need a temporary permit to drive it. This permit is valid for 30 days and can be obtained from the Missouri Department of Revenue.

- Calculate the Sales Tax: Use the steps outlined earlier to calculate the sales tax based on the purchase price and your location's total sales tax rate.

- Pay the Sales Tax: You can pay the sales tax online through the Missouri Department of Revenue's website or in person at a local license office. Make sure to have the necessary documentation, including the bill of sale and the vehicle's title.

- Register and Title the Vehicle: After paying the sales tax, you can proceed with registering and titling your vehicle. This process involves providing proof of insurance and paying any applicable registration fees.

Sales Tax for Out-of-State Vehicle Purchases

If you buy a car out of state and plan to register it in Missouri, you’ll need to pay sales tax in Missouri. Here’s what you should know:

- Out-of-State Tax Credit: If you've already paid sales tax in the state where you purchased the vehicle, you may be eligible for a credit for that amount when paying Missouri sales tax. This credit can reduce your Missouri sales tax liability.

- Proof of Out-of-State Sales Tax Payment: To claim the out-of-state tax credit, you'll need to provide proof of payment. This could be a receipt, invoice, or other documentation showing the sales tax paid in the other state.

Sales Tax Tips for Car Buyers in Missouri

Here are some additional tips to consider when navigating sales tax on car purchases in Missouri:

- Research Local Sales Tax Rates: Before finalizing your purchase, check the local sales tax rate in the city or county where you plan to register the vehicle. This will help you budget accurately for the sales tax.

- Consider Trade-In Value: If you're trading in a vehicle, ensure you understand how the trade-in value affects the sales tax calculation. A higher trade-in value can reduce the sales tax on your new vehicle.

- Check for Special Programs: Missouri may offer special programs or incentives that can impact sales tax. Stay informed about any available programs that could benefit you.

- Keep Records: Retain all documents related to your vehicle purchase, including the bill of sale, proof of insurance, and sales tax payment records. These documents can be essential for future reference.

Future Outlook and Potential Changes

The sales tax landscape in Missouri is subject to change, and it’s essential to stay updated on any potential modifications. While there are no immediate significant changes expected, the state and local governments may consider adjustments to sales tax rates or regulations in the future.

Keeping an eye on legislative updates and tax news can help you stay informed about any changes that may impact your vehicle purchase or ownership.

In conclusion, understanding the sales tax system in Missouri is crucial for car buyers. By familiarizing yourself with the rates, exemptions, and calculation methods, you can navigate the process effectively and ensure compliance with Missouri's tax regulations. Remember to consult official sources and seek professional advice when needed to make informed decisions about your vehicle purchase.

Can I negotiate the sales tax on my car purchase?

+No, sales tax is a mandatory charge determined by the state and local governments. You cannot negotiate the sales tax itself, but you can negotiate the purchase price of the vehicle, which will impact the overall sales tax amount.

Are there any sales tax holidays in Missouri for vehicle purchases?

+As of my last update, Missouri does not have specific sales tax holidays for vehicle purchases. However, it’s worth checking for any general sales tax holidays that may apply to other retail items, as they could provide an opportunity to save on sales tax for your vehicle purchase.

Can I deduct sales tax on my car purchase from my taxes?

+The deductibility of sales tax on a car purchase depends on your tax situation and the applicable tax laws. Generally, if you itemize your deductions and meet certain criteria, you may be able to deduct sales tax. However, it’s recommended to consult a tax professional for personalized advice.