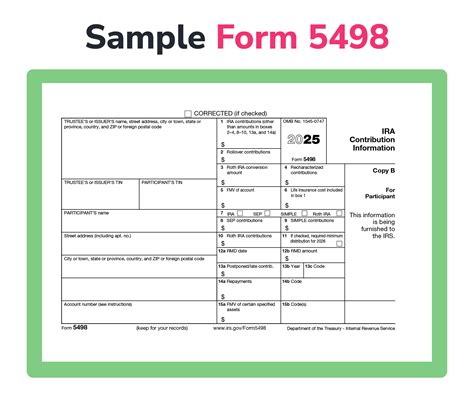

5498 Tax Form

Welcome to a comprehensive guide on the 5498 Tax Form, a crucial document for many individuals and businesses when it comes to tax reporting and compliance. In this article, we will delve into the intricacies of this form, its purpose, and its impact on financial transactions. With the tax season fast approaching, it's essential to understand the role of the 5498 Tax Form and how it can affect your financial planning.

Unraveling the 5498 Tax Form: A Comprehensive Overview

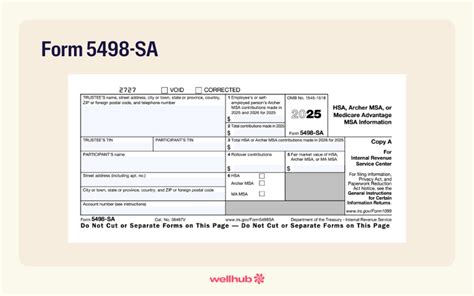

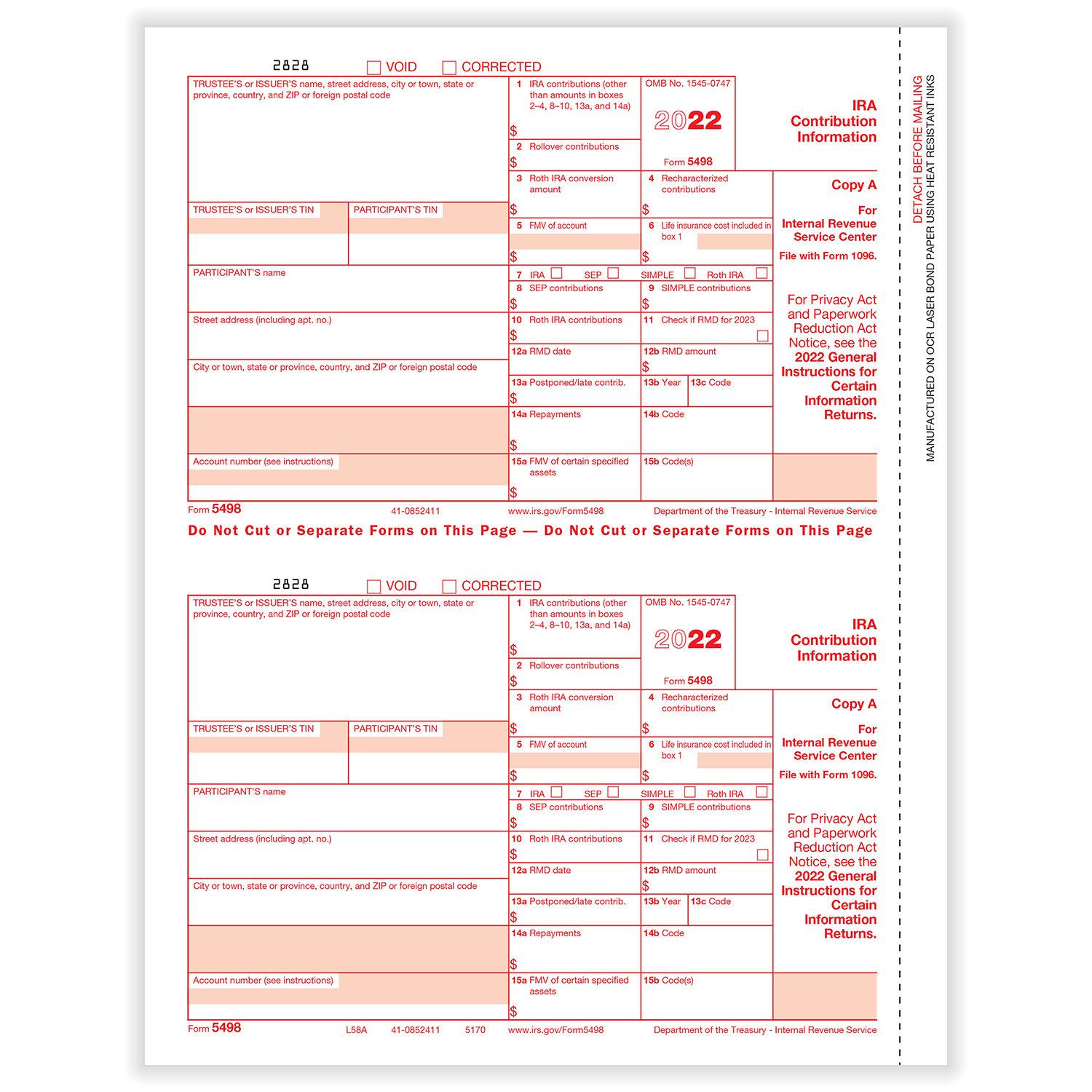

The 5498 Tax Form, officially known as the “Coverdell Education Savings Account Contribution Information”, is a vital component of the United States tax system. This form serves as a reporting mechanism for contributions made to Coverdell Education Savings Accounts (ESAs), offering a structured way to save for future educational expenses. By understanding the intricacies of this form, individuals can navigate the complex world of tax-advantaged education savings with confidence.

Understanding Coverdell ESAs and Their Benefits

Coverdell Education Savings Accounts (ESAs) are tax-advantaged savings plans designed to help families set aside funds for future educational expenses. These accounts offer a range of benefits, including tax-free growth on contributions and earnings, provided the funds are used for qualified education expenses. The 5498 Tax Form plays a pivotal role in ensuring compliance with these tax-advantaged plans.

One of the key advantages of Coverdell ESAs is their flexibility. Unlike other education savings plans, Coverdell ESAs can be used for a wide range of educational expenses, including elementary and secondary school costs, in addition to traditional college expenses. This makes them an attractive option for families with diverse educational goals.

| Key Benefits of Coverdell ESAs | Description |

|---|---|

| Tax-Free Growth | Contributions and earnings grow tax-free within the account. |

| Flexibility | Suitable for a wide range of educational expenses, from elementary to higher education. |

| Contribution Limits | $2,000 annual contribution limit per beneficiary. |

| Qualified Distributions | Distributions used for qualified education expenses are tax-free. |

The Role of the 5498 Tax Form in Reporting Contributions

The 5498 Tax Form is a critical tool for reporting contributions made to Coverdell ESAs. Financial institutions, including banks and brokerage firms, are responsible for issuing this form to account holders to report the total contributions made to the account during the tax year. This form ensures that the IRS is aware of all contributions and can verify compliance with the contribution limits.

For individuals who contribute to Coverdell ESAs, understanding the 5498 Tax Form is essential. It provides a clear record of their contributions, ensuring they stay within the annual contribution limit of $2,000 per beneficiary. Exceeding this limit can result in penalties, so accurate reporting is crucial.

Filing Requirements and Deadlines

Financial institutions must file the 5498 Tax Form with the IRS by the 15th day of the third month after the end of the tax year. For example, for the tax year ending December 31, 2023, the filing deadline would be March 15, 2024. This timely filing ensures that the IRS has accurate information about Coverdell ESA contributions.

Account holders should also receive a copy of the 5498 Tax Form from their financial institution. This form serves as a crucial record for their tax return, as it reports the total contributions made to the Coverdell ESA. It's important to keep this form with other tax documents for future reference and to ensure accurate reporting on tax returns.

Common Mistakes to Avoid with the 5498 Tax Form

While the 5498 Tax Form is relatively straightforward, there are a few common mistakes that individuals should be aware of to avoid potential penalties or complications:

- Exceeding Contribution Limits: As mentioned, the annual contribution limit for Coverdell ESAs is $2,000 per beneficiary. Exceeding this limit can result in a 6% excise tax on the excess amount. It's crucial to monitor contributions throughout the year to stay within the limit.

- Reporting Errors: Inaccurate reporting on the 5498 Tax Form can lead to discrepancies with the IRS. Always double-check the information provided by your financial institution to ensure accuracy.

- Missing or Late Filing: Financial institutions are required to file the 5498 Tax Form by the deadline. If an institution fails to do so, it can result in penalties. As an account holder, ensure that you receive your copy of the form in a timely manner.

The Impact of the 5498 Tax Form on Financial Planning

The 5498 Tax Form is more than just a reporting requirement; it has a significant impact on financial planning for education. By accurately reporting contributions, individuals can take full advantage of the tax benefits offered by Coverdell ESAs. This form ensures that contributions are within the allowable limits and that the funds are used exclusively for qualified education expenses.

For families with long-term education goals, understanding the role of the 5498 Tax Form is essential. It provides a structured framework for saving and ensures compliance with tax regulations, allowing them to maximize the benefits of their Coverdell ESA.

Conclusion: Navigating the Tax Landscape with Confidence

The 5498 Tax Form is a vital component of the Coverdell ESA system, offering a structured way to report contributions and ensure compliance with tax regulations. By understanding the purpose and impact of this form, individuals can navigate the complex world of tax-advantaged education savings with confidence. Whether you’re a parent planning for your child’s future education or an individual saving for your own educational pursuits, the 5498 Tax Form is a crucial tool to ensure your financial planning remains on track.

What is the purpose of the 5498 Tax Form?

+The 5498 Tax Form is used to report contributions made to Coverdell Education Savings Accounts (ESAs). It ensures that the IRS is aware of these contributions and helps maintain compliance with the contribution limits and tax regulations associated with Coverdell ESAs.

Who needs to file the 5498 Tax Form?

+Financial institutions, such as banks and brokerage firms, are responsible for filing the 5498 Tax Form with the IRS. They must report the total contributions made to Coverdell ESAs during the tax year.

What are the key benefits of Coverdell ESAs?

+Coverdell ESAs offer tax-free growth on contributions and earnings, provided the funds are used for qualified education expenses. They are flexible and can be used for a wide range of educational costs, from elementary school to college.

What is the annual contribution limit for Coverdell ESAs?

+The annual contribution limit for Coverdell ESAs is $2,000 per beneficiary. Exceeding this limit can result in penalties, so it’s important to monitor contributions throughout the year.