Wisconsin My Tax Account

Welcome to this comprehensive guide on the Wisconsin My Tax Account platform, a digital tool that empowers Wisconsin taxpayers to manage their tax obligations efficiently and securely. As a taxpayer in the Badger State, having a clear understanding of this online portal and its functionalities is essential for seamless tax management. This guide will delve into the intricacies of Wisconsin My Tax Account, offering an in-depth analysis of its features, benefits, and impact on taxpayers' experiences.

Unveiling Wisconsin My Tax Account: A Digital Transformation for Taxpayers

The Wisconsin Department of Revenue, recognizing the evolving needs of taxpayers in the digital age, introduced Wisconsin My Tax Account as a modern solution to traditional tax management methods. This innovative platform, launched in [launch date], has since become an indispensable tool for individuals and businesses alike, revolutionizing the way taxpayers interact with the state’s revenue department.

At its core, Wisconsin My Tax Account is designed to streamline tax-related tasks, offering a user-friendly interface that guides taxpayers through a range of functions. From filing returns to making payments and accessing vital tax information, this digital platform provides a one-stop solution, eliminating the need for multiple visits to different physical locations or complex paperwork.

Key Features of Wisconsin My Tax Account

The platform boasts an array of features that cater to diverse taxpayer needs. Here’s an overview of some of its most notable capabilities:

- Secure Registration and Login: Users can create a secure account with multi-factor authentication, ensuring their tax information remains protected.

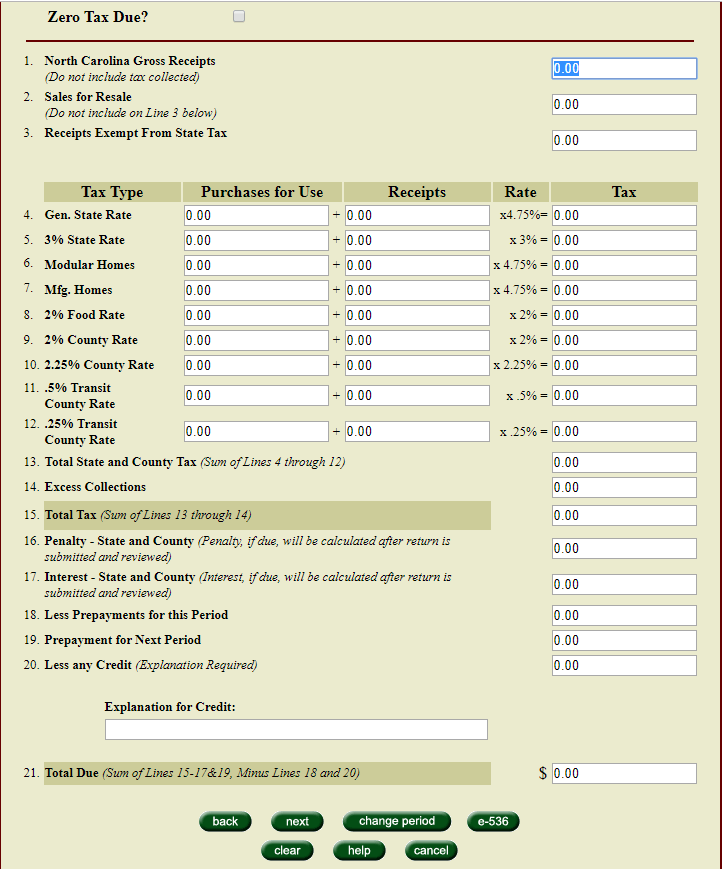

- Tax Return Filing: The platform allows taxpayers to file various types of returns, including individual income tax, business tax, and more. It provides interactive forms and guides to simplify the filing process.

- Payment Options: Wisconsin My Tax Account offers multiple payment methods, including credit/debit cards, e-checks, and direct withdrawal from bank accounts. Taxpayers can also set up payment plans for larger balances.

- Account Overview: A centralized dashboard provides a clear overview of all tax-related activities, including pending returns, payment due dates, and account balances.

- Tax Estimate Calculator: This feature assists taxpayers in estimating their tax liabilities, helping them plan their finances effectively.

- Notification System: Users can opt to receive email or text notifications for important tax-related events, ensuring they stay updated on deadlines and account changes.

| Feature | Description |

|---|---|

| Electronic Signatures | The platform supports digital signatures, allowing taxpayers to sign tax forms electronically, eliminating the need for physical signatures. |

| Document Upload | Users can upload supporting documents, such as receipts or tax forms, directly to their account, making it easier to organize and access crucial tax-related information. |

| Tax History | A comprehensive view of past tax returns, payments, and related activities is accessible, providing a historical perspective on a taxpayer's financial interactions with the state. |

User Experience and Accessibility

Wisconsin My Tax Account is designed with a user-centric approach, ensuring that taxpayers of all technical backgrounds can navigate the platform with ease. The intuitive interface guides users through each step, providing clear instructions and feedback. Additionally, the platform is optimized for mobile devices, allowing taxpayers to access their accounts on the go, a feature particularly beneficial for busy professionals and small business owners.

The platform's accessibility features also extend to individuals with disabilities. Screen reader support and keyboard navigation ensure that users with visual impairments or motor disabilities can access and utilize the platform's services. This commitment to inclusivity demonstrates Wisconsin's dedication to serving all its taxpayers effectively.

Security and Data Protection

Maintaining the security and confidentiality of taxpayer data is a top priority for Wisconsin My Tax Account. The platform employs advanced encryption protocols to safeguard sensitive information during transmission and storage. Additionally, robust access controls and user authentication mechanisms prevent unauthorized access, ensuring that only registered users can view and manage their tax accounts.

Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities, further strengthening the platform's security posture. Wisconsin's commitment to data protection aligns with industry best practices, providing taxpayers with the confidence that their personal and financial information is secure.

Impact on Taxpayer Experience

The introduction of Wisconsin My Tax Account has significantly enhanced the taxpayer experience, streamlining previously time-consuming and complex processes. By digitizing tax management, the platform has reduced the administrative burden on taxpayers, allowing them to focus more on their core activities.

One notable impact is the reduction in processing times for tax returns. With electronic filing, taxpayers can receive acknowledgment of their submissions almost instantly, compared to the delays often associated with traditional mail services. This efficiency not only benefits taxpayers but also reduces the administrative workload for the state revenue department.

Furthermore, the platform's ability to provide real-time updates and notifications has improved taxpayers' ability to stay compliant with state tax regulations. By receiving timely reminders and alerts, taxpayers can avoid late fees and penalties, leading to a more positive financial outcome.

Future Prospects and Continuous Improvement

Wisconsin My Tax Account is an evolving platform, with ongoing enhancements and updates to meet the changing needs of taxpayers. The Wisconsin Department of Revenue actively seeks feedback from users to identify areas for improvement and implement new features that enhance the user experience.

One area of focus for future development is the integration of additional tax-related services. The platform could potentially expand to include features like tax preparation assistance, providing taxpayers with step-by-step guidance to complete their returns accurately. This would further simplify the tax filing process and reduce the need for external tax preparation services.

Additionally, the department is exploring ways to leverage data analytics to provide personalized recommendations and insights to taxpayers. By analyzing historical tax data, the platform could offer tailored suggestions for tax planning, helping individuals and businesses optimize their financial strategies.

Community Outreach and Education

To ensure that all taxpayers can benefit from Wisconsin My Tax Account, the state revenue department conducts regular outreach programs and educational initiatives. These efforts aim to raise awareness about the platform’s capabilities and encourage its adoption among taxpayers who may be hesitant to transition to digital tax management.

Workshops, webinars, and informational sessions are organized to provide hands-on training and guidance on using the platform. These events also serve as platforms for taxpayers to voice their concerns and suggestions, fostering a collaborative environment for continuous improvement.

Conclusion

Wisconsin My Tax Account represents a significant step forward in the state’s tax administration, offering taxpayers a secure, efficient, and user-friendly platform for managing their tax obligations. With its wide range of features and ongoing improvements, the platform continues to enhance the taxpayer experience, making it easier for individuals and businesses to fulfill their tax responsibilities.

As Wisconsin continues to embrace digital transformation, the role of Wisconsin My Tax Account will become even more integral to the state's tax ecosystem. By staying committed to innovation and taxpayer-centric design, the platform is poised to further streamline tax processes, contributing to a more efficient and transparent tax system in the Badger State.

How do I register for a Wisconsin My Tax Account?

+To register for a Wisconsin My Tax Account, you’ll need to visit the official Wisconsin Department of Revenue website. On the homepage, look for the “Register” or “Create Account” button. Follow the prompts to provide your personal information, including your name, address, and tax identification number. You’ll also be required to create a secure password and may need to answer security questions for added account protection. Once your registration is complete, you’ll receive a confirmation email with further instructions on how to log in and access your account.

What types of taxes can I manage through Wisconsin My Tax Account?

+Wisconsin My Tax Account supports a wide range of tax types, including individual income tax, business tax (both corporate and partnership), sales and use tax, and more. The platform is designed to cater to the diverse tax obligations of Wisconsin residents and businesses. You can file returns, make payments, and manage your tax liabilities for all applicable tax types through this single platform.

Can I view my tax history through Wisconsin My Tax Account?

+Absolutely! One of the key benefits of Wisconsin My Tax Account is its ability to provide a comprehensive view of your tax history. Once logged in, you can access a detailed record of your past tax returns, payments, and other tax-related activities. This feature is particularly useful for tracking your tax obligations over time and for referencing previous filings.