Montgomery County Real Estate Taxes

Welcome to a comprehensive guide on Montgomery County's real estate taxes, a topic of interest for homeowners, investors, and anyone looking to understand the financial implications of owning property in this vibrant county. Montgomery County, located in the heart of Pennsylvania, boasts a rich history, a thriving economy, and a diverse range of residential and commercial properties. As one of the key revenue sources for the county, real estate taxes play a crucial role in funding essential public services and infrastructure development.

Understanding Montgomery County Real Estate Taxes

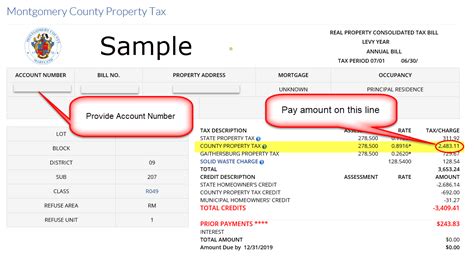

Montgomery County’s real estate tax system is designed to ensure fairness and transparency, while also generating revenue to support the county’s operations and development. The tax structure is based on the assessed value of properties, which is determined by the Montgomery County Assessment Office. This value is then used to calculate the tax amount due for each property owner.

The county's real estate tax rate is set annually by the Montgomery County Commissioners. This rate is applied to the assessed value of the property, resulting in the tax bill that property owners receive. The tax rate is often expressed in mills, where one mill represents $1 of tax for every $1,000 of assessed property value.

For example, if a property has an assessed value of $200,000 and the tax rate is 20 mills, the annual real estate tax bill would be calculated as follows:

| Assessed Value | $200,000 |

|---|---|

| Tax Rate (in mills) | 20 mills |

| Annual Real Estate Tax | $4,000 |

In this case, the property owner would be responsible for paying $4,000 in real estate taxes for the year.

Tax Relief Programs

Montgomery County recognizes the importance of supporting its residents and offers several tax relief programs to eligible property owners. These programs aim to provide financial assistance and ensure that the tax burden is manageable for those who qualify.

One notable program is the Homestead and Farmstead Exclusion, which provides a reduction in the assessed value of a property for tax purposes. This exclusion benefits homeowners and farmers by reducing their overall tax liability. To qualify, property owners must meet certain residency and usage requirements, and the exclusion amount is based on the property's assessed value.

Additionally, Montgomery County offers the Senior Tax Relief Program, which provides a credit towards real estate taxes for eligible senior citizens. This program aims to assist seniors in maintaining their independence and staying in their homes. The credit amount is determined based on income and property value, ensuring that those who need it most receive adequate support.

Payment Options and Due Dates

Montgomery County provides flexibility in terms of real estate tax payments, allowing property owners to choose from various payment options. These options include paying the entire tax bill in one installment or opting for quarterly payments. The county also accepts payments through online platforms, mail, or in person at designated locations.

The due dates for real estate taxes are typically aligned with the fiscal year, with the first installment due in early spring and subsequent installments due at regular intervals throughout the year. It is important for property owners to stay informed about these due dates to avoid penalties and late fees.

The Impact of Real Estate Taxes on Property Owners

Real estate taxes are a significant financial obligation for property owners in Montgomery County. While the tax rate may fluctuate from year to year, it is essential for homeowners and investors to consider these taxes as a regular expense when budgeting for property ownership.

The tax burden can vary significantly based on the assessed value of the property, with higher-value properties generally facing higher tax liabilities. This can impact the overall affordability of owning a home or investing in real estate, especially for those on a fixed income or with limited financial resources.

However, it is important to note that real estate taxes are an investment in the community. The revenue generated from these taxes supports critical services such as education, public safety, infrastructure maintenance, and economic development initiatives. By contributing to these taxes, property owners play a vital role in shaping the future of Montgomery County.

Strategies for Managing Real Estate Taxes

For property owners looking to manage their real estate tax burden effectively, there are several strategies to consider:

- Understand the Assessment Process: Property owners can benefit from familiarizing themselves with the assessment process and ensuring that their property's assessed value is accurate. If there are concerns about the assessed value, property owners can appeal the assessment through the Montgomery County Assessment Office.

- Explore Tax Relief Programs: As mentioned earlier, Montgomery County offers several tax relief programs. Property owners should research and apply for these programs if they meet the eligibility criteria. These programs can provide significant financial relief and ease the tax burden.

- Consider Payment Options: Choosing the right payment option can help property owners manage their cash flow effectively. Paying taxes in installments can reduce the financial strain compared to a single, large payment.

- Budgeting and Financial Planning: Integrating real estate taxes into annual budgeting and financial planning is crucial. Property owners can set aside funds specifically for tax payments to ensure they have the necessary funds when due dates approach.

The Future of Real Estate Taxes in Montgomery County

As Montgomery County continues to evolve and grow, the real estate tax system is likely to undergo changes and adaptations to meet the needs of the community. The county’s leadership and policymakers are dedicated to ensuring that the tax structure remains fair, transparent, and supportive of the county’s economic development goals.

One potential area of focus is the exploration of innovative tax policies that promote sustainable development and environmental initiatives. Montgomery County could consider implementing tax incentives or credits for property owners who adopt energy-efficient practices or invest in green technologies. Such initiatives not only support the county's sustainability goals but also encourage responsible property ownership.

Additionally, as the county experiences demographic shifts and changing economic landscapes, the tax system may need to adapt to accommodate these changes. This could involve reevaluating tax rates, reassessing properties more frequently, or introducing new tax relief programs to support specific segments of the population.

Conclusion

Montgomery County’s real estate tax system is a crucial component of the county’s financial landscape, providing the necessary funds to support essential services and infrastructure development. While real estate taxes represent a significant financial obligation for property owners, the county’s tax relief programs and flexible payment options aim to make the tax burden more manageable.

By understanding the tax system, exploring available relief programs, and employing effective financial strategies, property owners can navigate the real estate tax landscape with confidence. As Montgomery County continues to thrive and evolve, the real estate tax system will play a pivotal role in shaping the county's future, ensuring a sustainable and prosperous community for all its residents.

How often are real estate tax rates adjusted in Montgomery County?

+The Montgomery County Commissioners review and adjust the real estate tax rate annually. This ensures that the tax rate remains fair and reflects the county’s financial needs.

Are there any tax incentives for energy-efficient properties in Montgomery County?

+Yes, Montgomery County offers tax incentives for property owners who invest in energy-efficient improvements. These incentives can reduce the overall tax liability and encourage sustainable practices.

How can I appeal my property’s assessed value if I believe it is inaccurate?

+Property owners can appeal their assessed value by contacting the Montgomery County Assessment Office. They will guide you through the appeal process and provide information on the necessary steps.

What happens if I miss the real estate tax payment deadline?

+Missing the real estate tax payment deadline can result in penalties and late fees. It is important to stay informed about due dates and make timely payments to avoid additional financial burdens.