San Mateo Property Tax

San Mateo County, located in the heart of the San Francisco Bay Area, is renowned for its thriving tech industry, diverse landscapes, and high-quality living. With a diverse range of cities and towns, from the vibrant Peninsula cities to the tranquil coastal communities, the county offers a unique blend of urban and suburban lifestyles. However, one of the most significant aspects that potential homeowners consider is the property tax landscape, which varies across different regions within the county.

In this comprehensive guide, we will delve into the intricacies of San Mateo property tax, exploring the factors that influence tax rates, the assessment process, and the strategies employed by homeowners to manage their property tax obligations effectively. By understanding these aspects, homeowners and prospective buyers can make informed decisions and navigate the property tax landscape with confidence.

Understanding Property Tax in San Mateo County

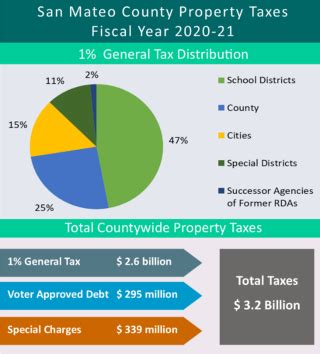

Property tax is a vital revenue source for local governments in California, including San Mateo County. It plays a crucial role in funding essential services such as education, public safety, infrastructure, and social programs. The property tax system in San Mateo County, like the rest of the state, is governed by Proposition 13, a landmark constitutional amendment that was passed in 1978.

Proposition 13 introduced significant changes to the property tax system in California, including a cap on the annual property tax rate at 1% of the assessed value of a property and limitations on property tax increases. Under this system, property taxes are based on the assessed value of a property, which is typically its purchase price or its value as determined by an assessor. This assessed value serves as the basis for calculating the property tax owed by homeowners.

The Assessment Process

The assessment process in San Mateo County is overseen by the San Mateo County Assessor’s Office. This office is responsible for assessing the value of all taxable properties within the county and ensuring compliance with Proposition 13’s guidelines.

When a property is purchased, the Assessor's Office records the purchase price and assesses the property based on its market value. This initial assessment becomes the property's base year value. From this point on, the property's taxable value is either adjusted annually by the maximum allowable rate of 2% or to reflect changes in ownership, new construction, or improvements made to the property.

It's important to note that Proposition 13 also allows for reassessment of properties under certain circumstances, such as when there is a change in ownership or when substantial improvements are made. In these cases, the property's assessed value may increase, resulting in higher property taxes.

Factors Influencing Property Tax Rates

Property tax rates in San Mateo County are influenced by a combination of factors, including the assessed value of the property, local tax rates, and any additional assessments or special taxes imposed by local governments or special districts.

The assessed value of a property is a key determinant of its property tax liability. As mentioned earlier, this value is either based on the purchase price or the assessed value determined by the Assessor's Office. However, it's important to understand that the assessed value may not always reflect the current market value of a property.

Local tax rates, which are set by local governments and special districts, also play a significant role in determining property tax rates. These rates can vary significantly across different regions within the county, depending on the services and infrastructure provided by each locality.

Additionally, San Mateo County, like many other counties in California, has various special assessments and taxes that are imposed to fund specific projects or services. These assessments and taxes can include measures for infrastructure improvements, school bonds, or local improvement districts. These additional assessments and taxes are typically added to the base property tax rate, increasing the overall property tax burden.

| Region | Assessed Value | Local Tax Rate | Additional Assessments | Total Tax Rate |

|---|---|---|---|---|

| San Mateo City | $1,200,000 | 1.05% | $0.20 per $100 assessed value | 1.25% |

| Redwood City | $850,000 | 1.10% | $0.15 per $100 assessed value | 1.25% |

| Belmont | $900,000 | 1.08% | $0.25 per $100 assessed value | 1.33% |

| Hillsborough | $2,500,000 | 1.02% | $0.10 per $100 assessed value | 1.12% |

In the table above, we provide a simplified example of how these factors come together to determine the total tax rate for four different regions within San Mateo County. The assessed value, local tax rate, and additional assessments all contribute to the final tax rate, which can vary significantly across different areas.

Managing Property Tax Obligations

Understanding the assessment process and the factors influencing property tax rates is just the first step in managing property tax obligations effectively. Homeowners in San Mateo County have various strategies and resources at their disposal to navigate the property tax landscape.

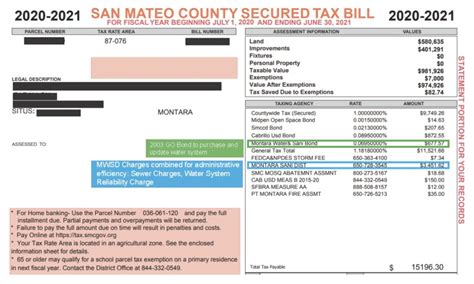

Reviewing Property Tax Bills

One of the most important steps for homeowners is to carefully review their property tax bills. These bills, typically sent out annually, provide detailed information about the assessed value of the property, the applicable tax rates, and any additional assessments or special taxes. By reviewing these bills, homeowners can identify any discrepancies or errors and take appropriate action.

If a homeowner believes that their property's assessed value is incorrect or that they have been overcharged, they have the right to appeal the assessment. The appeal process allows homeowners to present evidence and arguments to support their case for a reduction in their property's assessed value.

Appealing Property Assessments

The property assessment appeal process in San Mateo County is overseen by the Assessment Appeals Board. Homeowners who wish to appeal their property’s assessed value must file an appeal within a specified timeframe, typically after receiving their property tax bill. The appeal process involves submitting documentation and evidence to support the homeowner’s claim that the assessed value is excessive or inaccurate.

During the appeal process, the Assessment Appeals Board reviews the evidence presented by both the homeowner and the Assessor's Office. The board may request additional information or schedule a hearing to gather more details. Ultimately, the board makes a decision on whether to grant a reduction in the assessed value, which can result in lower property taxes for the homeowner.

It's important to note that appealing a property assessment requires careful preparation and a strong understanding of the assessment process. Homeowners may consider seeking professional assistance or consulting with tax professionals to ensure a successful appeal.

Utilizing Property Tax Exemptions and Deductions

California offers various property tax exemptions and deductions that can help reduce the property tax burden for eligible homeowners. These exemptions and deductions can be based on factors such as age, disability, veteran status, or income level.

For example, the Homeowners' Exemption reduces the assessed value of a primary residence by up to $7,000, resulting in lower property taxes. Additionally, the Disabled Veterans' Exemption provides a reduction in assessed value for qualifying disabled veterans, offering significant savings on property taxes. Other exemptions, such as the Elderly Persons' Exemption and the Disabled Persons' Homeowner Assistance Exemption, further contribute to easing the property tax burden for eligible homeowners.

Homeowners should explore these exemptions and deductions to determine their eligibility and take advantage of the savings they offer. It's important to note that these exemptions and deductions are subject to specific criteria and requirements, so careful research and consultation with tax professionals are essential.

Considerations for New Homebuyers

For new homebuyers in San Mateo County, understanding the property tax landscape is crucial for financial planning and budgeting. When considering a property purchase, it’s essential to factor in the property tax obligations associated with the home.

Prospective buyers should carefully review the property tax history and any outstanding tax liens or assessments on the property they are interested in. This information can be obtained from the Assessor's Office or through a title search. Understanding the property's tax history can provide valuable insights into potential future tax obligations.

Additionally, new homebuyers should be aware of the potential for property tax reassessment upon purchase. Under Proposition 13, a change in ownership can trigger a reassessment of the property's value, which may result in higher property taxes. Buyers should consider the potential impact of a reassessment on their budget and financial plans.

Seeking professional guidance from real estate agents, tax professionals, or financial advisors can help new homebuyers navigate the complexities of property taxes and make informed decisions during the home-buying process.

Case Study: Property Tax in San Mateo County

To illustrate the practical application of property tax concepts in San Mateo County, let’s consider a hypothetical case study involving a homeowner, John Smith.

John, a long-time resident of San Mateo City, recently received his property tax bill for the year. His property, a single-family home with an assessed value of $1.2 million, has been his primary residence for over a decade. John has always paid his property taxes promptly and has never appealed his assessed value.

Upon reviewing his tax bill, John notices that the assessed value of his property has increased by 5% compared to the previous year. This increase, he realizes, is due to the annual adjustment allowed by Proposition 13. Additionally, he discovers that there is a new special assessment for a local infrastructure improvement project, adding an additional $0.20 per $100 of assessed value to his tax bill.

John decides to explore his options for managing his property tax obligations. He begins by reviewing the Homeowners' Exemption, which he qualifies for based on his primary residence status. By applying for this exemption, he can reduce his assessed value by $7,000, resulting in a lower property tax bill.

Furthermore, John considers appealing his assessed value, as he believes that the 5% increase is excessive given the current real estate market conditions. He gathers evidence, such as recent sales data of comparable properties in his neighborhood, to support his case for a reduction in assessed value. John carefully prepares his appeal and submits it to the Assessment Appeals Board within the specified timeframe.

During the appeal process, John provides detailed arguments and evidence to the board, highlighting the discrepancies between his property's assessed value and the market value of similar homes in the area. The Assessment Appeals Board carefully considers John's case and ultimately grants a reduction in his assessed value, resulting in lower property taxes for the upcoming year.

John's case study demonstrates the importance of understanding the property tax landscape and taking proactive steps to manage tax obligations. By reviewing his tax bill, exploring exemptions, and appealing his assessed value, John was able to optimize his property tax payments and ensure fairness in the assessment process.

Conclusion

San Mateo County’s property tax landscape is a complex yet crucial aspect of homeownership in the region. By understanding the assessment process, the factors influencing tax rates, and the available strategies for managing property tax obligations, homeowners can navigate this landscape with confidence.

From reviewing property tax bills and appealing assessments to utilizing exemptions and seeking professional guidance, homeowners have a range of tools at their disposal to optimize their property tax payments. By staying informed and proactive, homeowners can ensure that their property tax obligations are fair and accurate, contributing to their overall financial well-being.

What is the average property tax rate in San Mateo County?

+The average property tax rate in San Mateo County can vary depending on the specific region and property characteristics. On average, the total tax rate ranges from 1.10% to 1.33% of the assessed value of the property. However, it’s important to note that additional assessments and special taxes can further impact the overall tax rate.

How often are property tax assessments made in San Mateo County?

+Property tax assessments in San Mateo County are typically made annually. The assessed value of a property is either adjusted by the maximum allowable rate of 2% or to reflect changes in ownership, new construction, or improvements. Reassessments may also occur under certain circumstances, such as a change in ownership or substantial improvements.

Can I appeal my property’s assessed value in San Mateo County?

+Yes, homeowners in San Mateo County have the right to appeal their property’s assessed value if they believe it is excessive or inaccurate. The appeal process is overseen by the Assessment Appeals Board, and homeowners must file an appeal within a specified timeframe. It’s important to gather evidence and prepare a strong case to support the appeal.

Are there any property tax exemptions available in San Mateo County?

+Yes, San Mateo County offers various property tax exemptions that can reduce the assessed value of eligible properties. These exemptions include the Homeowners’ Exemption, Disabled Veterans’ Exemption, Elderly Persons’ Exemption, and Disabled Persons’ Homeowner Assistance Exemption. Each exemption has specific criteria and requirements, so careful research is necessary to determine eligibility.