Dekalb County Ga Property Tax

When it comes to property ownership, understanding the local tax landscape is crucial. In DeKalb County, Georgia, property taxes play a significant role in the financial obligations of residents and business owners. This comprehensive guide aims to shed light on the intricacies of DeKalb County's property tax system, offering an in-depth analysis of the rates, assessment processes, and implications for taxpayers.

The DeKalb County Property Tax System: A Comprehensive Overview

DeKalb County, situated in the heart of Georgia, is renowned for its diverse neighborhoods, vibrant communities, and thriving businesses. As one of the most populous counties in the state, it boasts a rich cultural heritage and a robust economy. However, with this prosperity comes the responsibility of contributing to the local tax system, primarily through property taxes.

Property taxes in DeKalb County are levied on real estate properties, including residential homes, commercial buildings, and vacant land. These taxes serve as a primary source of revenue for the county, funding essential services such as education, public safety, infrastructure development, and community initiatives.

Property Tax Rates in DeKalb County

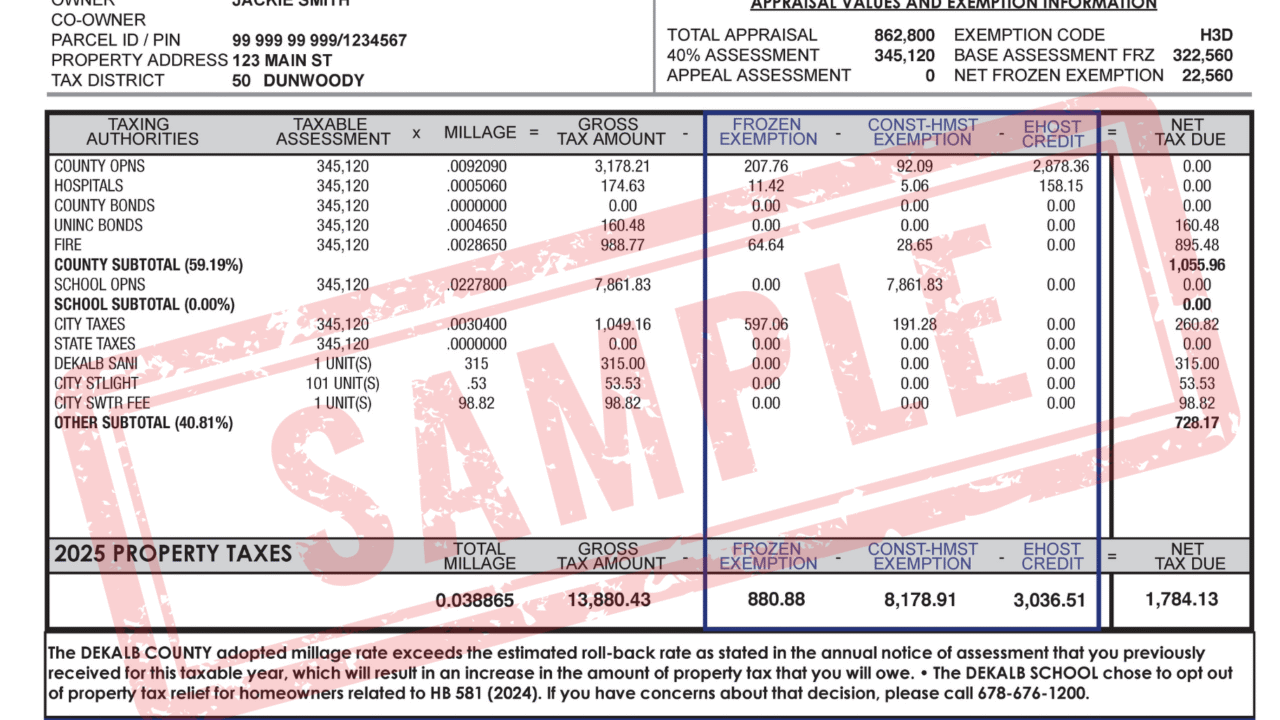

The property tax rates in DeKalb County are determined by a combination of factors, including the assessed value of the property and the millage rates set by various taxing authorities.

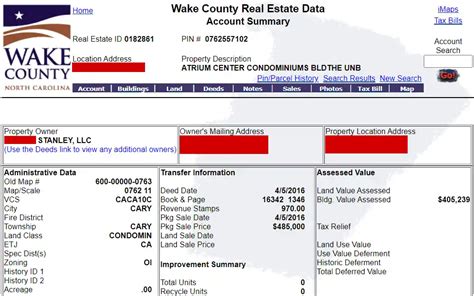

The assessed value of a property is established through a systematic evaluation process conducted by the DeKalb County Board of Tax Assessors. This board is responsible for ensuring that all properties within the county are assessed fairly and accurately. The assessed value takes into account factors such as the property's size, location, improvements, and recent market trends.

Once the assessed value is determined, it is subjected to a millage rate, which is a tax rate expressed in mills. One mill represents a tax liability of $1 for every $1,000 of assessed property value. The millage rate is set annually by the DeKalb County Board of Commissioners, in collaboration with other taxing authorities such as the school board and special districts.

The millage rate varies depending on the specific jurisdiction within DeKalb County. For instance, the millage rate for the general fund may differ from that of the school district or special purpose districts. These variations ensure that the tax revenue is allocated efficiently to fund the unique needs of each jurisdiction.

| Jurisdiction | Millage Rate (2023) |

|---|---|

| General Fund | 14.89 mills |

| School District | 21.14 mills |

| Special Purpose Districts | Varies by district |

It's important to note that the millage rates are subject to change annually, influenced by factors such as budgetary requirements, economic conditions, and public feedback. Property owners can stay informed about the latest millage rates by monitoring the official websites of the DeKalb County government and the Board of Tax Assessors.

Property Tax Assessment Process

The property tax assessment process in DeKalb County is a meticulous and transparent procedure aimed at ensuring fairness and accuracy. Here’s a step-by-step breakdown of how property values are assessed:

- Data Collection: The Board of Tax Assessors collects extensive data on all properties within the county. This includes information on recent sales, property characteristics, and market trends.

- Mass Appraisal: Utilizing sophisticated software and statistical models, the board performs a mass appraisal, analyzing comparable properties to determine the fair market value of each individual property.

- Property Inspection: In certain cases, especially for unique or recently improved properties, the Board of Tax Assessors may conduct physical inspections to gather additional data and ensure accuracy.

- Notice of Assessment: Once the assessed value is determined, property owners receive a Notice of Assessment, detailing the assessed value and providing an opportunity for review and appeal.

- Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal. The appeal process involves submitting documentation and evidence to support their case, which is reviewed by an independent panel.

- Final Assessment: After the appeal process, the Board of Tax Assessors finalizes the assessed value, taking into account any adjustments made during the appeal.

Throughout the assessment process, the Board of Tax Assessors adheres to strict guidelines and regulations to maintain transparency and fairness. Property owners are encouraged to actively participate in the process, ensuring that their properties are accurately valued.

Implications for Taxpayers

The property tax system in DeKalb County has significant implications for both residential and commercial taxpayers. Understanding these implications is crucial for effective financial planning and budgeting.

For residential homeowners, property taxes can represent a substantial portion of their annual expenses. The tax liability is directly proportional to the assessed value of the property and the applicable millage rates. Homeowners can mitigate their tax burden by staying informed about assessment values, appealing if necessary, and exploring potential tax relief programs offered by the county.

Commercial property owners face similar considerations but often have more complex tax situations. The value of commercial properties is influenced by factors such as rental income, vacancy rates, and market demand. Commercial property taxes can impact a business's bottom line, and strategic tax planning is essential to optimize financial outcomes.

Future Outlook and Initiatives

The DeKalb County government is committed to maintaining a robust and fair property tax system. As the county continues to grow and evolve, several initiatives are underway to enhance the tax assessment process and improve taxpayer services.

One notable initiative is the implementation of advanced technology and data analytics to streamline the assessment process. By leveraging digital tools and big data, the Board of Tax Assessors aims to increase efficiency, accuracy, and transparency. This modernization effort will benefit taxpayers by providing faster and more reliable assessment information.

Additionally, DeKalb County is exploring ways to enhance taxpayer engagement and education. This includes developing comprehensive resources and guides to help property owners understand the tax assessment process, their rights, and available relief programs. By empowering taxpayers with knowledge, the county aims to foster a more transparent and collaborative relationship.

Conclusion: Navigating the DeKalb County Property Tax Landscape

Understanding the DeKalb County property tax system is crucial for residents and business owners alike. By comprehending the assessment process, tax rates, and implications, taxpayers can effectively manage their financial obligations and contribute to the vibrant community they call home.

As DeKalb County continues to thrive and grow, the property tax system will remain a vital component of its economic ecosystem. With a commitment to fairness, transparency, and modernization, the county aims to ensure that the tax burden is distributed equitably, supporting the continued prosperity of its residents and businesses.

How can I determine the assessed value of my property in DeKalb County?

+

You can find the assessed value of your property by visiting the DeKalb County Tax Assessors website. Search for your property using your address or parcel number, and the assessed value will be displayed along with other relevant information.

Are there any property tax exemptions or relief programs available in DeKalb County?

+

Yes, DeKalb County offers various tax exemptions and relief programs to eligible taxpayers. These include homestead exemptions, senior citizen exemptions, and disability exemptions. Additionally, the county provides tax relief programs for qualifying low-income homeowners. It’s recommended to consult the DeKalb County Tax Assessors website or reach out to their office for detailed information on eligibility criteria and application processes.

How often are property tax assessments conducted in DeKalb County?

+

Property tax assessments in DeKalb County are conducted annually. The assessment process typically begins in January, and property owners receive their Notice of Assessment by March 1. This notice provides details about the assessed value and allows property owners the opportunity to review and appeal if necessary.

Can I appeal my property’s assessed value if I disagree with it?

+

Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal. The appeal process in DeKalb County involves submitting an appeal application, providing supporting evidence, and attending a hearing if necessary. It’s important to review the appeal guidelines and timelines provided by the DeKalb County Board of Tax Assessors to ensure a successful appeal.

How can I stay updated on changes to property tax rates and assessment procedures in DeKalb County?

+

To stay informed about changes to property tax rates and assessment procedures in DeKalb County, it’s advisable to regularly visit the official websites of the DeKalb County government and the Board of Tax Assessors. These websites provide up-to-date information, including millage rates, assessment schedules, and any updates or changes to the tax system. Additionally, subscribing to their newsletters or following their social media channels can ensure you receive timely notifications.