Wake County Property Tax Search

The Wake County Property Tax Search is an invaluable tool for homeowners, investors, and anyone interested in real estate within the vibrant Wake County, North Carolina. This digital platform provides an accessible way to explore property tax information, offering a wealth of data that empowers individuals to make informed decisions regarding their real estate holdings and investments. In this comprehensive guide, we delve into the intricacies of the Wake County Property Tax Search, uncovering its features, benefits, and the impact it has on the local real estate landscape.

Understanding the Wake County Property Tax Search

The Wake County Property Tax Search is an online portal managed by the Wake County Tax Administration, a department dedicated to ensuring fair and efficient property tax assessment and collection processes. This innovative platform allows users to access detailed property tax records and information for any property within Wake County, making it an essential resource for property owners, prospective buyers, and real estate professionals alike.

Key Features of the Wake County Property Tax Search

One of the standout features of the Wake County Property Tax Search is its user-friendly interface. The platform is designed with simplicity in mind, allowing users to quickly and easily navigate through various property-related data. Here’s a glimpse at some of its key features:

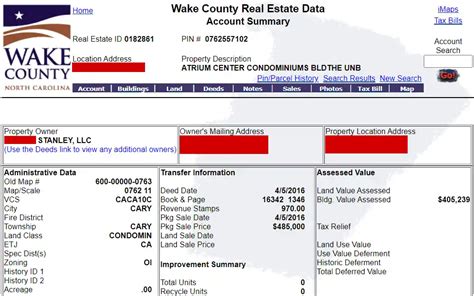

- Property Search by Address or Parcel Number: Users can search for properties by entering a specific address or parcel number, making it convenient to access information for any property of interest.

- Detailed Property Information: The platform provides comprehensive details about each property, including ownership information, property value, tax assessment, and historical tax data.

- Interactive Maps: Visualizing property locations is made easy with interactive maps, which provide a clear spatial understanding of the area.

- Tax Payment and History: Users can access their tax payment records, including the current year's tax amount, due dates, and a history of previous payments.

- Assessment Details: Property assessments, which determine the tax liability, are explained in detail, offering transparency to property owners and prospective buyers.

These features, among others, make the Wake County Property Tax Search an invaluable resource for anyone seeking in-depth knowledge about property taxes within the county.

Benefits of Using the Wake County Property Tax Search

The Wake County Property Tax Search offers a range of benefits that contribute to its popularity among real estate stakeholders. Here are some key advantages:

- Transparency and Accessibility: By providing detailed property tax information online, the platform promotes transparency in the real estate market. This accessibility empowers individuals to make informed decisions, whether they are buying, selling, or simply curious about property values.

- Efficiency for Property Owners: Property owners can easily access their tax records, payment history, and assessment details without having to visit the tax office in person. This convenience saves time and effort, especially for those with multiple properties.

- Research and Planning for Investors: Investors and real estate professionals can utilize the platform to conduct market research, analyze property values, and make strategic decisions. The historical tax data and assessment trends offer valuable insights for investment planning.

- Education and Awareness: The platform serves as an educational tool, helping individuals understand the property tax process, assessment methodologies, and their rights as property owners. This awareness fosters a more informed and engaged community.

Real-World Applications

The Wake County Property Tax Search finds application in various real-world scenarios, benefiting individuals and professionals alike. Consider these examples:

- Homeowners: For homeowners, the platform provides a quick way to access their property tax records, ensuring they stay informed about their tax obligations and payment history. It also offers a convenient way to dispute any inaccuracies in their property assessments.

- Prospective Buyers: Buyers can use the platform to research properties they are interested in purchasing. By accessing tax records, they can gain insights into the property's value, tax liability, and potential future assessments, aiding in their decision-making process.

- Real Estate Agents: Real estate agents leverage the Wake County Property Tax Search to provide their clients with comprehensive property information. This includes details about the property's history, current tax status, and potential tax implications, adding value to their services.

- Tax Professionals: Tax professionals, such as accountants and financial advisors, utilize the platform to assist their clients in understanding their property tax obligations and strategies for tax planning.

Performance and Reliability

The Wake County Property Tax Search is renowned for its performance and reliability. The platform is regularly updated with the latest tax information, ensuring users have access to accurate and current data. The Wake County Tax Administration takes pride in maintaining a secure and efficient system, safeguarding user information and ensuring data integrity.

Future Implications

The Wake County Property Tax Search continues to evolve, embracing technological advancements to enhance user experience and data accessibility. Future developments may include:

- Mobile Optimization: Making the platform more accessible on mobile devices, allowing users to access property tax information on the go.

- Enhanced Data Visualization: Implementing advanced data visualization techniques to present tax data in a more intuitive and engaging manner.

- Integration with Other Services: Exploring partnerships with other real estate-related platforms to provide a more comprehensive suite of tools for users.

These potential enhancements aim to further empower individuals and professionals, making the Wake County Property Tax Search an even more indispensable tool for the local real estate community.

Conclusion

The Wake County Property Tax Search stands as a testament to the county’s commitment to transparency and efficiency in property tax administration. By offering an accessible and user-friendly platform, the Wake County Tax Administration has revolutionized the way property tax information is accessed and utilized. With its comprehensive features, the platform empowers individuals, investors, and professionals, fostering a more informed and engaged real estate community in Wake County.

How often is the Wake County Property Tax Search updated with new data?

+The platform is typically updated annually, with new data becoming available in the early months of the year, reflecting the most recent tax assessments and property information.

Can I dispute my property tax assessment through the Wake County Property Tax Search platform?

+While the platform provides access to assessment details, the dispute process typically requires submitting a formal request to the Wake County Tax Administration. The platform, however, can be a valuable resource for gathering the necessary information for a dispute.

Is the Wake County Property Tax Search compatible with mobile devices?

+Yes, the platform is designed to be mobile-friendly, allowing users to access property tax information on their smartphones and tablets with ease.