Westminster Sales Tax

In the bustling city of Westminster, California, sales tax plays a significant role in shaping the local economy and influencing consumer behavior. Understanding the intricacies of Westminster's sales tax system is crucial for businesses and residents alike. This comprehensive guide aims to shed light on the various aspects of sales tax in Westminster, providing valuable insights and practical information.

The Westminster Sales Tax Landscape

Westminster, nestled in Orange County, boasts a vibrant business community and a thriving retail sector. The city’s sales tax structure is a key component of its economic framework, contributing to the overall fiscal health of the region. Let’s delve into the specifics of Westminster’s sales tax to uncover its impact and implications.

Understanding the Tax Rates

Westminster’s sales tax rates consist of a combination of state, county, and city taxes. As of the latest update, the total sales tax rate in Westminster stands at 9.75%, which is slightly higher than the average sales tax rate in California. This rate includes the following components:

| Tax Component | Rate |

|---|---|

| California State Sales Tax | 6.0% |

| Orange County Sales Tax | 0.25% |

| Westminster City Sales Tax | 3.5% |

It's important to note that these rates are subject to change, and businesses and consumers should stay updated with the latest tax regulations to ensure compliance.

Sales Tax Exemptions and Special Considerations

Like many other jurisdictions, Westminster has certain sales tax exemptions and special considerations in place. Understanding these exemptions can help businesses optimize their tax strategies and provide clarity to consumers.

One notable exemption in Westminster is the food and drug exemption. Prepared food, medications, and certain non-prepared food items are exempt from sales tax. This exemption extends to a wide range of products, including groceries, over-the-counter medications, and certain restaurant meals. However, it's essential to consult the specific guidelines provided by the California Board of Equalization to understand the nuances of this exemption.

Additionally, Westminster offers a tax holiday during specific periods. During these designated tax-free days, certain categories of items are exempt from sales tax, providing a boost to consumer spending and offering businesses a unique opportunity to promote their products.

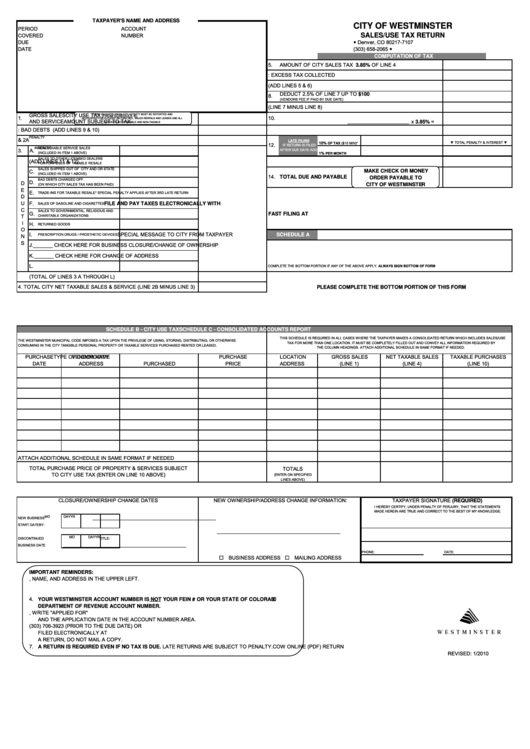

Sales Tax Collection and Remittance

For businesses operating in Westminster, sales tax collection and remittance are critical aspects of their financial operations. The process involves calculating the applicable tax on each transaction, accurately recording the sales, and then remitting the collected tax to the appropriate authorities.

Businesses in Westminster are required to register with the California Department of Tax and Fee Administration (CDTFA) to obtain a seller's permit. This permit allows them to collect and remit sales tax on behalf of the state and local government. The CDTFA provides comprehensive guidelines and resources to assist businesses in navigating the sales tax collection process.

Regular reporting and remittance are essential to ensure compliance. Businesses typically file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume and the requirements set by the CDTFA. Late or inaccurate filings can result in penalties and interest charges, so it's crucial for businesses to stay organized and timely in their tax obligations.

The Impact of Sales Tax on Businesses

Sales tax has a significant influence on the operations and strategies of businesses in Westminster. It affects pricing, profit margins, and consumer behavior, making it a critical factor in business planning.

From a business perspective, the sales tax rate can impact pricing decisions. To maintain competitive pricing, businesses may need to absorb a portion of the tax or pass it on to consumers. This delicate balance requires careful consideration of market dynamics and consumer expectations.

Moreover, sales tax can impact a business's profitability. A higher sales tax rate can reduce the net profit margin, especially for businesses with slim profit margins. Effective tax planning and strategic pricing can help mitigate the impact of sales tax on profitability.

Sales Tax and Consumer Behavior

Sales tax also plays a crucial role in shaping consumer behavior in Westminster. It influences purchasing decisions, shopping patterns, and consumer expectations.

For instance, the higher sales tax rate in Westminster compared to neighboring cities can lead to a phenomenon known as cross-border shopping. Consumers may choose to make purchases in areas with lower tax rates, impacting the local economy. To counteract this, businesses in Westminster often emphasize the benefits of shopping locally, such as convenience, personalized service, and supporting the local community.

Additionally, sales tax can influence consumer perceptions of value. Consumers may perceive a product to be more expensive due to the added tax, affecting their willingness to purchase. Businesses often address this by communicating the value proposition of their products and services, highlighting the benefits beyond the price tag.

The Future of Sales Tax in Westminster

As Westminster continues to evolve and adapt to changing economic landscapes, the future of sales tax remains a topic of interest and speculation. Several factors could influence the direction of sales tax in the city.

One potential development is the rise of e-commerce and online sales. With an increasing number of consumers opting for online shopping, the traditional brick-and-mortar sales tax model may need to be reevaluated. Westminster and other cities may explore alternative tax structures to capture revenue from online sales, ensuring a fair and balanced tax system.

Furthermore, the ongoing technological advancements in the retail sector could impact sales tax collection and compliance. Innovative solutions, such as automated tax calculation software and point-of-sale systems, can streamline the tax collection process and reduce the risk of errors. These advancements can benefit both businesses and tax authorities, enhancing efficiency and accuracy.

In conclusion, Westminster's sales tax landscape is a complex yet crucial aspect of the city's economy. From understanding the tax rates and exemptions to exploring the impact on businesses and consumers, this guide provides a comprehensive overview. As Westminster continues to thrive, staying informed about sales tax regulations and strategies will remain essential for both businesses and residents.

What is the current sales tax rate in Westminster, California?

+As of the latest update, the total sales tax rate in Westminster, California, is 9.75%. This rate includes the state, county, and city sales taxes.

Are there any sales tax exemptions in Westminster?

+Yes, Westminster offers certain sales tax exemptions. One notable exemption is the food and drug exemption, which applies to prepared food, medications, and certain non-prepared food items.

How often do businesses need to file sales tax returns in Westminster?

+The frequency of filing sales tax returns depends on the sales volume and requirements set by the California Department of Tax and Fee Administration (CDTFA). Businesses may file on a monthly, quarterly, or annual basis.

What are the consequences of late or inaccurate sales tax filings in Westminster?

+Late or inaccurate sales tax filings can result in penalties and interest charges. It is crucial for businesses to stay organized and timely in their tax obligations to avoid these consequences.

How does sales tax impact consumer behavior in Westminster?

+Sales tax can influence consumer purchasing decisions and shopping patterns. Consumers may consider the tax when evaluating prices, and businesses often emphasize the value proposition of their products to counteract the impact of sales tax.