Vermont Income Tax

In the verdant state of Vermont, nestled in the heart of New England, understanding the intricacies of the Vermont Income Tax system is essential for both residents and businesses. With its picturesque landscapes, thriving local communities, and a rich history, Vermont has a unique approach to taxation that reflects its values and economic priorities. This article delves into the specifics of Vermont's income tax, offering an in-depth analysis for those seeking clarity and expertise on the subject.

The Fundamentals of Vermont Income Tax

The Vermont Department of Taxes administers the Vermont Income Tax, a progressive tax system designed to contribute to the state’s fiscal sustainability and social welfare programs. The tax is levied on the total taxable income of individuals, trusts, and estates, and is calculated based on a series of tax brackets and rates.

Vermont's tax year runs concurrently with the federal government's, starting on January 1st and ending on December 31st. Residents are required to file their tax returns annually, with the deadline typically falling on April 15th, mirroring the federal tax deadline.

Taxable Income and Exemptions

The state defines taxable income as the total income earned by an individual, including wages, salaries, bonuses, commissions, tips, and other forms of compensation. It also includes income from investments, business activities, and certain types of retirement accounts. However, Vermont offers certain exemptions and deductions to reduce the taxable income, which can vary based on individual circumstances.

For instance, Vermont allows a standard deduction, which is adjusted annually, and provides for personal exemptions. These exemptions are typically higher for taxpayers with dependents and those over a certain age.

| Standard Deduction for Tax Year 2023 | $3,200 for Single Filers |

|---|---|

| Standard Deduction for Married Filing Jointly | $6,400 |

| Personal Exemption Amount | $4,500 per person |

Tax Brackets and Rates

Vermont’s progressive tax system employs a series of tax brackets and rates, which means that as income increases, so does the tax rate. The current tax rates for the year 2023 are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 3.35% |

| $10,001 - $25,000 | 5.50% |

| $25,001 - $200,000 | 6.80% |

| Over $200,000 | 8.75% |

These tax brackets are subject to periodic adjustments to account for inflation and economic changes.

Filing Vermont Income Tax Returns

Filing income tax returns in Vermont involves a straightforward process that can be done online or through traditional paper methods. The Vermont Department of Taxes provides an online filing system, MyVTax, which offers a secure and efficient way to file returns, check refund status, and make payments.

Required Forms and Documentation

Taxpayers need to complete the Vermont Individual Income Tax Return form, also known as Form VT-1040. This form is available on the Vermont Department of Taxes website and includes instructions for completing it accurately. Along with the form, taxpayers must provide supporting documentation, such as W-2 forms from employers, 1099 forms for various types of income, and any relevant receipts or statements for deductions and credits.

Due Dates and Late Filing Penalties

The annual deadline for filing Vermont income tax returns is typically April 15th, aligning with the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. It’s important to note that failing to file a tax return by the deadline can result in penalties and interest charges.

For late filings, Vermont imposes a penalty of 5% of the unpaid tax for each month (or part of a month) the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax balance at a rate of 0.5% per month until the balance is paid in full.

Vermont Income Tax Credits and Deductions

Vermont offers a range of tax credits and deductions to ease the tax burden on residents and encourage specific behaviors or investments. These incentives are designed to promote economic growth, support education, and provide assistance to low- and middle-income families.

Education and Child Care Credits

The state of Vermont recognizes the importance of education and offers several tax credits to support it. The Vermont Education Tax Credit allows taxpayers to claim a credit for certain educational expenses, including tuition, fees, and books for eligible educational institutions within the state. This credit can significantly reduce the tax liability for families investing in their children’s education.

Additionally, Vermont provides a Child and Dependent Care Credit, which helps taxpayers offset the costs of childcare. This credit is designed to encourage workforce participation by making childcare more affordable, and it's particularly beneficial for single parents and low-income families.

Energy and Environmental Incentives

Vermont is at the forefront of promoting renewable energy and environmental sustainability. As such, the state offers tax credits for homeowners and businesses that invest in energy-efficient improvements and renewable energy systems. The Residential Energy Efficiency Property Tax Credit, for instance, provides a credit for the cost of installing energy-efficient windows, insulation, and other qualifying improvements.

Similarly, the Residential Renewable Energy Systems Tax Credit incentivizes the installation of solar panels, wind turbines, and other renewable energy systems. These credits not only benefit the environment but also help taxpayers reduce their energy costs over time.

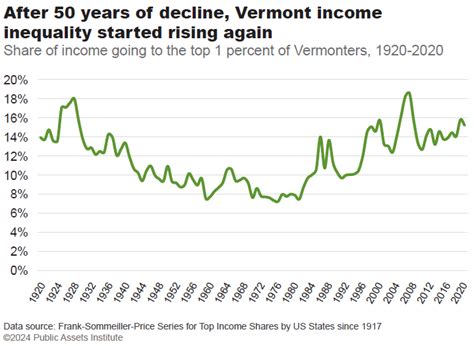

Low-Income Tax Relief

Vermont is committed to providing tax relief to low- and moderate-income taxpayers. The Vermont Low-Income Taxpayer Credit is designed to offset the impact of state taxes on those with limited financial means. This credit is based on the taxpayer’s income and can provide a substantial reduction in their tax liability.

Conclusion

Understanding the Vermont Income Tax system is crucial for individuals and businesses operating within the state. From the progressive tax rates to the array of tax credits and deductions, Vermont’s approach to taxation reflects its commitment to social welfare, environmental sustainability, and economic growth. By staying informed about the state’s tax policies and utilizing the available incentives, taxpayers can optimize their financial strategies and contribute to Vermont’s thriving economy.

Frequently Asked Questions

How do I calculate my Vermont state income tax?

+To calculate your Vermont state income tax, you first need to determine your taxable income after applying all applicable deductions and exemptions. Then, refer to the tax brackets and rates provided by the Vermont Department of Taxes for the current tax year. Apply the corresponding tax rate to each bracket of your income and sum them up to get your total tax liability.

Are there any tax breaks for first-time homebuyers in Vermont?

+Yes, Vermont offers a First-Time Homebuyer Tax Credit to encourage homeownership. This credit provides a one-time credit of up to $5,000 for eligible first-time homebuyers. To qualify, you must be a Vermont resident, purchase a primary residence in the state, and meet certain income and purchase price requirements.

What happens if I don’t file my Vermont income tax return on time?

+Failing to file your Vermont income tax return by the deadline can result in penalties and interest charges. The state imposes a late filing penalty of 5% of the unpaid tax for each month (or part of a month) the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax balance at a rate of 0.5% per month until the balance is paid in full.