St Charles County Property Tax

St. Charles County, located in the vibrant state of Missouri, is a bustling community known for its thriving businesses, vibrant culture, and, of course, its property tax system. The property tax landscape in St. Charles County is an intricate one, with various factors influencing the rates and assessments. Understanding this system is crucial for both residents and investors alike, as it impacts their financial planning and decision-making processes.

The Intricacies of St. Charles County Property Tax

St. Charles County’s property tax structure is a complex mechanism designed to fund essential public services and infrastructure. It plays a pivotal role in shaping the county’s fiscal health and the overall well-being of its residents. The tax rates and assessments are determined by a combination of state laws, local ordinances, and the specific characteristics of each property.

How Property Taxes are Calculated

The process of calculating property taxes in St. Charles County involves several key steps. First, the county’s assessor’s office determines the assessed value of each property. This value is derived from a combination of market trends, recent sales data, and the property’s physical attributes. Once the assessed value is established, it is then multiplied by the tax rate, which is set annually by the county’s governing body.

The tax rate is expressed as a percentage and varies depending on the type of property and its location within the county. For instance, residential properties might have a different tax rate compared to commercial or agricultural lands. Additionally, the tax rate can also differ between school districts, as these districts often rely on property taxes for their funding.

| Property Type | Average Assessed Value | Tax Rate (%) |

|---|---|---|

| Residential | $250,000 | 1.10 |

| Commercial | $500,000 | 1.30 |

| Agricultural | $150,000 | 0.90 |

To illustrate, consider a hypothetical residential property with an assessed value of $250,000. If the tax rate for that area is 1.10%, the annual property tax bill would amount to $2,750 ($250,000 x 0.0110). This calculation provides a clear picture of the financial obligations property owners face within St. Charles County.

Factors Influencing Property Tax Assessments

Several factors come into play when assessing property values in St. Charles County. These include:

- Market Conditions: The local real estate market plays a significant role in determining property values. Factors like supply and demand, economic trends, and the overall health of the housing market influence assessed values.

- Property Improvements: Any additions or improvements made to a property, such as renovations, new structures, or landscaping enhancements, can increase its assessed value. These improvements are taken into account during the assessment process.

- Location: The location of a property within the county can significantly impact its value. Proximity to schools, parks, commercial hubs, and other amenities often affects the property's desirability and, consequently, its assessed value.

- Age and Condition: Older properties may require more maintenance and repairs, which can impact their value. Additionally, the overall condition of a property, including any structural issues or deferred maintenance, can affect its assessed value.

Appealing Property Tax Assessments

Property owners in St. Charles County have the right to appeal their tax assessments if they believe the assessed value is inaccurate or unfair. The appeal process typically involves:

- Reviewing the assessment notice and identifying any discrepancies or errors.

- Gathering supporting evidence, such as recent sales data of similar properties or expert opinions on the property's value.

- Submitting a formal appeal to the county's assessor's office within the designated timeframe.

- Attending a hearing, if necessary, to present the appeal and supporting evidence.

- Awaiting the decision, which may result in a revised assessment or a confirmation of the original assessment.

It's important to note that appealing a property tax assessment requires careful preparation and a thorough understanding of the process. Engaging the services of a professional tax consultant or attorney can be beneficial to navigate this process effectively.

Impact on Local Economy and Community

The property tax system in St. Charles County has a profound impact on the local economy and community. Property taxes are a significant source of revenue for the county, funding vital services such as education, public safety, infrastructure development, and social programs.

Additionally, the property tax system encourages responsible property ownership and maintenance. It incentivizes homeowners to invest in their properties, which not only improves their personal living spaces but also enhances the overall aesthetic and value of the community. This, in turn, attracts new residents and businesses, fostering economic growth and development.

A Comprehensive Guide to St. Charles County Property Tax

Understanding the intricacies of St. Charles County’s property tax system is essential for anyone considering purchasing or investing in property within the county. By familiarizing themselves with the assessment process, tax rates, and appeal procedures, property owners can make informed decisions and effectively manage their financial obligations.

Furthermore, staying engaged with local government initiatives and attending public meetings can provide valuable insights into the county's fiscal policies and future plans. This level of involvement ensures that property owners have a say in the decision-making processes that directly impact their financial well-being.

Conclusion

In conclusion, the property tax system in St. Charles County is a vital component of the local economy and community. It funds essential services, influences property values, and shapes the overall fiscal landscape. By navigating this system effectively, property owners can ensure they are fairly assessed and actively contribute to the vibrant and thriving community of St. Charles County.

How often are property tax assessments conducted in St. Charles County?

+Property tax assessments in St. Charles County are typically conducted on a biennial basis, meaning they occur every two years. However, certain circumstances, such as significant property improvements or changes in ownership, may trigger a reassessment outside of the regular cycle.

What happens if I disagree with my property tax assessment?

+If you believe your property tax assessment is inaccurate or unfair, you have the right to appeal. The appeal process involves submitting a formal request to the assessor’s office, providing supporting evidence, and potentially attending a hearing. It’s advisable to consult a professional for guidance through this process.

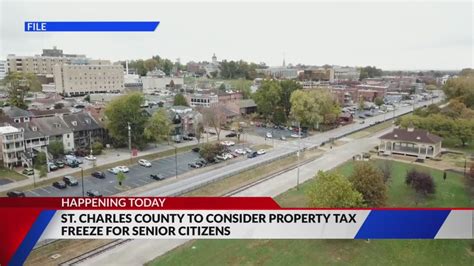

Are there any property tax exemptions or reductions available in St. Charles County?

+Yes, St. Charles County offers various property tax exemptions and reductions to eligible property owners. These may include homestead exemptions for primary residences, senior citizen discounts, and exemptions for certain types of properties, such as agricultural lands or historic buildings. It’s recommended to consult the county’s assessor’s office or a tax professional to determine your eligibility.