Oregon Tax Forms

For individuals and businesses residing in the beautiful state of Oregon, understanding and navigating the world of taxes is an essential part of financial management. The Oregon Tax Forms, though seemingly straightforward, play a crucial role in ensuring compliance with state tax regulations and facilitating timely revenue collection for the state's operations. In this comprehensive guide, we will delve into the intricacies of Oregon's tax system, exploring the various forms, their purpose, and the key considerations for accurate filing.

Understanding Oregon’s Tax Landscape

Oregon, with its diverse economy and vibrant communities, has a unique tax structure that supports its residents and businesses. The state’s tax system is designed to promote fairness, encourage economic growth, and provide essential services to its citizens. Let’s unravel the complexities of Oregon’s tax landscape, beginning with the fundamentals.

The Oregon Department of Revenue: A Brief Overview

The Oregon Department of Revenue (ODOR) is the governing body responsible for administering and enforcing the state’s tax laws. Their primary objective is to ensure that all taxable entities, including individuals, businesses, and organizations, meet their tax obligations accurately and timely. The ODOR provides a range of resources and support to taxpayers, making the tax filing process as seamless as possible.

The department's website, https://www.oregon.gov/dor/Pages/default.aspx, serves as a comprehensive hub for all tax-related information. Here, taxpayers can find forms, instructions, publications, and various tools to assist with tax preparation. The ODOR also offers a dedicated helpline and live chat support for taxpayers who require additional assistance.

Taxable Entities in Oregon

Oregon’s tax system encompasses a wide range of taxable entities, each with its own set of responsibilities and obligations. These entities include:

- Individuals: Oregon residents and non-residents with income sourced from the state must file individual income tax returns. This includes wages, salaries, business income, investments, and other forms of taxable income.

- Businesses: All businesses operating in Oregon, regardless of size or structure, are subject to state taxes. This includes corporations, partnerships, sole proprietorships, and LLCs. Business taxes can range from income taxes to specific industry-related taxes, such as excise taxes for certain industries.

- Non-Profit Organizations: Non-profit entities, such as charities and religious organizations, are also required to file tax returns. While they may be exempt from certain taxes, they must still comply with reporting requirements and pay applicable taxes on any unrelated business income.

- Trusts and Estates: Trustees and executors of estates with taxable income in Oregon must file appropriate tax returns. This includes reporting income, gains, and losses from trust assets and estate properties.

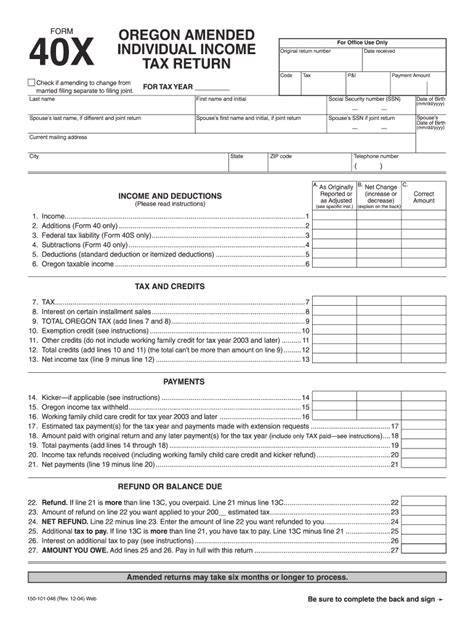

Key Oregon Tax Forms and Their Significance

Oregon utilizes a variety of tax forms to collect information and calculate the appropriate tax liabilities for different taxable entities. Here, we’ll explore some of the most common forms and their specific purposes.

Individual Income Tax Forms

Form OR-40: This is the primary income tax form for individuals in Oregon. It is used to report personal income, including wages, salaries, interest, dividends, capital gains, and other taxable sources. The form calculates the tax liability based on the taxpayer’s filing status, exemptions, and deductions.

Form OR-40N: This is a simplified version of the OR-40, designed for taxpayers with limited income and no dependents. It offers a more streamlined filing process for those who meet the eligibility criteria.

Form OR-40S: The OR-40S is intended for taxpayers who are 62 years of age or older and meet certain income and filing status requirements. It provides a simplified filing process with reduced tax rates for eligible seniors.

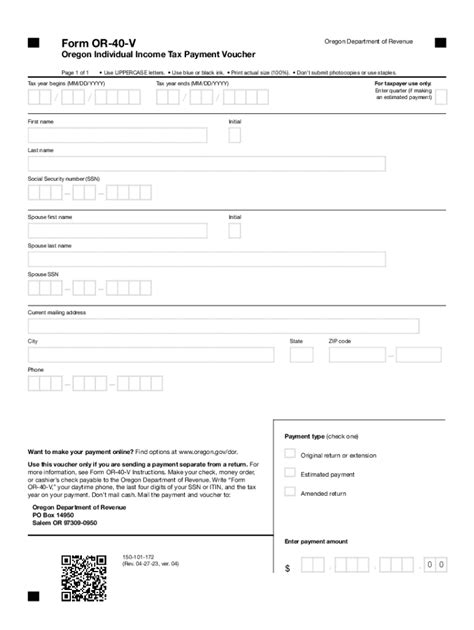

Form OR-40-V: This form is used to make payments for estimated taxes or to accompany tax returns when a full payment is not included. It is an essential tool for taxpayers to ensure they meet their tax obligations throughout the year.

| Form | Purpose |

|---|---|

| OR-40 | Primary income tax form for individuals |

| OR-40N | Simplified form for taxpayers with limited income |

| OR-40S | Form for seniors 62 years or older with specific income and filing status |

| OR-40-V | Payment voucher for estimated taxes or accompanying tax returns |

Business Tax Forms

Form OR-20: This form is used by corporations, S-corporations, and limited liability companies (LLCs) to report business income and calculate their corporate excise tax liability. It includes sections for reporting business income, deductions, and credits.

Form OR-20S: Similar to the OR-20, this form is designed for S-corporations. It simplifies the reporting process for these entities by allowing them to file a single return for both federal and state purposes.

Form OR-20-V: Just like the OR-40-V, this form is used by businesses to make payments for estimated taxes or to accompany their tax returns when a full payment is not included.

| Form | Purpose |

|---|---|

| OR-20 | Corporate excise tax form for corporations and LLCs |

| OR-20S | S-corporation tax form, combining federal and state reporting |

| OR-20-V | Payment voucher for business estimated taxes or accompanying tax returns |

Other Relevant Forms

Form OR-E: This form is specifically for entities with excise tax obligations. Excise taxes are levied on certain goods and services, such as tobacco, alcohol, and fuel. The OR-E form calculates the excise tax liability for these entities.

Form OR-6120: Used by non-profit organizations to report their unrelated business income. This form ensures that non-profits comply with their tax obligations on any income generated from activities unrelated to their charitable or educational purposes.

Form OR-6140: This form is for fiduciaries, such as trustees or executors, to report and pay taxes on behalf of estates or trusts. It includes sections for reporting income, gains, and losses from trust assets and estate properties.

| Form | Purpose |

|---|---|

| OR-E | Excise tax form for entities with excise tax obligations |

| OR-6120 | Unrelated business income tax form for non-profit organizations |

| OR-6140 | Income tax form for fiduciaries of estates and trusts |

Tax Filing and Payment Deadlines

Understanding the tax filing and payment deadlines is crucial to avoid penalties and ensure compliance with Oregon’s tax laws. Here are some key deadlines to keep in mind:

- Individual Income Tax Returns: The deadline for filing individual income tax returns in Oregon is typically April 15th of each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. It's important to note that extensions are available for those who cannot file by the deadline, but interest and penalties may apply.

- Business Tax Returns: For businesses, the filing deadline depends on the entity type. For example, corporations and LLCs typically have a deadline of April 15th, while S-corporations have a deadline of March 15th. It's crucial to refer to the specific instructions for each form to ensure timely filing.

- Estimated Tax Payments: Oregon requires taxpayers to make estimated tax payments throughout the year if their tax liability exceeds a certain threshold. The deadlines for estimated tax payments are typically April 15th, June 15th, September 15th, and January 15th of the following year. Failure to make these payments on time can result in penalties.

Online Filing and Payment Options

To streamline the tax filing process and offer convenience to taxpayers, Oregon provides online filing and payment options. The ODOR’s website offers a secure portal where taxpayers can register, file their returns, and make payments online. This option is not only efficient but also ensures that taxpayers receive their refunds promptly.

Benefits of Online Filing

- Accuracy: Online filing platforms often include built-in error checks and calculators, reducing the chances of errors and ensuring more accurate tax returns.

- Speed: Taxpayers can file their returns quickly and conveniently from the comfort of their homes or offices, eliminating the need for physical visits to tax offices.

- Record Keeping: Online filing systems often provide a secure platform to store and access previous tax returns, making it easier to retrieve past information and supporting documents.

Online Payment Options

Oregon taxpayers have various online payment options, including:

- Credit Cards: Taxpayers can use major credit cards to make online payments. However, it’s important to note that credit card processors may charge a fee for this service.

- Electronic Funds Transfer (EFT): This method allows taxpayers to transfer funds directly from their bank accounts to the ODOR’s account. It’s a secure and convenient way to make payments without incurring additional fees.

- Payment Plans: For taxpayers who cannot afford to pay their tax liabilities in full, the ODOR offers payment plans. These plans allow taxpayers to pay their taxes in installments over a specified period.

Resources and Support for Taxpayers

The Oregon Department of Revenue understands that taxes can be complex, and they offer a range of resources and support to assist taxpayers. Here are some key resources to explore:

Tax Publications and Guides

The ODOR provides an extensive library of publications and guides on their website. These resources cover a wide range of tax topics, including individual and business taxes, excise taxes, and estate and trust taxes. Taxpayers can download these publications for free and use them as references throughout the tax filing process.

Taxpayer Assistance

For taxpayers who require additional support, the ODOR offers a dedicated helpline and live chat service. Taxpayers can call or chat with a tax professional who can provide guidance and answers to specific tax-related questions. The ODOR also hosts tax clinics and workshops throughout the state, providing in-person assistance to taxpayers.

Taxpayer Education

To promote tax awareness and compliance, the ODOR actively engages in taxpayer education initiatives. They offer seminars and webinars on various tax topics, helping taxpayers understand their obligations and rights. Additionally, the ODOR maintains an active social media presence, providing regular updates and tips to keep taxpayers informed.

Future Outlook and Potential Changes

The tax landscape in Oregon, like in any state, is subject to change and evolution. As economic conditions shift and new policies are introduced, the tax system may undergo modifications to adapt to these changes. Here are some potential future developments to keep an eye on:

- Tax Reform Initiatives: The Oregon legislature and the ODOR continuously evaluate the state's tax system to ensure fairness and effectiveness. Tax reform initiatives may propose changes to tax rates, deductions, or credits to align with the state's economic goals.

- Digital Tax Services: With the increasing adoption of digital technologies, the ODOR may explore ways to enhance their online tax services. This could include the development of mobile apps, improved user interfaces, and additional features to make the tax filing process even more efficient and accessible.

- International Tax Considerations: As Oregon's economy becomes more interconnected with global markets, the state may need to address international tax considerations. This could involve changes to tax treaties or the introduction of new regulations to ensure compliance with international tax standards.

Conclusion

Navigating Oregon’s tax system can be a complex journey, but with the right knowledge and resources, taxpayers can ensure compliance and take advantage of the state’s tax benefits. The Oregon Department of Revenue’s commitment to providing comprehensive support and guidance makes the tax filing process more manageable. By staying informed and utilizing the available resources, individuals and businesses can meet their tax obligations with confidence.

What is the penalty for late tax filing in Oregon?

+Late tax filing in Oregon can result in penalties and interest charges. The penalty for late filing is typically 5% of the unpaid tax for each month (or part of a month) the return is late, up to a maximum of 25%. Additionally, interest is charged on the unpaid tax amount at a rate of 0.5% per month, compounded daily. It’s important to note that penalties and interest can quickly add up, so it’s best to file on time or request an extension if needed.

Can I file my Oregon tax return online for free?

+Yes, Oregon offers free online filing through its website. Taxpayers can register and file their individual or business tax returns online without any additional charges. This option provides a convenient and secure way to file taxes and receive refunds promptly.

Are there any tax credits or deductions available for Oregon residents?

+Oregon offers a variety of tax credits and deductions to help reduce tax liabilities. These include credits for low-income individuals, property tax relief for homeowners, education credits, and credits for certain business expenses. It’s important to review the specific eligibility criteria and requirements for each credit to determine if you qualify.