Understanding the New York Tax Status: A Comprehensive Guide for Residents

When navigating the labyrinth of fiscal obligations and civic responsibilities in one of the nation’s most dynamic cities, understanding New York State's tax status becomes paramount for residents. With complex legislation, frequent updates, and nuanced distinctions between local and state-level taxes, many residents find themselves entangled in confusion. This comprehensive guide aims to unravel the myth-busting truths about New York's tax system, empowering residents with clear, evidence-based insights rooted in expert analysis.

Decoding New York Tax Status: Myths and Realities

For many, the phrase “New York tax” conjures images of daunting paperwork, exorbitant bills, or worse—misunderstanding. Several misconceptions persist, skewing residents’ perceptions of their obligations and rights. The prevalent myth is that New York State’s taxes are uniformly high across the board, a belief that oversimplifies the complex tax landscape. In reality, the tax burden varies significantly based on income level, residency status, and specific local jurisdictions.

Common Misconception 1: All New Yorkers Are Subject to Same Income Tax Rates

It’s a widespread misconception that every resident pays a flat income tax rate in New York. However, New York employs a progressive income tax structure with multiple brackets—ranging from 4% for lower-income earners to 10.9% for the highest brackets. This tiered system, coupled with deductions and credits, means tax liability can differ substantially among residents based on income and filing status. For instance, a single filer earning $50,000 faces a markedly lower rate than a multimillionaire in the highest bracket.

Debunking the Myth of Uniform Taxation

Furthermore, local taxes contribute significantly to the overall tax burden. New York City, for example, imposes its own income taxes, which can reach an additional 3.876%, layered atop state rates. Other jurisdictions, such as Westchester or Nassau County, levy local property and income taxes, influencing the overall tax environment. This decentralization defies the myth of uniform taxation and underscores the importance of understanding local tax laws.

| Tax Category | Average Tax Rate or Impact |

|---|---|

| State Income Tax | 4% to 10.9% depending on income bracket |

| New York City Income Tax | 2.907% to 3.876% (additional to state rate) |

| Property Tax | Varies; median effective rate approximately 1.6% |

| Sales Tax | 7% combined (state + local) |

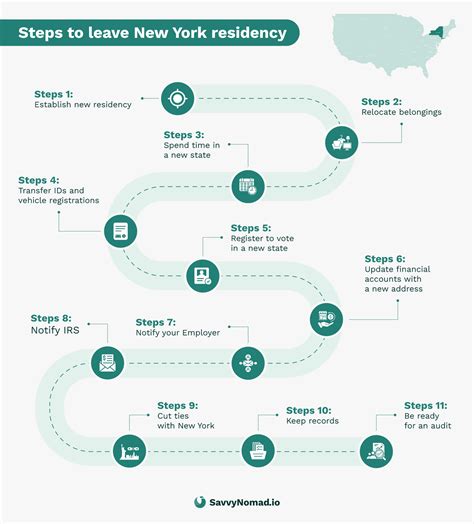

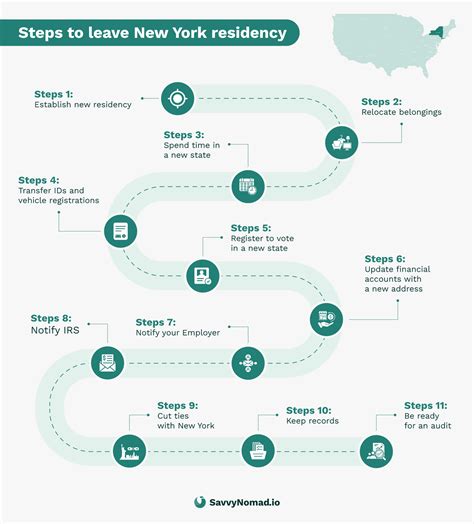

Legal Residency and Its Impact on Tax Liability

Another myth centers around the idea that all residents, by virtue of living in New York, are taxed equally. In truth, the definition of residency plays a crucial role. Legal resident status for tax purposes hinges on where an individual’s primary domicile is located, which influences tax obligations.

Residency Rules Explored

For example, someone living in New York City but maintaining a domicile elsewhere—say, in New Jersey—may only be liable for certain taxes, depending on their time spent and ties to the state. Conversely, part-year residents are taxed only on income earned within New York State during their period of residency. This distinction mitigates the myth that all residents face identical tax burdens and highlights the importance of individual circumstances.

| Residency Status | Tax Implication |

|---|---|

| Full-Year Resident | Taxed on all income worldwide |

| Part-Year Resident | Taxed on income during residency period |

| Non-Resident | Taxed only on income derived from New York sources |

Impact of Federal Tax Policies on State and Local Taxes

It’s tempting to see federal policies as separate from state-level taxation. Many believe that New York’s taxes are independently set, ignoring the interplay with federal regulations that influence allowable deductions, credits, and overall tax strategy. This myth oversimplifies the interdependent nature of tax systems.

Federal Deduction Limitations and State Tax Planning

Recent federal tax reforms, notably the Tax Cuts and Jobs Act of 2017, introduced caps on state and local tax (SALT) deductions—limiting individuals to a maximum of $10,000. For New York residents with high property taxes and income, this change significantly affects their after-tax income and decision-making regarding property ownership or income reporting strategies.

| Federal Policy Effect | Impact on NY Tax Planning |

|---|---|

| SALT deduction increased to $10,000 cap | Limits on deductibility reduce overall itemized deductions for high-tax areas |

| Standard deduction doubled | May influence decision to itemize or take standard deduction |

Tax Filing Requirements and Strategic Considerations

Misconceptions extend into the realm of filing obligations. It’s often presumed that only high-income earners are required to file. However, New York’s thresholds for filing are quite broad, encompassing lower-income brackets that might not realize they have filing duties.

Thresholds and Credits

For the 2023 tax year, the filing threshold for single filers under age 65 is $15,000 gross income, but any amount above that triggers filing obligations if the individual qualifies for refunds, credits, or additional taxes owed. Credits such as the Earned Income Tax Credit (EITC) or the Child and Dependent Care Credit can significantly offset liabilities or even result in refunds, making awareness of these credits crucial for all eligible residents.

| Filing Thresholds | Implications |

|---|---|

| Single under 65: $15,000 gross income | Requirement to file returns; access to credits |

| New York City residents | Additional local filing requirements |

| Part-year residents | Pro-rated income reporting |

Conclusion: Making Informed Decisions in a Complex Environment

Dispelling myths about New York tax status reveals a systemrich in nuance, interdependence, and strategic opportunities. Residents who understand the layered structure of state and local taxes, the intricacies of residency and income sourcing, and the influence of federal policies possess a competitive edge in planning their financial future. This knowledge not only safeguards compliance but also opens avenues for tax optimization and wealth preservation.