College Tax Form

Completing tax forms as a college student can be a complex process, especially with the numerous deductions, credits, and exemptions available. The College Tax Form, a specialized tax document tailored for students, plays a crucial role in helping them navigate the tax system efficiently. This article aims to provide an in-depth guide to understanding and utilizing the College Tax Form effectively, covering its purpose, benefits, and the essential steps involved in the process.

The College Tax Form: A Comprehensive Guide

The College Tax Form is a dedicated tax document designed to simplify the tax filing process for students. It encompasses various tax benefits and incentives aimed at supporting students’ financial well-being and academic pursuits. By understanding the intricacies of this form and leveraging its advantages, students can optimize their tax obligations and potentially maximize their refunds.

Understanding the Purpose and Benefits

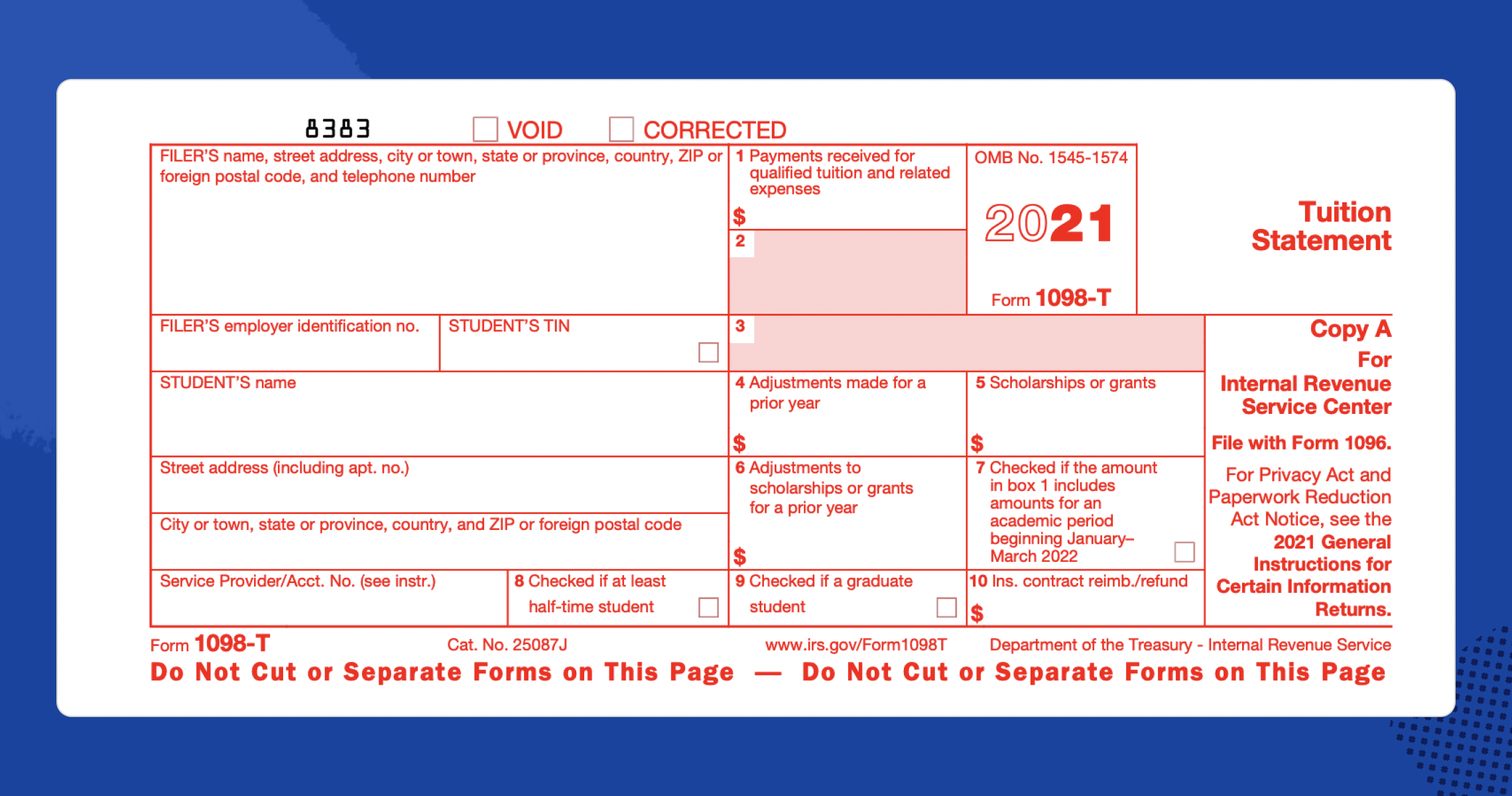

The primary purpose of the College Tax Form is to provide a streamlined approach for students to claim tax benefits specifically tailored for their circumstances. These benefits can include deductions for educational expenses, credits for tuition fees, and exemptions for certain scholarships or grants. By utilizing this form, students can ensure they are taking full advantage of the tax system to support their educational journey.

One of the key benefits of the College Tax Form is its focus on simplifying the process. Students often face unique financial situations, with a combination of part-time jobs, scholarships, and educational expenses. This form helps to navigate these complexities, providing a clear framework for declaring income, expenses, and applicable tax benefits.

Eligibility and Requirements

To be eligible for the College Tax Form, students must meet specific criteria set by the tax authority. Generally, students pursuing a degree or certificate at an accredited educational institution are eligible. The form typically requires basic personal information, such as name, address, and social security number, along with details of the student’s educational status and expenses.

Additionally, students must provide accurate records of their educational expenses, including tuition fees, books, supplies, and any other qualified expenses. It's essential to keep detailed records throughout the academic year to ensure an accurate and complete tax filing.

| Eligibility Criteria | Requirements |

|---|---|

| Accredited Educational Institution | Provide enrollment verification or proof of attendance. |

| Student Status | Submit a copy of the student ID or other official documentation. |

| Educational Expenses | Maintain detailed records of tuition fees, books, supplies, and other eligible expenses. |

Step-by-Step Guide to Completing the Form

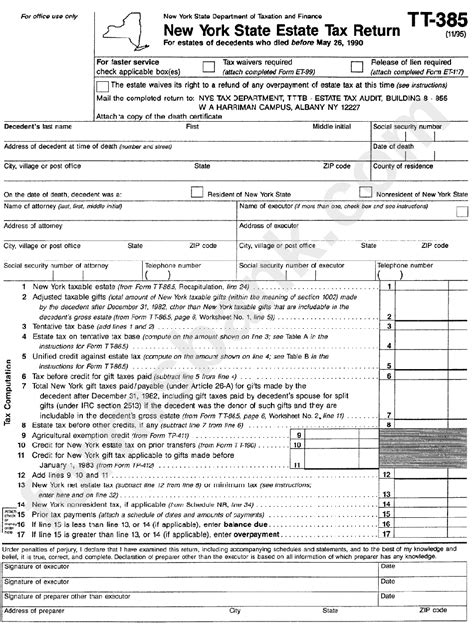

- Gather Necessary Documents: Before starting the form, ensure you have all the required documents. This includes enrollment verification, records of educational expenses, and any relevant financial documents.

- Access the Form: The College Tax Form is typically available online through the official tax authority’s website. You can also obtain a physical copy from the institution’s financial aid office or tax preparation services.

- Personal Information: Start by filling in your personal details accurately. Ensure you provide the correct name, address, and social security number to avoid any processing delays.

- Educational Status: Declare your student status and provide details about the educational institution you are attending. This information is crucial for determining your eligibility for tax benefits.

- Income and Expenses: Carefully record your income, including wages from part-time jobs, scholarships, and any other sources. Additionally, list all eligible educational expenses, such as tuition fees, books, and supplies.

- Calculating Tax Benefits: The College Tax Form will guide you through the process of calculating your tax benefits. This includes deductions, credits, and exemptions specific to your student status and expenses.

- Review and Submit: Once you have completed the form, thoroughly review it for accuracy. Ensure all calculations are correct and that you have attached any required supporting documents. Submit the form through the designated channel, whether online or by mail.

Maximizing Your Tax Benefits

The College Tax Form offers a range of tax benefits, and understanding how to maximize these advantages can significantly impact your financial situation. Here are some strategies to consider:

- Tuition and Fees Deduction: Students can deduct qualified education expenses, including tuition and fees, from their taxable income. Ensure you claim this deduction to reduce your tax liability.

- American Opportunity Tax Credit (AOTC): The AOTC provides a credit of up to $2,500 per eligible student for qualified tuition and related expenses. This credit can be claimed for up to four years of post-secondary education.

- Lifetime Learning Credit: This credit allows students and their families to claim a credit of up to $2,000 for qualified education expenses. It can be claimed for an unlimited number of years and is particularly beneficial for part-time students.

- Scholarship and Grant Exemption: Scholarships and grants used for tuition and related expenses are generally exempt from taxation. Ensure you declare these correctly to avoid any potential tax liabilities.

Seeking Professional Advice

The tax system can be complex, and it’s essential to seek professional advice when needed. Consider consulting a tax professional or utilizing tax preparation services to ensure accurate and optimal tax filing. They can provide personalized guidance based on your specific circumstances and help you navigate any unique situations.

Conclusion

The College Tax Form is a valuable tool for students to navigate the tax system efficiently and maximize their financial benefits. By understanding its purpose, eligibility, and the step-by-step process, students can ensure a smooth tax filing experience. Remember to keep detailed records, explore all available tax benefits, and seek professional advice when necessary. With proper utilization of the College Tax Form, students can focus on their academic pursuits with financial peace of mind.

Can international students use the College Tax Form?

+Yes, international students attending accredited institutions in the country are generally eligible to use the College Tax Form. However, they may have additional requirements or need to meet specific visa conditions. It’s recommended to consult a tax professional for accurate guidance.

How long does it take to process the College Tax Form?

+The processing time for the College Tax Form can vary depending on several factors, including the complexity of the form, the accuracy of the information provided, and the volume of tax returns being processed. Typically, it takes several weeks to receive a refund or notice of processing.

Can I file the College Tax Form electronically?

+Yes, the College Tax Form can often be filed electronically through the official tax authority’s website. Electronic filing is generally faster and more efficient, and it reduces the risk of errors. However, some situations may require a physical copy to be mailed.