Michigan Real Estate Tax Calculator

Michigan's real estate market is an intriguing landscape, offering a diverse range of opportunities for investors, homeowners, and businesses alike. Navigating this market effectively requires an understanding of the various taxes associated with real estate transactions and ownership. This article aims to delve into the intricacies of Michigan's real estate tax system, providing a comprehensive guide for those looking to make informed decisions.

Unraveling Michigan’s Real Estate Tax Structure

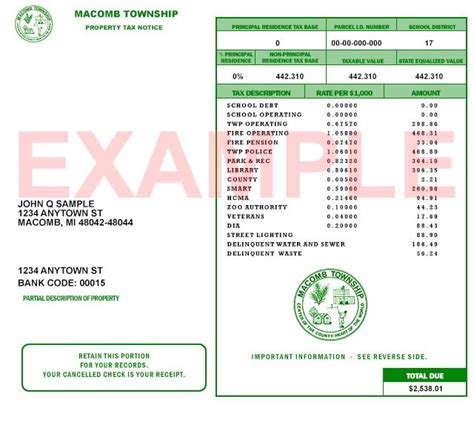

The state of Michigan imposes property taxes on all real estate, including residential, commercial, and industrial properties. These taxes are primarily used to fund local government services such as schools, police and fire departments, road maintenance, and more. Understanding how these taxes are calculated and the factors that influence them is essential for any real estate investor or homeowner.

Assessing Property Values

The foundation of Michigan’s real estate tax system lies in the assessment of property values. Each year, the local government assesses the market value of all properties within its jurisdiction. This value, known as the “assessed value,” is then used as the basis for calculating property taxes. However, Michigan employs a unique “State Equalized Value” (SEV) system, which is typically 50% of the property’s market value. This SEV is then multiplied by the applicable millage rate to determine the property tax liability.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 40% of Market Value |

| Commercial/Industrial | 58% of Market Value |

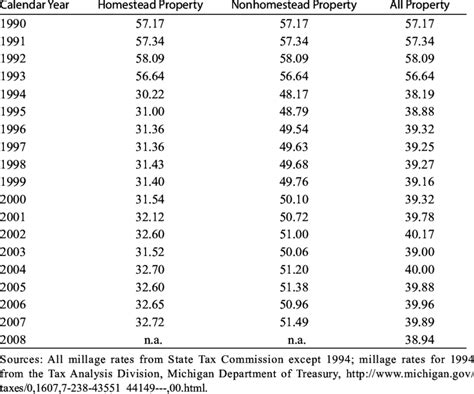

Understanding Millage Rates

A crucial component of Michigan’s real estate tax equation is the “millage rate.” This rate, expressed in mills, represents the tax rate per dollar of assessed value. One mill is equivalent to 1 of tax for every 1,000 of assessed value. Millage rates are determined by local taxing authorities, including school districts, counties, cities, townships, and special assessment districts. These rates can vary significantly from one jurisdiction to another, influencing the overall property tax burden.

| Taxing Authority | Average Millage Rate |

|---|---|

| County | 10 mills |

| School District | 20 mills |

| City/Township | 5 mills |

Calculating Real Estate Taxes

To calculate the real estate taxes owed on a property in Michigan, the following formula is used:

Taxes = (Assessed Value x State Equalized Value Ratio) x Millage Rate

For instance, consider a residential property with an assessed value of $200,000 and a millage rate of 15 mills. The calculation would be as follows:

Taxes = ($200,000 x 0.4) x 0.015 = $1,200

Thus, the property owner would owe $1,200 in real estate taxes for that year.

Factors Influencing Real Estate Taxes in Michigan

Several factors can impact the real estate tax burden in Michigan. These factors include the property’s location, its use, and any applicable exemptions or deductions.

Property Location

Michigan’s real estate tax system is decentralized, with taxes primarily levied at the local level. This means that property taxes can vary significantly from one municipality to another. Factors such as the cost of living, the local economy, and the availability of services can influence the millage rates set by local governments. As a result, properties in different cities or townships within Michigan may face vastly different tax liabilities.

Property Use

As mentioned earlier, Michigan differentiates between residential, commercial, and industrial properties when it comes to assessment ratios. This means that a commercial property with the same market value as a residential property will typically have a higher assessed value and, consequently, a higher tax liability. Additionally, special assessment districts may impose additional taxes on specific properties, such as those with waterfront access or located within a designated business district.

Exemptions and Deductions

Michigan offers several exemptions and deductions that can reduce the tax burden for certain property owners. These include homestead exemptions, which provide a tax credit for owner-occupied residential properties, and the Principal Residence Exemption (PRE), which exempts primary residences from certain local taxes. Additionally, veterans, seniors, and those with disabilities may be eligible for specific tax relief programs.

Real-World Examples of Michigan’s Real Estate Tax Calculator

Let’s explore a few real-world scenarios to illustrate how Michigan’s real estate tax calculator works in practice.

Scenario 1: Residential Property in Detroit

Consider a single-family home in Detroit with an assessed value of $150,000. The average millage rate for Detroit is approximately 25 mills. Using the formula mentioned earlier, we can calculate the annual real estate taxes as follows:

Taxes = ($150,000 x 0.4) x 0.025 = $1,500

Therefore, the homeowner in this scenario would owe $1,500 in real estate taxes for the year.

Scenario 2: Commercial Property in Grand Rapids

Now, let’s look at a commercial office building in Grand Rapids with an assessed value of $500,000. The average millage rate for commercial properties in Grand Rapids is around 30 mills. The calculation for this property’s real estate taxes would be:

Taxes = ($500,000 x 0.58) x 0.03 = $8,820

As a result, the owner of this commercial property would owe $8,820 in real estate taxes annually.

Scenario 3: Industrial Property with Special Assessment

Imagine an industrial warehouse located in a special assessment district in Flint. The assessed value of the property is $300,000, and the average millage rate is 20 mills. However, due to the special assessment, an additional 5 mills is added to the millage rate. The calculation for this property’s real estate taxes is as follows:

Taxes = ($300,000 x 0.58) x (0.02 + 0.005) = $3,480

In this scenario, the industrial property owner would be responsible for $3,480 in real estate taxes, including the special assessment.

Conclusion: Navigating Michigan’s Real Estate Tax Landscape

Michigan’s real estate tax system, while complex, is designed to fund essential local services and maintain the state’s infrastructure. By understanding the assessment process, millage rates, and the factors influencing tax liabilities, property owners and investors can make informed decisions. The real estate tax calculator, as illustrated through the scenarios above, provides a valuable tool for estimating tax obligations and planning financial strategies.

Key Takeaways

- Michigan’s real estate tax system relies on assessed values and millage rates set by local authorities.

- Assessment ratios differ based on property type, with residential properties taxed at a lower rate.

- Millage rates can vary significantly between municipalities, impacting overall tax liability.

- Exemptions and deductions, such as the homestead and Principal Residence Exemptions, can reduce tax burdens for eligible property owners.

- Special assessment districts may impose additional taxes on certain properties.

How often are property values assessed in Michigan?

+Property values are typically assessed annually by local government assessors. However, major improvements or renovations to a property may trigger a reassessment outside of the regular assessment cycle.

Can property owners appeal their assessed value or tax liability?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The appeal process typically involves submitting evidence to support the claim and may require a hearing before the local Board of Review.

Are there any tax incentives for renewable energy installations on real estate properties in Michigan?

+Yes, Michigan offers tax incentives for the installation of renewable energy systems, such as solar panels or wind turbines, on real estate properties. These incentives can include property tax abatements or exemptions, making renewable energy more financially attractive for property owners.