Mn Property Tax

Minnesota's property tax system is a crucial aspect of the state's revenue generation and plays a significant role in funding local services and infrastructure. Understanding how property taxes work in Minnesota is essential for homeowners, investors, and anyone interested in the state's real estate market. This comprehensive guide will delve into the intricacies of Minnesota property taxes, covering everything from assessment processes to tax rates and relief options.

Understanding Minnesota’s Property Tax System

Property taxes in Minnesota are primarily used to fund local governments, including counties, cities, townships, and school districts. These taxes are levied on real estate properties, including land and improvements such as buildings and structures. The state’s property tax system is designed to ensure that each property owner contributes their fair share based on the value of their property.

Property Tax Assessment

The process of assessing property values is a critical step in determining property taxes. In Minnesota, the County Assessor’s Office is responsible for this task. Assessors conduct regular property inspections and use various methods to estimate the market value of each property. These methods include sales comparison, cost approach, and income approach.

The sales comparison approach compares the property with similar properties that have recently sold in the area. The cost approach estimates the cost of replacing the property, while the income approach is more common for income-generating properties like rental units.

| Assessment Method | Description |

|---|---|

| Sales Comparison | Comparing property to recent sales of similar properties. |

| Cost Approach | Estimating replacement cost minus depreciation. |

| Income Approach | Analyzing potential income from the property. |

Once the assessor determines the market value, they apply a class rate to calculate the property's assessed value. Minnesota uses a classification system to group properties based on their use, such as residential, commercial, or agricultural. Each class has a specific rate that is applied to the market value to determine the assessed value, which is then used for tax calculations.

Property Tax Rates and Calculations

Property tax rates in Minnesota vary depending on the location and the specific taxing authority. Each county, city, township, and school district sets its own tax rate, known as the tax levy. These rates are expressed as a percentage of the property’s assessed value and are used to fund various local services and projects.

To calculate the property tax, the assessed value is multiplied by the applicable tax rate for each taxing authority. For instance, if a property has an assessed value of 200,000 and is located in a county with a tax rate of 1.5%, the annual property tax would be 3,000.

| Taxing Authority | Tax Rate (%) |

|---|---|

| County | 1.5% |

| City | 1.2% |

| School District | 2.0% |

In the example above, the total property tax would be $6,700 ($3,000 + $2,400 + $1,300), assuming the property is located in the given county, city, and school district.

Tax Bill Payment and Deadlines

Property owners in Minnesota typically receive their tax bills twice a year. The first installment is due in the spring, and the second is due in the fall. Late payments may incur penalties and interest charges. It’s crucial to stay informed about payment due dates to avoid any financial penalties.

Property Tax Relief Programs in Minnesota

Minnesota offers several programs aimed at providing property tax relief to eligible homeowners. These programs can help reduce the financial burden of property taxes, especially for low- to moderate-income individuals and families.

Homestead Tax Credit

The Homestead Tax Credit is a state-funded program that provides a direct reduction in property taxes for eligible homeowners. To qualify, the property must be the owner’s primary residence, and their household income must meet certain thresholds. The credit amount varies based on income and can significantly reduce the overall tax burden.

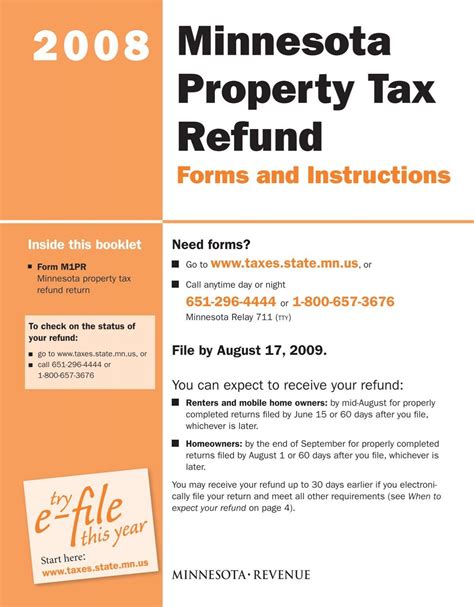

Property Tax Refund

The Property Tax Refund program offers a refund to eligible homeowners based on their household income and property taxes paid. This program is designed to ensure that property taxes remain affordable, especially for seniors and individuals with disabilities. The refund amount is determined by a formula that considers income, property value, and the total property taxes paid.

Property Tax Deferral Program

For homeowners who are 65 or older, disabled, or surviving spouses of military veterans, the Property Tax Deferral Program provides an option to defer their property taxes. This program allows eligible individuals to postpone paying their property taxes until they sell the property or no longer occupy it as their primary residence. The deferred taxes accumulate with interest, but the program ensures that property owners are not forced to sell their homes due to tax burdens.

Appealing Property Tax Assessments

If a homeowner believes their property’s assessed value is incorrect, they have the right to appeal the assessment. The process involves submitting an appeal to the County Assessor’s Office, typically within a specified timeframe after the assessment notice is received. The assessor will review the appeal and may adjust the assessment if warranted.

Steps to Appeal

- Review the assessment notice and identify any discrepancies or errors.

- Gather supporting evidence, such as recent sales of similar properties or professional appraisals.

- Submit a formal appeal to the County Assessor’s Office, including a detailed explanation and supporting documentation.

- Attend a hearing or provide additional information as requested by the assessor.

- If the appeal is unsuccessful, homeowners can further pursue the matter through the Minnesota Department of Revenue’s Property Tax Division.

The Impact of Property Taxes on Minnesota’s Real Estate Market

Property taxes in Minnesota can significantly influence the real estate market. For buyers, understanding the potential tax burden is crucial when considering a property purchase. High property taxes can affect a property’s overall affordability and may impact its resale value.

Factors Influencing Property Taxes

- Location: Property taxes can vary widely across Minnesota, with urban areas often having higher rates than rural areas.

- Property Value: As property values increase, so do the assessed values, leading to higher property taxes.

- Local Services: The level of services and infrastructure provided by a locality can impact tax rates, as these services need funding.

Strategies for Managing Property Taxes

Homeowners and investors can employ various strategies to manage property taxes effectively:

- Homestead Status: Applying for homestead status provides significant tax benefits, including reduced tax rates and eligibility for tax relief programs.

- Tax Deductions: Take advantage of federal and state tax deductions for property taxes, especially if you itemize your deductions.

- Appeals and Assessments: Regularly review your property’s assessment and consider appealing if you believe it’s overvalued.

- Tax Relief Programs: Research and apply for relevant tax relief programs to reduce your overall tax burden.

Conclusion

Understanding Minnesota’s property tax system is vital for anyone involved in the state’s real estate market. From assessment processes to tax rates and relief options, this guide has provided a comprehensive overview. By staying informed about property taxes, homeowners and investors can make more informed decisions and effectively manage their financial obligations.

FAQ

What is the average property tax rate in Minnesota?

+

The average effective property tax rate in Minnesota is approximately 1.19% as of 2023, but it can vary significantly by location.

How often are property taxes assessed in Minnesota?

+

Property assessments in Minnesota are conducted every year, with the assessed values used to calculate property taxes.

Are there any tax breaks or exemptions for certain types of properties in Minnesota?

+

Yes, Minnesota offers various tax breaks and exemptions, including the Homestead Credit, which provides tax relief for primary residences, and the Property Tax Deferral Program for eligible seniors and disabled individuals.

Can I appeal my property’s assessed value in Minnesota?

+

Absolutely. If you believe your property’s assessed value is incorrect, you can appeal the assessment to the County Assessor’s Office. The appeal process involves providing evidence and justifying your claim.