Nys Estate Tax

Welcome to a comprehensive guide on the New York State Estate Tax, a critical aspect of estate planning for many individuals and families in the Empire State. With its unique thresholds and exemptions, understanding this tax is essential to ensure a smooth and efficient transfer of wealth. This article will delve into the intricacies of the NYS Estate Tax, providing a detailed analysis of its components, recent changes, and potential strategies to navigate this complex landscape.

Unraveling the Complexity: An Overview of the NYS Estate Tax

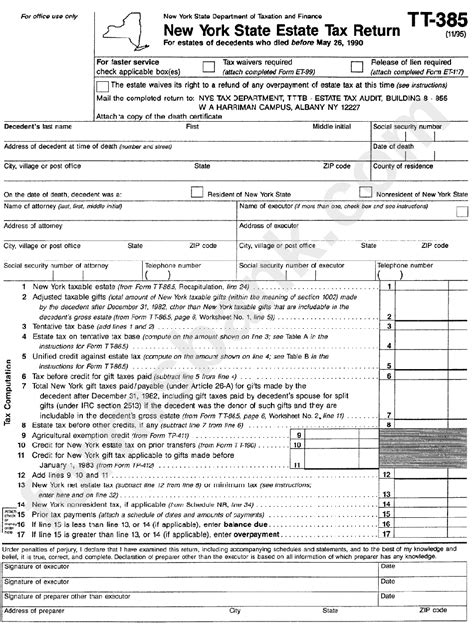

The New York State Estate Tax, often referred to as the NYS Estate Tax, is a levy imposed on the transfer of a decedent’s taxable estate. It is distinct from the federal estate tax and is administered by the New York State Department of Taxation and Finance. This tax is designed to capture a portion of the value of an individual’s estate, ensuring that the state benefits from the transfer of wealth.

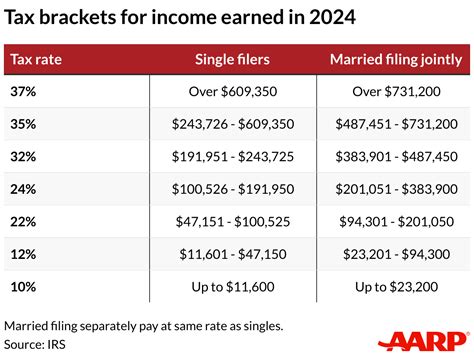

The NYS Estate Tax is a progressive tax, meaning that the tax rate increases as the value of the estate grows. This structure aims to ensure that those with larger estates contribute a greater share. The tax is calculated based on the value of the estate, taking into account various deductions and exemptions, which we will explore in detail.

Key Features and Recent Developments

Over the years, the NYS Estate Tax has undergone several significant changes. As of the 2023 tax year, the state has adopted a unique approach, offering a full exemption for estates valued at $5.9 million or less, mirroring the federal estate tax exemption. This exemption is particularly beneficial for many New York residents, as it shields a substantial portion of estates from taxation.

For estates exceeding the exemption amount, the NYS Estate Tax applies a graduated tax rate, starting at 3.06% and rising to 16% for estates valued at $10,000,000 or more. This progressive rate structure ensures that larger estates contribute a higher proportion of their value to the state.

| Estate Value | Tax Rate |

|---|---|

| $5.9 million or less | 0% |

| $5.9 million to $10 million | 3.06% to 16% |

| $10 million or more | 16% |

One notable feature of the NYS Estate Tax is its portability. Spouses can elect to transfer any unused portion of the deceased spouse's exemption to the surviving spouse, effectively doubling the exemption amount for married couples. This portability provision allows for more efficient estate planning and can significantly reduce the overall tax liability.

Navigating the Exemptions and Deductions

Understanding the exemptions and deductions available under the NYS Estate Tax is crucial for effective estate planning. These provisions can significantly reduce the taxable value of an estate, thereby minimizing the tax liability.

Exemptions: Shielding Assets from Taxation

The primary exemption under the NYS Estate Tax is the $5.9 million exemption, which applies to estates valued at this amount or less. This exemption, as mentioned earlier, is a significant benefit for many New York residents, as it allows for the transfer of a substantial portion of wealth without incurring state estate taxes.

Additionally, the NYS Estate Tax allows for certain specific exemptions, which can further reduce the taxable value of an estate. These exemptions include:

- Family-owned farms and small businesses: Certain assets related to family-owned farms and small businesses may be eligible for an exemption, ensuring that these vital economic entities are protected.

- Qualified charitable contributions: Donations made to qualified charitable organizations may be exempt from the estate tax, encouraging philanthropy and supporting community causes.

- Life insurance proceeds: Proceeds from life insurance policies may be exempt, provided certain conditions are met. This exemption can provide significant relief for estates with substantial life insurance policies.

Deductions: Reducing the Taxable Estate

In addition to exemptions, the NYS Estate Tax allows for various deductions, which can further reduce the taxable value of an estate. These deductions include:

- Debts and mortgages: Outstanding debts, including mortgages, can be deducted from the taxable estate, as these obligations are not considered part of the transfer of wealth.

- Funeral and administrative expenses: The costs associated with the funeral and the administration of the estate, such as attorney fees and court costs, are deductible.

- Certain taxes and losses: Some taxes, such as real estate taxes and losses incurred during the settlement of the estate, may be deductible, reducing the overall taxable value.

Strategies for Minimizing NYS Estate Tax Liability

Given the complexity of the NYS Estate Tax, it is essential to employ effective strategies to minimize tax liability. These strategies can help individuals and families preserve more of their wealth for future generations.

Maximizing Exemptions and Deductions

One of the most straightforward strategies is to fully utilize the available exemptions and deductions. By carefully planning and structuring one’s estate, it is possible to reduce the taxable value significantly. For instance, making charitable contributions or ensuring proper documentation of debts and expenses can lead to substantial tax savings.

Gifting and Transferring Assets

Another effective strategy is to gift assets during one’s lifetime. By transferring assets to heirs or beneficiaries before death, individuals can reduce the value of their taxable estate. New York allows for annual gift tax exclusions, which can be used to transfer assets tax-free. Additionally, the use of trusts can provide flexibility and control over the distribution of assets.

Consider the case of Mr. Johnson, a successful entrepreneur with a substantial estate. By establishing a trust and transferring a portion of his assets into it, he was able to reduce his taxable estate and ensure a smooth transfer of wealth to his heirs. This strategy not only minimized tax liability but also provided peace of mind, knowing that his affairs were in order.

Life Insurance and Retirement Accounts

Life insurance policies and retirement accounts, such as IRAs and 401(k)s, can be powerful tools for minimizing NYS Estate Tax liability. By naming beneficiaries other than the estate, these assets bypass the probate process and are not included in the taxable estate. This strategy can provide significant tax savings, especially for individuals with substantial life insurance policies or retirement savings.

The Future of NYS Estate Tax

As with any tax system, the future of the NYS Estate Tax is subject to change. While the current exemption and rate structure provide a significant benefit to many New York residents, future legislative changes could impact the tax landscape. It is essential for individuals and estate planners to stay informed about potential developments and adjust their strategies accordingly.

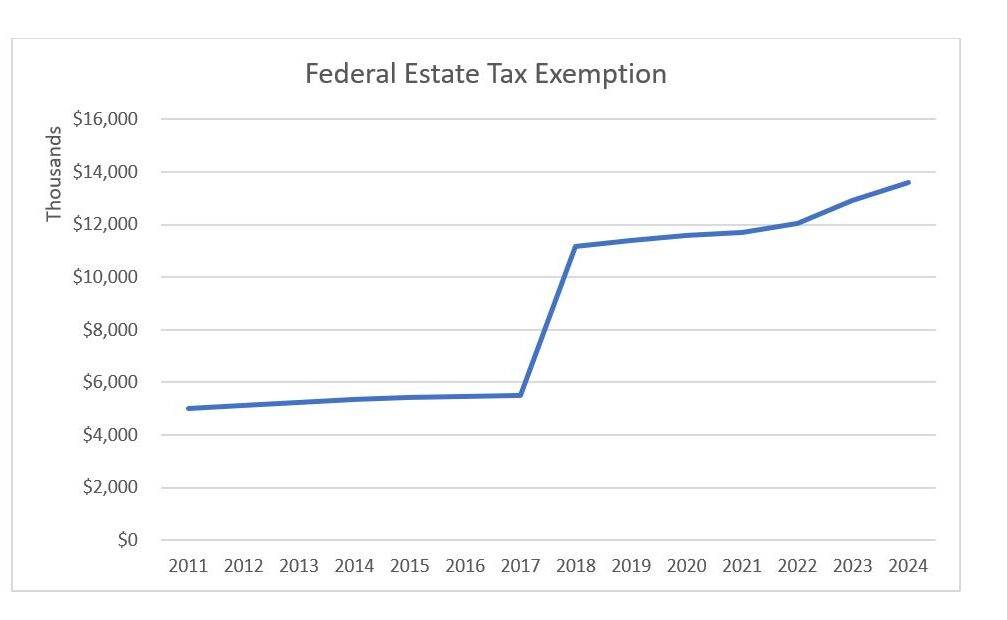

One potential future implication is the possibility of federal and state tax reforms. If the federal estate tax exemption were to change, it could have a cascading effect on the NYS Estate Tax. Additionally, changes in state tax policies or economic conditions could lead to adjustments in the tax rates or exemptions.

To navigate these potential changes, it is crucial to work with experienced estate planning professionals who can provide up-to-date information and tailored strategies. By staying informed and proactive, individuals can ensure that their estate plans remain effective and aligned with the evolving tax landscape.

Conclusion: A Comprehensive Approach to Estate Planning

The NYS Estate Tax is a critical component of estate planning for many New Yorkers. By understanding the intricacies of this tax, individuals can make informed decisions to minimize their tax liability and ensure a smooth transfer of wealth. From maximizing exemptions and deductions to employing strategic gifting and asset transfers, there are numerous tools available to navigate this complex landscape.

As you embark on your estate planning journey, remember that each estate is unique. It is essential to seek professional advice and tailor your strategies to your specific circumstances. With careful planning and a comprehensive approach, you can ensure that your legacy is protected and your wishes are honored.

What is the current NYS Estate Tax exemption amount for 2023?

+The current NYS Estate Tax exemption for the 2023 tax year is 5.9 million. This means that estates valued at 5.9 million or less are exempt from the state estate tax.

Are there any changes expected to the NYS Estate Tax in the near future?

+While there are no immediate changes announced, the NYS Estate Tax, like any tax system, is subject to potential reforms. It is advisable to stay updated with any legislative developments to ensure your estate plan remains current.

How can I maximize the benefits of the NYS Estate Tax exemptions and deductions?

+To maximize the benefits, it is crucial to work with an experienced estate planning professional who can guide you through the process. They can help you understand the available exemptions and deductions and tailor a strategy that aligns with your specific goals and circumstances.