When Is The Tax Deadline For 2025

Tax deadlines are a crucial aspect of financial management, and understanding the timeline for filing taxes is essential for individuals and businesses alike. The Internal Revenue Service (IRS) sets specific dates for taxpayers to submit their tax returns and make any necessary payments. This article will delve into the tax deadline for the year 2025, providing a comprehensive overview of the key dates, potential extensions, and any notable changes or considerations.

Understanding the 2025 Tax Deadline

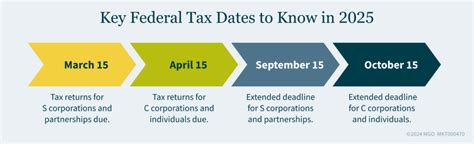

The tax deadline for the year 2025 will fall on April 15th, as is customary for most tax years. This date marks the final day for taxpayers to file their federal income tax returns and pay any outstanding tax liabilities for the previous year, which in this case, would be the 2024 tax year.

It's important to note that while April 15th is the standard deadline, there are certain circumstances and exceptions that can influence the actual due date. These factors include holidays, weekends, and specific state-level considerations.

Holidays and Weekend Adjustments

In the event that April 15th falls on a Saturday, Sunday, or a recognized federal holiday, the tax deadline is typically extended to the next business day. For example, if April 15th, 2025, happens to be a Saturday, the deadline would shift to the following Monday, ensuring taxpayers have ample time to meet their obligations.

However, it's crucial to stay updated on any potential adjustments, as the IRS may announce specific changes for particular years. These adjustments are often made to accommodate taxpayers and ensure a smooth filing process.

State-Specific Considerations

While the federal tax deadline is a unifying factor across the United States, individual states may have their own tax filing dates and requirements. Some states follow the federal deadline, while others may have slightly different timelines. It’s essential for taxpayers to be aware of their state’s specific rules to avoid any potential penalties or late fees.

For instance, certain states like California and New York have their own income tax systems and may have different due dates for state tax returns. Taxpayers residing in these states should consult their state's tax agency or a trusted tax professional to ensure compliance with both federal and state tax laws.

Extensions and Late Filing

In cases where taxpayers are unable to meet the standard tax deadline, the IRS provides the option of requesting an extension. Filing for an extension allows individuals and businesses to postpone the due date for filing their tax returns, providing them with additional time to gather necessary documents and complete their filings accurately.

To request an extension, taxpayers can use Form 4868, which is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form must be filed before the original due date to ensure compliance with IRS regulations. It's important to note that while an extension provides more time to file, it does not grant an extension for paying any taxes owed.

If a taxpayer fails to file their tax return by the extended deadline, they may face penalties and interest charges. The IRS assesses penalties based on the length of the delay and the amount of tax owed. Therefore, it's crucial to stay organized and plan ahead to avoid any unnecessary financial burdens.

Late Payment Penalties

In addition to late filing penalties, taxpayers who fail to pay their taxes by the due date may also incur late payment penalties. These penalties are calculated based on the amount of tax owed and the length of the delay. The IRS imposes a monthly rate, typically a percentage of the unpaid tax, until the full amount is paid.

To avoid late payment penalties, taxpayers should make estimated tax payments throughout the year, especially if they anticipate owing taxes. This helps to minimize the overall penalty amount and ensures a more manageable financial situation.

Tax Preparation and Planning

Preparing for tax season is a critical step in ensuring a smooth and stress-free process. Here are some key considerations and strategies for effective tax preparation and planning:

Gathering Necessary Documents

Taxpayers should begin by gathering all relevant financial documents, including W-2 forms, 1099 forms, statements from financial institutions, and any other records related to income, deductions, and credits. Having these documents organized and readily available can significantly streamline the filing process.

It's advisable to start collecting these documents early, as some may take time to arrive in the mail. Additionally, keeping digital copies or utilizing tax preparation software can make the process more efficient and secure.

Understanding Tax Laws and Changes

Tax laws and regulations can change from year to year, so it’s crucial to stay informed about any updates or modifications that may impact your tax situation. The IRS provides comprehensive resources and guidance on their website, including publications and FAQs, to help taxpayers navigate these changes.

Staying abreast of tax law changes can help individuals and businesses make informed decisions regarding deductions, credits, and other tax-related strategies. Consulting with a tax professional or utilizing reputable tax preparation software can also provide valuable insights and ensure compliance with the latest regulations.

Utilizing Tax Preparation Software

In today’s digital age, tax preparation software has become an invaluable tool for many taxpayers. These software programs offer a user-friendly interface, guiding users through the filing process step by step. They often include features such as data import, tax calculation, and error checking, making the entire process more efficient and accurate.

Tax preparation software can be especially beneficial for taxpayers with complex financial situations or those who prefer a more streamlined approach. However, it's important to choose a reputable and trusted software provider to ensure data security and accuracy.

Seeking Professional Assistance

For taxpayers with more intricate tax situations or those who prefer expert guidance, seeking the assistance of a tax professional can be highly beneficial. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), possess extensive knowledge and experience in navigating the complex world of taxation.

These professionals can provide personalized advice, help identify potential deductions and credits, and ensure compliance with tax laws. They can also assist with more complex tax scenarios, such as business taxation, estate planning, or international tax issues.

Working with a tax professional can provide taxpayers with peace of mind, knowing that their tax obligations are being handled accurately and efficiently. Additionally, tax professionals can offer valuable insights and strategies to optimize tax planning and minimize potential liabilities.

Conclusion

Understanding the tax deadline for 2025 is a crucial step in effective tax management. By staying informed about the key dates, potential extensions, and state-specific considerations, taxpayers can ensure timely compliance with their tax obligations. Additionally, proper tax preparation, planning, and seeking professional assistance when needed can contribute to a more seamless and successful tax filing experience.

As we approach the tax season of 2025, it's essential to remain proactive and organized. By staying on top of deadlines, gathering necessary documents, and seeking expert guidance when required, taxpayers can navigate the tax landscape with confidence and peace of mind.

Can I file my tax return before the deadline if I have all the necessary information?

+Absolutely! While the deadline is set for April 15th, you can file your tax return as soon as you have all the required information and documents. In fact, filing early can be beneficial as it reduces the risk of errors and ensures a quicker refund, if applicable.

What happens if I miss the tax deadline without requesting an extension?

+If you miss the tax deadline without a valid reason or an extension, you may be subject to penalties and interest charges. The IRS imposes late filing and late payment penalties, which can add up over time. It’s crucial to file your tax return as soon as possible to avoid these penalties.

Are there any online resources available to help with tax preparation and filing?

+Yes, the IRS provides a wealth of online resources to assist taxpayers. Their website, www.irs.gov, offers publications, tax forms, and interactive tools to guide you through the tax preparation process. Additionally, there are numerous tax preparation software options available that can simplify the filing process.