Illegal Immigrants Taxes

The topic of illegal immigrants and taxes is a complex and often controversial issue, with many misconceptions and misunderstandings surrounding it. This article aims to provide a comprehensive and informative analysis, shedding light on the realities and implications of illegal immigrants' tax contributions and responsibilities.

Understanding the Tax Landscape for Illegal Immigrants

Illegal immigrants, despite their legal status, often contribute significantly to the tax system and the economy. This section aims to explore the various aspects of their tax obligations and the impact they have on society.

Tax Contributions of Illegal Immigrants

Contrary to popular belief, illegal immigrants are not exempt from paying taxes. In fact, many undocumented individuals are actively contributing to the tax system through various channels. Here are some key insights:

- Payroll Taxes: Illegal immigrants who work in the informal sector, such as construction, agriculture, or domestic services, often pay payroll taxes, including Social Security and Medicare contributions. These taxes are typically deducted from their wages, regardless of their legal status.

- Income Taxes: Despite not having a valid Social Security Number (SSN), many undocumented workers file income tax returns using Individual Taxpayer Identification Numbers (ITINs). These ITINs allow them to pay federal and state income taxes, similar to legal residents and citizens.

- Sales and Property Taxes: Illegal immigrants, like any other residents, contribute to sales and property taxes when they make purchases or own property. These taxes are an integral part of local and state revenue streams.

| Tax Type | Contribution by Illegal Immigrants |

|---|---|

| Payroll Taxes | Estimated to contribute billions of dollars annually, supporting social safety net programs. |

| Income Taxes | ITIN filers paid over $11.7 billion in federal income taxes in 2020, with many also paying state income taxes. |

| Sales and Property Taxes | Illegal immigrants contribute to local economies, generating revenue for essential services and infrastructure. |

Challenges and Limitations

While illegal immigrants contribute to the tax system, they also face several challenges and limitations:

- Limited Access to Benefits: Despite paying taxes, undocumented workers are often ineligible for many government benefits and social services. This includes programs like Medicaid, food stamps, and unemployment benefits, which are funded by the taxes they pay.

- Fear of Deportation: The fear of deportation can deter illegal immigrants from claiming tax refunds or accessing government services. This fear often leads to underreporting of income and underutilization of tax credits and deductions.

- Tax Compliance: The complex tax system can be challenging for undocumented individuals to navigate. Lack of access to professional tax assistance and language barriers further complicate their tax compliance.

The Economic Impact and Policy Considerations

The tax contributions of illegal immigrants have significant economic implications. This section explores the broader impact and the policy considerations surrounding their tax status.

Economic Contributions

Illegal immigrants’ tax contributions are not only significant in terms of revenue but also have a ripple effect on the economy:

- Job Creation: Undocumented workers often fill critical gaps in the labor market, especially in sectors with high demand and low supply of domestic workers. Their contributions to industries like agriculture, construction, and hospitality create jobs and stimulate economic growth.

- Entrepreneurship: Many illegal immigrants are entrepreneurs, starting small businesses that contribute to local economies. These businesses generate revenue, create jobs, and foster innovation.

- Consumption and Investment: The spending power of illegal immigrants boosts local economies. Their consumption patterns, including housing, transportation, and retail, drive economic activity and support local businesses.

Policy and Legal Considerations

The tax contributions and economic impact of illegal immigrants raise important policy questions:

- Immigration Reform: Discussions around immigration reform often consider the economic benefits of integrating undocumented workers into the formal economy. Policies that provide pathways to legal status could increase tax compliance and further boost economic contributions.

- Tax Policy: The tax system can be a tool for promoting economic fairness. Exploring ways to ensure that illegal immigrants' tax contributions are fairly distributed and that they have access to the benefits their taxes fund could be a crucial aspect of tax policy reform.

- Social Safety Net: Considering the contributions of illegal immigrants to social safety net programs, there is a debate about whether they should have access to certain benefits, especially given their economic contributions and the services they utilize.

Real-World Examples and Case Studies

To illustrate the impact of illegal immigrants’ tax contributions, let’s examine some real-world examples and case studies:

State-Level Analysis

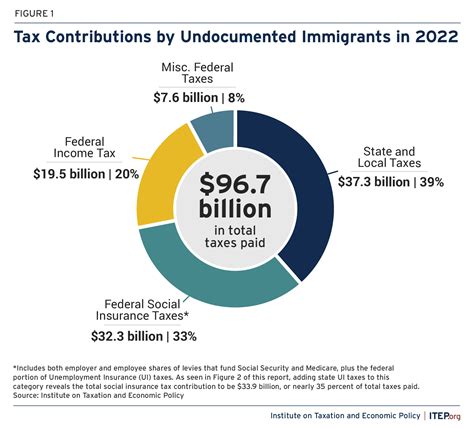

A study conducted by the Institute on Taxation and Economic Policy (ITEP) examined the tax contributions of undocumented immigrants at the state level. The findings revealed that in many states, illegal immigrants contribute significant amounts to state and local revenues:

- California: Undocumented immigrants paid an estimated $3.2 billion in state and local taxes in 2017, making up about 3.1% of the state's total tax revenue.

- Texas: In 2016, undocumented immigrants contributed over $1.6 billion in state and local taxes, accounting for 1.5% of the state's tax revenue.

- New York: Despite a smaller undocumented population, New York received an estimated $750 million in tax contributions from illegal immigrants in 2017.

Individual Stories

Beyond the statistics, there are countless individual stories of illegal immigrants who contribute to the tax system and the economy:

- Maria, an undocumented worker in the agriculture sector, has been paying payroll taxes for over a decade. Her contributions support her family and also fund social programs that benefit the broader community.

- Juan, an entrepreneur, started a small construction business. Despite facing challenges, he has successfully created jobs and contributed to the local economy through his business's tax payments.

Looking Ahead: Future Implications and Potential Solutions

The issue of illegal immigrants and taxes is complex and multifaceted. As we look to the future, there are several potential implications and solutions to consider:

Implications for Tax Policy

- Simplifying Tax Compliance: Efforts to simplify the tax system and provide accessible tax assistance could encourage greater tax compliance among undocumented workers.

- Exploring Tax Amnesty Programs: Implementing tax amnesty programs specifically targeted at illegal immigrants could provide a pathway for them to regularize their tax obligations and gain access to benefits.

Social and Economic Integration

- Pathways to Legal Status: Policies that offer legal status to eligible undocumented immigrants could lead to increased tax compliance and economic contributions.

- Education and Awareness: Educating the public about the economic contributions of illegal immigrants and the importance of their tax payments can help foster a more inclusive and supportive environment.

Conclusion

The tax landscape for illegal immigrants is complex and often overlooked. However, their contributions to the tax system and the economy are significant and deserve recognition. As we move forward, it is crucial to consider the potential benefits of integrating undocumented workers into the formal economy and ensuring that their tax contributions are fairly acknowledged and utilized.

How much do illegal immigrants contribute to the tax system annually?

+The exact contribution varies by year and region, but estimates suggest that illegal immigrants contribute billions of dollars annually to the tax system through payroll, income, and other taxes.

Can illegal immigrants receive tax refunds?

+Yes, illegal immigrants who file taxes using ITINs can receive tax refunds if they are eligible. However, they may face challenges in claiming these refunds due to fear of deportation or lack of awareness.

What are the economic benefits of integrating undocumented workers into the formal economy?

+Integrating undocumented workers into the formal economy can lead to increased tax compliance, job creation, economic growth, and a more stable and prosperous society. It also ensures that their tax contributions are fairly distributed and utilized for the benefit of all.