California Sales Tax Orange County

Understanding sales tax in California, and more specifically in Orange County, is crucial for businesses and consumers alike. This article aims to provide an in-depth exploration of California sales tax, with a particular focus on its intricacies within Orange County. By delving into the rates, regulations, and practical implications, we can navigate the complex world of sales taxation effectively.

The California Sales Tax Framework

California, the most populous state in the United States, boasts a robust economy with a diverse range of industries. The sales tax system in California is a vital component of the state’s revenue stream, contributing significantly to public services and infrastructure development.

Sales tax in California is a consumption tax levied on the sale of tangible personal property and certain services. It is collected by businesses and remitted to the state government. The tax rate is determined by a combination of state and local rates, resulting in varying rates across different regions.

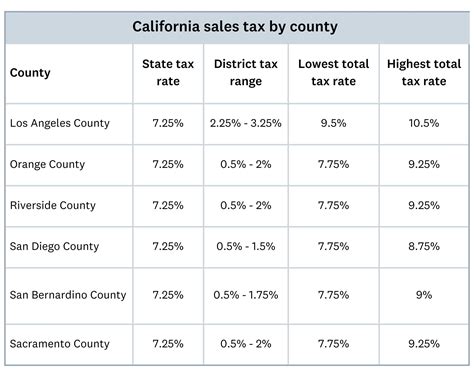

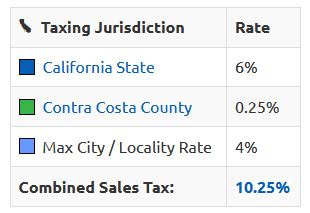

As of 2023, the statewide sales and use tax rate in California is 7.25%. This base rate is applicable across the state and serves as the foundation for the total tax rate. However, local governments have the authority to impose additional sales taxes, leading to variations in the overall tax burden.

Local Sales Tax Variations

California’s diverse local jurisdictions, including counties, cities, and special districts, have the autonomy to impose their own sales taxes. These additional taxes, often referred to as local option sales taxes, are levied on top of the state rate. The purpose of these local taxes is to fund specific projects or services within the community.

| County/City | Local Sales Tax Rate |

|---|---|

| Orange County | 1.25% |

| City of Anaheim | 1.00% |

| City of Santa Ana | 1.50% |

| Other Cities in Orange County | Varies (0.50% - 1.25%) |

As seen in the table, Orange County itself imposes an additional 1.25% sales tax, bringing the total sales tax rate within the county to 8.50%. However, it's important to note that specific cities within Orange County may have different local tax rates, as shown for Anaheim and Santa Ana.

Sales Tax in Orange County: A Closer Look

Orange County, located in Southern California, is renowned for its vibrant economy, sunny climate, and diverse business landscape. With a population exceeding 3 million, it is the third-most populous county in California. The county’s sales tax structure is a critical aspect of its fiscal framework, impacting both businesses and residents.

Key Industries and Sales Tax

Orange County’s economy is driven by a range of industries, including technology, healthcare, tourism, and manufacturing. Each of these sectors contributes to the county’s economic vitality and, subsequently, its sales tax revenue.

For instance, the technology sector, with its concentration of software and hardware companies, generates significant sales tax revenue from the sale of electronic equipment and software licenses. Similarly, the healthcare industry, with its numerous hospitals and medical centers, contributes through sales of medical devices and pharmaceuticals.

The tourism industry, a cornerstone of Orange County's economy, also plays a vital role. Attractions like Disneyland, Knott's Berry Farm, and the county's pristine beaches draw millions of visitors annually, leading to substantial sales tax revenue from hotel stays, restaurant meals, and retail purchases.

Retail and Sales Tax

Retail businesses in Orange County are at the forefront of sales tax collection. From shopping malls to boutique stores, these establishments are responsible for calculating and collecting the appropriate sales tax on each transaction. The sales tax rate, at 8.50% within the county, is included in the final price paid by consumers.

To ensure compliance, businesses utilize point-of-sale (POS) systems that automatically calculate the sales tax based on the customer's location. This integration simplifies the process for both the business and the customer, providing transparency in pricing.

Online Sales and Sales Tax

With the rise of e-commerce, online sales have become a significant portion of Orange County’s retail landscape. Online retailers, whether based in Orange County or selling to customers within the county, are subject to sales tax regulations.

To ensure compliance, online businesses use a process called sales tax nexus. This concept determines whether a business has a sufficient connection or presence in a state or county to be liable for collecting and remitting sales tax. In the case of Orange County, businesses with a physical presence or significant online sales to the county may be required to collect and remit the applicable sales tax.

Sales Tax Registration and Compliance

For businesses operating within Orange County, sales tax registration and compliance are essential aspects of their financial operations.

Registering for Sales Tax

Businesses selling taxable goods or services in Orange County are required to register with the California Department of Tax and Fee Administration (CDTFA). The registration process involves providing business information, including the business entity type, physical location, and the nature of the products or services sold.

Once registered, businesses receive a unique permit number, which is used for identifying the business in all tax-related transactions and communications with the CDTFA.

Sales Tax Compliance

Compliance with sales tax regulations is a continuous process. Businesses must collect the correct sales tax rate, based on the customer’s location, and remit the collected tax to the CDTFA on a regular basis. The frequency of these remittances can vary, with options including monthly, quarterly, or annually, depending on the business’s sales volume.

Additionally, businesses are required to maintain accurate records of sales transactions, including the tax collected, for a minimum of four years. These records are essential for tax audits and ensure the business's compliance with sales tax regulations.

Penalties and Audits

Failure to comply with sales tax regulations can result in penalties and interest charges. The CDTFA has the authority to conduct audits to ensure businesses are accurately collecting and remitting sales tax. Audits can be triggered by various factors, including significant changes in business operations, discrepancies in tax filings, or random selections.

During an audit, the CDTFA examines the business's sales records, tax returns, and other financial documents to verify compliance. If discrepancies are found, the business may be required to pay additional tax, penalties, and interest. Therefore, maintaining accurate records and ensuring compliance is crucial to avoid such consequences.

Sales Tax for Consumers

For consumers in Orange County, understanding sales tax is essential for making informed purchasing decisions. The sales tax rate, currently at 8.50%, is included in the final price of most goods and services, making it a significant component of the overall cost.

When making a purchase, consumers can expect to see the sales tax amount clearly displayed on their receipt. This transparency allows consumers to understand the breakdown of the total cost, ensuring they are aware of the tax burden associated with their purchase.

Sales Tax Exemptions

While most goods and services are subject to sales tax in Orange County, certain items are exempt. These exemptions can vary based on state and local regulations. Common examples of sales tax-exempt items include:

- Prescription medications

- Grocery staples (food and beverages)

- Certain medical devices

- Clothing and footwear (below a certain price threshold)

- Residential electricity and gas

It's important for consumers to be aware of these exemptions, as they can significantly impact the final cost of their purchases. Understanding which items are exempt can help consumers plan their spending more effectively.

Sales Tax on Large Purchases

For significant purchases, such as vehicles, real estate, or high-value electronics, the sales tax can become a substantial consideration. In these cases, the sales tax amount can be calculated based on the total purchase price and the applicable sales tax rate.

For example, when purchasing a new vehicle, the sales tax is calculated as a percentage of the vehicle's price. This amount is added to the base price, resulting in the final cost. Similarly, for real estate transactions, the sales tax is often included in the overall closing costs.

Future Implications and Potential Changes

The sales tax landscape in California, and specifically in Orange County, is subject to potential changes and evolving regulations. As the state and local governments aim to balance their budgets and meet the needs of their constituents, sales tax rates and regulations may undergo modifications.

Potential Rate Adjustments

Local governments in Orange County may propose changes to the local sales tax rate to address budgetary concerns or fund specific projects. While rate adjustments are relatively rare, they can significantly impact the total sales tax burden for businesses and consumers.

For instance, in 2020, several cities within Orange County considered increasing their local sales tax rates to fund infrastructure improvements and address revenue shortfalls caused by the COVID-19 pandemic. While these proposals did not materialize, they highlight the potential for future rate adjustments.

Simplification and Modernization

Efforts to simplify and modernize the sales tax system in California are ongoing. These initiatives aim to streamline tax collection, improve compliance, and enhance the overall efficiency of the system.

One such initiative is the Marketplace Fairness Act, which aims to establish a uniform sales tax system for online retailers. If enacted, this act would provide a standardized approach to sales tax collection for online businesses, reducing the complexity and potential for errors.

Conclusion

California sales tax, particularly within Orange County, is a dynamic and intricate system. With a combination of state and local rates, businesses and consumers must navigate a complex landscape to ensure compliance and understand the tax implications of their transactions.

As the economy continues to evolve, so too will the sales tax regulations. Staying informed and adapting to these changes is essential for businesses to maintain compliance and for consumers to make informed purchasing decisions. By understanding the sales tax framework, we can effectively navigate the financial landscape of Orange County and contribute to its thriving economy.

What is the current sales tax rate in Orange County, California?

+As of my last update in January 2023, the total sales tax rate in Orange County is 8.50%, which includes the state rate of 7.25% and the local rate of 1.25%.

Are there any cities in Orange County with different sales tax rates?

+Yes, some cities in Orange County have additional local sales tax rates. For example, the City of Anaheim has a 1.00% local rate, while the City of Santa Ana has a 1.50% local rate.

How do online businesses determine if they need to collect sales tax in Orange County?

+Online businesses determine their sales tax nexus by evaluating their physical presence or significant economic connections within Orange County. If they meet certain criteria, they are required to collect and remit sales tax.

What are the consequences of non-compliance with sales tax regulations in Orange County?

+Non-compliance with sales tax regulations can result in penalties, interest charges, and potential legal action. It is crucial for businesses to register, collect, and remit sales tax accurately to avoid these consequences.