Income Tax Rate For Oregon

Income taxes play a crucial role in shaping the financial landscape of any state, and Oregon is no exception. Understanding the income tax rate is essential for individuals and businesses alike, as it directly impacts their financial obligations and planning. In this comprehensive article, we delve into the specifics of Oregon's income tax rate, exploring its structure, rates, and implications for taxpayers.

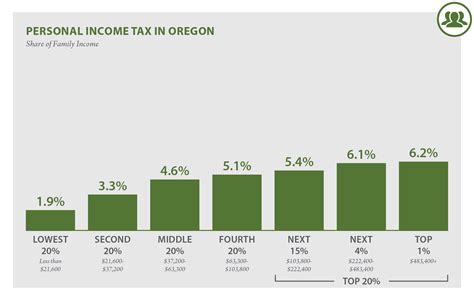

Oregon’s Progressive Income Tax System

Oregon operates on a progressive income tax system, which means that the tax rate increases as an individual’s or household’s income rises. This approach ensures that higher-income earners contribute a larger proportion of their income to the state’s revenue. Let’s break down the key aspects of Oregon’s income tax structure.

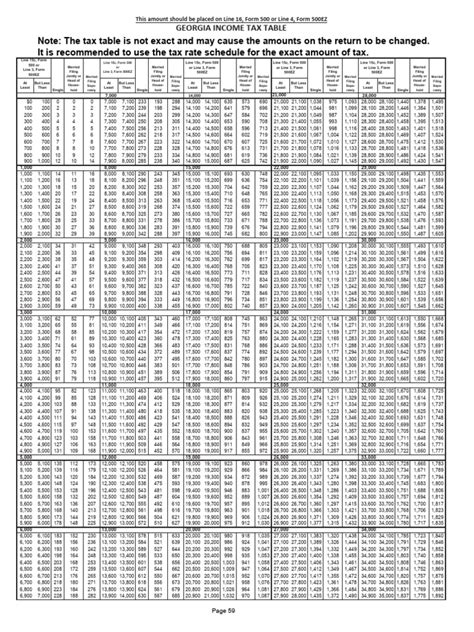

Tax Brackets and Rates

Oregon’s income tax brackets are divided into four categories, each with its own tax rate. As of the most recent tax year, these brackets and rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| Single Filers: Up to 4,000</td> <td>5%</td> </tr> <tr> <td>Single Filers: 4,001 - 8,000</td> <td>6%</td> </tr> <tr> <td>Single Filers: 8,001 - 10,000</td> <td>7%</td> </tr> <tr> <td>Single Filers: Over 10,000 | 9.9% |

| … | … |

| … | … |

| Joint Filers: Over $24,000 | 9.9% |

It's important to note that these tax brackets and rates are subject to periodic adjustments by the state government to account for inflation and other economic factors. Therefore, taxpayers should always refer to the most current tax guidelines for the most accurate information.

Taxable Income and Deductions

Oregon’s taxable income includes various sources such as wages, salaries, commissions, bonuses, and investment income. However, the state offers several deductions and credits to reduce the taxable income, thereby providing some relief to taxpayers. Common deductions include:

- Standard deduction (varies based on filing status)

- Itemized deductions for medical expenses, state and local taxes, charitable contributions, and certain other expenses

- Retirement plan contributions (e.g., IRA, 401(k))

- Education-related expenses (e.g., tuition and fees)

- Dependent care expenses

Additionally, Oregon provides tax credits for specific circumstances, such as the Low-Income Credit for individuals with limited income and the Child and Dependent Care Credit for those with childcare expenses.

Taxable Entities and Exemptions

Oregon’s income tax applies to individuals, trusts, estates, and corporations. However, certain entities and individuals may be exempt from income tax, such as certain types of trusts and charitable organizations. Additionally, Oregon offers a tax exemption for military pensions, providing a partial or full exemption for qualified military retirees.

Impact on Taxpayers

Oregon’s progressive income tax system has a significant impact on taxpayers’ financial obligations. For those with lower incomes, the lower tax brackets provide a relatively modest tax burden. However, as income rises, the higher tax rates can result in a substantial portion of income being allocated to taxes.

The state's income tax system encourages taxpayers to be mindful of their financial planning and tax strategies. By utilizing deductions and credits effectively, individuals and businesses can optimize their tax liabilities and potentially reduce their overall tax burden.

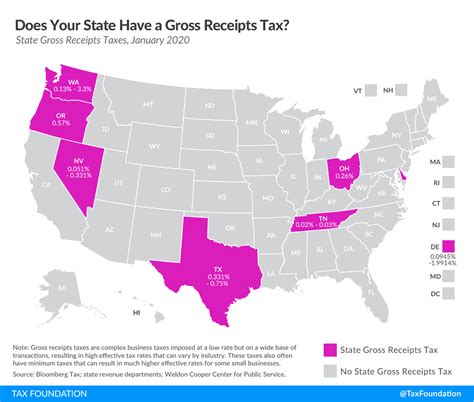

Comparison with Other States

Compared to other states, Oregon’s income tax rates are relatively competitive. While some states have lower flat tax rates, Oregon’s progressive system ensures that higher-income earners contribute a larger share. This approach aims to maintain a balanced and equitable tax structure.

Furthermore, Oregon's tax system offers certain advantages, such as the military pension exemption and various deductions, which can make it more attractive for specific taxpayer profiles.

Future Implications and Tax Planning

Oregon’s income tax rates and structure are subject to ongoing review and potential changes. As economic conditions evolve, the state may adjust tax brackets and rates to maintain a sustainable revenue stream. Taxpayers should stay informed about any proposed or enacted changes to ensure they can effectively plan their finances.

Effective tax planning is crucial for individuals and businesses in Oregon. By understanding the current tax rates, brackets, and available deductions, taxpayers can make informed decisions about their income, investments, and expenses. This proactive approach can lead to more efficient tax management and potentially reduce the overall tax liability.

Staying Informed and Seeking Professional Advice

Given the complexity of tax laws and the potential for frequent changes, it is essential for taxpayers to stay informed about Oregon’s income tax guidelines. The Oregon Department of Revenue provides up-to-date information and resources to help taxpayers navigate the tax system effectively.

For more complex tax situations or for those seeking personalized advice, consulting with a tax professional or certified public accountant (CPA) is highly recommended. These experts can provide tailored guidance and ensure compliance with Oregon's tax laws.

Conclusion

Oregon’s income tax rate is a critical aspect of the state’s financial framework, impacting individuals, businesses, and the overall economy. By understanding the progressive tax system, taxpayers can make informed decisions and effectively manage their financial obligations. As the state continues to adapt its tax policies, staying informed and proactive in tax planning becomes increasingly important.

For more information on Oregon's tax laws and resources, visit the Oregon Department of Revenue's website. Stay up-to-date, plan wisely, and ensure a smooth tax journey in the Beaver State.

What is the highest income tax rate in Oregon?

+As of the most recent tax year, the highest income tax rate in Oregon is 9.9% for single filers with income over 10,000 and joint filers with income over 24,000.

Are there any tax credits available in Oregon?

+Yes, Oregon offers various tax credits, including the Low-Income Credit and the Child and Dependent Care Credit. These credits provide relief for specific circumstances and can reduce taxable income.

How often are Oregon’s tax brackets and rates updated?

+Oregon’s tax brackets and rates are subject to periodic updates, typically to account for inflation and economic changes. It’s important to refer to the most current tax guidelines for accurate information.

Can I file my Oregon income tax return electronically?

+Yes, Oregon offers electronic filing options for individual and business taxpayers. The Oregon Department of Revenue provides resources and guidance for electronic filing, making it a convenient and efficient process.

Are there any tax exemptions for senior citizens in Oregon?

+Oregon does not offer specific tax exemptions based solely on age. However, certain tax credits and deductions may provide relief for senior citizens, such as the Low-Income Credit and the Senior and Disabled Homeowner Property Tax Deferral.