Los Angeles County Tax Rate

Los Angeles County, nestled in the heart of Southern California, is not only a cultural hub but also a complex administrative region when it comes to tax matters. Understanding the Los Angeles County tax rate is crucial for residents, businesses, and investors alike, as it directly impacts their financial obligations and planning.

Understanding the Los Angeles County Tax Landscape

The tax system in Los Angeles County is a multifaceted entity, comprising a range of taxes and rates that vary depending on the type of taxpayer and the specific location within the county. This complexity arises from a combination of state, county, and municipal tax policies, each with its own unique set of regulations and rates.

For instance, the property tax system, a cornerstone of local government revenue, operates under the California Constitution's Proposition 13, which limits property tax increases to a maximum of 2% annually unless there's a change in ownership. This proposition has had a significant impact on property tax rates across the state, including Los Angeles County.

Additionally, Los Angeles County imposes a sales and use tax, which is applied to the retail sale, lease, or rental of most goods, as well as the storage, use, or other consumption of tangible personal property in the county. This tax is collected by retailers and remitted to the state, which then distributes the revenue to the county and other local governments.

The county also levies a personal income tax on residents and businesses, with rates varying depending on income levels. This tax is a significant source of revenue for the county, funding various public services and infrastructure projects.

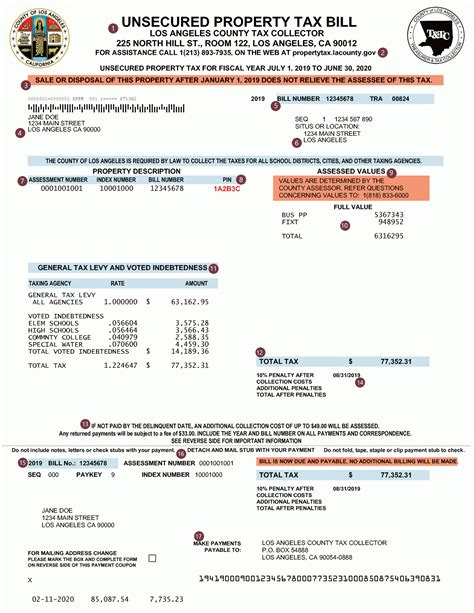

Breaking Down the Los Angeles County Property Tax Rate

Property taxes are a major component of the tax landscape in Los Angeles County. As per the provisions of Proposition 13, the maximum annual property tax rate is set at 1% of the property’s taxable value, with additional assessments allowed for certain purposes, such as the reimbursement of costs for special district services.

However, it's important to note that the effective property tax rate can vary significantly from this maximum rate. This is because the taxable value of a property can change due to factors like ownership changes, new construction, or improvements, and these changes can trigger reassessments.

For instance, if a homeowner makes significant improvements to their property, the assessed value could increase, leading to a higher property tax bill. On the other hand, during economic downturns, property values might decrease, resulting in lower property taxes.

Here's a breakdown of the property tax rates for a few select cities in Los Angeles County:

| City | Property Tax Rate |

|---|---|

| Los Angeles | 1.065% |

| Santa Monica | 1.114% |

| Glendale | 1.01% |

| Burbank | 1.01% |

These rates are calculated based on the assessed value of the property and the various tax rates and assessments applied by the county, city, and special districts.

Sales and Use Tax in Los Angeles County

Los Angeles County also imposes a sales and use tax, which is applied to the sale of goods and services within the county. As of [date of latest update], the sales and use tax rate in Los Angeles County is [current rate]%, which is comprised of the state base rate, county rate, and various city and district add-ons.

For instance, the city of Los Angeles has a sales tax rate of [LA sales tax rate]%, which includes the state base rate, county rate, and a city add-on. This rate can vary depending on the specific location within the city, as certain districts or areas might have additional tax assessments.

Here's a breakdown of the sales tax rates for a few select cities in Los Angeles County:

| City | Sales Tax Rate |

|---|---|

| Los Angeles | [LA sales tax rate]% |

| Long Beach | [Long Beach sales tax rate]% |

| Pasadena | [Pasadena sales tax rate]% |

| Glendale | [Glendale sales tax rate]% |

It's important to note that these rates are subject to change, and businesses operating in Los Angeles County should stay updated on the latest tax rates to ensure compliance.

Income Tax Rates for Los Angeles County Residents

Los Angeles County residents are subject to both state and federal income taxes. California has a progressive income tax system, with tax rates ranging from [lowest state income tax rate]% to [highest state income tax rate]%, depending on taxable income.

Additionally, Los Angeles County residents are subject to a local income tax, which is a portion of the state income tax allocated to the county. This local income tax rate is [LA county local income tax rate]% of the state income tax liability.

Here's a simplified breakdown of the combined state and local income tax rates for Los Angeles County residents, based on taxable income:

| Taxable Income | Combined State and Local Income Tax Rate |

|---|---|

| $0 - $9,652 | 1% |

| $9,653 - $27,497 | 2% |

| $27,498 - $54,996 | 4% |

| $54,997 - $90,549 | 6% |

| $90,550 - $228,233 | 8% |

| $228,234 - $354,698 | 9.3% |

| $354,699 and above | 11.3% |

These rates are subject to change, and it's important to consult the latest tax guidelines and consult with tax professionals for accurate and up-to-date information.

FAQ

¿Cómo se calcula el impuesto sobre la propiedad en el Condado de Los Ángeles?

+

El impuesto sobre la propiedad en el Condado de Los Ángeles se calcula en base al valor gravable de la propiedad, que está limitado al 1% según la Proposición 13. Sin embargo, este valor puede cambiar debido a mejoras o cambios de propiedad, lo que puede resultar en una evaluación diferente.

¿Qué incluye el impuesto de ventas y uso en el Condado de Los Ángeles?

+

El impuesto de ventas y uso en el Condado de Los Ángeles se aplica a la venta de bienes y servicios. Incluye el impuesto estatal base, el impuesto del condado, y adiciones de ciudades y distritos específicos. Estos impuestos pueden variar según la ubicación dentro del condado.

¿Cómo se determinan las tasas de impuestos a la renta para los residentes del Condado de Los Ángeles?

+

Las tasas de impuestos a la renta para los residentes del Condado de Los Ángeles se basan en un sistema progresivo. La tasa de impuesto estatal varía según el ingreso gravable, mientras que el impuesto local se calcula como un porcentaje del impuesto estatal. Estos impuestos pueden cambiar anualmente, por lo que es importante mantenerse actualizado.