2022 Tax Tables

Unveiling the 2022 Tax Tables: A Comprehensive Guide to Understanding Your Tax Obligations

As we navigate the complex world of taxation, having a clear understanding of the tax tables for the year is crucial for individuals and businesses alike. The tax landscape is ever-evolving, with new regulations and rates shaping our financial obligations. In this article, we will delve into the intricacies of the 2022 tax tables, providing you with an expert analysis to ensure you stay informed and prepared.

The tax tables, a fundamental component of the Internal Revenue Service (IRS) guidelines, outline the tax rates and brackets applicable to various income levels. These tables serve as a roadmap, guiding taxpayers through the process of calculating their tax liabilities accurately. By examining the 2022 tax tables, we can gain valuable insights into the economic landscape and the potential financial implications for taxpayers.

Understanding the Structure of the 2022 Tax Tables

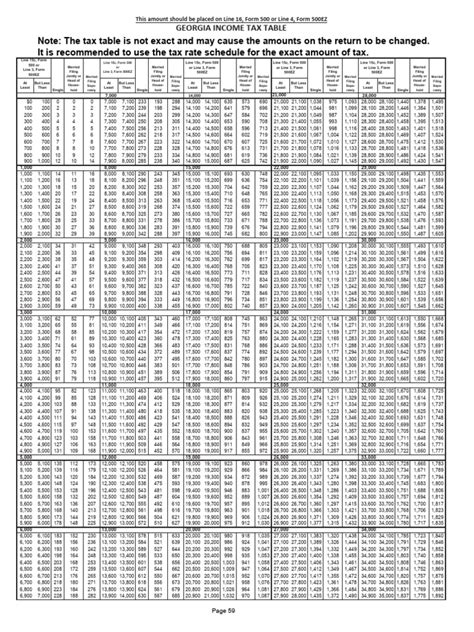

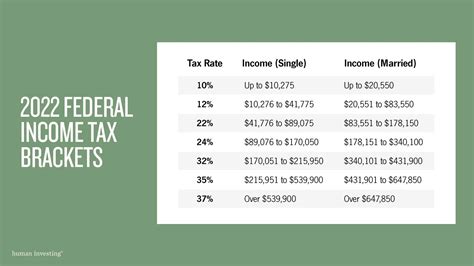

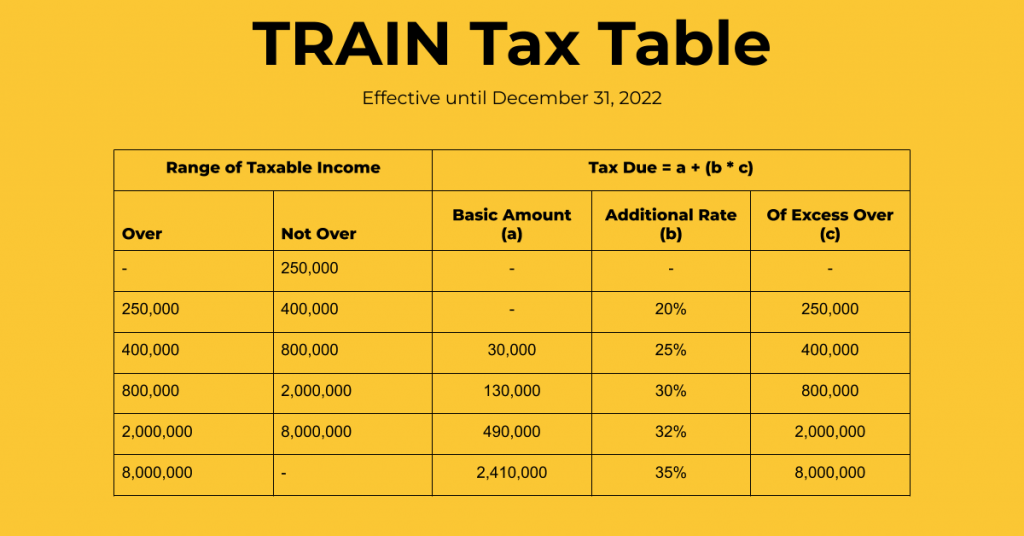

The 2022 tax tables are meticulously designed to accommodate the diverse income levels of taxpayers. These tables are categorized based on filing status, with distinct brackets for single filers, married filing jointly, married filing separately, and head of household. This classification ensures that the tax burden is distributed fairly across different households.

Each filing status is further divided into tax brackets, which determine the applicable tax rate for a specific income range. These brackets are progressive, meaning that as income increases, so does the tax rate. This structure aims to maintain a balanced approach, ensuring that higher-income earners contribute a larger proportion of their income to taxes.

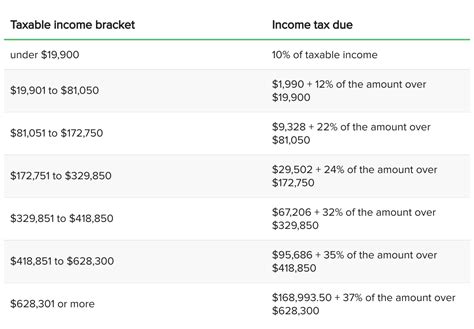

Let's take a closer look at the tax brackets for the 2022 tax year. For single filers, the tax brackets range from 10% for incomes up to $9,950 to a maximum rate of 37% for incomes exceeding $539,900. Married couples filing jointly enjoy slightly lower tax rates, with brackets ranging from 10% for incomes up to $19,900 to a top rate of 35% for incomes over $647,850. Head of household filers have tax brackets similar to single filers, while married individuals filing separately face higher tax rates, reflecting the unique nature of their filing status.

| Filing Status | Tax Bracket | Tax Rate |

|---|---|---|

| Single | Up to $9,950 | 10% |

| Single | $9,951 - $41,775 | 12% |

| Single | $41,776 - $89,075 | 22% |

| Single | $89,076 - $170,050 | 24% |

| Single | $170,051 - $215,950 | 32% |

| Single | $215,951 - $539,900 | 35% |

| Single | Over $539,900 | 37% |

| Married Filing Jointly | Up to $19,900 | 10% |

| Married Filing Jointly | $19,901 - $83,350 | 12% |

| Married Filing Jointly | $83,351 - $178,150 | 22% |

| Married Filing Jointly | $178,151 - $340,100 | 24% |

| Married Filing Jointly | $340,101 - $431,900 | 32% |

| Married Filing Jointly | $431,901 - $647,850 | 35% |

| Married Filing Jointly | Over $647,850 | 37% |

| Head of Household | Up to $14,650 | 10% |

| Head of Household | $14,651 - $55,200 | 12% |

| Head of Household | $55,201 - $89,050 | 22% |

| Head of Household | $89,051 - $170,050 | 24% |

| Head of Household | $170,051 - $215,950 | 32% |

| Head of Household | $215,951 - $539,900 | 35% |

| Head of Household | Over $539,900 | 37% |

| Married Filing Separately | Up to $9,950 | 10% |

| Married Filing Separately | $9,951 - $41,675 | 12% |

| Married Filing Separately | $41,676 - $89,075 | 22% |

| Married Filing Separately | $89,076 - $135,075 | 24% |

| Married Filing Separately | $135,076 - $215,950 | 32% |

| Married Filing Separately | $215,951 - $323,925 | 35% |

| Married Filing Separately | Over $323,925 | 37% |

It's important to note that these tax brackets and rates are subject to adjustments each year, taking into account factors such as inflation and economic conditions. Therefore, it is essential to refer to the most up-to-date tax tables to ensure accuracy when calculating tax liabilities.

Analyzing the Impact of the 2022 Tax Tables

The 2022 tax tables have far-reaching implications for taxpayers, influencing their financial planning and decision-making. By examining these tables, we can identify key trends and potential opportunities.

Adjusted Tax Brackets for Inflation

One notable change in the 2022 tax tables is the adjustment of tax brackets to account for inflation. This adjustment ensures that taxpayers are not disproportionately affected by rising costs of living. As a result, individuals and households with income levels that would have placed them in a higher tax bracket in previous years may find themselves in a lower bracket, leading to potential tax savings.

Tax Relief for Middle-Income Earners

The 2022 tax tables introduce tax relief measures aimed at benefiting middle-income earners. With tax rates remaining relatively stable or even slightly reduced for this demographic, individuals and families in this income range can expect a modest tax burden. This move aligns with the government's efforts to promote economic growth and provide financial relief to those who are often considered the backbone of the economy.

Impact on High-Income Earners

For high-income earners, the 2022 tax tables may present a different scenario. With progressive tax rates, those with higher incomes are subject to a larger proportion of their income being taxed. While this is a standard practice to ensure a fair distribution of tax obligations, it is important for high-income earners to carefully review their tax strategies and explore potential deductions and credits to optimize their tax liabilities.

Strategies for Maximizing Tax Efficiency

Understanding the 2022 tax tables is just the first step in navigating the complex world of taxation. To truly optimize your tax obligations, it is essential to implement effective tax strategies. Here are some key strategies to consider:

Take Advantage of Deductions and Credits

The tax code offers a range of deductions and credits that can significantly reduce your tax liability. From standard deductions to itemized deductions, such as mortgage interest, charitable contributions, and medical expenses, there are numerous opportunities to lower your taxable income. Additionally, various tax credits, such as the Child Tax Credit and the Earned Income Tax Credit, can provide substantial financial benefits. Consult with a tax professional to identify the deductions and credits applicable to your situation.

Explore Retirement Account Contributions

Contributing to tax-advantaged retirement accounts, such as 401(k)s and IRAs, can offer significant tax benefits. These contributions reduce your taxable income in the present and provide tax-deferred growth over time. Furthermore, certain retirement accounts offer immediate tax deductions, further enhancing your tax efficiency. Consider maximizing your contributions to take full advantage of these tax-saving opportunities.

Strategic Timing of Income and Expenses

The timing of your income and expenses can have a significant impact on your tax liability. By carefully planning the timing of income-generating activities and expenses, you can potentially shift your taxable income into more favorable tax brackets. For example, if you anticipate a higher income in the following year, consider deferring certain income-generating activities to reduce your tax liability in the current year. Similarly, strategically timing deductible expenses can help optimize your tax position.

The Role of Professional Tax Guidance

Navigating the complexities of the tax system can be challenging, and seeking professional guidance is often the best approach to ensure compliance and optimize your tax obligations. Tax professionals, such as certified public accountants (CPAs) and enrolled agents, possess the expertise and knowledge to provide personalized advice tailored to your specific circumstances.

These professionals can assist in various aspects of tax planning, from maximizing deductions and credits to structuring your business for optimal tax efficiency. They can also guide you through the ever-changing tax landscape, ensuring you stay up-to-date with the latest regulations and tax-saving strategies. Engaging the services of a tax professional can provide peace of mind and help you make informed decisions to minimize your tax burden.

Stay Informed and Plan Ahead

As we approach the end of the 2022 tax year, it is crucial to stay informed about any potential changes or updates to the tax tables. The IRS regularly releases tax guidance and clarifications, ensuring taxpayers have the most accurate information. By staying updated, you can make informed decisions and adjust your financial strategies accordingly.

Furthermore, tax planning is an ongoing process. It is essential to review your financial situation regularly and make necessary adjustments to ensure compliance and optimize your tax obligations. Consider setting aside time each year to reassess your tax strategies and seek professional advice to stay ahead of any potential tax challenges.

How do I calculate my tax liability using the 2022 tax tables?

+To calculate your tax liability using the 2022 tax tables, you’ll need to determine your filing status and taxable income. Start by locating the appropriate tax bracket for your filing status and taxable income. Multiply your taxable income by the applicable tax rate within that bracket. Repeat this process for each bracket until you reach the total tax amount. Remember to consider any deductions or credits that may apply to your specific situation.

Are there any tax changes expected for the 2023 tax year?

+While it is too early to predict specific tax changes for the 2023 tax year, it is essential to stay informed about potential adjustments. Keep an eye on official IRS announcements and consult tax professionals for the latest insights. Tax laws can evolve, and staying updated ensures you can plan effectively for the upcoming tax season.

What are some common deductions and credits that can reduce my tax liability?

+Common deductions and credits that can reduce your tax liability include the standard deduction, which provides a fixed amount based on your filing status, and itemized deductions, such as mortgage interest, charitable contributions, and medical expenses. Additionally, tax credits like the Child Tax Credit, Earned Income Tax Credit, and various education-related credits can provide significant financial benefits. Consult a tax professional to identify the most relevant deductions and credits for your specific circumstances.

How can I stay updated on tax-related news and changes?

+To stay updated on tax-related news and changes, consider subscribing to reputable tax websites, following tax professionals on social media, and regularly checking the IRS website for official announcements and updates. Additionally, consider attending tax seminars or webinars to gain insights into the latest tax trends and strategies.