Seattle Wa Sales Tax

Welcome to a comprehensive guide on Seattle, Washington's sales tax system. This article will delve into the intricacies of sales tax in the Emerald City, providing an in-depth analysis of rates, applicable goods and services, exemptions, and more. Seattle's sales tax structure is an important aspect of the city's economy, impacting both local businesses and residents. Understanding the nuances of this system is crucial for making informed financial decisions and ensuring compliance with tax regulations.

Understanding Seattle’s Sales Tax Structure

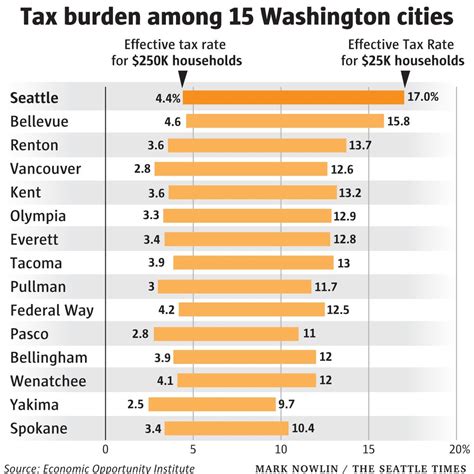

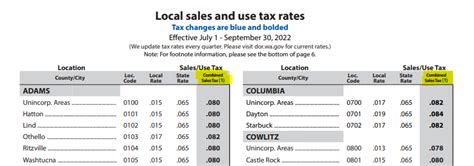

Seattle’s sales tax is a consumption tax levied on the sale of tangible goods and some services. It is an essential revenue source for the city, state, and local governments, funding various public services and infrastructure projects. The sales tax rate in Seattle is comprised of several components, including state, county, city, and potentially other local taxes.

As of [Date], the combined sales tax rate in Seattle is [Rate]%. This rate is subject to change, so it's advisable to check for the most current information when planning business operations or personal finances.

Components of Seattle’s Sales Tax

The sales tax rate in Seattle is a combination of various tax components. Here’s a breakdown of the typical structure:

- State Sales Tax: [Rate]% is levied by the state of Washington to fund state-wide services and initiatives.

- County Sales Tax: [Rate]% is collected by King County, in which Seattle is located, to support county-wide operations and projects.

- City Sales Tax: Seattle imposes a sales tax of [Rate]% to generate revenue for city services and development.

- Optional Local Taxes: Some cities or special-purpose districts within King County may have additional sales taxes to finance specific projects or services. These rates can vary and may be applicable only to certain types of transactions.

It's important to note that while the sales tax rates are standardized, the taxable goods and services can vary depending on various factors, including the nature of the business and the specific items being sold.

Taxable Goods and Services

Seattle’s sales tax applies to a wide range of tangible goods and certain services. Here are some key categories that are typically subject to sales tax:

- Retail Goods: This includes clothing, electronics, furniture, appliances, and most other items sold by retailers.

- Groceries: While some essential food items are exempt, most groceries are subject to sales tax in Seattle.

- Vehicles: Sales of new and used cars, motorcycles, and other vehicles are taxable.

- Construction Materials: Materials used for construction, renovation, or repair projects are generally taxable.

- Services: Certain services, such as car repairs, home improvements, and professional services like legal or accounting, may be subject to sales tax.

It's important for businesses and consumers to understand which goods and services are taxable to ensure proper tax compliance. Misunderstanding the taxable items can lead to significant tax liabilities and penalties.

Exemptions and Special Considerations

While Seattle’s sales tax applies to a broad range of goods and services, there are certain exemptions and special considerations to be aware of. These exemptions can significantly impact tax liabilities for businesses and consumers.

- Food Exemptions: Some food items, particularly staple foods like bread, milk, and eggs, are exempt from sales tax. However, prepared foods and beverages are generally taxable.

- Prescription Medications: Sales of prescription medications are exempt from sales tax, providing a necessary relief for healthcare expenses.

- Educational Materials: Certain educational materials, such as textbooks and supplies, are exempt from sales tax to support access to education.

- Resale Exemption: Businesses that purchase goods for resale, such as wholesalers and retailers, are not required to pay sales tax on their purchases. However, they must collect and remit sales tax on the final sale to the end consumer.

- Manufacturing Exemption: Manufacturing businesses often have special considerations regarding sales tax. While raw materials used in manufacturing may be exempt, the final product sold to consumers is typically taxable.

Understanding these exemptions and special considerations is crucial for businesses to avoid overpaying taxes and for consumers to take advantage of tax-free purchases where applicable.

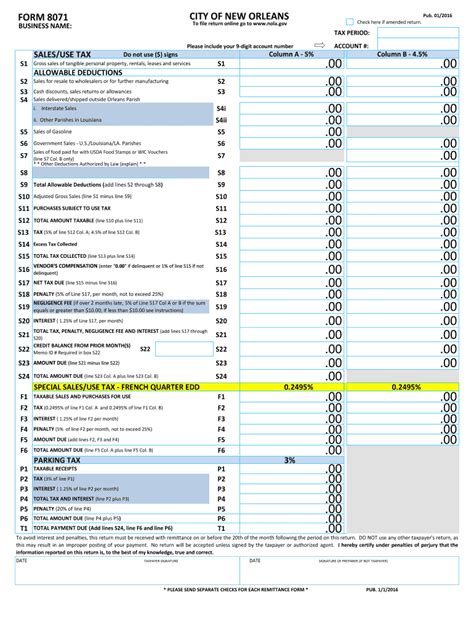

Sales Tax Collection and Remittance

Sales tax collection and remittance is a critical responsibility for businesses operating in Seattle. The process involves several key steps to ensure compliance with tax regulations.

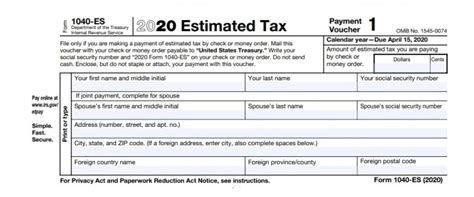

- Registration: Businesses must register with the Washington State Department of Revenue to obtain a sales tax permit. This permit authorizes the business to collect and remit sales tax.

- Tax Calculation: Businesses must calculate the sales tax on each taxable transaction, typically by applying the combined sales tax rate to the taxable amount.

- Tax Collection: The sales tax is collected from customers at the point of sale and must be clearly displayed on the receipt.

- Recordkeeping: Businesses are required to maintain accurate records of all sales transactions, including the taxable amount, sales tax collected, and the corresponding tax rate.

- Remittance: Sales tax collected must be remitted to the state and local taxing authorities within a specified timeframe, typically on a monthly, quarterly, or annual basis. Late payments may incur penalties and interest.

Proper sales tax collection and remittance are essential for businesses to maintain good standing with tax authorities and avoid penalties for non-compliance.

Sales Tax Audits and Compliance

Sales tax audits are a critical component of ensuring compliance with tax regulations. Tax authorities conduct audits to verify that businesses are accurately calculating and remitting sales tax. Here’s what you need to know about sales tax audits in Seattle:

- Audit Selection: Tax authorities use various criteria to select businesses for audit, including risk assessment, industry trends, and random selection. Businesses with complex operations or a history of non-compliance may be more likely to be audited.

- Audit Process: During an audit, tax authorities will review a business's sales records, tax returns, and other relevant documentation. They may also conduct interviews with business owners and employees to verify the accuracy of the records.

- Audit Findings: If an audit reveals discrepancies or underreporting of sales tax, the business may be subject to penalties and interest on the outstanding tax liability. In some cases, the business may also face criminal charges for tax evasion.

- Appeals Process: Businesses that disagree with the audit findings have the right to appeal. The appeals process typically involves a formal review by a higher authority within the tax agency or a hearing before an administrative law judge.

To minimize the risk of audits and ensure compliance, businesses should maintain accurate records, calculate sales tax correctly, and remit payments on time. Consulting with tax professionals can also help businesses navigate the complex world of sales tax regulations.

Impact of Sales Tax on Businesses and Consumers

Seattle’s sales tax has a significant impact on both businesses and consumers in the city. Understanding these impacts is crucial for making informed financial decisions and staying competitive in the local market.

For businesses, the sales tax can affect pricing strategies, cash flow, and overall profitability. Businesses must factor in the sales tax when setting their prices, as it directly impacts the final cost to the consumer. Additionally, businesses must consider the administrative burden of collecting and remitting sales tax, which can be time-consuming and complex.

On the other hand, consumers in Seattle bear the direct burden of the sales tax. The tax increases the cost of goods and services, which can impact purchasing decisions and overall spending power. However, consumers also benefit from the public services and infrastructure improvements funded by sales tax revenue.

To mitigate the impact of sales tax, businesses can explore strategies such as offering discounts or promotions, bundling services, or negotiating better terms with suppliers. Consumers can also take advantage of tax-free shopping events, comparison shopping, and budgeting strategies to manage the financial impact of sales tax.

Future Implications and Potential Changes

As Seattle’s economy and tax landscape continue to evolve, there are several potential future implications and changes to consider regarding the sales tax system. These developments can significantly impact businesses and consumers, making it essential to stay informed and adaptable.

- Economic Growth and Development: Seattle's booming economy and technological advancements may lead to increased revenue from sales tax. As the city attracts new businesses and residents, the tax base expands, potentially resulting in more robust public services and infrastructure.

- Tax Reform and Simplification: There may be efforts to simplify the sales tax system, making it easier for businesses to comply and reducing administrative burdens. This could involve standardizing tax rates across jurisdictions or introducing new technologies for more efficient tax collection and remittance.

- Online Sales Tax: With the rise of e-commerce, the collection of sales tax on online purchases has become a complex issue. Future changes may focus on clarifying the rules for online sales tax collection, ensuring fair competition between online and brick-and-mortar retailers, and preventing tax evasion.

- Exemptions and Incentives: To promote specific industries or initiatives, Seattle may consider introducing new exemptions or tax incentives. For example, there could be discussions about exempting certain renewable energy technologies or providing tax breaks for businesses investing in green technologies or social initiatives.

Staying informed about these potential changes and their implications can help businesses and consumers make strategic decisions and adapt to the evolving tax landscape in Seattle.

How often do sales tax rates change in Seattle?

+Sales tax rates can change periodically, typically as a result of legislative actions or local initiatives. It’s important to stay updated on any changes by regularly checking the Washington State Department of Revenue’s website or consulting with tax professionals.

Are there any sales tax holidays in Seattle?

+While some states have sales tax holidays for specific items, Seattle and Washington State do not currently have any sales tax holidays. However, it’s always a good idea to check for any potential future changes or special promotions.

How can I calculate sales tax in Seattle for my business transactions?

+To calculate sales tax in Seattle, multiply the taxable amount by the combined sales tax rate. For example, if the combined rate is 10.5% and the taxable amount is 100, the sales tax would be 10.50. It’s important to ensure accuracy and consult tax professionals for complex transactions.