Do You Pay Taxes On Life Insurance

Taxation is a complex topic that often raises questions, especially when it comes to financial instruments like life insurance. Many individuals wonder whether the proceeds from a life insurance policy are taxable. In this comprehensive guide, we will delve into the intricacies of life insurance taxation, exploring the various aspects that determine whether you need to pay taxes on life insurance.

Understanding Life Insurance and Taxation

Life insurance is a financial contract that provides a lump-sum payment, known as a death benefit, to the designated beneficiaries upon the insured person’s death. This benefit serves as a financial safety net for the policyholder’s loved ones, ensuring they receive support during a difficult time. However, the tax treatment of life insurance can vary depending on several factors, including the type of policy, the policyholder’s intentions, and the purpose of the proceeds.

Key Factors Influencing Taxability

When determining the tax implications of life insurance, several critical factors come into play:

- Policy Type: Different life insurance policies have distinct tax treatments. Common types include term life insurance, whole life insurance, and universal life insurance. Each type has its own set of rules regarding taxability.

- Policy Ownership: The ownership of the policy can impact tax liability. If the policyholder owns the policy, certain conditions may apply, whereas if the policy is owned by a trust or another entity, different tax rules might come into effect.

- Purpose of Proceeds: The intended use of the life insurance proceeds is a significant factor. Proceeds used for specific purposes, such as paying for medical expenses or educational costs, may have different tax consequences compared to general income or investment.

- Tax Status of Beneficiaries: The tax status of the beneficiaries receiving the death benefit can also influence the tax treatment. Beneficiaries may be subject to income tax on the proceeds, especially if they are not the spouse or legal dependent of the policyholder.

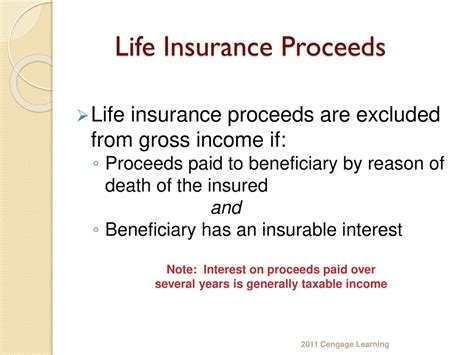

Taxation of Life Insurance Proceeds

The tax treatment of life insurance proceeds can vary depending on the circumstances and the type of policy. Here’s a breakdown of the key scenarios:

Term Life Insurance

Term life insurance is a popular and relatively straightforward type of coverage. The primary purpose of term life insurance is to provide financial protection for a specified period, often ranging from 10 to 30 years. Here’s how the tax treatment works:

- Death Benefit: The death benefit proceeds received by the beneficiaries are typically not taxable as income. This means that the beneficiaries can use the money without having to worry about paying taxes on it.

- Cash Value: Term life insurance policies usually have no cash value component, so there is no potential for taxable growth within the policy.

Whole Life Insurance

Whole life insurance is a permanent life insurance policy that provides coverage for the policyholder’s entire life, as long as premiums are paid. It also accumulates cash value over time. The tax implications for whole life insurance are as follows:

- Death Benefit: Similar to term life insurance, the death benefit proceeds are generally non-taxable for the beneficiaries. This means that the money received can be used for any purpose without tax consequences.

- Cash Value Growth: The cash value within a whole life insurance policy grows on a tax-deferred basis. This means that the policy's cash value is not taxed as it accumulates. However, if the policyholder takes out a loan against the cash value or surrenders the policy, the growth may become taxable.

Universal Life Insurance

Universal life insurance is another type of permanent life insurance that offers flexibility in premium payments and death benefit amounts. It also accumulates cash value. The tax treatment for universal life insurance is similar to whole life insurance:

- Death Benefit: The death benefit proceeds are generally tax-free for the beneficiaries, allowing them to use the money as they see fit without tax implications.

- Cash Value Growth: The cash value within a universal life insurance policy grows on a tax-deferred basis, similar to whole life insurance. The policyholder can access this cash value through policy loans or withdrawals, but any gains may be subject to taxation.

Tax Considerations for Policyholders

While life insurance proceeds are often tax-free for beneficiaries, policyholders should be aware of certain tax considerations during the policy’s lifetime:

Policy Premiums

Life insurance premiums are generally not tax-deductible as a personal expense. However, there are certain situations where premiums may be tax-deductible, such as when the policy is owned by a business or is part of an employee benefit plan.

Policy Loans and Withdrawals

Taking out a loan against the cash value of a life insurance policy or making withdrawals can have tax implications. Any gains realized from these actions may be subject to income tax. It’s essential to consult with a tax professional to understand the tax consequences of policy loans or withdrawals.

Special Cases and Exceptions

While the general rule is that life insurance proceeds are tax-free, there are some special cases and exceptions to be aware of:

Key Person Insurance

Key person insurance is a type of life insurance taken out by a business to protect against the financial loss that may occur if a key employee or owner passes away. The proceeds from key person insurance are generally taxable as business income, and the business must pay taxes on the death benefit.

Accelerated Death Benefit Riders

Some life insurance policies offer accelerated death benefit riders, which allow policyholders to receive a portion of the death benefit while they are still alive if they have a terminal illness or long-term care needs. The tax treatment of these accelerated benefits can be complex and may depend on the specific circumstances. It’s crucial to consult a tax advisor when considering an accelerated death benefit rider.

Planning for Tax-Efficient Life Insurance

To ensure tax efficiency when it comes to life insurance, policyholders can take certain steps:

- Consult a Professional: Working with a financial advisor or tax professional can help you navigate the complex world of life insurance taxation. They can provide personalized advice based on your specific circumstances.

- Review Policy Options: Compare different life insurance policies and understand their tax implications. Consider the purpose of your policy and choose one that aligns with your financial goals and tax preferences.

- Consider Beneficiary Designation: Proper beneficiary designation can help ensure the tax-free transfer of life insurance proceeds. Review your beneficiary designations regularly and update them as needed to reflect any life changes.

| Policy Type | Death Benefit Taxability | Cash Value Growth Taxability |

|---|---|---|

| Term Life Insurance | Non-taxable | Not applicable |

| Whole Life Insurance | Non-taxable | Tax-deferred, may become taxable upon withdrawal or surrender |

| Universal Life Insurance | Non-taxable | Tax-deferred, may become taxable upon withdrawal or surrender |

Are life insurance proceeds always tax-free for beneficiaries?

+In most cases, life insurance proceeds are non-taxable for beneficiaries. However, there are exceptions, such as key person insurance, where the proceeds are taxable as business income.

Can I deduct life insurance premiums from my taxes?

+Life insurance premiums are generally not tax-deductible as a personal expense. However, there are certain situations, like business-owned policies, where premiums may be deductible.

What happens if I take a loan against my life insurance policy’s cash value?

+Any gains realized from a policy loan or withdrawal may be subject to income tax. It’s essential to consult a tax professional to understand the tax consequences.