Chicago Tax Rate

Welcome to a comprehensive guide on the Chicago tax rate, a topic of great importance for residents, businesses, and anyone considering a move to the Windy City. Understanding the tax landscape is crucial for making informed financial decisions, and this article aims to provide an in-depth analysis, complete with real-world examples and expert insights.

Navigating the Chicago Tax Landscape

Chicago, the bustling metropolis on the shores of Lake Michigan, is not only a cultural hub but also a complex ecosystem of taxes and regulations. From property taxes to sales taxes, the city and its surrounding areas have a unique tax structure that can significantly impact your financial planning. Let’s delve into the specifics and uncover the intricacies of the Chicago tax rate.

Property Taxes: A Significant Burden

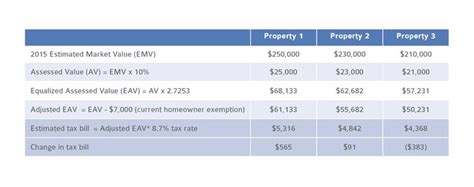

One of the most notable aspects of the Chicago tax landscape is its property taxes. The city is known for having some of the highest property tax rates in the nation. For homeowners and real estate investors, this can be a substantial financial consideration.

Consider the case of Mr. Johnson, a long-time resident of Chicago’s North Side. He purchased his home in 2005 for 350,000. Over the years, as property values rose, so did his tax bill. In 2022, Mr. Johnson found himself paying over 7,500 in annual property taxes, a significant increase from the $4,500 he paid when he first moved in.

This real-world example highlights the financial burden that property taxes can impose on Chicago residents. It’s not uncommon for property taxes to exceed 1.5% of a home’s assessed value, and in some cases, they can be even higher.

| Year | Property Value | Annual Property Tax |

|---|---|---|

| 2005 | $350,000 | $4,500 |

| 2022 | $550,000 | $7,500 |

While property tax rates can vary based on the specific location within Chicago, the overall trend is consistently high. This has led to a situation where some residents find it challenging to keep up with their tax obligations, especially in neighborhoods with rapidly appreciating property values.

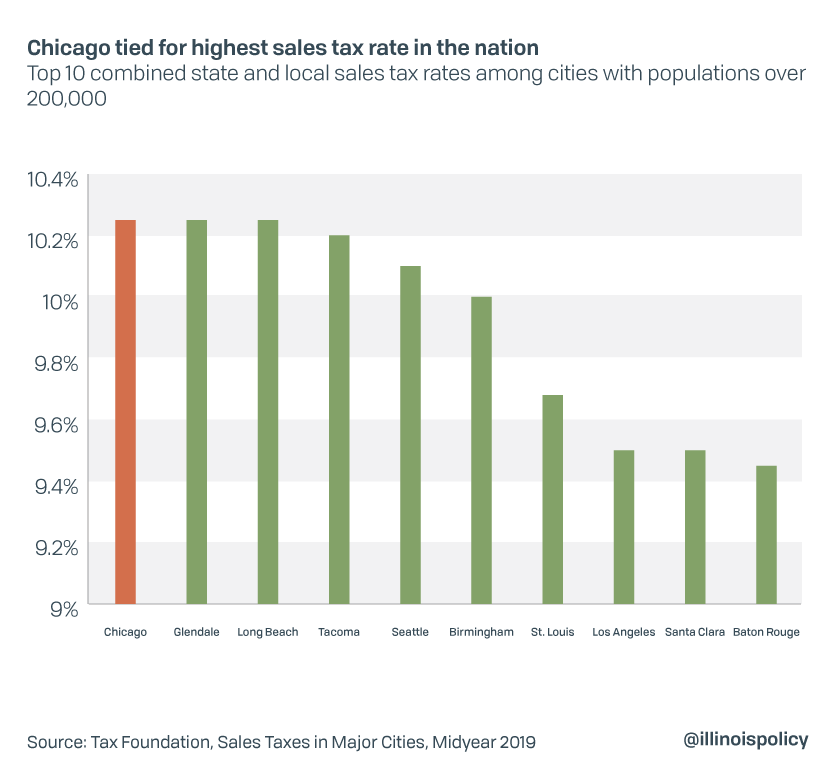

Sales Taxes: Adding Up the Costs

In addition to property taxes, Chicagoans also encounter sales taxes on various goods and services. The city’s sales tax rate is a combination of both state and local taxes, which can add up quickly for consumers.

Let’s take a look at an example to illustrate the impact of sales taxes in Chicago. Imagine you’re planning a night out on the town, starting with a dinner at a popular restaurant. The total bill, including a meal for two and a few drinks, comes to 150. With Chicago's sales tax rate of 10.25%, your final bill swells to 168.38.

This additional cost is not limited to dining experiences. Sales taxes are applied to a wide range of goods, from clothing and electronics to groceries and household items. For Chicago residents, this means that every purchase contributes to their overall tax burden.

| Item | Price | Sales Tax | Total Cost |

|---|---|---|---|

| Dinner for Two | $150 | $15.38 | $165.38 |

| Clothing Item | $80 | $8.20 | $88.20 |

| Groceries | $120 | $12.30 | $132.30 |

As you can see, the cumulative effect of sales taxes can significantly impact your budget. While these taxes are a necessary part of funding public services and infrastructure, they can make everyday expenses more costly for Chicago residents.

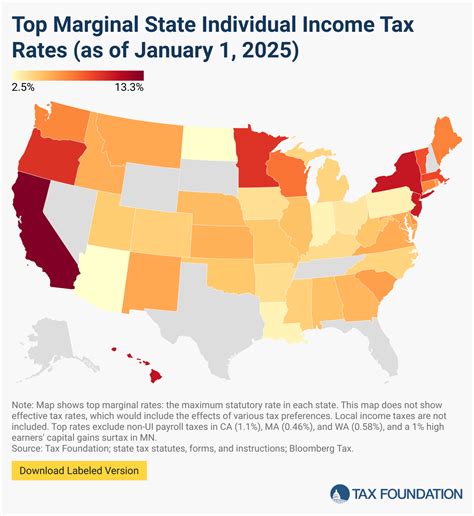

Income Taxes: Navigating State and Local Regulations

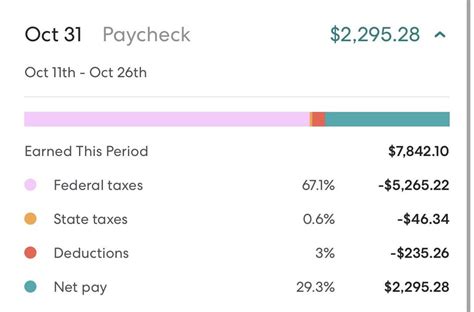

Income taxes in Chicago are another crucial aspect of the tax landscape. The city, like many other metropolitan areas, has its own set of income tax regulations, which can impact individuals and businesses alike.

For individuals, Chicago’s non-resident income tax is a notable feature. If you work in Chicago but reside outside the city limits, you may be subject to this tax. This is an additional layer of taxation on top of state and federal income taxes, further complicating the financial picture for commuters.

Let’s consider the case of Ms. Smith, a resident of the suburbs who commutes to her job in downtown Chicago. In addition to her state and federal income taxes, Ms. Smith must also pay a non-resident income tax to the city of Chicago, which can amount to several hundred dollars annually.

For businesses, the income tax landscape is equally complex. Chicago’s corporate income tax rate can impact companies operating within city limits. This tax is applied to the net income of corporations, and it can vary based on factors such as revenue and industry.

To illustrate, let’s look at a hypothetical business, ABC Inc., which operates a manufacturing facility in Chicago. With a net income of 2 million for the year, ABC Inc. would be subject to a corporate income tax rate of 9.5%, resulting in a tax liability of 190,000.

| Business | Net Income | Corporate Income Tax Rate | Tax Liability |

|---|---|---|---|

| ABC Inc. | $2,000,000 | 9.5% | $190,000 |

This example showcases how income taxes can significantly impact a business's bottom line. For companies operating in Chicago, understanding and planning for these taxes is essential for financial success.

Conclusion: Understanding the Chicago Tax Rate

In conclusion, navigating the Chicago tax rate is a multifaceted task that requires a deep understanding of property, sales, and income taxes. From the high property taxes that can strain homeowners to the cumulative effect of sales taxes on everyday expenses, the city’s tax landscape is a significant consideration for residents and businesses.

As we’ve explored, the tax structure in Chicago can impact individuals in various ways, from commuters facing non-resident income taxes to homeowners grappling with rising property tax bills. For businesses, corporate income taxes add another layer of complexity to financial planning.

By providing real-world examples and expert insights, this guide aims to shed light on the often-complex world of Chicago taxes. Whether you’re a resident, a business owner, or someone considering a move to the Windy City, understanding these tax rates is essential for making informed financial decisions.

Stay tuned for more detailed insights and analyses on specific aspects of Chicago’s tax landscape, as we continue to explore this vital topic in depth.

How do Chicago’s property taxes compare to other major cities in the US?

+Chicago’s property taxes are among the highest in the nation. While exact comparisons can vary, on average, Chicago’s property tax rates are higher than many other major cities, including New York City, Los Angeles, and Miami.

Are there any tax incentives or breaks available for homeowners in Chicago?

+Yes, Chicago does offer some tax incentives and breaks for homeowners. For example, the Homeowner Exemption reduces the assessed value of a property by up to $7,000, resulting in lower property taxes. Additionally, senior citizens and persons with disabilities may qualify for further tax relief.

How often do property tax rates change in Chicago?

+Property tax rates in Chicago can change annually. The Cook County Assessor’s office is responsible for assessing property values, and these assessments are used to calculate property taxes. As property values can fluctuate, so too can the tax rates.