Sales Tax Car Arizona

Welcome to a comprehensive guide on understanding and navigating the complex world of sales tax on cars in the state of Arizona. In this article, we will delve into the specific regulations, rates, and processes involved in purchasing a vehicle in Arizona, ensuring you are well-informed and prepared for your next automotive transaction.

The Arizona Sales Tax Landscape for Vehicles

Arizona, like many states, imposes a sales tax on the purchase of vehicles, which is an essential revenue stream for the state government. This tax is applied to the total purchase price of the vehicle, including any additional fees and costs associated with the transaction. Understanding this sales tax is crucial for buyers, as it directly impacts the overall cost of acquiring a car.

Sales Tax Rates in Arizona

The sales tax rate in Arizona varies depending on the location of the transaction. The state of Arizona imposes a base sales tax rate of 5.6%, which is applied uniformly across the state. However, this base rate is often supplemented by additional taxes imposed by counties and municipalities, leading to varying effective tax rates across different regions.

| County | Additional Tax Rate | Total Effective Rate |

|---|---|---|

| Maricopa County | 1.27% | 6.87% |

| Pima County | 1.30% | 6.90% |

| Yavapai County | 0.50% | 6.10% |

| Apache County | 1.55% | 7.15% |

Exemptions and Special Cases

While the sales tax is a standard component of vehicle purchases in Arizona, there are certain exemptions and special cases that buyers should be aware of. These can significantly impact the overall cost of the transaction and may provide opportunities for savings.

- Military Exemptions: Active-duty military personnel and their spouses are eligible for a sales tax exemption on the purchase of a vehicle in Arizona. This exemption can result in substantial savings and is a great benefit for those serving our country.

- Trade-Ins: When trading in an old vehicle as part of a new purchase, the sales tax is often calculated based on the difference between the trade-in value and the new vehicle's purchase price. This can reduce the overall tax burden, making it a strategic financial move.

- Disability Exemptions: Individuals with disabilities may qualify for sales tax exemptions on certain vehicle modifications or purchases of specialized vehicles. These exemptions are designed to ensure equal access and opportunities for those with disabilities.

Calculating Sales Tax: A Step-by-Step Guide

Calculating the sales tax on a vehicle purchase can be a straightforward process once you understand the components involved. Here’s a step-by-step guide to help you estimate the sales tax for your next car purchase in Arizona.

- Determine the Purchase Price: Start by identifying the total purchase price of the vehicle, including any additional fees and costs. This is the base amount on which the sales tax will be calculated.

- Identify the Applicable Tax Rate: Determine the specific tax rate that applies to your transaction. This will depend on the county or municipality where the purchase is taking place. Refer to the table above for a guide, but always verify the current rates.

- Calculate the Sales Tax: Multiply the purchase price by the applicable tax rate to determine the sales tax amount. For example, if the purchase price is $25,000 and the tax rate is 6.87%, the sales tax would be $1,717.50 ($25,000 x 0.0687).

- Add the Sales Tax to the Purchase Price: Finally, add the calculated sales tax to the original purchase price to get the total cost of the vehicle, inclusive of tax. In our example, the total cost would be $26,717.50 ($25,000 + $1,717.50).

The Impact of Sales Tax on Car Buying Decisions

The sales tax on vehicles in Arizona can significantly influence buying decisions and the overall cost of ownership. Understanding these implications is crucial for making informed choices when purchasing a car.

Financial Considerations

The sales tax adds a substantial amount to the overall cost of a vehicle purchase. For a mid-range car priced at 30,000, the sales tax alone could amount to over 2,000, depending on the applicable tax rate. This additional cost should be factored into the budget and considered when comparing different vehicles or financing options.

Strategic Shopping and Negotiation

Awareness of the sales tax can lead to strategic shopping and negotiation tactics. Buyers can aim to negotiate a lower purchase price, knowing that the sales tax will be calculated based on this amount. Additionally, considering the tax rate variations across counties, some buyers may opt to purchase in areas with lower tax rates to save on costs.

Long-Term Ownership Costs

The sales tax is not a one-time expense but can impact long-term ownership costs. When considering the total cost of ownership, including maintenance, fuel, and insurance, the initial sales tax should be factored in. This can influence the overall financial viability of different vehicle choices and ownership periods.

Comparative Analysis: Arizona vs. Other States

Comparing Arizona’s sales tax rates with those of other states provides valuable insights into the competitive landscape. While Arizona’s base rate of 5.6% is relatively moderate, the additional county and municipal taxes can push the effective rate higher, making it important for buyers to research and compare before making a purchase.

| State | Base Rate | Additional Taxes | Effective Rate |

|---|---|---|---|

| California | 7.25% | Varies by County | Up to 10.25% |

| Texas | 6.25% | None | 6.25% |

| Florida | 6% | Varies by County | Up to 8.5% |

| Arizona | 5.6% | Varies by County | Up to 7.15% |

Tips and Strategies for Navigating Arizona’s Sales Tax Landscape

Navigating the sales tax landscape in Arizona requires a strategic approach. Here are some tips and strategies to help you optimize your vehicle purchase and minimize the impact of sales tax.

Research and Comparison

Conduct thorough research on the sales tax rates applicable to your transaction. Compare rates across different counties and consider the overall cost implications. This research can help you identify the most favorable locations for your purchase.

Negotiate the Purchase Price

Remember that the sales tax is calculated based on the purchase price. Negotiating a lower purchase price can significantly reduce the overall cost, even with the tax included. Use market research, competitive pricing, and negotiation tactics to your advantage.

Explore Financing Options

Financing a vehicle purchase can impact the overall cost, including the sales tax. Explore different financing options, such as loans or leasing, and compare the total cost over the ownership period. Consider the impact of sales tax on the overall financial commitment.

Utilize Exemptions and Discounts

Be aware of any exemptions or discounts that may apply to your situation. Military personnel, individuals with disabilities, and those trading in vehicles may be eligible for reduced or exempted sales tax. Take advantage of these opportunities to minimize your tax burden.

Timing Your Purchase

Consider the timing of your purchase. Some dealerships or counties may offer promotional periods with reduced sales tax rates or other incentives. Planning your purchase around these periods can result in significant savings.

The Future of Sales Tax in Arizona: Trends and Predictions

Understanding the future trends and predictions regarding sales tax in Arizona can provide valuable insights for both buyers and the automotive industry. Here’s a glimpse into what the future may hold.

Potential Rate Adjustments

Sales tax rates are subject to change, and Arizona is no exception. While the base rate of 5.6% is relatively stable, there have been discussions and proposals for adjustments, particularly in the context of budget considerations and economic trends. Stay informed about any proposed changes to anticipate their impact on vehicle purchases.

Technological Innovations

The automotive industry is experiencing rapid technological advancements, and these innovations can influence sales tax collection and compliance. As vehicle sales move increasingly online, the state may need to adapt its tax collection methods to accommodate digital transactions. This could lead to new regulations and processes for online car sales.

Environmental Considerations

With a growing focus on sustainability and environmental initiatives, Arizona may explore incentives or adjustments to the sales tax for environmentally friendly vehicles. Electric and hybrid vehicles, for example, may become eligible for reduced tax rates or other benefits to encourage their adoption.

Economic Impacts and Rebalancing

The economic landscape can significantly influence tax rates and policies. If Arizona experiences economic shifts or budget constraints, there may be discussions about rebalancing the tax structure, including the sales tax. These changes could impact the overall cost of vehicle purchases and the tax landscape.

Consumer Advocacy and Awareness

As consumers become more aware of the impact of sales tax on vehicle purchases, there may be increased advocacy for transparency and fairness in tax rates. This could lead to initiatives to simplify tax calculations, provide clearer information to buyers, or explore alternative tax structures.

What is the average sales tax rate for vehicle purchases in Arizona?

+The average sales tax rate for vehicle purchases in Arizona is approximately 6.4%. This includes the base state rate of 5.6% and the average additional tax rates imposed by counties and municipalities.

Are there any ways to reduce the sales tax on a vehicle purchase in Arizona?

+Yes, there are strategies to reduce the sales tax burden. Exploring exemptions for military personnel, individuals with disabilities, or those trading in vehicles can result in substantial savings. Additionally, negotiating the purchase price and timing your purchase during promotional periods can also reduce the overall tax.

How often do sales tax rates change in Arizona?

+Sales tax rates can change periodically, typically as a result of legislative actions or budget considerations. While the base rate is relatively stable, the additional tax rates imposed by counties and municipalities may fluctuate more frequently. It’s important to stay updated on any changes to ensure accurate calculations.

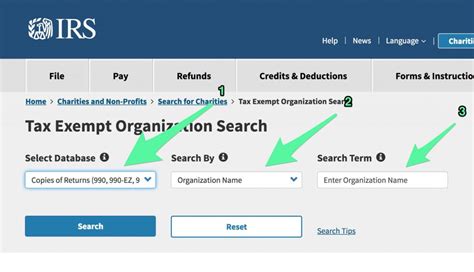

Are there any online resources to help calculate the sales tax for a vehicle purchase in Arizona?

+Yes, there are online calculators and tools available that can assist with estimating the sales tax for a vehicle purchase in Arizona. These resources often take into account the base rate and additional county-specific rates to provide an accurate estimate. It’s always recommended to verify the rates with official sources.

Can I negotiate the sales tax on a vehicle purchase in Arizona?

+The sales tax rate itself is typically non-negotiable, as it is a mandated tax imposed by the state and local governments. However, you can negotiate the purchase price of the vehicle, which will directly impact the sales tax amount. Lowering the purchase price can result in a reduced sales tax liability.