Income Tax In Minnesota Calculator

Welcome to our comprehensive guide on understanding and calculating income tax in the state of Minnesota. Income tax is an essential aspect of financial planning and management, and having a clear understanding of how it works can help individuals and businesses make informed decisions. In this expert-written article, we will delve into the intricacies of Minnesota's tax system, provide practical calculations, and offer valuable insights to navigate this crucial financial obligation.

Understanding Minnesota's Income Tax Structure

Minnesota, like many other states, operates a progressive income tax system, which means that the tax rate you pay increases as your income rises. This structure ensures that individuals with higher incomes contribute a larger share of their earnings towards state revenues. The Minnesota Department of Revenue is responsible for administering and enforcing the state's tax laws, providing guidelines, and ensuring compliance.

The income tax rates in Minnesota are determined by tax brackets, and individuals are taxed based on their taxable income falling within these brackets. As of [insert most recent year's tax information], Minnesota had six tax brackets, each with its own tax rate. These rates can change annually, so it's essential to stay updated with the latest tax tables.

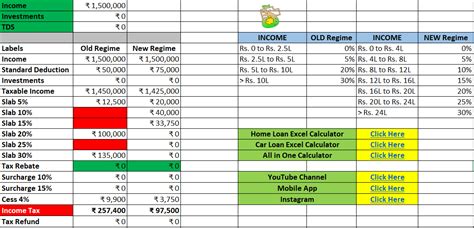

Here's a simplified breakdown of Minnesota's tax brackets for the current tax year:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| Bracket 1 | 5.35% | Up to $15,000 |

| Bracket 2 | 7.05% | $15,001 - $30,000 |

| Bracket 3 | 7.85% | $30,001 - $75,000 |

| Bracket 4 | 8.85% | $75,001 - $150,000 |

| Bracket 5 | 9.85% | $150,001 - $250,000 |

| Bracket 6 | 9.85% | Over $250,000 |

It's important to note that these tax brackets and rates may vary for different types of income, such as capital gains or rental income. Additionally, Minnesota offers several tax credits and deductions that can reduce your taxable income and, consequently, your tax liability. These include deductions for dependent children, education expenses, and certain medical costs.

Calculating Your Minnesota Income Tax

Calculating your income tax in Minnesota involves a series of steps to determine your taxable income and apply the appropriate tax rates. Here's a step-by-step guide to help you through the process:

Step 1: Determine Your Gross Income

Start by calculating your total gross income for the tax year. This includes all sources of income, such as wages, salaries, bonuses, interest, dividends, rental income, and any other taxable earnings. Ensure you include all relevant income, as any omission could lead to underreporting and potential penalties.

Step 2: Subtract Adjustments and Deductions

Next, you need to subtract any adjustments and deductions allowed by the state of Minnesota. These adjustments can include contributions to retirement accounts, student loan interest payments, and certain business expenses. Deductions, on the other hand, directly reduce your taxable income and can include personal exemptions, standard deductions, or itemized deductions.

The choice between taking the standard deduction or itemizing your deductions depends on which option provides the most tax benefit for your specific situation. Itemizing deductions involves keeping detailed records of eligible expenses and may be more advantageous if you have significant medical costs, charitable contributions, or mortgage interest payments.

Step 3: Calculate Taxable Income

Once you've determined your adjusted gross income and applied all eligible deductions, you'll arrive at your taxable income. This is the amount of income that will be subject to Minnesota's progressive tax rates.

Step 4: Apply Tax Rates and Calculate Tax Liability

Using the tax brackets provided earlier, determine which bracket(s) your taxable income falls into. Apply the corresponding tax rate(s) to calculate your tax liability. Remember that if your income spans multiple brackets, you'll need to calculate the tax for each bracket separately and then sum them up to find your total tax liability.

Step 5: Account for Tax Credits

Minnesota offers a variety of tax credits that can reduce your tax liability. These credits are designed to provide relief for specific situations, such as having dependent children, adopting a child, or investing in renewable energy. Research and claim any applicable credits to further reduce your tax burden.

Strategies for Effective Tax Management

Managing your income tax effectively can involve a range of strategies, from optimizing your deductions to planning for tax-efficient investments. Here are some tips to consider:

- Maximize Deductions: Carefully review all eligible deductions to ensure you're taking advantage of every opportunity to reduce your taxable income. This could include contributing to retirement accounts, such as 401(k)s or IRAs, or timing certain purchases to maximize deductions.

- Explore Tax Credits: Familiarize yourself with the various tax credits available in Minnesota. Some credits, like the Working Family Credit, can provide significant savings for low- to moderate-income families. Understanding and claiming these credits can make a substantial difference in your tax liability.

- Consider Tax-Efficient Investments: Certain investments, like municipal bonds or real estate, can provide tax advantages. Consult with a financial advisor to explore options that align with your financial goals while minimizing tax implications.

- Stay Informed: Tax laws and regulations can change annually, so it's crucial to stay updated with the latest developments. This ensures you're aware of any new deductions, credits, or changes in tax rates that could impact your financial planning.

Minnesota's Tax Environment: A Snapshot

Minnesota's tax system, like those of other states, serves as a critical source of revenue for funding essential services and infrastructure. The state's progressive tax structure ensures that those with higher incomes contribute a larger share, promoting fairness and economic stability.

In addition to income tax, Minnesota residents also pay property taxes, sales taxes, and various other taxes that contribute to the state's overall revenue. The state's tax environment is designed to support public services, education, healthcare, and infrastructure development, all of which are vital for the well-being of its residents and the growth of its economy.

Key Statistics and Facts:

- As of [year], Minnesota's tax revenue accounted for [percentage] of the state's total revenue.

- The state's tax system generates funds for [major services/programs], including [list a few key areas].

- Minnesota's tax structure has evolved over the years, with [mention any recent changes or significant reforms].

Understanding the broader context of Minnesota's tax environment can provide a more comprehensive view of the state's financial landscape and the role that income tax plays in supporting its residents and businesses.

Frequently Asked Questions (FAQ)

How often do tax rates change in Minnesota?

+

Tax rates in Minnesota can change annually, often as a result of legislative decisions and economic factors. It’s important to stay updated with the latest tax tables to ensure accurate calculations.

Are there any tax benefits for homeowners in Minnesota?

+

Yes, Minnesota offers several tax benefits for homeowners. These include deductions for mortgage interest, property taxes, and certain home improvements. Additionally, first-time homebuyers may be eligible for tax credits.

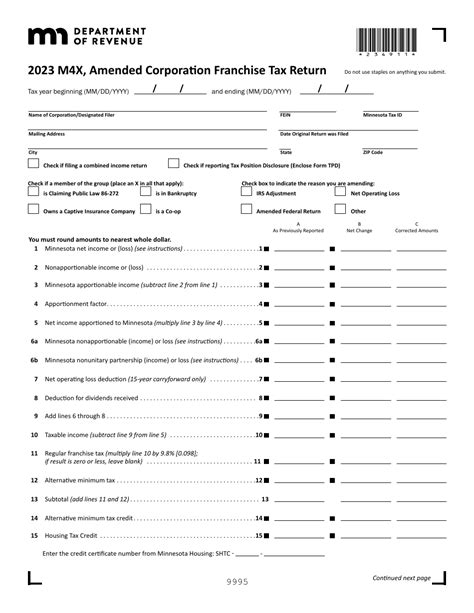

Can I file my Minnesota income tax return online?

+

Absolutely! Minnesota offers online filing through its official website. Online filing is secure, convenient, and often results in faster processing times compared to paper returns.